An electrical engineer works on a laptop.

How do you know that you’re investing properly? Well, the renowned economist Paul Samuelson offers an answer to us: “There is something in people; you might even call it a little bit of a gambling instinct… I tell people investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

When done right, your approach to investing from the outside looking in should be very boring to other people. That doesn’t mean it has to be boring to you: Over the years, I have found the process of slowly and surely building wealth to be quite exciting. But success as an investor largely depends on emotional intelligence (e.g., patience, reasoning, and learning from past mistakes) and buying great businesses at attractive valuations. Once you begin to take those actions, it’s a matter of riding out the storm of market volatility.

As a dividend growth investor, receiving consistently growing dividend payments helps me to do just that with my portfolio. The electric and natural gas utility Xcel Energy (NASDAQ:XEL) flies under the radar of most dividend growth investors. However, I believe the stock deserves more respect and attention from investors. For the first time since May 2022, let’s discuss why that is the case.

The Dividend Is Sustainable

When you think of utilities, you often think of stodgy dividend payers. However, having delivered 6.4% annual dividend growth to shareholders over the past 10 years, Xcel Energy has been a respectable dividend grower. Thus, the Seeking Alpha Quant system grades the company’s dividend growth at a B- versus the overall utility sector.

Similar dividend growth should continue in the future. Xcel Energy posted $3.17 in diluted EPS in 2022. Against the $1.92 in dividends per share that were paid during that time, this equates to a 60.6% diluted EPS payout ratio. This is on the low end of the company’s 60-70% targeted diluted EPS payout ratio, which gives it the flexibility to deliver dividend growth slightly higher than earnings growth.

Xcel Energy expects midpoint diluted EPS of $3.35 ($3.30 to $3.40) for 2023. Compared to the $2.0475 in dividends per share that are slated to be paid in 2023, this works out to a 61.1% diluted EPS payout ratio.

The consensus is that Xcel Energy will deliver annual diluted EPS growth of roughly 6% over the next five years. This is in line with the 6.1% average annual diluted EPS growth of 6.1% that the utility has put up for nearly two decades (slide 19 of 80 of Xcel Energy Barclays Investor Presentation). That is why I believe the company can hand out 6.5% annual dividend increases in the long run.

Holding Up Despite Headwinds

Boasting an electric customer base of 3.8 million and a natural gas customer base of 2.1 million, Xcel Energy is a major utility. The company operates four companies in eight states throughout the Midwest and Southwest United States.

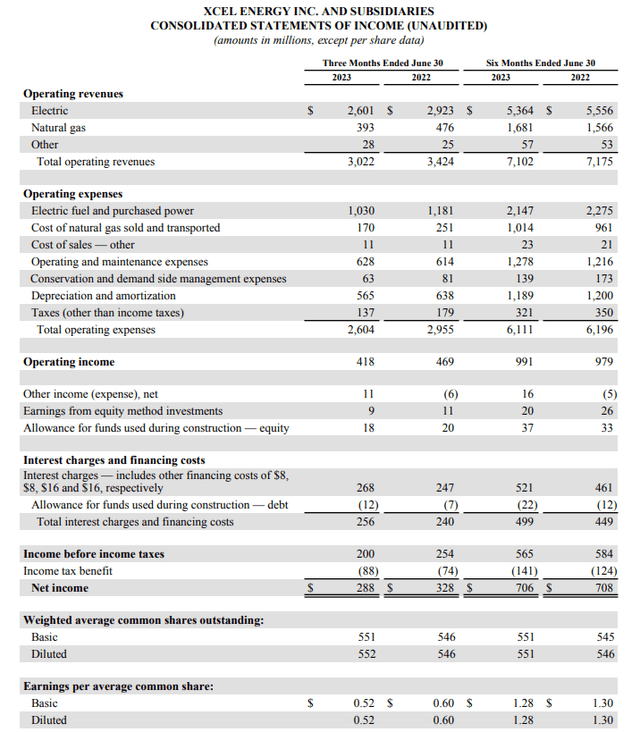

Xcel Energy Q2 2023 Earnings Press Release

Xcel Energy’s operating revenue fell 1% over the year-ago period to $7.1 billion in the first half of 2023. Unfavorable weather and the electric rate case in Minnesota were primarily responsible for the dip in the topline for the first half of the year.

In the case of the latter, the Minnesota Public Utilities Commission gave the go-ahead to a three-year rate increase of $311 million based on a 9.25% return on equity. This was significantly less than the 10.2% and $498 million that Xcel Energy filed for in its rate case.

The company’s diluted EPS declined by 1.5% year over year to $1.28 during the first half of the year. Higher interest rates weighed on diluted EPS to the tune of $0.08 in that period. Negative weather impacts contributed to another $0.04 in headwinds.

But even after these challenges, Xcel Energy reiterated its midpoint diluted EPS guidance of $3.35. This would be a 5.7% growth rate over its 2022 diluted EPS base of $3.17. This decent growth rate will be supported by a few factors: During the earnings call, CFO Brian Van Abel pointed to sales growth in its service territories and additional rate case revenue from Colorado and New Mexico that will begin to take place in the second half of this year.

