Overview

Dream Finders Homes (NYSE:DFH) is a mid-sized regional homebuilder that primarily operates in the southeast and Texas. Over 80% of the company’s revenue comes from the Florida, North Carolina, South Carolina, and Texas markets. The company sold 6878 homes in 2022, up 41.1% from 4874 homes in 2021. The company’s revenue has grown every year since 2013, demonstrating exceptionally consistent past performance. In addition, the company reported surprisingly solid Q2 earnings, with quarterly revenue of $945.34M, beating estimates by $278.68M, and GAAP EPS of $0.65, beating estimates by $0.29. Despite a downturn in the real estate sector that has reduced the revenues and profits of the company’s competitors and slowed Dream Finders Homes’s expansion, the company is continuing to demonstrate the consistent growth that it has earned a reputation for. As such, we believe that Dream Finders Homes’s long term outlook remains solid.

An Advantageous Land-Light Strategy

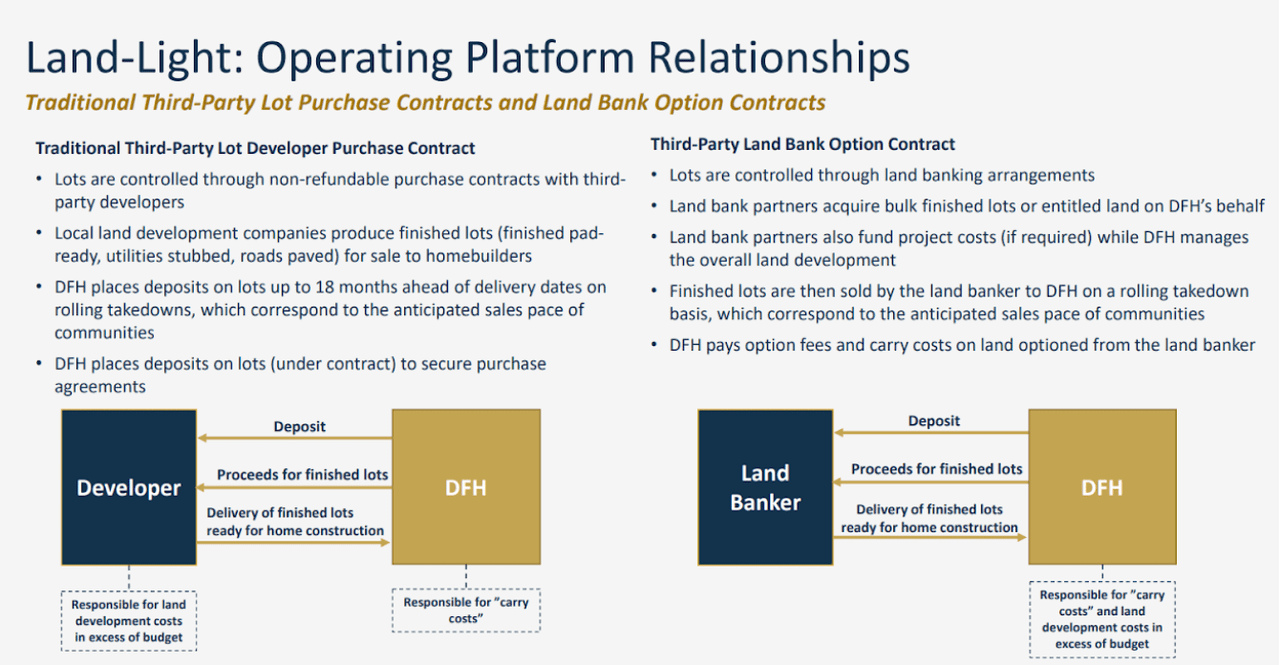

Dream Finders Homes uses the land-light strategy, where they purchase options to buy land instead of buying it directly. In addition, land is purchased as late as possible. This allows the company to control large amounts of land with less capital, thereby allowing Dream Finders Homes to achieve an impressive 46% return on equity in Q1 2023. Additionally, the land-light strategy reduces the company’s balance sheet risk since the company does not need to be concerned about buying land that does not end up being developed. As such, home builders that use this unorthodox strategy are better able to weather recessions.

