Arbe Robotics Ltd. (NASDAQ:ARBE) received new financing to accelerate the penetration in China as well as to increase capacity. The company expects to start shipping production chips from 2023, which may accelerate net sales growth. With many analysts expecting positive net income in 2023, ARBE benefits from the growing market of assistance and autonomous vehicle applications. Yes, there are risks from small adoption of new products or lack of new equity investors, however, the company appears undervalued.

Arbe Robotics

Arbe Robotics is a semiconductor company that specializes in the development of advanced radar solutions for driver assistance and autonomous vehicle applications.

Its solution includes a radar chipset composed of transmitter chips, receivers, and processors, offering high-resolution and four-dimensional detection capabilities.

Its chipsets are designed to address key challenges in detecting stationary objects, vulnerable road users, and low lighting conditions, minimizing false alarms. Its radar technology is suitable for advanced ADAS functions as well as higher levels of autonomous driving.

The company does not have its own manufacturing facilities, but it develops cutting-edge radar technology and solutions using multi-channel radio frequency integrated circuits and specialized radar processing units.

Arbe offers two radar development platforms, the Phoenix Perception Radar with ultra-high resolution and the Lynx, which complements the Phoenix with a 360° view around the vehicle. Both platforms offer superior performance and contribute to safer and more autonomous driving.

Successful Relationships With Tier 1 Manufacturers And OEMs In The Automotive Industry Could Lead To FCF Growth

Arbe’s business model is based on establishing strong relationships with Tier 1 manufacturers and OEMs in the automotive industry. With the supply of imaging radar chipsets to Tier 1 manufacturers, who integrate them into radar systems sold to OEMs, the company’s sales and marketing team focuses on expanding relationships with existing customers and pursuing opportunities in other industries.

They use marketing strategies such as conferences, public relations, newsletters, and proactive consultations to reach new prospects. In addition, they take advantage of digital channels, joint events, and relationships with analysts and media to promote their products as well as to generate demand. Under my discounted cash flow (“DCF”) model, I assumed that new connections in the automotive industry will most likely bring net sales growth. In this regard, it is worth noting that the automotive radar market size is expected to grow at double-digit in the coming years.

Automotive radar market size worth $9.51 Billion, globally, by 2030 at a CAGR of 10.5%. Source: Automotive Radar Market

Growing Demand For Autonomous Vehicles And Level 2+ ADAS Systems In The Mass Market Could Bring Substantial Net Sales Growth

Additionally, Arbe Robotics taps into the growing demand for autonomous vehicles and Level 2+ ADAS systems in the mass market. It also focuses on capitalizing on regulatory changes related to the installation of accident prevention systems and economic incentives from insurance companies and other private parties. I believe that these new target markets could accelerate Arbe’s net sales growth. Experts in the assessment of the valuation of the ADAS sensors market size and autonomous vehicles market demand expect sales growth close to 10%-14%.

The ADAS Sensors Market Size Is expected to boost sales at an impressive 14.1% CAGR over the forecast period, with the market valuation reaching US$ 43.2 Billion by 2030. Autonomous Vehicles Market Demand: Is projected to grow at a CAGR of 10.9% between 2022 and 2032, totalling around 99,451 million by 2032. Source: Advanced Driver Assistance System ADAS Testing Equipment.

Finally, Arbe Robotics noted in the last annual report that it may also look to expand its product applications beyond vehicles, exploring opportunities in fields such as robotics, industry, agriculture, smart traffic, and biotechnology.

The Company Expects To Start Shipping Production Chips From 2024, And I Assumed That We May See An Acceleration In Net Sales Growth

I believe that it is a great time for assessing the valuation of Arbe Robotics as management recently noted beneficial net sales growth expectations. Sales growth will most likely accelerate in 2023 as clients receive production chips:

Revenues are expected to be in the range of $5 to $7 million.