Looking off into the horizon, Xcel Energy has plans to invest $29.5 billion into its electric and natural gas infrastructure between 2023 and 2027. This should be made possible by the company’s BBB+ credit rating from S&P and a manageable debt-to-EBITDA ratio of just 4.9. That is why Xcel Energy believes it can deliver 5% to 7% diluted EPS growth annually in the long term (all details in this section sourced from Xcel Energy Barclays Investor Presentation and Xcel Energy Q2 2023 Investor Presentation and Xcel Energy Q2 2023 earnings press release).

Risks To Consider

As a utility, Xcel Energy isn’t as risky as a tech startup. Nonetheless, there are still risks.

The disappointing regulatory outcome in the Minnesota electric rate case provided a valuable reminder to utility sector investors: The sector is at least partially dependent on favorable regulatory outcomes to support growth. The good news for Xcel Energy is that it is a diversified utility, which means it can still salvage its growth after a bad regulatory outcome.

Xcel Energy’s debt load isn’t high for a utility. But for a business overall, the company is being saddled with higher interest costs as of late. This has also reduced the appeal of its stock in financial markets, which explains its poor performance since the rate hike cycle began.

What A Difference A Year (And Change) Makes

Utilities can be wonderful investments. But when I last covered Xcel Energy over a year ago, I thought that the $75 share price was simply much too high. Now that shares have sold off 20% since that time, I am comfortable upgrading the stock to a buy again. Let’s jump into two valuation models to expand on this argument.

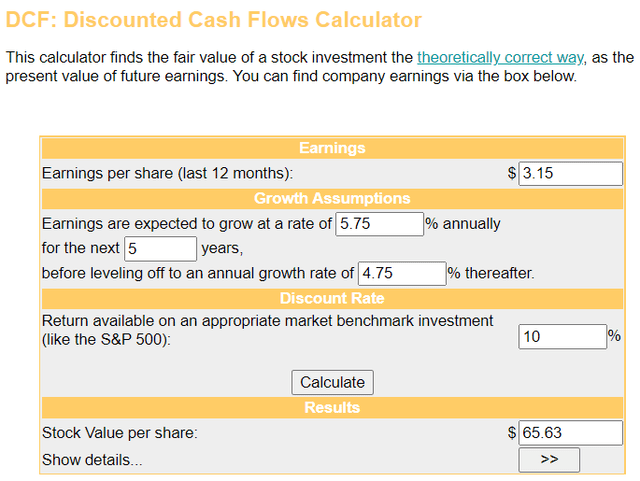

Money Chimp

The first valuation model that I will utilize to value Xcel Energy’s shares is the discounted cash flows or DCF model. This consists of three inputs.

The first input for the DCF model is the last 12 months of diluted EPS. This is $3.15 for Xcel Energy.

The second input into the DCF model is growth projections. Since Xcel Energy has historically posted annual diluted EPS growth just above 6%, I will use a 5.75% rate for the first five years of this model. I’ll then assume a slowdown to 4.75% in the years that follow.

The third input for the DCF model is the discount rate, which is the annual total return rate. I’ll use 10% for this input.

Plugging these inputs into the DCF model, I get a fair value output of $65.63 a share. This implies that shares of Xcel Energy are trading at an 8.7% discount to fair value and offer a 9.5% upside from the current price of $59.94 a share (as of September 22, 2023).

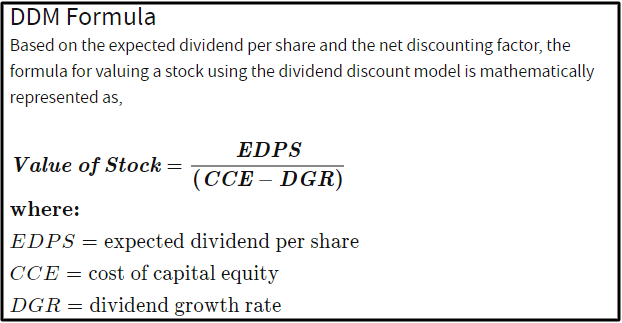

Investopedia

The other valuation model that I’ll employ to estimate the fair value of Xcel Energy’s shares is the dividend discount model, or DDM. Like the DCF model, this also has three inputs.

The first input into the DDM is the annualized dividend per share. Xcel Energy’s current annualized dividend per share is $2.08.

The next input for the DDM is the cost of capital equity or annual total return rate. Again, I will use 10%.

The final input into the DDM is the annual dividend growth rate. I’ll use 6.5% for this input.

Using these inputs for the DDM, I arrived at a fair value of $59.43. That means shares of Xcel Energy are priced 0.9% above fair value and could depreciate by 0.9%.

When averaging out these fair values, I compute a fair value of $62.53 a share. This signals that Xcel Energy’s shares are trading at a 4.1% discount to fair value and offer a 4.3% upside from the current share price.

Summary: A Reliable Dividend Payer Worth Buying

After this year is complete, Xcel Energy will have upped its dividend for 20 consecutive years after its dividend cut in 2002 that reshaped the business. The company looks like it should have many years of dividend growth in the future due to its low payout ratio and reasonable earnings growth potential.

To be clear, Xcel Energy isn’t absurdly cheap, or a no-brainer buy for income investors. However, my valuation models show the stock to be priced 4% below fair value. That is why I am upgrading the stock to a buy rating.

Read the full article here