This article is part of a series that provides an ongoing analysis of the changes made to Harris Associates 13F stock portfolio on a quarterly basis. It is based on Harris Associates’ regulatory 13F Form filed on 8/14/2023. William Nygren’s 13F portfolio value increased from $55.60B to $56.60B this quarter. The portfolio is diversified with recent 13F reports showing around 200 positions. There are 63 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Alphabet, Capital One Financial, Amazon.com, Charter Communications, and Fiserv. They add up to ~21% of the portfolio. Please visit our Tracking William Nygren’s Harris Associates Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q1 2023.

Harris Associates currently has ~$100B under management. Their flagship mutual funds are the Oakmark Fund (MUTF:OAKMX) incepted in 1991 and the Oakmark International (MUTF:OAKIX) incepted in 1992. Both funds have produced substantial alpha during their lifetimes: 12.55% annualized return compared to 10.16% for the S&P 500 index for OAKMX and 8.73% annualized return for OAKIX compared to 5.86% annualized return for the MSCI World ex-US Index. The other mutual funds in the group are Oakmark Select (OAKLX), Oakmark Equity and Income (OAKBX), Oakmark Global (OAKGX), Oakmark Global Select (OAKWX), and Oakmark International Small Cap (OAKEX).

Note: The top holdings in the Oakmark International Fund are not in the 13F report as they are not 13F securities. The positions are Lloyds Banking Group (LYG), BNP Paribas (OTCQX:BNPQF), Mercedes-Benz Group (DDAIF), Intesa Sanpaolo (OTCPK:ISNPY), Bayer (OTCPK:BAYRY), Allianz (OTCPK:ALIZF), Continental (OTCPK:CTTAF), BMW (OTCPK:BMWYY), and Fresenius (OTCPK:FSNUY).

Stake Increases:

Capital One Financial (COF) and Intercontinental Exchange (ICE): COF is a large (top three) 3.69% of the portfolio stake built during the last four quarters at prices between ~$85 and ~$122 and it is now at ~$98. The 2.91% ICE stake saw a whopping 170% increase during Q4 2022 at prices between ~$90 and ~$110. The stock currently trades at ~$110. The last two quarters saw another ~50% increase at prices between ~$95 and ~$113.

Charter Communications (CHTR): CHTR is a large (top five) 3.49% of the portfolio stake. It was established in 2015 when around 2M shares were purchased at prices between ~$150 and ~$190. Recent activity follows. There was a ~20% stake increase in H1 2021 at prices between ~$597 and ~$722. That was followed with a ~30% increase in Q1 2022 at prices between ~$545 and ~$648. This quarter also saw a ~25% increase at prices between ~$320 and ~$367. The stock currently trades at ~$445.

KKR & Co. (KKR): KKR is a 2.89% of the portfolio stake that saw a ~115% increase during Q4 2022 at prices between ~$43 and ~$57.50. This quarter also saw a ~9% stake increase. The stock currently trades at ~$62.

CNH Industrial (CNHI): CNHI is a 2.87% of the portfolio position purchased in Q4 2020 at prices between $7.75 and $13 and the stock currently trades at ~$12. The five quarters through Q1 2022 saw a ~55% selling at prices between ~$11 and ~$17. There was a ~20% stake increase this quarter at prices between ~$12.80 and ~$14.60.

Note: They control ~8% of the business.

ConocoPhillips (COP): COP is a 2.92% of the portfolio stake primarily built during the last two quarters at prices between ~$94 and ~$125. The stock currently trades at $119.

Bank of America (BAC): BAC was a minutely small position in their first 13F filing in 1999. It became a significant part of the portfolio in 2011. The 2012 to 2015 timeframe saw the stake built from 9.8M shares to 138M shares at prices between ~$6 and ~$18. Recent activity follows. Q3 2022 saw a ~15% selling and that was followed with marginal trimming next quarter. There was a ~20% increase last quarter at prices between ~$27 and ~$37. The stock is now at $27.64, and the stake is at 2.71% of the portfolio. This quarter also saw a ~6% increase.

General Motors (GM): GM is a 2.63% of the portfolio position. It is a very long-term stake. The original position was small in 2007 and it was disposed the following year. In 2013, a huge ~70M share stake was established at prices between $27 and $41. The position size peaked at ~81M shares in 2015. The stake was sold down by ~25% in the 2016-2019 timeframe at prices between $28 and $46. That was followed with a ~45% reduction in the five quarters through Q2 2021 at prices between ~$18 and ~$64. There was a ~25% stake increase in Q1 2022 at prices between ~$40 and ~$66. The last five quarters have seen only minor adjustments. The stock currently trades at $32.58.

CBRE Group (CBRE): The 2.10% CBRE stake saw a ~20% increase during H1 2022 at prices between ~$70 and ~$109. H2 2022 also saw a similar increase at prices between ~$67.50 and ~$88. The stock currently trades at $75.17. The last two quarters saw only minor adjustments.

Wells Fargo (WFC): The 1.81% WFC stake saw a ~45% increase during Q3 2022 at prices between ~$39 and ~$46. It now goes for $41.23. This quarter also saw a ~6% increase.

Warner Bros. Discovery (WBD): WBD is a 1.43% of the portfolio position purchased during Q3 2022 at prices between ~$11.30 and ~$17.50 and the stock currently trades at $11.10. Q4 2022 also saw a ~10% stake increase. There was marginal trimming last quarter and a ~7% increase this quarter.

