In an era of high inflation, investors often seek out commodity exposure as commodities are ‘hard assets’ that have historically protected against prolonged periods of inflation. However, for investors seeking commodity exposure, I would recommend they skip the WisdomTree Enhanced Commodity Strategy Fund ETF (NYSEARCA:GCC).

Simply put, the GCC ETF’s disclosures are confusing and its historical performance pales in comparison to passive commodity ETFs.

Fund Overview

The WisdomTree Enhanced Commodity Strategy Fund is an actively managed ETF that intends to provide broad-based exposure to the commodity sectors through investments in futures contracts. The GCC ETF primarily invests in Energy, Agriculture, Industrial Metals, and Precious Metals futures, although the GCC ETF may also invest up to 5% of its net assets in bitcoin futures contracts.

The Case For Commodities

Investors concerned about inflation often turn to commodities as an inflation hedge because they have intrinsic value that rises with inflation. For example, a barrel of oil contains about 1,700 kWh of energy. If inflation is running at 10% per annum, 1,700 kWh of energy worth $80 today should be worth $88 in a year’s time, all else equal.

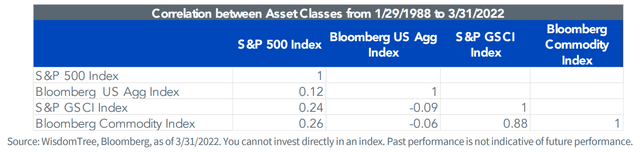

Another reason why investors often turn to commodities is as a portfolio diversifier. Over the long run, commodities tend to have low correlations with other major asset classes like equities and bonds (Figure 1).

Figure 1 – Commodities have low correlations with major asset classes (wisdomtree.com)

By adding commodities to a diversified portfolio, investors may be able to generate superior risk-adjusted returns.

WisdomTree’s GCC Investment Process

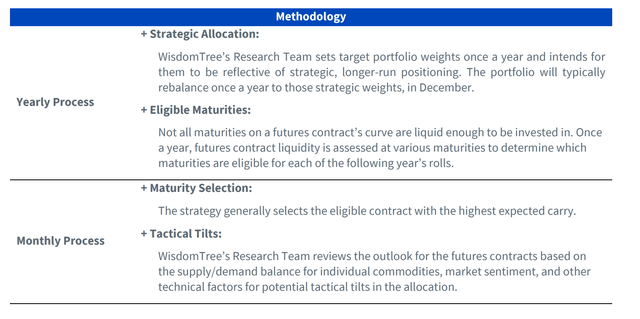

The GCC ETF is a long-only fund investing in commodities and bitcoin futures. Every December, WisdomTree determines the target weights for each sector and commodity based on the investment manager’s macroeconomic outlook and specific commodity forecasts. On a monthly basis, the manager will review the outlook for the various commodities and based on the supply/demand balance for individual commodities, market sentiment, and other technical factors, the GCC ETF may add a tactical tilt to the portfolio weights (Figure 2).

Figure 2 – GCC portfolio construction process (wisdomtree.com)

The GCC ETF manages $171 million in assets and charges a relatively low 0.55% expense ratio.

Portfolio Holdings

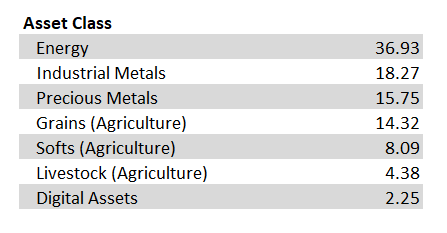

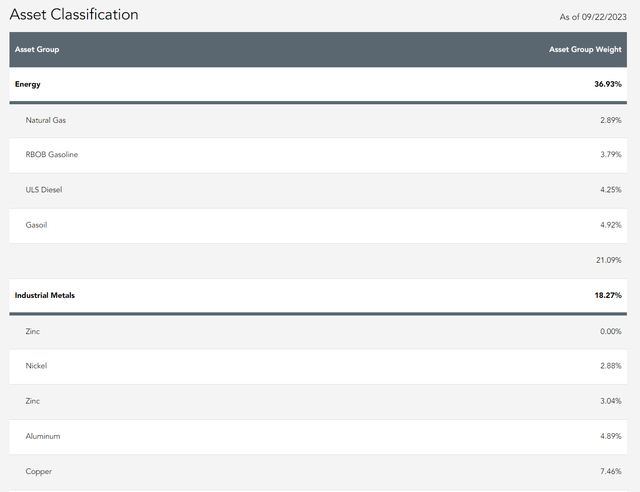

Figure 3 shows the asset class allocation of the GCC ETF as of September 22, 2023. It has 36.9% allocated to Energy, 18.3% allocated to Industrial Metals, 15.8% allocated to Precious Metals, and 26.8% allocated to Agricultural commodities. GCC is one of the first ETFs to incorporate bitcoin futures and it currently has a 2.25% allocation to bitcoin.