Revenues will be heavily weighted towards the end of the year as Arbe expects to start shipping production chips. Source: 10-Q

The Recent Investment Received May Enhance The Penetration In The Chinese Automotive Market, And Enlarge Net Sales Growth

Taking into account the recent investment received by Arbe, I believe that more investors will have Arbe Robotics under the radar. In my view, if the company successfully uses its money to enter the market in China as well as to increase chipset line capacity, we may see net sales growth acceleration in the coming years. In this regard, management provided the following commentary.

We are pleased that Special Situations Funds, together with current investors, chose to invest $23 million in our company’s future. We intend to use the proceeds from the financing to further enhance our penetration in the Chinese automotive market, expedite our R&D efforts, increase our chipset line capacity, capitalize on recently proposed safety regulations and strengthen our balance sheet. Source: 10-Q

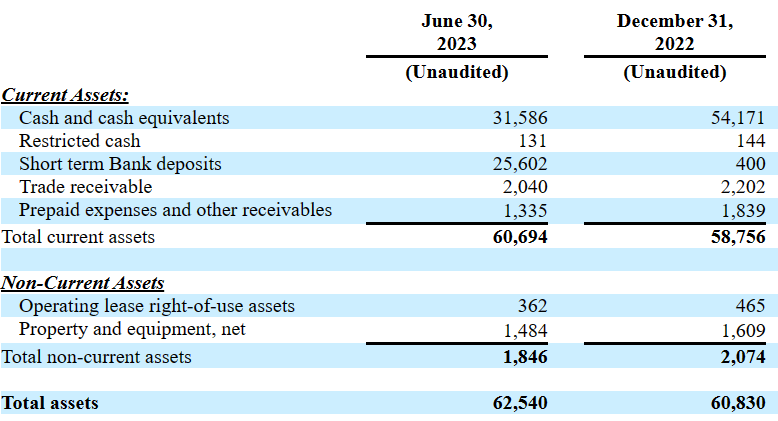

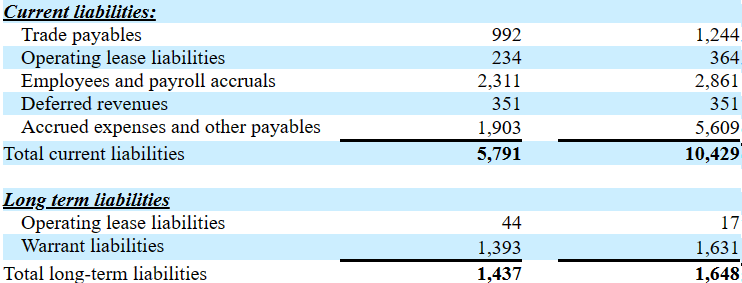

Balance Sheet: There Is Plenty Of Cash In The Balance Sheet

As of June 30, 2023, Arbe Robotics reported cash and cash equivalents worth $31 million, with short-term bank deposits worth $25 million. It is worth noting that the total amount of cash represents close to 49% of the total amount of assets. With no financial debt, I would say that Arbe is cash-rich. Management has a significant amount of liquidity to design new products as well as to launch new marketing campaigns.

The list of assets also includes trade receivables worth $2 million, with prepaid expenses and other receivables of close to $1 million, property and equipment of $1 million, and total assets of $62 million.

10-Q

The list of liabilities does not seem worrying. Arbe Robotics only reported total current liabilities of $5.7 million, with total long-term liabilities of $1.4 million. The only liability that I included for the calculation of the enterprise value is warrant liabilities worth $1.3 million.