APA Corporation (APA), Ally Financial (ALLY), American International Group (AIG), American Express (AXP), Altria Group (MO), Bank of New York Mellon (BK), Carlisle Companies (CSL), Charles Schwab (SCHW), Comcast Corp (CMCSA), EOG Resources (EOG), First Citizens BancShares (FCNCA), Fortune Brands (FBIN), Kroger Co. (KR), Liberty Broadband (LBRDK), Lithia Motors (LAD), Masco Corporation (MAS), Moody’s Corporation (MCO), State Street Corporation (STT), and Truist Financial (TFC): These small (less than 2% of the portfolio each) positions were increased this quarter.

Stake Decreases:

Alphabet Inc. (GOOG) (GOOGL): GOOG is currently the largest 13F position by far at 6.13% of the portfolio. The bulk of the stake was purchased in 2014 at prices between ~$26 and ~$30. Next year also saw a ~20% stake increase at prices between ~$25 and ~$38. The two years through Q4 2020 saw a ~28% selling at prices between ~$53 and ~$91. That was followed by a ~26% selling this quarter at prices between ~$104 and ~$128. The stock currently trades at ~$131.

Amazon.com (AMZN): The top three 3.60% of the portfolio AMZN stake was built during the last five quarters at prices between ~$85 and ~$170. There was a one-third selling this quarter at prices between ~$98 and ~$130. The stock currently trades at ~$129.

Fiserv, Inc. (FI): FI is a large (top five) 3.45% of the portfolio position primarily built during 2021 at prices between ~$96 and ~$111. The last five quarters saw a ~40% selling at prices between ~$89 and ~$126. The stock currently trades at ~$116.

Oracle Corporation (ORCL): The 2.54% ORCL position saw a ~90% increase during Q4 2022 at prices between ~$61 and ~$84. There was a ~37% selling this quarter at prices between ~$93 and ~$127. The stock currently trades at ~$109.

Salesforce, Inc. (CRM): CRM is a 1.89% stake that saw a roughly two-thirds increase during Q4 2022 at prices between ~$128 and ~$191. There was a ~35% selling this quarter at prices between ~$189 and ~$223. It is now at ~$206.

Adobe Inc. (ADBE), Berkshire Hathaway (BRK.B), BlackRock, Inc. (BLK), Booking Holdings (BKNG), BorgWarner (BWA), Citigroup Inc. (C), Equifax (EFX), Goldman Sachs (GS), HCA Healthcare (HCA), Hilton Worldwide (HLT), Interpublic Group (IPG), Liberty Global (LBTYK), Meta Platforms (META) previously Facebook, Netflix, Inc. (NFLX), Open Text Corporation (OTEX), Parker-Hannifin (PH), Pinterest (PINS), PulteGroup (PHM), Reinsurance Group of America (RGA), Ryanair Holdings (RYAAY), TE Connectivity (TEL), Tenet Healthcare (THC), THOR Industries (THO), Visa Inc. (V), Willis Towers Watson (WTW), and Workday, Inc. (WDAY): These small (less than ~2% of the portfolio each) stakes were reduced during the quarter.

Note: Although the position sizes relative to the total portfolio value are very small, they have significant ownership stakes in APA Corporation, Lear Corp, Liberty Global, and Reinsurance Group of America.

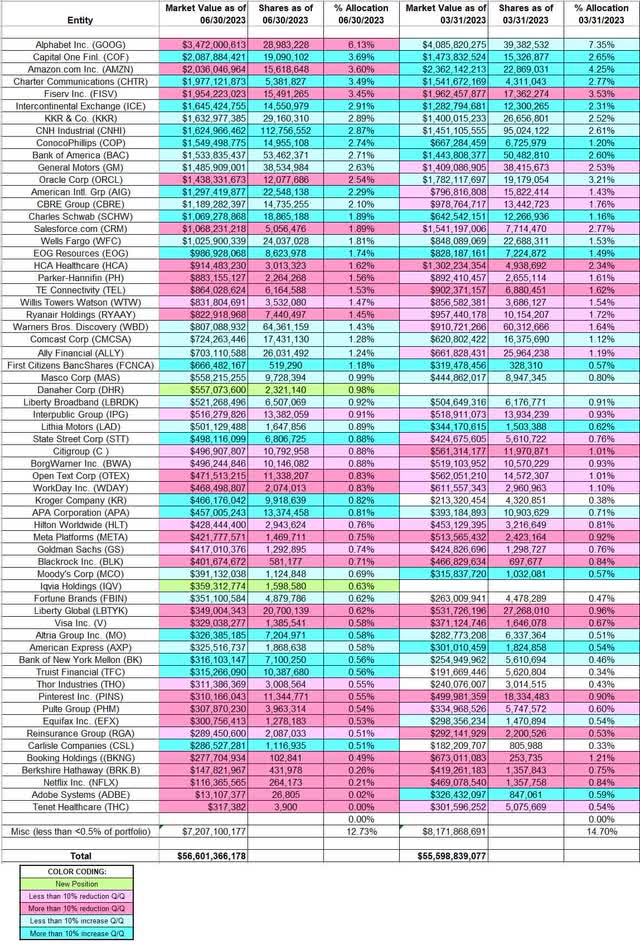

Below is a spreadsheet that shows the changes to William Nygren’s Harris Associates 13F portfolio holdings as of Q2 2023:

William Nygren – Oakmark – Harris Associates’ Q2 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Harris Associates’ 13F filings for Q1 2023 and Q2 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here