Summary

Following my coverage on Phreesia (NYSE:PHR), I recommended a buy rating as the business continues to execute well with strong logos despite uncertain times. This post is to provide an update on my thoughts on the business and stock. I continue to see the stock and business as attractive, although the shares took a big dive. I believe the share price action is not reflective of PHR fundamentals but rather investors’ disappointment that PHR did not raise FY24 guidance, a trend that management has historically followed (pre-FY24). At the current valuation, I believe the upside is appealing if management can hit its FY25 targets (the bull case).

Investment thesis

PHR reported $85.8 million in revenue for 2Q24, which was higher than the $85.2 million that was expected, and an EBITDA figure of -$11.5 million, which was better than the -$16 million that was expected by consensus. These two items are where my attention is being directed because I think the strength of PHR’s growth and its ability to turn profitable are the catalysts for stock prices to rise. Encouragingly, both of them are moving in the direction I expected.

The steady influx of 136 new provider clients during the quarter was a major contributor to PHR’s 26% growth year over year from 1Q24. As a result, the company’s average number of customers during the quarter was 3.4k, an increase of 24.1% year-over-year. Looking ahead, the near-term outlook is pretty much in the bag (positive) for logo adds, as PHR expects ~175 new clients in 3Q24, an acceleration from the 136 adds in 2Q24, although this includes clients from Access eForms acquisition. While the rate of new logo additions has slowed from the previous year (2Q24: 136 vs. 2Q23: 250), I believe the secular trend (as I mentioned in my initiation post) remains fundamentally sound, especially with the growing trend of value-based reimbursement models that require more follow-ups with patients (also meant there is a need for more appointments). As such, new logos addition will continue to be revenue contributor.

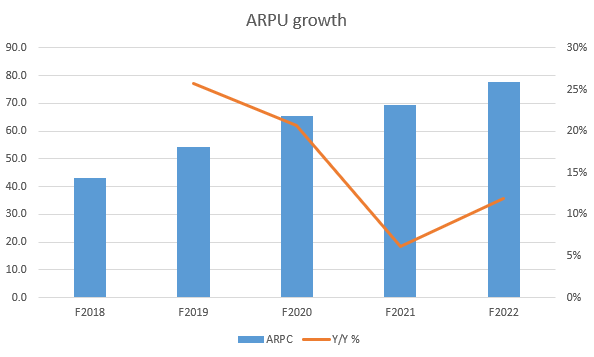

Remember that total revenue growth also includes the ARPU element, and I anticipate the ARPU component will continue to positively contribute to total revenue growth. Average revenue per provider client [ARPC] and average revenue per average healthcare services client [AHSC] were both projected to increase by management during the call. The following part of the management comments during the call is what provided me with confidence that ARPU has much more room to grow by upselling products to clients (albeit hard to quantify at the moment). Evidently, PHR also has a solid history of increasing ARPU over time, as evidenced by the company’s historical ARPC growth.

As such, I expect revenue to continue growing revenue at the current pace of >20%.

And then as we win new clients, we have a pretty good track record of keeping them and sell them more stuff and the way we sell them more stuff is we introduced product that has a lot of value to them. And sometimes we give it to them, sometimes we sell it to them, and sometimes it’s part of their transaction. 2Q24 earnings results call

Own calculation

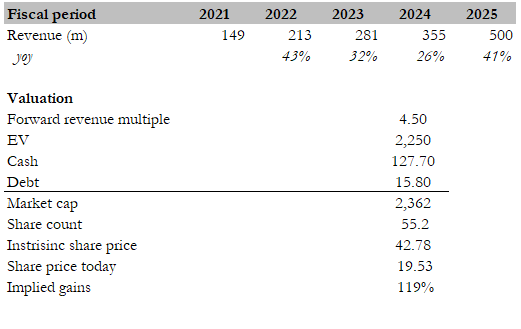

Recall that previously I mentioned PHR turning profitable as a key catalyst for valuation re-rating upwards. It was very positive to hear that management remains committed to reaching breakeven adjusted EBITDA and $500 million in annualized revenue in FY25.

Randy helped build a great finance organization and implemented processes systems and controls that we believe are important for a public company to be able to deliver durable and profitable growth over time.

when we’re at about $500 million of revenue, our G&A is around where it is now. It’s in the teens. And so beyond 25, we can sort of see ourselves getting back to the profile we had when we went public, which is a 20% grower on the top line and growing profit and I think how this sort of step up in profitability manifests, we will continue to communicate that as we get closer. 2Q24 earnings results call

