A Quick Take On TaskUs

TaskUs, Inc. (NASDAQ:TASK) provides enterprises with various outsourced digital services for customer care and content security applications.

I previously wrote about TASK with a Hold outlook.

Management is not providing 2024 guidance, and TaskUs, Inc. continues to face revenue headwinds from technology company clients reducing their employee headcount and related spending.

I remain Neutral [Hold] on TASK for the near term.

TaskUs Overview And Market

Texas-based TaskUs was created to provide labor outsourcing services to enterprises seeking to accommodate increased demand via its online service.

Management is headed by co-founder and Chief Executive Officer Bryce Maddock, who received a B.A. in International Business from New York University.

The company’s main offerings include:

- Digital Customer Experience

- Trust and Safety

- AI Operations.

The firm provides these services to firms in industries including technology, online streaming, food delivery and ride-sharing, financial and health technology.

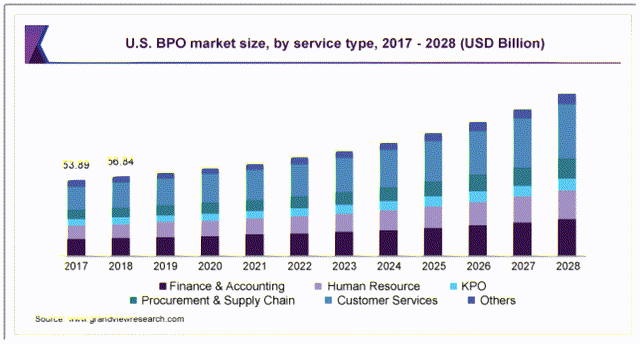

According to a 2021 market research report by Grand View Research, the worldwide market for business process outsourcing [BPO] was an estimated $232 billion in 2020 and is forecasted to reach $446 billion by 2028.

This represents a forecast of 8.5% from 2021 to 2028.

The main drivers for this expected growth are increasing usage of online services tools and delocalized talent to maximize business efficiencies.

Also, the variety of outsourcing services is increasing as other types of service process automation and intelligence add to improved efficiencies for enterprises.

Below is a chart showing the recent historical and expected future growth trajectory of business process outsourcing services in the U.S.:

Grand View Research

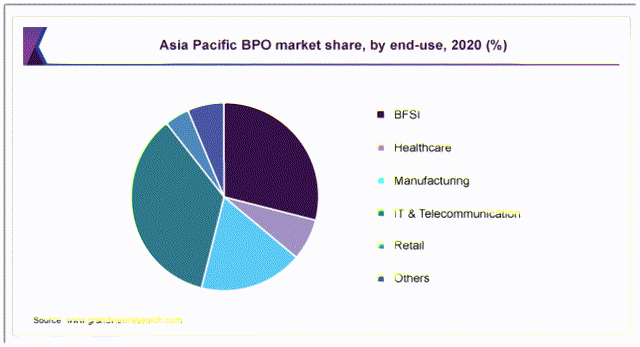

The Asia Pacific market is forecast to see the highest compound annual growth rate from 2021 to 2028, and the chart below shows the breakdown of market share in the Asia Pacific region by end-use industry in 2020:

Grand View Research

Major competitive or other industry participants include:

- 24/7 Intouch

- Appen

- TDCX

- Accenture

- Genpact

- Tata Consultancy

- Cognizant

- Teleperformance

- Telus International

- TTEC

- VXI

- Sutherland.

TaskUs’ Recent Financial Trends

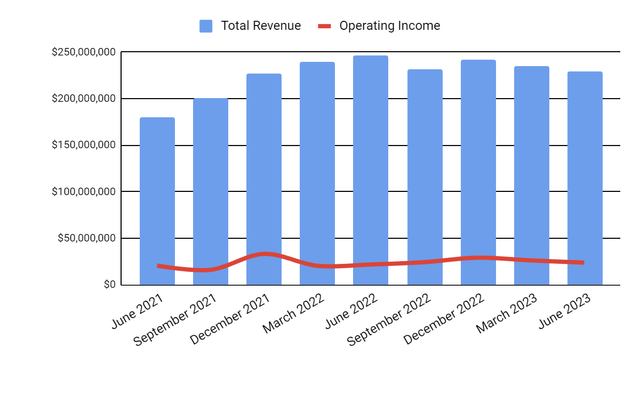

- Total revenue by quarter has dropped in recent quarters; Operating income by quarter has trended slightly lower more recently:

