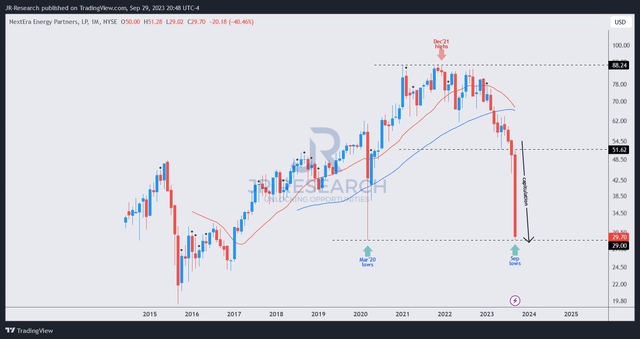

Unitholders in NextEra Energy Partners, LP (NYSE:NEP) have suffered the worst hammering since the COVID pandemic, leading to NEP’s March 2020 lows at the $29 level.

Incredibly, the significant guidance downgrade highlighted by NEP CEO John Ketchum led to a re-test of that level this week, as investors witnessed NEP revisiting the levels last seen in March 2020. Is the downward valuation de-rating justified? While I’m not a NEP holder, I believe that the downgrade is justified, as investors assess critically the revised growth prospects of NextEra Energy Partners. Why?

NEP was positioned as a growth LP, leveraging on assets acquired mainly from NextEra Energy (NEE), the majority owner (55% ownership). Therefore, if the previous growth rates aren’t anticipated, holders shouldn’t be expected to hold the bag as capital is competitive, with unitholders seeking other growth opportunities. Furthermore, NEP traded at a forward distribution yield below 8% (pre-downgrade) before the massive de-rating that recently saw its forward yield rising to 11.6%.

Income investors have highly attractive “risk-free” opportunities to consider, as the 2Y Treasury yield last printed above 5%. As such, the spread might have been justified (pre-guidance), as NEP was still positioned for robust growth. However, with the guidance change, investors are likely assessing whether NEP’s forward distribution could be slashed, which I believe the market is currently signaling.

Accordingly, management highlighted that its previous 12% to 15% annualized growth in distribution per unit through at least 2026 was no longer viable in the current market conditions. As such, the company stressed that it made a strategic decision to “delay a drop-down offering to avoid unfavorable market conditions.” Consequently, NextEra Energy Partners’ revised annualized distributions per unit growth rates of 6% is expected to “benefit unit holders and position NEP for long-term success.”

I applaud management for making the correct decision, as the highly elevated cost of capital could have compelled the company to make worse decisions, increasing balance sheet risks while possibly falling short of delivering distributions accretion. However, the significant markdown in valuation by the market surely didn’t benefit investors who added at the highs between 2021 and 2023. With NEP down nearly 70% from its 2021 highs, I believe unitholders who anticipated a robust income investment opportunity based on NextEra’s market leadership have likely fled.

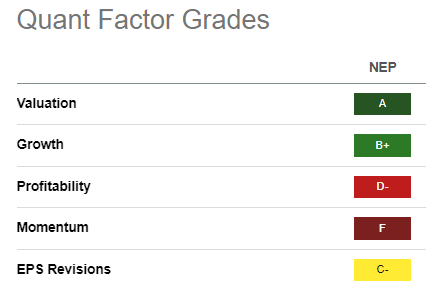

NEP Quant Grades (Seeking Alpha)

Seeking Alpha Quant’s “A” valuation grade suggests significant damage has already been inflicted on NEP, corroborating my assessment that the market is likely signaling a cut in distribution per unit.

Given NEP’s growth grade of “B+,” investors are pricing in significant pessimism. However, the assessment is justified, given the uncertainty, behooving a closer evaluation of NextEra Energy Partners’ growth prospects if interest rates remain higher for longer.

NEP price chart (monthly) (TradingView)

The damage in NEP’s long-term price action is significant but also suggested a capitulation, annotated in my chart above. The “F” momentum grade also supports that massive selloff, suggesting investors must be wary about catching the falling knives unless they anticipate a robust bullish reversal at the current levels.

NEP dip buyers could form a bear trap (false downside breakdown) against the $29 support zone. As such, I believe the selling fervor over the past week could subside as it potentially reaches exhaustion. However, given the damage inflicted, it’s still too early for NEP dip buyers to return.

I urge holders to give NEP more time to re-establish a new buying support zone as it re-tested the $29 level. Given the market signaling of peak pessimism, a possible mean-reversion opportunity could occur over the next three to four months if a robust bullish reversal signal is validated.

Meanwhile, it’s essential to remain patient to let the market action play out accordingly.

Rating: Initiate Hold. (On the watch for a rating change).

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here