Angi Inc. (NASDAQ:ANGI) has established itself as a notable home service player, evolving in brand identity and market strategy. I believe its diversified service offerings and international expansions demonstrate a promising forward-thinking approach. However, some aspects warrant caution. You see, Angi Inc. is a subsidiary of IAC Inc. (IAC) and has evolved considerably since its 2017 inception, resulting from the merger of IAC’s HomeAdvisor and Angie’s List. Then, by 2021, ANGI was rebranded to Angi Inc. Hence, looking at ANGI’s financial metrics, growth patterns across segments, and the nuances of its dual-class stock structure present potential challenges. Based on my valuation model, ANGI appears to be trading close to its intrinsic value, suggesting limited room for significant price movement in either direction. Given these factors, I assign ANGI a neutral rating, indicating a balanced outlook on its investment potential.

Business Overview

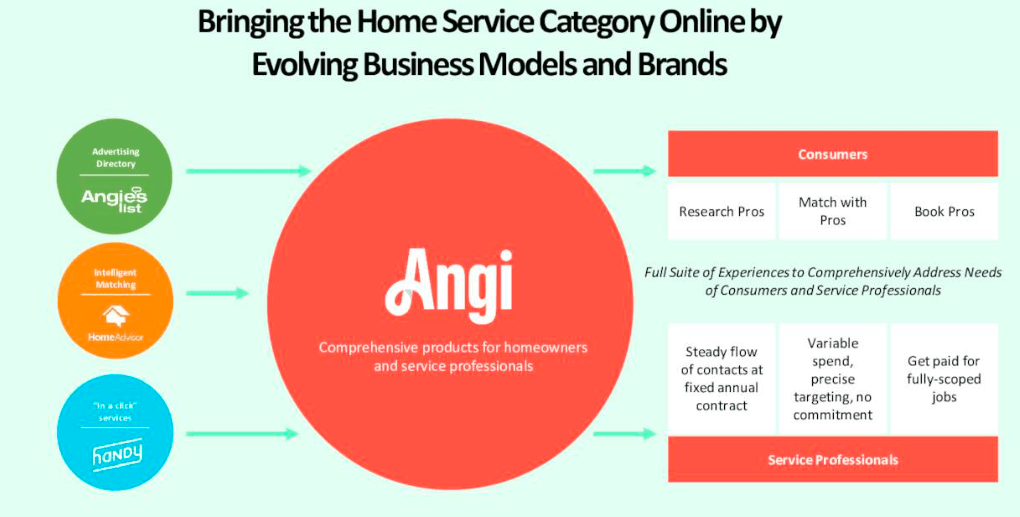

Angi Inc., headquartered in Denver, Colorado, is a company in the home services industry, both domestically and internationally. The company aims to bridge the gap between consumers and home service professionals. This objective is achieved through various platforms and services, including an online directory that spans multiple service categories, tools for consumers to research and hire local services, and advertising avenues for service professionals connecting them to users across over 500 categories like home repair and landscaping. Notably, Angi Inc. rebranded in March 2021, transitioning from its former name, ANGI Homeservices Inc., a change that likely aimed to streamline its brand identity. Currently, Angi operates under four segments: 1) Ads and Leads, 2) Services, 3) Roofing, and 4) Corporate.

