It’s been a while since I last visited Kinder Morgan (NYSE:KMI) back in May with a ‘Buy’ rating. The market has seen plenty of rough waters, to say the least, with inflation and interest rates serving as an ever-present backdrop.

Plus, add in the AI-bubble that looks set to pop, with Nvidia (NVDA) falling by 16% in recent weeks, and you have a recipe for plenty more volatility for the rest of the year.

Perhaps that’s why some income investors would want to stick with ‘logical’ dividend paying stocks that simply make sense for achieving growing and recurring dividends to ride out the noise. KMI may be one such stock, with a 4.8% total return since my last piece, surpassing the 2.2% rise in the S&P 500 (SPY) over the same timeframe.

As shown below, KMI remains at the low end of its 52-week range, sitting just a few percentage points above its 52-week low of $16. In this piece, I provide an update on the company and discuss why this high yielding stock is solidly attractive choice for a choppy market.

KMI Stock (Seeking Alpha)

Why KMI?

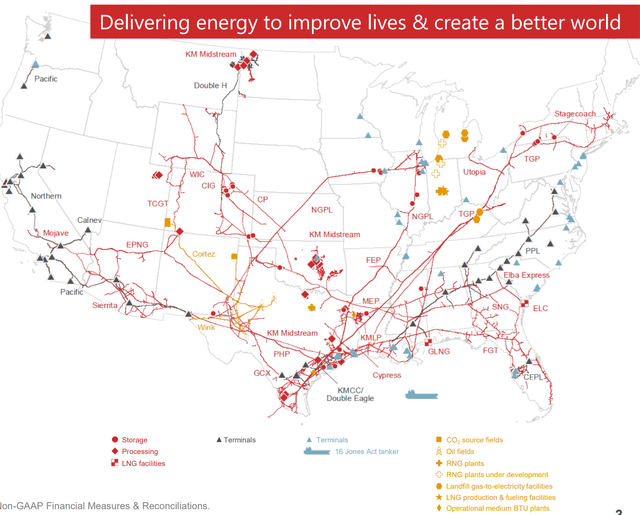

Kinder Morgan is a leading midstream company that’s primarily tilted towards natural gas, with the largest transmission network in the U.S. This includes 70K miles of natural gas pipelines that move around 40% of U.S. natural gas production, and 700 bcf of working storage capacity, comprising around 15% of U.S. natural gas storage.

Beyond natural gas KMI also transports and stores refined products and has the largest CO2 transport capacity in the U.S. with 1,500 miles of CO2 pipelines. AS shown below, KMI’s infrastructure footprint spans from coast to coast, connecting end markets with producing regions.

Investor Presentation

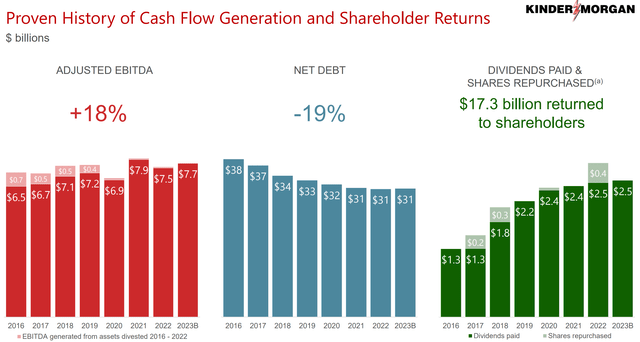

Of course, a key reason for why investors would want own KMI is for its steady business performance in varying economic climates. This is supported by 93% of its cashflows being take-or-pay, hedged, and fee-based, thereby limiting commodity price risk for KMI. This has enabled robust shareholder returns. Since 2016, KMI has grown its adjusted EBITDA by 18%, while reducing its net debt by 19% and returning $17.3 billion to shareholders through share buybacks and dividends, as shown below.