Dream Finders Homes Q2 Investor Presentation

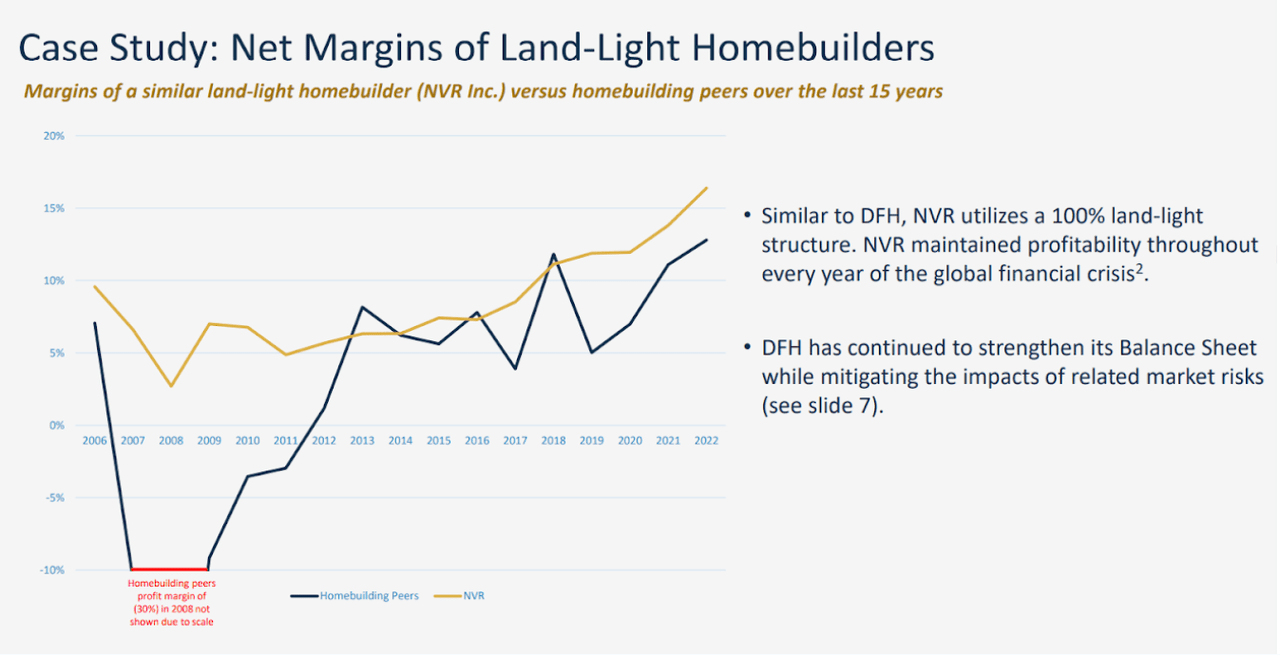

The land-light strategy’s effectiveness in hedging homebuilders against downturns is demonstrated by the fact that NVR (NVR), the one of largest home builders that uses this strategy, was able to remain profitable during the Great Recession while almost every other home builder lost money, with average profit margins for the industry bottoming out at under -30%. Dream Finders Homes itself has also demonstrated the resilience of the land-light strategy during the Great Recession, as the company, despite being founded in 2008, has been profitable every year since its founding.

Dream Finders Homes Q2 Investor Presentation

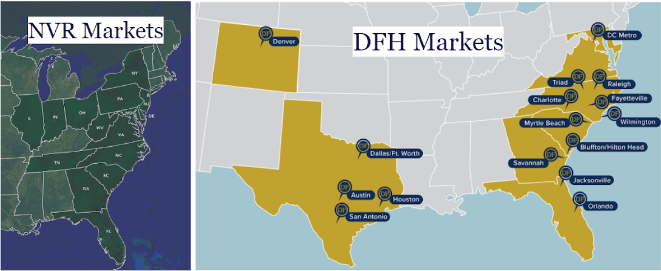

Despite the stability that the land-light strategy provides, most homebuilders still prefer the more straightforward traditional model of purchasing large amounts of land outright before starting a project. As such, Dream Finders Homes has limited direct competition. Even NVR’s competition with the Dream Finders Homes is limited since Dream Finders Homes builds exclusively in the southeast, Texas, and Colorado, while NVR operates in 35 metro areas in 15 states, and focuses on the Northeast and Midwest in addition to the Southeast and does not have a presence in Texas or Colorado.

