As real estate investors, we see great value in understanding long-term demographic trends. Population in the U.S. is overall growing, but there is quite a bit of disparity between regions. Higher population density almost universally increases demand for real estate along with its value per square foot, so we want to own properties in areas to which people are flocking.

This article will discuss population movements and other demographic shifts with regard to their impact on REIT value over the next 5 years.

We are getting old

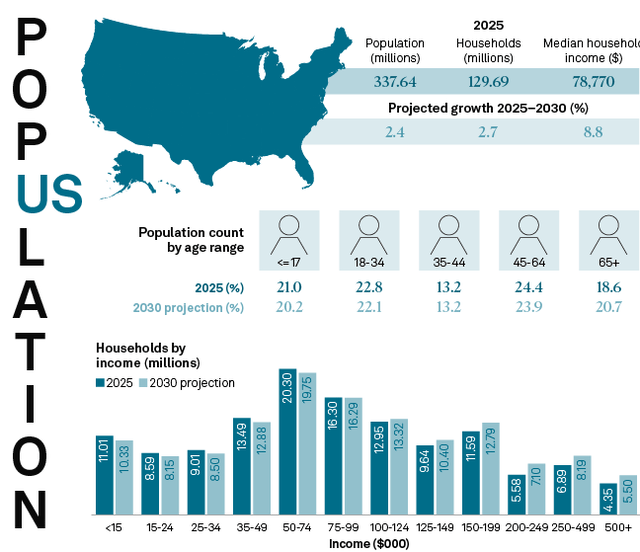

S&P Global Market Intelligence predicts that the portion of Americans over 65 years old will increase from 18.6% today to 20.7% in 2030.

S&P Global Market Intelligence

This sort of upside-down population pyramid has been seen in other countries before. Notably, it is at least partially blamed for Japan’s long period of economic stagnation.

The aging of the U.S. population, however, is concurrent with a substantial increase in income. Claritas data suggests that median household income will increase from $78,770 now to $85,719 by 2030.

This 8.8% increase is quite different than what has been observed in other aging countries. With increased wealth, the older generation of Americans is more self-sustaining in expenses, which should help GDP flow and could potentially allow the U.S. to evade the stagnation experienced by peers.

Impacts of aging population on real estate

It is broadly known that higher age correlates with higher consumption of healthcare. Nearly every healthcare REIT references the upcoming “silver tsunami” as a demand driver.

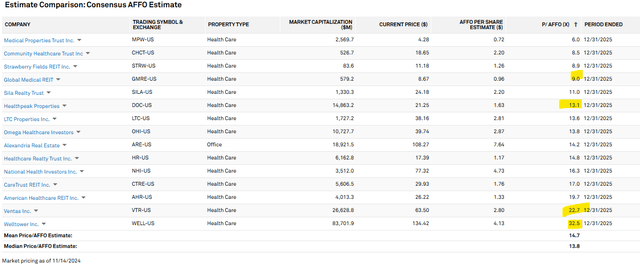

I think the anticipated increased demand is largely true, but because of how popularized the notion is, the stock prices already reflect it. Senior housing is the property type that most directly benefits from an aging population and the senior housing focused REITs Ventas (VTR) and Welltower (WELL) trade at 22.7X and 32.5X AFFO, respectively.

S&P Global Market Intelligence

We see better value in medical office which is also positioned to benefit from an aging population, but trades at much more attractive valuations. Medical office REITs Global Medical REIT (GMRE) and Healthpeak Properties (DOC) trade at 9X and 13.1X AFFO, respectively.

CBRE is calling for increased MOB leasing and sales transactions, as well as reduced vacancy for the sector. GMRE and DOC already operate at low vacancy, so any incremental demand is likely to translate to higher rental rates for their space.

Population movement

Many types of infrastructure are agnostic to population. For example, an oil rig in Texas produces the same amount of oil whether people move to or away from Houston.