Figure 3 – GCC asset class allocation (Author created with data from GCC’s website)

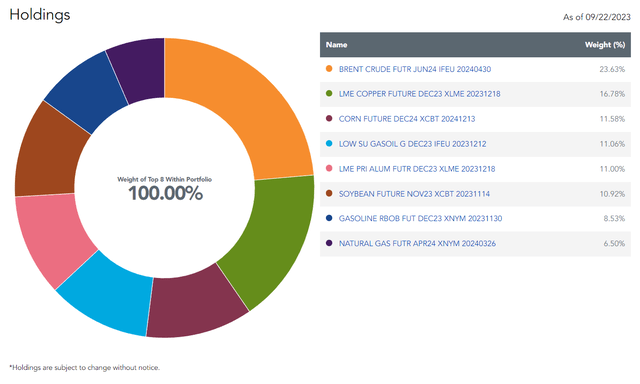

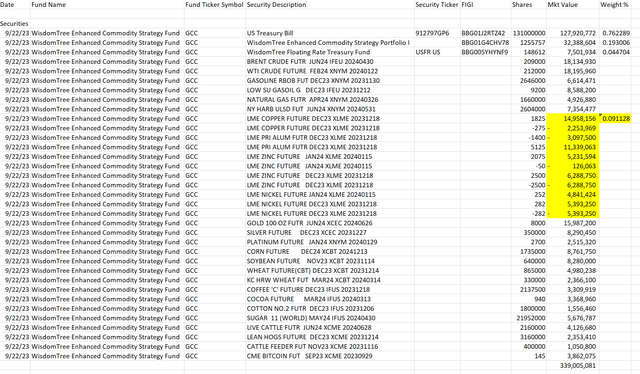

Figure 4 shows the 8 largest single positions of the GCC ETF. According to the table on the fund’s website, the ETF currently has 23.6% allocated to Brent June 2024 futures, 16.8% to LME Copper December 2023 futures, 11.6% to Corn December 2024 futures, and 11.1% to Low Sulfur Gasoil December 2023 futures.

Figure 4 – GCC largest holdings (wisdomtree.com)

Investors should note there are major discrepancies with respect to the fund’s disclosures. For example, the fund’s website shows that the GCC ETF has an 18.3% allocation to Industrial Metals (Figure 5). However, from Figure 4 above (copied from the same website referencing the same portfolio date), the fund has a 16.8% allocation to LME Copper and an 11.0% allocation to LME Aluminum, which sum to over 27%.

Figure 5 – GCC partial asset class allocation (wisdomtree.com)

Furthermore, these large position weights cannot be reconciled to the fund’s complete holdings report referencing the same date, which shows a total market value of $339 million and Industrial Metals having a combined market value of $30.9 million or 9.1% (Figure 6).

Figure 6 – GCC complete holdings report (Author created from GCC Excel holdings report)

It is unclear which set of positions is correct since the asset class summary does not match the large positions summary or the complete holdings report.

Returns

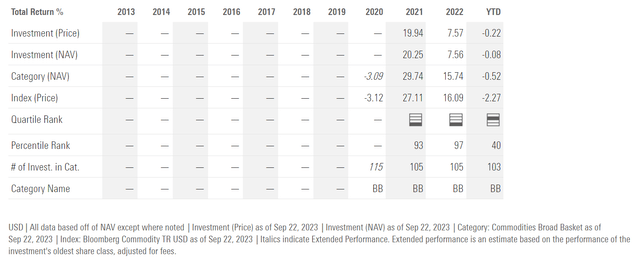

Investors should note that the WisdomTree Continuous Commodity Index Fund was merged into the WisdomTree Enhanced Commodity Strategy Fund on December 21, 2020, so historical performance prior to this date may not be representative of the resulting fund.

Since the fund merger, the GCC ETF has delivered a strong 2021 with a 20.3% return. 2022 was more modest, with the GCC ETF returning 7.6%. So far in 2023, the GCC ETF has been flat (Figure 7).

Figure 7 – GCC historical returns (morningstar.com)

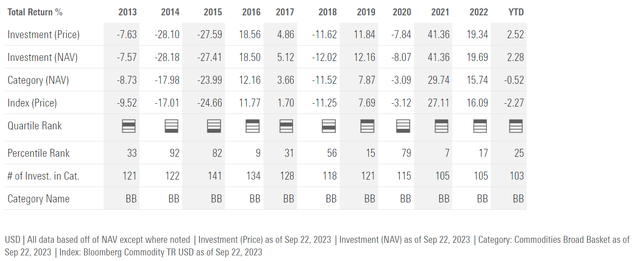

While GCC’s performance looks strong on an absolute basis, we should compare it against other commodity ETFs, for example, the Invesco DB Commodity Index Tracking Fund ETF (DBC). The DBC ETF is a passive ETF tracking the DBIQ Optimum Yield Diversified Commodity Index Excess Return and is one of the larger commodity-related ETFs in the market.

The DBC ETF has had far stronger comparable returns, with 41.4% in 2021, 19.7% in 2022, and 2.3% YTD 2023 (Figure 8).

Figure 8 – DBC historical returns (morningstar.com)

Conclusion

Although the GCC ETF claims to be an ‘enhanced’ active commodity ETF using WisdomTree’s macroeconomic forecasts to pick commodity sectors to overweight, its historical performance significantly lags that of the passive DBC ETF. I am also concerned with the ETF’s confusing portfolio disclosures. I would avoid the GCC ETF.

Read the full article here