Investor Presentation

This growth has continued in the near-term, as natural gas transport volumes grew by 5% YoY during the second quarter, supported volumes holding up well from the big producers. At the same time, natural gas gathering volumes were up by a robust 16% YoY, while refined products pipeline volumes were flat due to refinery maintenance and jet fuel volumes increased 9% YoY due to continued strong consumer travel demand.

Concerns around KMI stem from its reliance on fossil fuels, which may run counter to the clean energy transition. Also, KMI is not the lowest levered company in the midstream space, with a 4.1x net debt to adjusted EBITDA ratio, sitting higher than the 2.9x for the other industry giant, Enterprise Products Partners (EPD). This makes KMI relatively more vulnerable to higher interest rates. However, its leverage ratio still sits comfortably under the 4.5x level generally considered safe by ratings agencies, supporting its BBB investment grade credit rating.

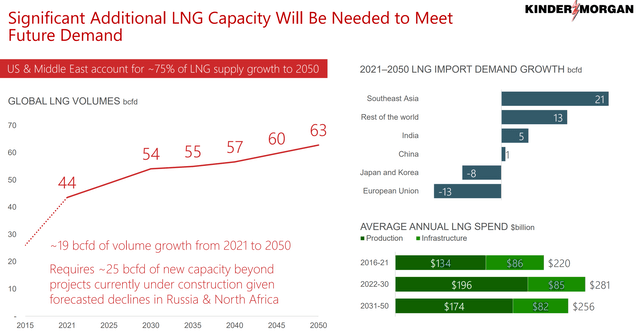

Nonetheless, natural gas remains a critical bridge fuel and it will be needed for the foreseeable future considering the intermittent nature of renewable energy. Between now and 2028, management expects U.S. natural gas demand to grow by 20% to 121 Bcf per day. In addition, global demand is expected to remain strong, and KMI expects for exports to ramp up with respect to LNG exports and demand coming from Mexico. As shown below, Global LNG volumes are expected to grow through at least 2050, with net import demand coming from parts of Asia and other regions around the world.

Investor Presentation

Moreover, management isn’t oblivious to the cleaner energy transition, and believes in a multi-pronged approach that will involve more than just solar and wind. This includes KMI’s renewable natural gas projects that are underway as part of its Kinetrex acquisitions from a couple years ago. This is in addition to liquid biofuels and carbon capture projects such as the Red Cedar Gathering project, which is expected to capture up to 400K metric tons of CO2 per year to be delivered to KMI’s existing Cortez pipeline.

Importantly for income investors, KMI currently pays a 6.8% dividend yield and the quarterly dividend was raised by 2% this year to $0.2825. This equates to a very comfortable DCF-to-dividend coverage ratio of 1.88x, based on $2.13 in expected DCF/share this year. This also leaves plenty of retained capital to fund growth projects and buy back shares. As of July, KMI has spent $330 million to buy back 20 million shares this year.

Lastly, KMI remains a compelling value investment at the current price of $16.60 with a price-to-cash flow of just 7.1x, sitting below its pre-pandemic range of 9x to 10x. It appears to be undervalued at this price, based on my expectation that KMI can achieve around mid-single digit long-term EBITDA growth based on tariff increases and contributions from new projects underway.

KMI’s valuation also sits below that of natural gas-focused peers Enterprise Products Partners and Williams Companies (WMB), while just sitting slightly above that of MPLX (MPLX), as shown below. As such, I reiterate a ‘Buy’ rating on KMI shares.

KMI and Peers Price-to-Cash Flow (Seeking Alpha)

Investor Takeaway

Kinder Morgan remains a logical dividend paying stock in a choppy market largely due to its attractive yield, stable business model, and visible growth prospects. Management also appears to be on top of the current environmental climate, as it has a number of cleaner energy projects underway that could drive cash flows down the line. With a high yield and plenty of retained capital after paying the dividend, the stock appears to be a solid bet for income and value investors alike.

Read the full article here