A large portion of companies in the stock market directly care about the health of the American consumer, yet it is exceedingly difficult to get a read on the consumer because so much of the data seems to conflict. Consumers are simultaneously the richest they have ever been on some metrics, while barely escaping poverty on other metrics.

Thus, the million-dollar question for all these consumer-facing companies is: What is the actual state of the American consumer?

I’m not entirely able to answer the question, but this article will cover the topic from a variety of angles to provide as much insight as we can. We shall begin with data suggesting the consumer is strong:

Strong Consumer

Real GDP per capita is the highest it has ever been.

FRED

This is a real figure, meaning it is already inflation adjusted.

GDP is interesting from a national level, but not as relevant to individual consumers. The average consumer’s health is going to be more closely tied to median household income.

There are 2 primary differences between median household income and GDP per capita.

- It is a median figure rather than the mean, which eliminates the positive skew of the extremely high earners.

- Household income has households as a denominator rather than population, and the number of households has increased as a percentage of the population.

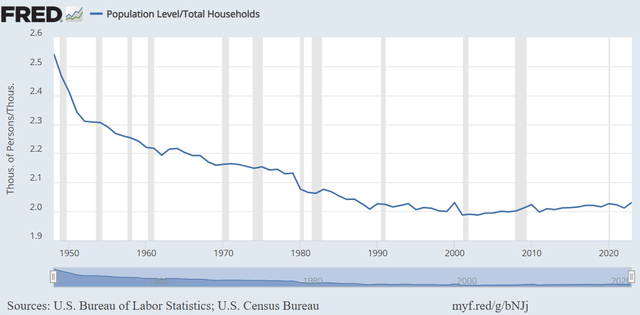

A household now averages about 2 people, down steadily from 2.5 in 1950.

FRED

So, by using the median, we have largely accounted for income disparity, and by adjusting for a lower number of people per household, we have accounted for the increased expenses that come with it. Both of these adjustments make median real household income less steep of an increase than GDP per capita.

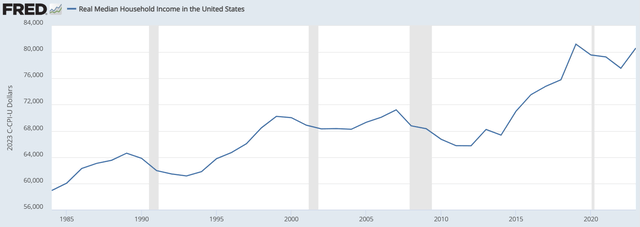

However, even after these adjustments, real household income is hovering near all-time highs and is much higher than a decade ago.

FRED

So, if the average consumer has more income in inflation-adjusted dollars, they should be strong, right?

Well, there is some conflicting data indicating a weak American consumer.

Weak Consumer

Consumer sentiment is well below normal levels, according to the University of Michigan read.

FRED

For the past few years, consumer sentiment has been at levels that are typically only seen during recessions.

This is a survey, so there is some subjectivity to it. Perhaps consumers are actually doing well but for some psychological, social or other reasons, they feel like they are struggling.

That could be the case, but there is also data indicating real financial difficulties. In November 2024, Apartment List reported cost-burdened households reaching a new record:

52% of the nation’s renters are cost-burdened, meaning they spend more than the recommended 30% of their income on housing. This cost burden rate has been trending up steadily since 2019, as growth in rents has outpaced growth in incomes. In total, today there are over 22 million rent-burden households across the United States, a new record”

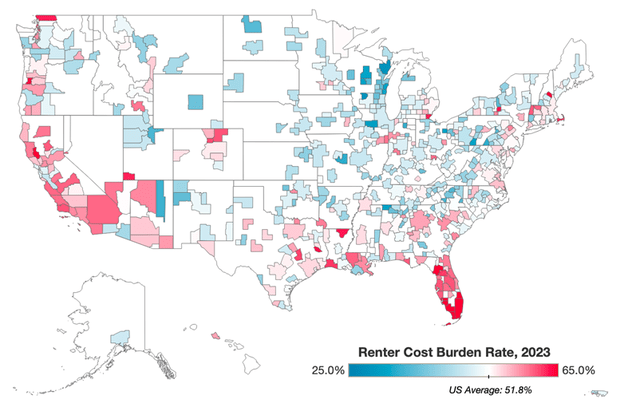

Historically, cost burdened households have been very region-specific. Certain cities were undersupplied with housing and people were getting priced out. Today, however, it is much more widespread.