Seeking Alpha

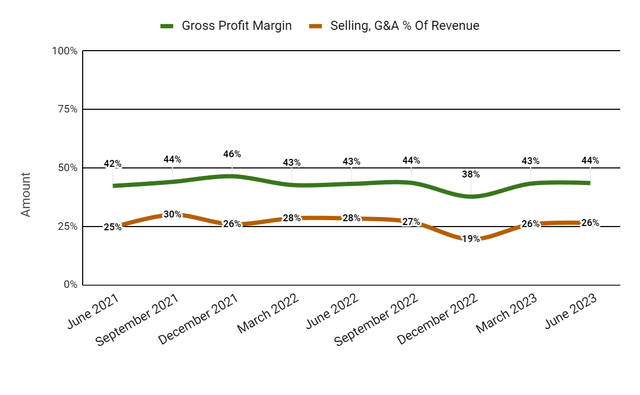

- Gross profit margin by quarter has varied within a range; Selling and G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

Seeking Alpha

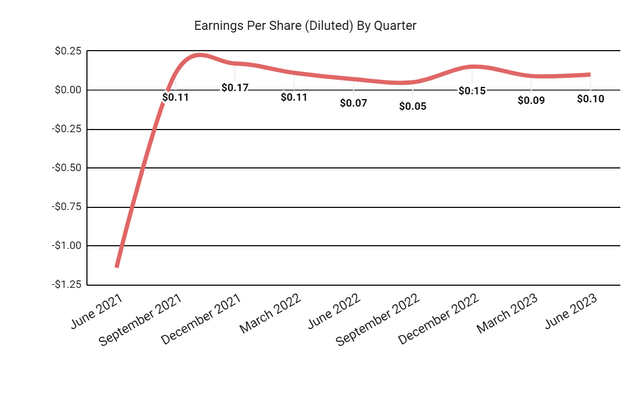

- Earnings per share (Diluted) have stabilized in recent quarters, per the chart below:

Seeking Alpha

(All data in the above charts is GAAP.)

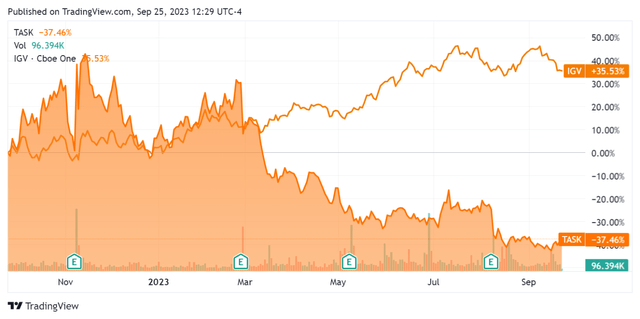

In the past 12 months, TASK’s stock price has fallen 37.46% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 35.53%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $153.6 million in cash and equivalents and $266.4 million in total debt, of which $5.4 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was an impressive $126.9 million, during which capital expenditures were $29.4 million. The company paid $58.9 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For TaskUs

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.1 |

|

Enterprise Value / EBITDA |

6.5 |

|

Price / Sales |

1.0 |

|

Revenue Growth Rate |

2.7% |

|

Net Income Margin |

4.3% |

|

EBITDA % |

17.3% |

|

Market Capitalization |

$905,690,000 |

|

Enterprise Value |

$1,060,000,000 |

|

Operating Cash Flow |

$156,340,000 |

|

Earnings Per Share (Fully Diluted) |

$0.39 |

(Source – Seeking Alpha.)

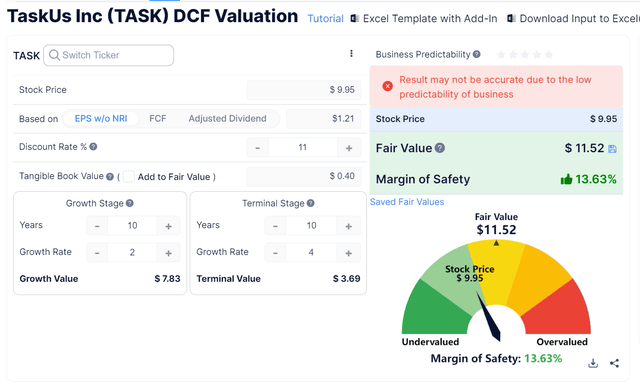

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GuruFocus

Based on the DCF, the firm’s shares would be valued at approximately $11.52 versus the current price of $9.95, indicating they are potentially currently slightly undervalued.