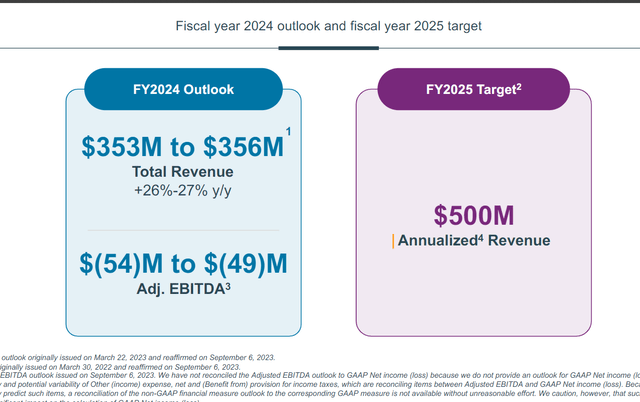

Management wasn’t just all words but no actions. The results show that the cost of revenue was $14.4 million in 2Q23, down from $14.9 million in 2Q22. This drop was attributed by management to a lower average headcount (source: 2Q24 10Q), which led to lower compensation and benefit costs. I am looking forward to management continuously optimizing its cost structure so that it can reach a positive EBITDA as soon as possible. Management’s outlook for FY24 is still cautious, but thanks to effective cost control, they’ve increased their adjusted EBITDA guidance. Phreesia has maintained its revenue guidance for FY24 at $353 million to $356 million, representing an annual growth of 26% at the midpoint, despite a promising start to the fiscal year. Some investors may be dissatisfied with the repetition, but I welcome the cautious outlook because it gives PHR more room to exceed and even exceed its own guidance. With regards to earnings, the revised range for adjusted EBITDA went up from a loss of $55 million to $60 million to a loss of $49 million to $54 million. I think management may be being too cautious with their adjusted EBITDA target, even though I agree that it makes sense to be cautious with the revenue line. Using the midpoint of their FY24 guidance, we can infer that the second half of the year is expected to perform worse than the first. Given the focus on cost management and the growing revenue base, it seems more likely that we will see a sequential improvement. This therefore presents yet another avenue for the development of a beat and rise. Also remember that management expects operating leverage to further accelerate, with management maintaining FY25 targets.

“The increase reflects continued operating leverage across the organization and continued progress on our path to adjusted EBITDA profitability. We’re also maintaining our revenue and profitability targets for fiscal 2025.”

Valuation

Own calculation

Considering the share price has taken a big dive, I aim to value PHR in the bull case scenario where it hits management’s FY25 target of $500 million in revenue. In this scenario, I believe the fair value for PHR based on my model is $43, a substantial upside from where it is today. PHR would also be profitable by then, which should further support an increase in valuation multiple. In recent history, PHR has traded at around 4.5x forward revenue but has since deepened to 2.3x after the 2Q24 earnings. I believe this rerating is not justified by any structural reasons (i.e., the business fundamentals weakened as the business continued to grow). In the bull case, I expect multiples to rerate back to 4.5x as it continues to grow >20% and reach EBITDA positive. This will make PHR in line with Definitive Healthcare (DH), which is growing at 20+% and is generating positive EBITDA.

PHR

Risk

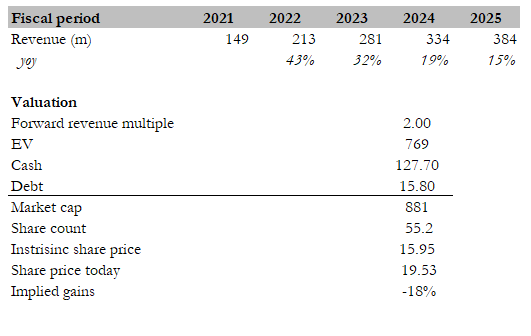

The risk with PHR lies more in expectations than in actual fundamental performance in the near term. Just as we have seen in the 2Q24 results, I think the share price took a dive because investors were expecting management to revise the FY24 revenue guideline; instead, management reiterated guidance. Management is now expecting $500 million in annualized revenue in FY25, which is a big increase from FY24 revenue. If they cannot hit this target, the stock could see another big hit.

Own calculation

In the bear case, suppose the slowdown in logo adds is structural and PHR fails to grow ARPU, growth could slow much further than what the business saw back in FY21. In this scenario, I would expect valuation to fall back to similar levels since back then, with possible chances of dipping even further. For model sake, I used 2x as the trough multiple, which suggests an 18% downside.

Conclusion

PPHR remains an attractive investment opportunity despite a recent dip in its share price. The company’s strong performance in 2Q24, with revenue surpassing expectations and a better-than-expected EBITDA figure, demonstrates its growth potential and path to profitability. Management’s commitment to achieving breakeven adjusted EBITDA and $500 million in annualized revenue by FY25 is a positive signal for long-term investors. The focus on cost optimization and effective cost control measures further supports this trajectory. From a valuation perspective, the current share price presents a substantial upside in a bull case scenario where Phreesia achieves its FY25 revenue target. The rerating of valuation multiples is expected as the company continues to grow and becomes EBITDA positive. However, it’s essential to recognize that the main risk lies in investor expectations. The recent share price dip was partly due to expectations of a revised FY24 revenue guideline, which did not materialize. Failure to meet the ambitious FY25 revenue target could lead to further volatility in the stock.

Read the full article here