Key Takeaways

Stocks Snap Losing Streak

Oil Continues Pushing Higher

Latest PCE Report Shows Inflation Coming Under Control

Both the S&P 500 and Nasdaq Composite snapped two day losing streaks to close higher on Thursday. The S&P 500 gained 0.6% while the Nasdaq Composite moved higher by 0.8%. It was the best day for each index in over two weeks. However, as things stand, it appears stocks are headed for their first quarterly loss of the year. As of Thursday’s close, the S&P was down 3.5% for the quarter and the Nasdaq was off 4%.

It’s been a tough quarter for investors, with interest rates soaring to levels not seen in over a decade. Oil prices have also surged with crude oil trading well over $90 a barrel and up a little more than 1% in premarket. At the same time, a strike by United Auto Workers shows no signs of improvement, which could send car prices higher. In fact, without substantial progress by lunchtime today, more walkouts are scheduled. We’re also staring at a potential government shutdown if lawmakers fail to reach agreement by tomorrow. However, there are also some positives as we move into the fourth quarter.

Bonds snapped a three-day losing streak on Thursday which had seen yields soar, especially at the long end of the curve. Rates on 30 year bonds hit an intraday high of 4.74% before pulling back and settling at 4.65%. The benchmark 10 year had been as high as 4.67% before also pulling back to close at 4.56%. The jump in rates is being felt in the housing market. Pending Home Sales for August were expected to be down just 0.8%; however, the actual number came in at a staggering -7.1%. Home owners face a conundrum at the moment. With many mortgages locked in at or near 3%, should they opt to move, they’re looking at taking on significantly higher financing rates. According to Freddie Mac, the average 30 year mortgage is now 7.31%, the highest level its seen since December of 2000. While that might be a negative for homeowners, it’s also a positive in terms of slowing inflation.

There is also reason for optimism that relations between China and the U.S. may be improving. High level talks between the Biden Administration and top Chinese officials are taking place and preparations for a summit between Presidents Biden and Xi are being discussed. Frosty relations have been both an economic and geopolitical concern. A thawing could provide confidence for U.S. companies that rely on China for both manufacturing, as well as, sales.

Also, while many have been forecasting a recession, we have thus far avoided one. The final reading on GDP for 2Q was a gain of 2.1%, which shows the economy continues to grow while inflation is also coming under control. The most recent report on Personal Consumption Expenditures (PCE), the inflation metric preferred by the Fed, came in at 0.1% on a month-over-month basis, slightly below forecasts for 0.2%. Year-over-year, there was an increase of 3.9%, in line with expectations. Heading into this morning’s PCE release, expectations for a rate increase were small. According to the CME, there was an 83% chance rates will remain unchanged in November and 66% chance rates will remain unchanged in December. Those numbers remain unchanged following the report’s release.

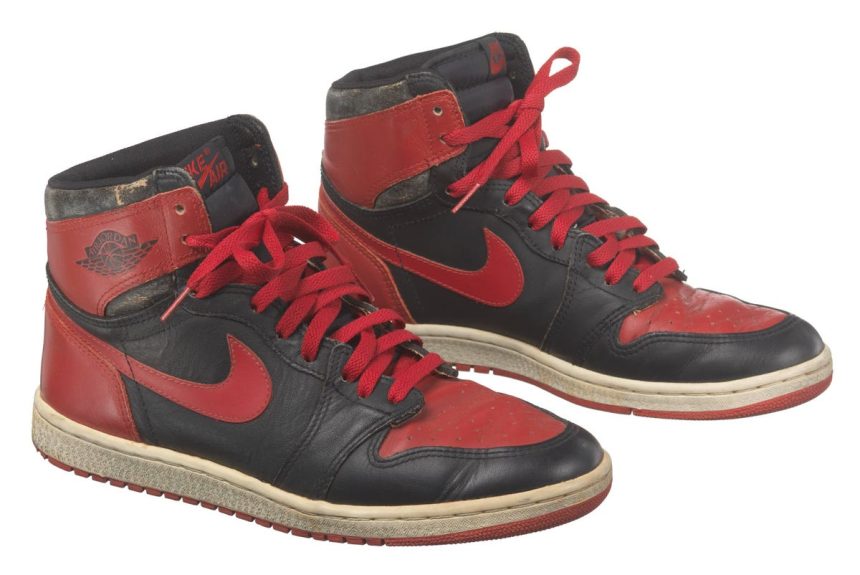

Shares of Nike

NKE

AAPL

tastytrade, Inc. commentary for educational purposes only. This content is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.

Read the full article here