10-Q

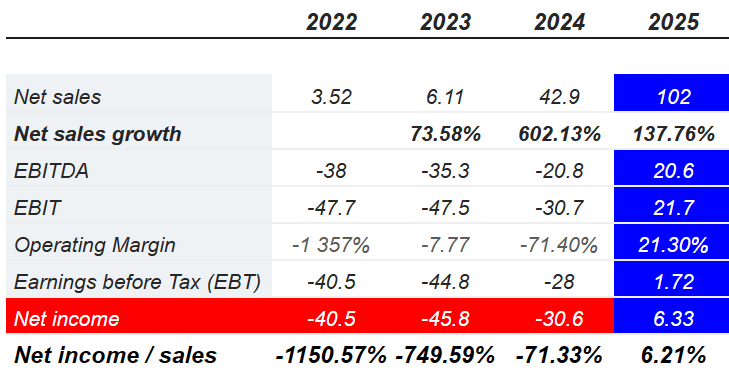

Market Expectations, My Expectations, And Valuation

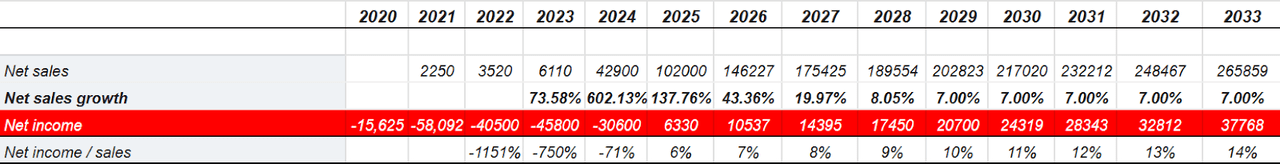

The company does not report positive net income right now, however, analysts out there are expecting significant sales growth in 2025 and 2024 as well as positive net income in 2025. With these figures, I think that making a full forecast about the financial statements appears quite appealing. 2025 net sales are expected to be close to $102 million, with 2025 EBIT of about $21.7 million, net income worth $6.33 million, and net income/sales of close to 6.21%. I used some of these figures for my valuation model.

S&P

My expectations are 2033 net sales of $265 million, with net sales growth of about 7%, net income of $37 million, and net income/sales close to 14%. I believe that my figures are quite conservative.

My Expectations

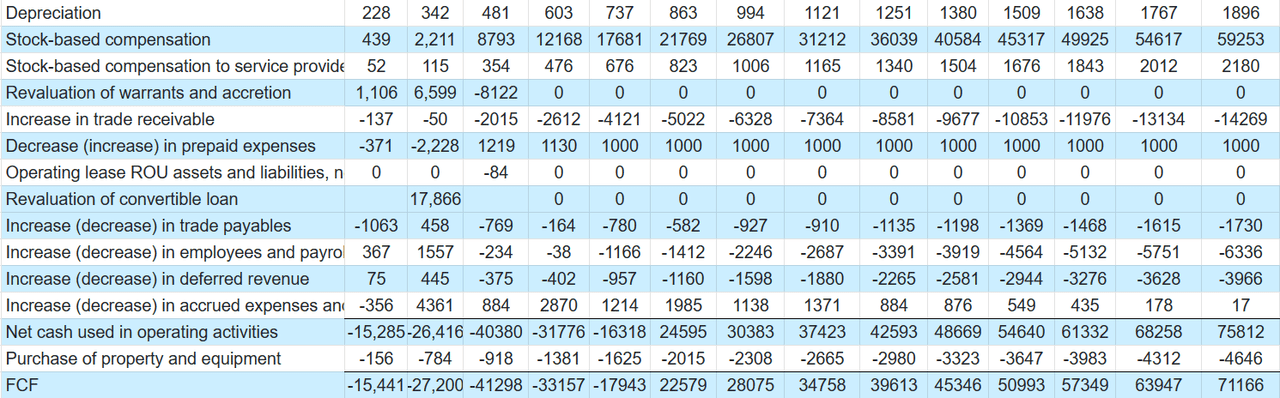

Also, including depreciation of $1 million and stock-based compensation worth $59 million, I included no revaluation of warrants and no revaluation of convertible loans. Additionally, if we also assume changes in trade receivable of -$15 million, changes in prepaid expenses of $1 million, and employees and payroll accruals worth -$7 million, net cash used in operating activities would stand at about $89 million. Finally, taking into account the 2033 purchase of property and equipment of -$5 million, 2033 FCF would be about $71 million.