TASK’s most recent unadjusted Rule of 40 calculation was 20.1% as of Q1 2023’s results, so the firm’s performance for this metric has dropped sequentially, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q1 2023 |

Q2 2023 |

|

Revenue Growth % |

12.8% |

2.7% |

|

EBITDA % |

15.9% |

17.3% |

|

Total |

28.7% |

20.1% |

(Source – Seeking Alpha.)

Sentiment Analysis

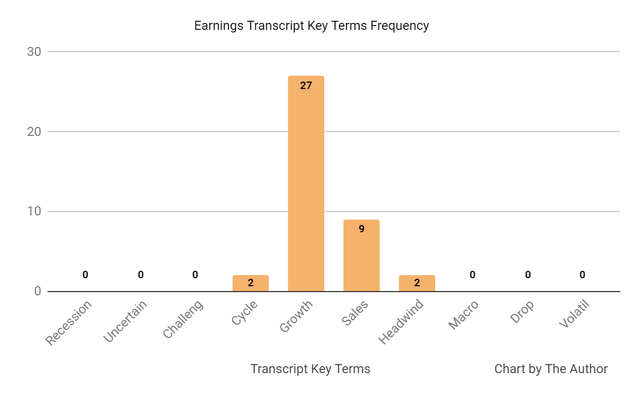

The chart below shows the frequency of certain keywords in management’s most recent earnings conference call with analysts:

Seeking Alpha

The word frequency shows “headwinds” from reduced customer spending from changes in product mix shifts.

Analysts asked management about its 2023 guidance reduction (and beyond) and leadership responded that it foresees a return to top line revenue growth in 2024.

Moreover, the revenue decline at its largest client has been due to the client shifting work to lower-cost offshore markets.

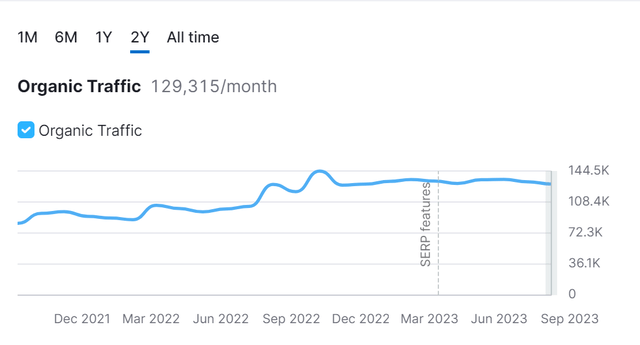

SEMRush’s monitoring system suggests relatively stable to climbing traffic counts to the TaskUs main website, as the chart shows here:

SEMRush

Commentary On TaskUs

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management’s prepared remarks highlighted beating revenue and adjusted EBITDA expectations for the quarter.

However, the company’s technology-centric client base continues to drive efficiencies after over-hiring during the pandemic, “thereby reducing volume expectations for the remainder of the year.”

The firm launched its TaskGPT AI solution with its existing client MoneyLion. The system promises to improve, automate and extend customer-facing functions at the firm’s clients, increasing efficiencies and customer retention.

Notably, management did not disclose any customer or revenue retention rate metrics.

Total revenue for Q2 2023 fell 7.0% year-over-year while gross profit margin increased by 0.3%.

Selling and G&A expenses as a percentage of revenue dropped by 1.9% YoY, a positive signal indicating improving efficiency, and operating income grew by 9.1% to $23.9 million.

The company’s financial position is solid, with ample liquidity, some long-term debt and substantial free cash flow generation.

TASK’s Rule of 40 performance has been only moderate and has dropped sequentially.

Looking ahead, consensus revenue estimates for 2023 suggest a decline of 5.7% over 2022.

This would represent a reversal in revenue growth rate versus 2022’s growth rate of 26.25% over 2021.

In the past twelve months, the firm’s EV/EBITDA valuation multiple has fallen 46%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include positive uptake in its AI solutions as well as increased hiring by technology companies driven by AI demand.

However, these potential upsides appear to be already included in management’s guidance for 2023, and they aren’t venturing to provide any guidance for 2024, other than a non-specific ‘return to growth’ comment.

Accordingly, since 2024 is only a few months away and the firm is still facing client hiring headwinds, I remain Neutral [Hold] on TaskUs, Inc. for the near term.

Read the full article here