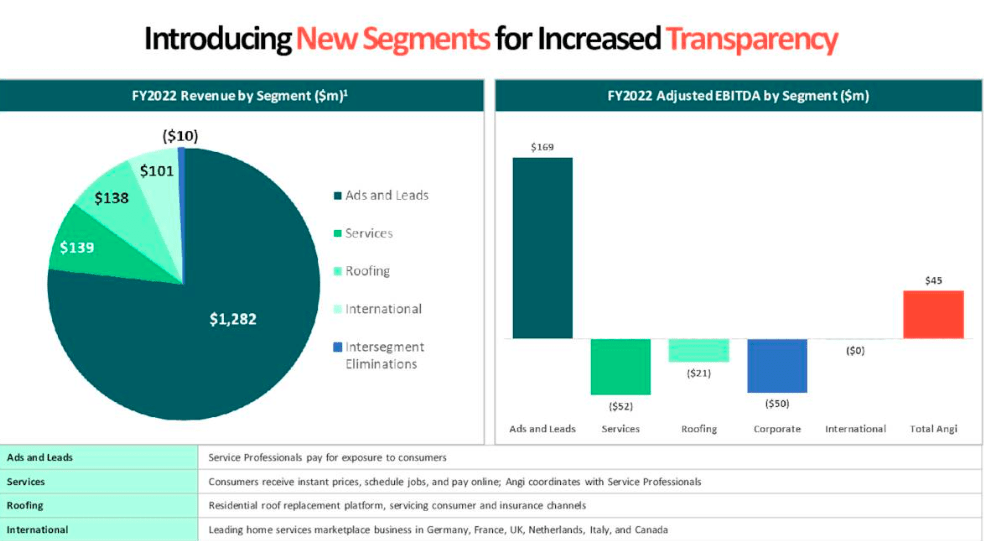

One of the interesting aspects of ANGI is that its offerings range from the Ads and Leads platform, which connects consumers with local service professionals. On the other hand, ANGI’s leads are a digital marketplace focusing on home repair and maintenance. Together, they comprise ANGI’s largest and most profitable business segment. In fact, in 2020, 2021, and 2022, ANGI’s “Ads and Leads” segments were the only ones with a positive EBIT contribution. Unfortunately, Services, Roofing, and Corporate are all losing money after COGS and operating expenses.

Nevertheless, ANGI has made strategic moves in the home services industry, particularly with its direct service provision in the Roofing segment, which specializes in roof replacement and repair. Given the consistent demand for such services, this specialization holds promise for long-term growth. Furthermore, diversifying into multiple business segments can potentially stabilize the company’s revenue streams. I believe such diversification mitigates risks associated with market fluctuations and positions ANGI as a comprehensive solution provider in the home services sector. This approach could ensure steady revenues and enhance the company’s market presence if executed effectively.

ANGI’s Earnings Slides.

Interestingly, Angi’s international presence, with marketplaces under brands like HomeAdvisor, Angie’s list, HomeStars (Canada), Travaux (France), MyHammer (Germany and Austria), MyBuilder (U.K.), Instapro (Italy) and Werkspot (Netherlands), indicates a strategic move to tap into global markets and diversify its consumer base. The company’s evolution and adaptability are further underscored by its acquisition of Handy Technologies in 2018, a platform that resonates with Angi’s ethos of connecting consumers with quality service professionals.

Recent Performance Analysis

Analyzing ANGI’s segment performance of Angi Inc., it looks like a business with steady long-term growth but experiencing a short-term revenue decline. Moreover, the Roofing and Services segments have seen substantial revenue increases of 102% and 31% in 2022. This growth suggests a deliberate move into direct service provisions, which I believe could capture higher profit margins and foster customer loyalty. However, it’s worth noting that the cost of revenue rose by 34% in the same year, primarily due to these segments. This rise underscores the cost-intensive nature of offering direct services. Additionally, the 17% increase in General and Administrative expenses highlights the costs associated with maintaining a high-quality professional network and navigating the legal complexities of a regulated market. The company has slightly increased its selling and marketing expenses by 3%, suggesting a measured brand-promotion approach. However, I think ANGI might need to spend more on marketing to revitalize its topline growth rate.

ANGI’s Earnings Slides.

Furthermore, recent statements suggest that Angi had previously prioritized short-term revenue, potentially at the expense of long-term business health and customer experience. This type of decision is a common pitfall for many businesses, where the allure of immediate financial gains can overshadow the importance of sustainable growth and customer satisfaction. It’s commendable that the company acknowledges this and is actively making changes to rectify it. Even if it meant a temporary dip in revenue, the decision to restructure some demand channels speaks volumes about Angi’s commitment to delivering an optimal customer experience. I believe this path will likely foster longer-term retention of professionals and enhance the homeowner experience on their platform.

It’s also worth noting that, as of December 31, 2022, IAC’s stake in Angi was significant, holding 84.1% economic and 98.1% voting interests, largely due to the dual-class stock structure. Class B stocks, exclusively owned by IAC, possess tenfold the voting power of Class A stocks, concentrating decision-making with IAC. This structure could influence Class A stock liquidity and value. The publicly traded Angi Inc. stock is Class A, while IAC retains substantial voting control through Class B shares. And if IAC offloads a large portion of its Class A shares, it might depress the stock price. Yet, given the voting disparity, IAC would maintain control, potentially divesting a significant economic stake without forfeiting decision-making power.