Dream Finders Homes Q2 Investor Presentation

Since the land-light strategy has been proven to be effective in protecting home builders against recessions, we believe that the current real estate downturn will not have long term effects on Dream Finders Homes’s performance. As such, we believe that the company is well positioned to continue to outperform its competitors in the industry in terms of growth.

Expansion in Rapidly Growing Markets

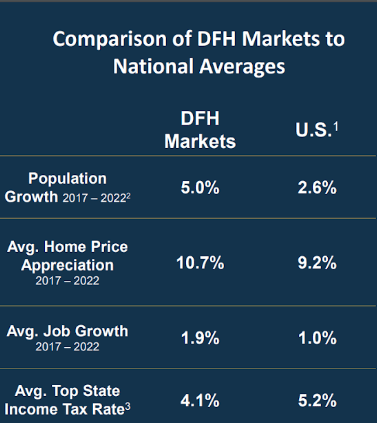

Dream Finders Homes focuses its homebuilding in metropolitan areas with exceptionally fast population growth. From 2017 to 2022, Dream Finders Homes markets have seen their population grow by an average of 5.0%, almost double the national average growth rate of 2.6%. The areas with above average rates of population growth tend to have higher rates of home price appreciation since an increasing population drives up demand for housing. As such, home prices in Dream Finders Homes markets have appreciated by 10.7% from 2017 to 2022 compared to 9.2% nationally.

Dream Finders Homes Q2 Investor Presentation

According to census estimates, the states that Dream Finders Homes focuses on, namely Florida, Texas, North Carolina, South Carolina, and Colorado, have all seen their populations grow faster than the national average of just 0.6% from 2020 to 2022. Florida’s population increased 3.2% during that time period, South Carolina’s population was up 3.2%, Texas’s population was up 3.0%, North Carolina’s population was up 2.5%, and Colorado’s population was up 1.1%.

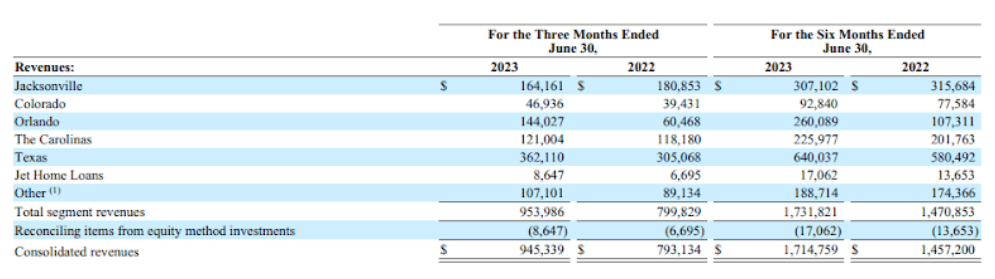

During the past year, Dream Finders Homes has expanded rapidly in Colorado, where revenues for the company is up 19.0% YoY, Texas, where revenues for the company is up 18.7% YoY, and especially Orlando, where revenues for the company rose an astonishing 238.2% YoY to over $144M. The company’s revenues are down 9.2% YoY in Jacksonville, FL, which was traditionally the Dream Finders Homes’ largest market and where the company’s headquarters are located. This is because, according to census estimates, Duval County (which contains Jacksonville) has grown 2.1% from 2020 to 2022, a rate that is far above the national average but nevertheless significantly below the Florida average rate of 3.3%.

Dream Finders Homes – 10Q

We believe that Dream Finders Homes has demonstrated the ability to shift its focus to different areas based on population trends, which will allow the company to continue to operate in areas with above average rates of population growth. We believe that operating in areas with high rates of population growth will allow Dream Finders Homes to enjoy high demand for their houses and contribute to the company’s growth.