My Expectations

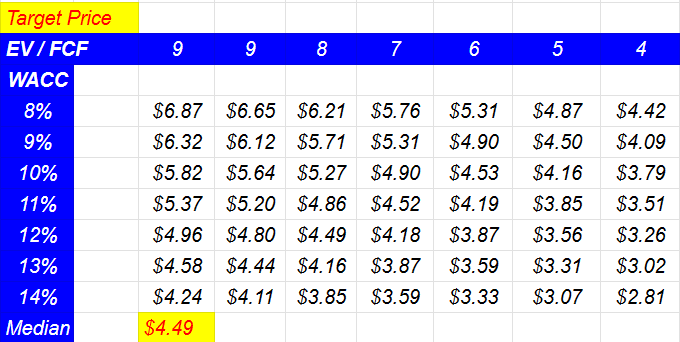

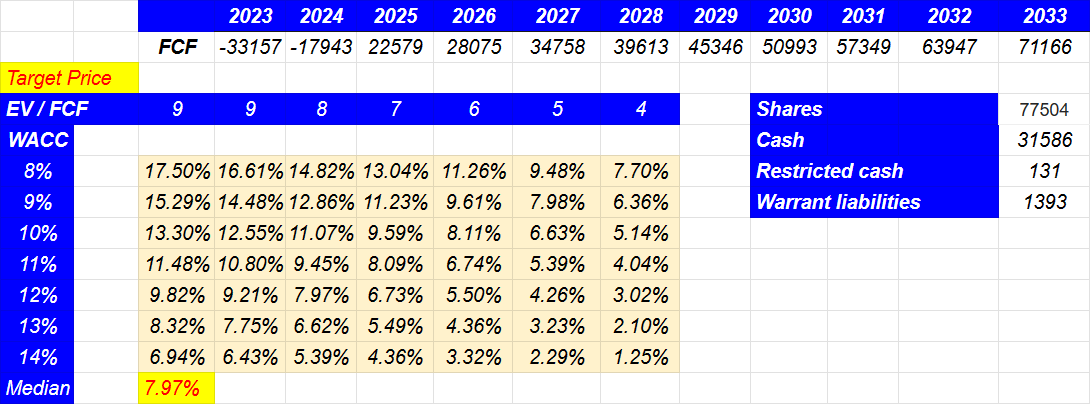

I cannot really make a very concrete forecast about the future cost of capital of Arbe Robotics. Hence, I believe that assuming a WACC between 8% and 14% makes sense. Besides, I assumed that the EV/FCF would most likely be close to 9x-4x. With the previous assumptions, the implied price would be close to $2.81 and $6 per share, and the median obtained from my sensitivity analysts would be close to $4.4 per share.

My Financial Model

I also made a sensitivity analysis for the calculation of the IRR, which stood at close to 7%. With these figures, I believe that Arbe Robotics appears substantially undervalued.

My Financial Model

Risks And Competition

The company faces financial risks due to its history of losses and uncertainty about its ability to generate profits in the future. High component costs and poor performance may make it difficult to sell at competitive prices, which would impact the generation of sufficient revenue to cover operating costs.

Demand risk arises from possible slow adoption of products, cancellation of agreements, and unpredictable factors such as international conflicts or weather conditions. Additionally, competitive and business disruption risks relate to industry competition, economic issues, supply disruptions, and adverse events that may impact the supply chain and operations. These risks can compromise profitability, growth, and business continuity.

The market is highly competitive. Arbe faces a wide range of competitors, from large companies to new startups. As a Tier 2 supplier, it supplies imaging radar chipsets to Tier 1 manufacturers and OEMs. To differentiate itself, the company stands out with its 4D imaging radar technology that offers superior perception capabilities, cost-effective and energy-efficient radar solutions, global coverage, validation by industry leaders, automotive-grade development and production, and established relationships with multiple Tier 1 suppliers. These strengths allow the company to compete successfully and maintain its leadership in target markets.

My Takeaway

Arbe Robotics Ltd. presents an interesting proposal in the market. Its focus on developing advanced radar technology and its strategy of establishing strong relationships with Tier 1 manufacturers and OEMs are key points for its growth. Considering the growth of the target markets, recent investments received, growing penetration in China, and capacity increases, I believe that we may see net sales growth in the coming years. The company also faces significant risks from the need for additional funds and the potential slow adoption of products. With that, I believe that Arbe Robotics remains quite undervalued.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here