Real estate is different from other forms of infrastructure in that its value can change drastically based on the population in its area. We like to own properties in medium density areas that are on their way to becoming high density in the future.

Retail space in Times Square is extremely valuable, but if you buy it today, it will cost an equally extreme price per square foot.

The trick, in my opinion, is to buy at low or medium density while prices are still affordable and own the real estate long term as population density rises and increases property values over time.

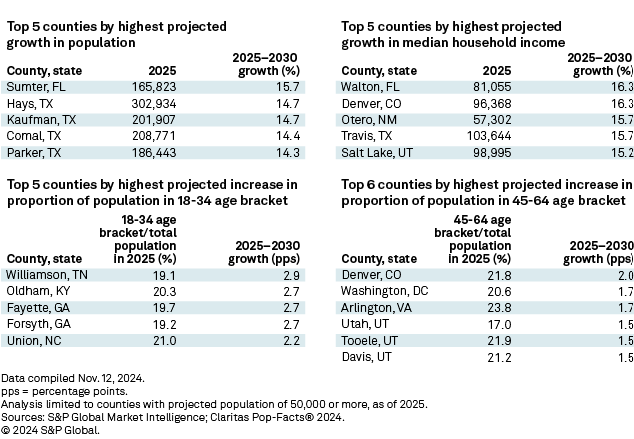

Presently the key areas are Florida, Texas, Arizona, Utah, Georgia and specifically Denver within Colorado. Retail real estate is cheap, but it won’t be for long with the amount of population and jobs moving to these areas.

S&P Global Market Intelligence

Also worth noting is the young people moving to Georgia and the high earning demographics (age 45-64) moving to Denver and Washington, DC.

Real estate generally benefits from more population and higher household income. Apartments are among the more direct beneficiaries, as rent tends to sit somewhere between 20% and 30% of household income.

More household income means higher rents.

More population means more demand and lower occupancy.

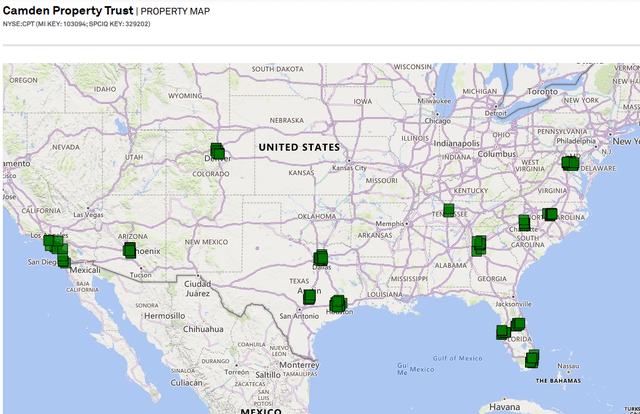

A variety of apartment REITs are well positioned with strong Sunbelt exposure, but Camden (CPT) stands out with its major markets almost perfectly aligned with the top 5 cities for population and income growth.

S&P Global Market Intelligence

- Denver

- Texas Triangle

- Key Florida markets

- Atlanta

- Nashville

- Washington DC

I would like to invest more in Salt Lake City, but REITs have surprisingly few properties in the MSA. Kennedy-Wilson (KW) owns 5 apartment properties in the area, but even that is quite small relative to the overall company.

Price per foot is an overlooked metric

There is very little difference in the physical topography of NYC as compared to the Sunbelt and yet price per square foot for commercial real estate will be somewhere around $100-$400 in the Sunbelt, while it can be well into the thousands in NYC.

The difference is population density.

I don’t think Phoenix, Houston or DFW will get all the way to NYC level density anytime soon, but these could very well go from $300 per foot cities to $600 per foot cities over the next couple of decades.

That asset level appreciation adds nicely to the cash flows generated by the properties as they operate. I think the market is broadly overlooking the value of real estate being located in cities with growing population, jobs and income.

Read the full article here