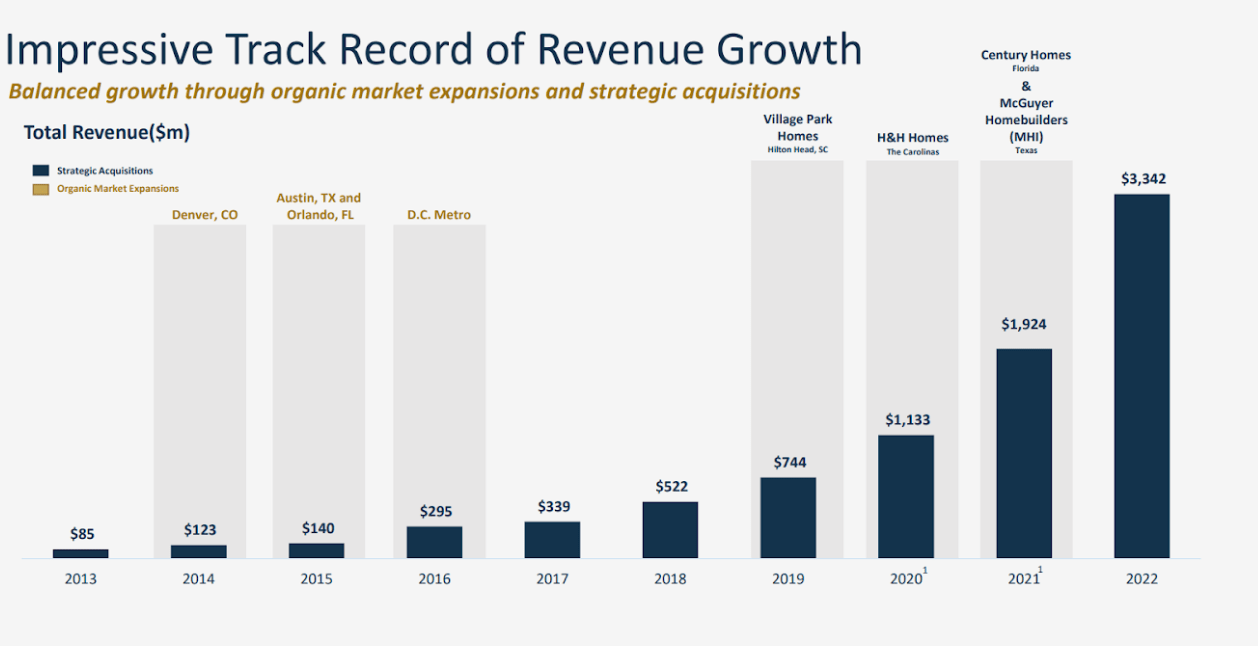

Consistent Growth

Dream Finders Homes’ growth has been very consistent, as demonstrated by the fact that the company’s annual revenue has increased every year since 2013. In fact, the company has seen an astounding average revenue CAGR of 58% since 2013. In recent years, this growth has been partially driven by Dream Finders Homes’ acquisition of smaller homebuilders, most recently the acquisitions of Century Homes and McGuyer Homebuilders in 2021. Partially because of these acquisitions, Dream Finders Homes’ annual revenue increased 73.7% from 1.924B in 2021 to 3.342B in 2022.

Dream Finders Homes Q2 Investor Presentation

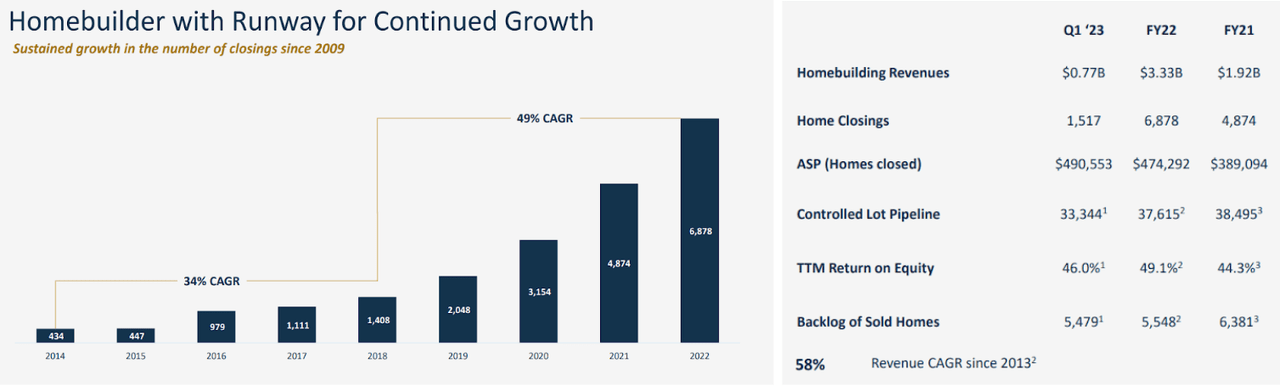

Dream Finders Homes’ stable revenue growth has been made possible by the company consistently selling more homes from year to year. The number of homes sold by the company has increased every year since 2009 at an impressive average rate of 34% from 2014 to 2018 and at an even higher average rate of 49% from 2018 to 2022. In addition, the company has enjoyed rising home prices in its main markets that have largely been driven by increasing populations in those areas. The average sales price for a house sold by Dream Finders Homes increased by 26.1 % from 2021 to Q1 2023.