ApartmentList

The sunbelt used to be a beacon of affordability, but now it has joined the coasts in being burdensomely expensive, at least from a housing standpoint.

Reasons for the data discrepancy

It seems contradictory that household income has been growing nicely even after inflation adjustment, and yet people feel poor and perhaps are poor when it comes to affording essentials like housing and food.

The most common argument for this contradiction is wealth inequality.

While there is some truth in the idea that income disparity has widened, it mathematically cannot be the whole story. The biggest source of growing income disparity is the tail on the wealthy side of the bell curve. While a small percentage of the population is making extreme amounts of money, that has little bearing on the median.

The median household has significantly grown their net of inflation income, and yet 51.8% of households are rent burdened (meaning more than 30% of income spent on rent).

51.8% includes the median. Therefore, even the households that have grown real income considerably are still somehow feeling this burden.

What gives?

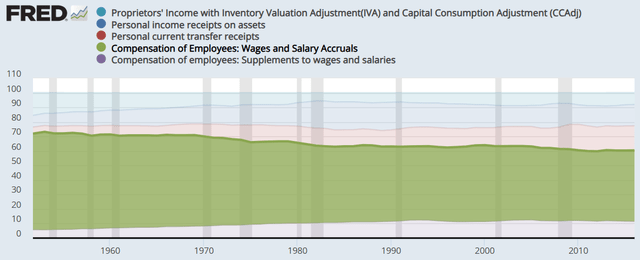

Well, there have been significant changes to the composition of household income. Specifically, the portion of income that comes from wages and salary has declined considerably, shown in green below.

FRED

These 5 categories add up to 100%, so where is the rest of income coming from?

2 categories have increased materially:

- Supplements to wages

- Government checks

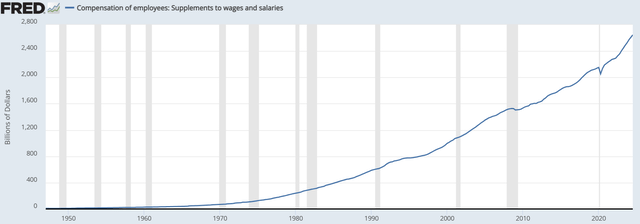

Supplements are ways in which employers pay their employees who aren’t directly through wages. It could be benefits such as insurance or things like employer contributions to 401ks. The combined supplements have risen sharply.

FRED

These supplements provide very real benefits to employees, but you can’t use them to pay for rent or groceries.

Thus, even though they are part of income, they feel more like reducing certain costs, such as the cost of independently buying health insurance.

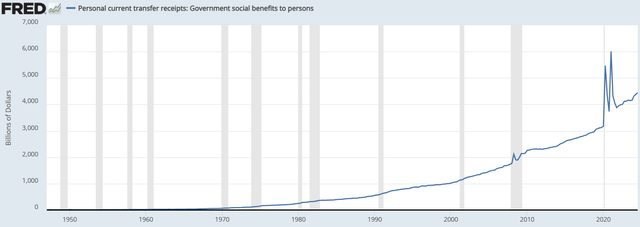

Government stimulus and other benefits shot up during COVID and have remained at an above trend level since.

FRED

This source of income, unlike employer supplementary benefits, can be and has been used to pay for rent and groceries.

I suspect this is a large source of the terribly low consumer sentiment.

Future government benefits/stimulus are unknown. So people have been able to pay rent and have been able to buy their groceries, but to the extent these were funded by the stimulus, it creates a certain uneasiness about affordability going forward.

Wage/salary funded expenses feel quite a bit better. When someone can afford daily living expenses through their salary and wages, it feels sustainable and in their control. They can forecast a budget and feel confident that they can make ends meet.

As such, I posit that the low consumer sentiment is a result of:

- Wages/salaries being a smaller portion of income

- Stimulus being a higher portion of income

I have no opinion on whether stimulus and other such government activity is good or bad. Perhaps it was necessary during the pandemic, that is not for me to decide, and it is outside the scope of this article.

The investment relevant point here is that consumer sentiment has long been viewed as a forward indicator of consumer spending. Each time a new low read comes out on consumer sentiment, retail and other directly consumer related stocks tend to sell off.

This might not be correct. Consumer spending has been strong in recent years, simultaneous with consumer sentiment being extremely low.

Retail and other consumer-facing companies don’t really care if the consumer feels good about their ability to spend, they merely care that the consumer actually does spend.

With all that said, my read on the strength of the American consumer is that forward consumer spending is likely to remain relatively high, even if there is a growing and perhaps rational sense of financial insecurity.

Read the full article here