Investment Thesis

Alliance Resource Partners, L.P. (NASDAQ:ARLP) has a whopping 13% dividend yield (or unit distribution). Clearly, that’s enticing. And even though I believe that ARLP’s prospects are attractive, there’s more to this story than just its high yield.

The way I sum this up is as such, ARLP’s substantial capital returns together with its medium-term prospects make this an alluring investment, even though readers should be mindful that this investment thesis is far from blemish-free.

Why Alliance Resource Partner?

Alliance Resource Partners primarily produces thermal coal. Thermal coal, also known as steam coal, is used for electricity generation in power plants. It is different from metallurgical coal (met coal), which is used in the production of steel. Alliance Resource Partners’ core business involves mining and selling thermal coal for power generation purposes. Incidentally, for those that are interested, I believe that metcoal could be even more attractive than thermal coal, read more here.

In my previous ARLP analysis, I said,

The whole appeal of investing in a thermal coal company is to get a large dividend out of the business. Management also recognizes this and they won’t meaningfully reduce their dividend (or unit distribution) unless market conditions became particularly hostile.

Since I penned that analysis, ARLP has in actuality increased its dividend, and it’s now returning to unitholders $2.80 per unit, which equals a yield of 13%.

One blemish to this investment thesis is that ARLP is slightly leveraged. More specifically, ARLP’s balance sheet holds around $100 million of net debt. This is not a dealbreaker for most investors, but it would be nice to see ARLP bring down its debt profile slightly. After all, these senior notes are due within less than 2 years. Also, given the 7.5% coupon on its senior notes, I believe that some investors would be more comfortable with a reduction of its share repurchases and less risk on its balance sheet.

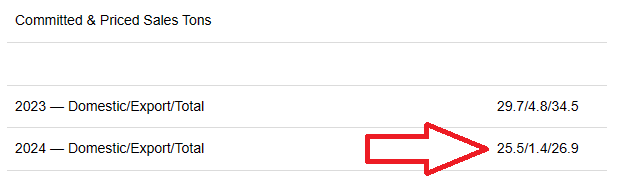

On the other hand, keep in mind that ARLP has already priced and committed approximately 75% of its production.

ARLP Q2 2023

With so much of its production already priced for next year, I believe this has already significantly de-risked its operations all the way into 2024.

Indeed, for a business that’s priced as if it’s going to out of business, at less than 4x this year’s EPS, plus a more than 10% dividend yield, I believe this reflects my underlying assertion that ARLP is a compelling investment.

What’s The Bear Case?

In my opinion, thermal coal has two main risk factors.

Beyond the obvious environmental consideration and the eagerness to phase out dirty coal, there’s an ongoing, admittedly slow, transition towards cleaner energy. That being said, frankly speaking, the electrical grid isn’t yet set up to embrace variable energy, as there are technical limitations to this, as well as the need for massive energy storage that comes from green energy supply.

The other main risk, which is arguably much more serious, is the ongoing shift from coal to natural gas as the preferred fuel for power plants. Natural gas is often considered a cleaner and more environmentally friendly energy source compared to coal. In fact, I’m a super strong believer in this thesis, and I’m heavily invested in Antero Resources (AR).

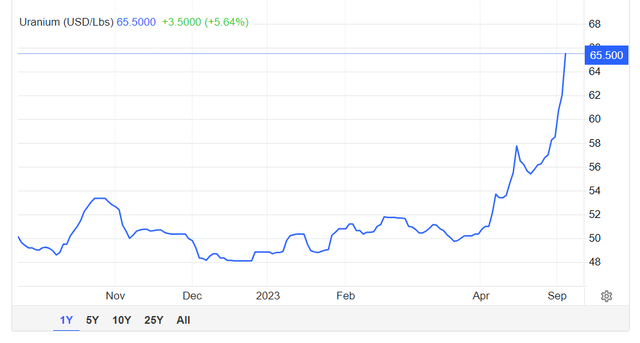

Another hefty element is that there’s a shift in the political winds toward nuclear energy to help in phasing out thermal coal.

Trading Economics

I’ve already discussed this at length throughout Seeking Alpha, and you may see my views on nuclear energy here, so I won’t repeat them here.

The Bottom Line

I find Alliance Resource Partners, L.P. to be an enticing investment proposition. Notably, it boasts a substantial 13% dividend yield, which certainly catches my eye. Beyond the attractive yield, ARLP’s strong capital returns and promising medium-term prospects make it a compelling choice.

While it’s essential to acknowledge the investment’s imperfections, such as ARLP’s moderate leverage and the evolving landscape of thermal coal, I believe its financial resilience, dividend policy, and the substantial percentage of its production already priced into the future lend credibility to the idea that Alliance Resource Partners, L.P. is a captivating investment opportunity. Accordingly, I believe that high-dividend coal stocks could be well-suited for many investors’ portfolios.

Read the full article here