Dream Finders Homes Q2 Investor Presentation

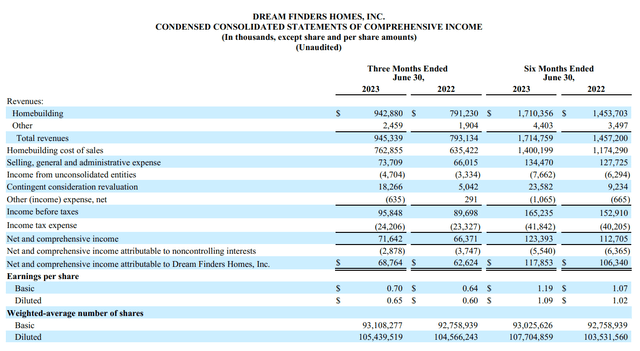

Dream Finders Homes’ growth has slowed down somewhat over the past year due higher mortgage rates reducing the demand for housing. The company’s quarterly revenue was $945.34M in Q2 2023, up 19.2% YoY. Its revenues in Q2 2023 was projected to have declined YoY, but the company beat expectations by an impressive $278.68M. Dream Finders Homes’ quarterly profit was 68.76M in that quarter, up 9.8% YoY.

Dream Finders Homes – 10Q

Dream Finders Homes has shown very rapid growth over the past decade. While its growth has slowed during the past year, the company is nevertheless still growing at a fast pace despite worsening market conditions. Due to the company’s remarkable consistency, we believe that it will continue to grow at a stable pace for the foreseeable future.

Strength Over Other Home Builders

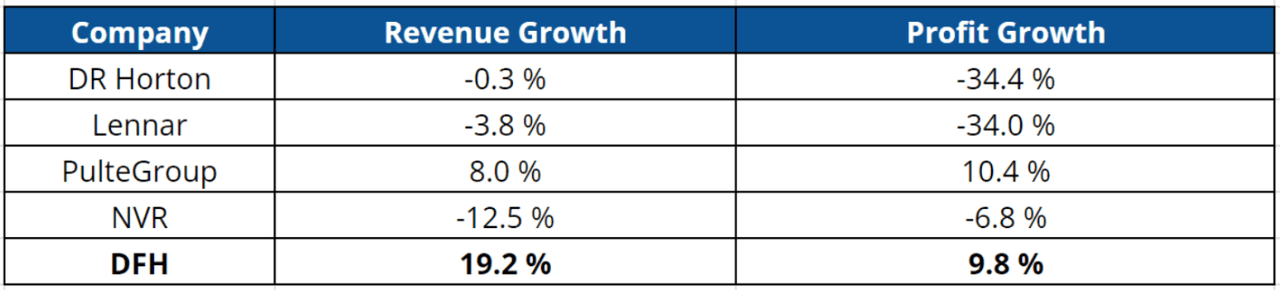

Dream Finders Homes’ revenue growth of 19.2% YoY in Q2 2023 has been exceptionally good compared to its competitors. 3 out of the 4 largest homebuilders in the country (DR Horton (DHI), Lennar (LEN), PulteGroup (PHM), and NVR) saw their revenues decline. The only one of the four companies that saw revenue growth, PulteGroup, saw their revenues grow by 8.0%, less than half of Dream Finders Homes’ rate.

Dream Finders Homes’ profit growth of 9.8% YoY in Q2 2023 is also very solid compared to its competitors. While PulteGroup grew their profits by 10.4% YoY in Q2 2023, slightly faster than DFH, DR Horton and Lennar, the two biggest homebuilders in America, saw their profits drop massively by 34.0% and 34.4% respectively. Additionally, NVR experienced a decline in profits of 6.8%. Despite using the land-light strategy, NVR’s performance was suboptimal because the real estate markets of the Midwest and Northeast, where they have a significant presence, are faring poorly.

Author

It is important to note that despite the declines in profit that DR Horton, Lennar, and NVR experienced, every one of these five companies remained profitable during Q2. This is largely because the market for new homes is faring much better than the market for old ones since homeowners are reluctant to sell their homes when interest rates are so high, reducing competition for the home building industry.

Dream Finders Homes’ performance over the past year has been better than most other homebuilders. While its growth rate has declined, the company is still growing at a fast pace. As such, we believe that the long term outlook for Dream Finders Homes remains positive.

Valuation

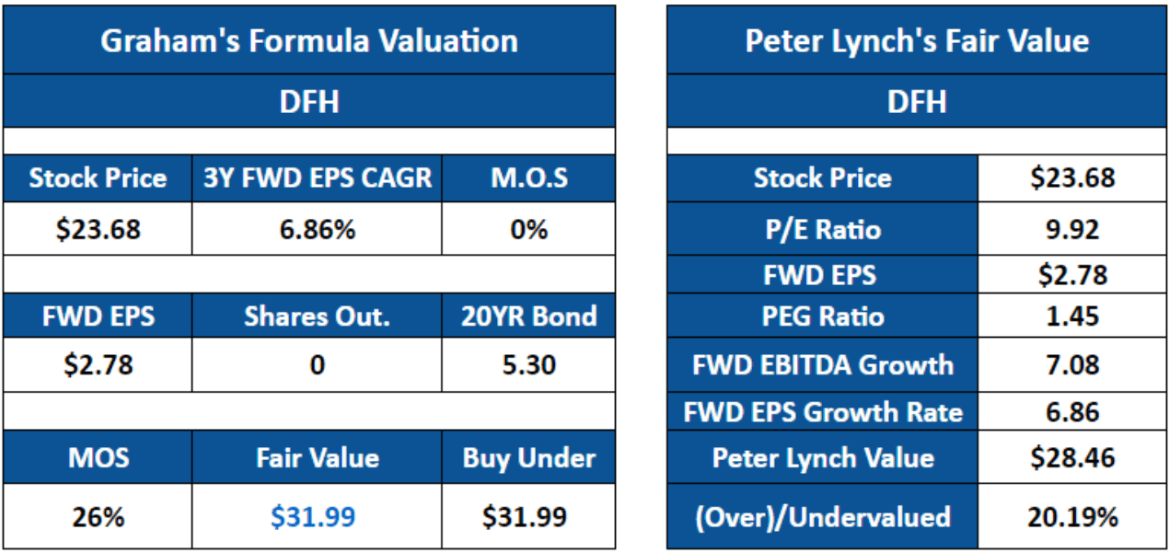

For valuation, we used Graham’s Formula and Peter Lynch Valuation models. We assume that Dream Finders Homes’ EBITDA and EPS growth will remain steady at 7.08% and 6.86% respectively over the next 3 years. We also assume that the company’s EPS will grow 12.6% to $2.78 in 2024. Based on the assumption that the company’s current growth rate persists, the Graham’s Formula calculates a fair value of $31.99, far above the stock’s current value of $23.68, while the Peter Lynch Valuation model gives the stock a slightly more conservative valuation of $28.46.

Author

We believe that the more conservative valuation from the Peter Lynch Valuation model is more accurate because there is no guarantee that the company’s growth rate will persist. Nevertheless, that model still shows that the stock is undervalued by 20.19%. As such, we believe that because of its fast and consistent growth, Dream Finders Homes is significantly undervalued.

Elevated Mortgage Rate Risk

The greatest risk facing Dream Finders Homes right now are high mortgage rates, which have reached over 7 percent. These high rates have caused demand for housing to fall, which already caused DR Horton and Lense, the country’s two largest home builders, to lose revenue and DFH’s growth to slow. However, the market for new homes has not been impacted as much as the market for existing homes, which has allowed all of the major homebuilders to remain profitable for now despite these high rates. Nevertheless, if mortgage rates keep rising, DFH’s revenues could decline. However, because of the land-light strategy, even if its revenues decline sharply, DFH is likely to remain profitable, similar to how NVR managed to remain profitable during the great recession. Because of this and the massive US housing shortage (over 3.8m units according to Freddie Mac) and the volatility of mortgage rates, we believe that rising mortgage rates pose only a short term risk to Dream Finders Homes and that the company’s long term outlook remains positive.

Conclusion

Dream Finders Homes has expanded at an incredibly rapid and consistent rate over the past decade. Additionally, the company’s unorthodox and resilient business model has allowed it to continue growing despite a downturn in the real estate sector. Based on the company’s current growth rates, its stock is significantly undervalued. As such, we rate Dream Finders Homes a buy.

Read the full article here