This matters because Christopher Halpin, IAC’s CEO and CFO, recently gave interesting insights into the company’s performance and future trajectory. A notable point is emphasizing “good riddance” to certain revenue streams. This suggests a strategic shift towards quality over quantity, focusing on revenue channels that align with the company’s long-term vision and customer satisfaction goals. The international segment, particularly the success in Europe, serves as a potential blueprint for the U.S. market, hinting at future strategies Angi might adopt domestically. Furthermore, the rise of short video platforms like TikTok and reels poses challenges and opportunities for companies to diversify their content strategies. The mention of MGM and the potential in online sports betting and iGaming is intriguing, hinting at possible future ventures or strategic alignments.

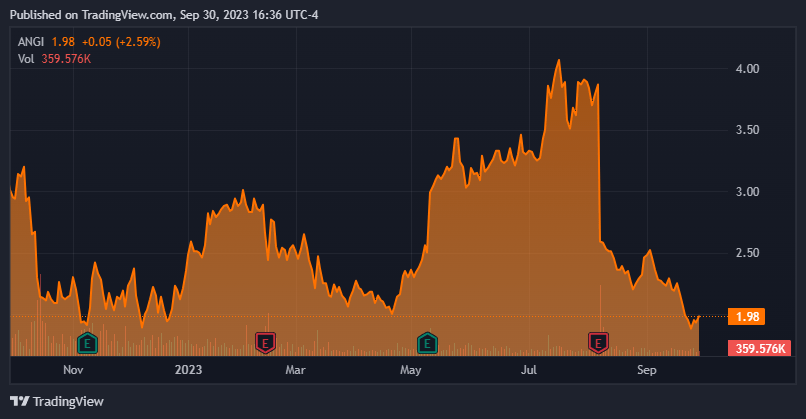

TradingView.

Valuation Perspective

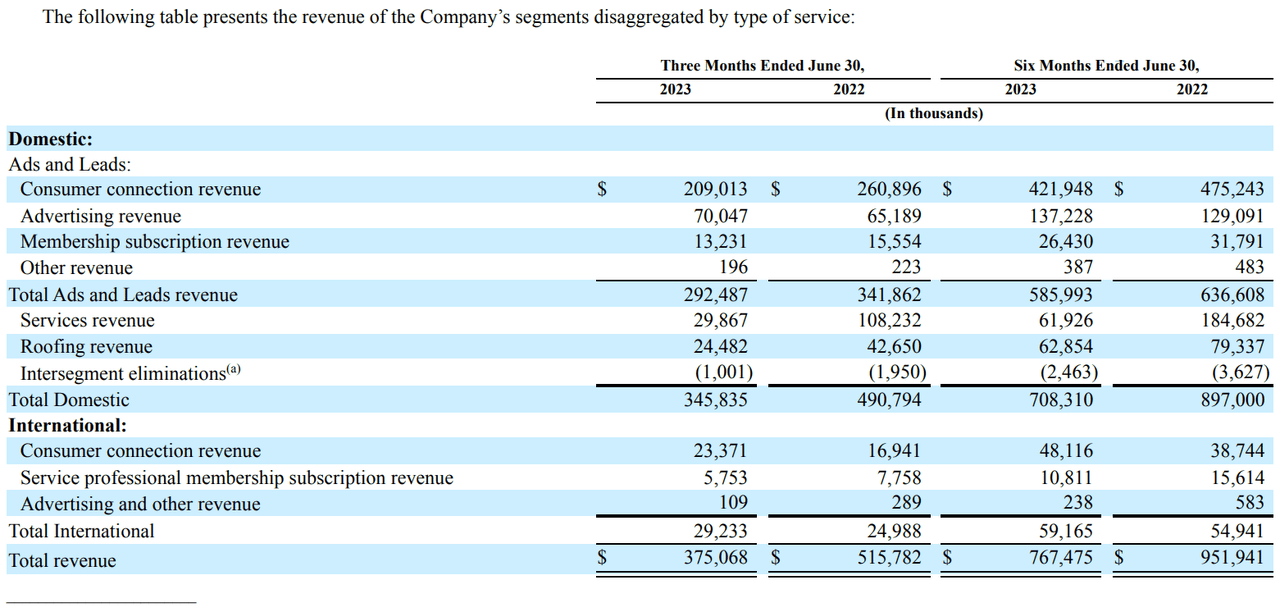

Since 2013, the company has consistently expanded its revenues, achieving a CAGR of approximately 26.8%. I believe such a consistent growth rate over a decade indicates strong management and a robust business model. However, recent financial data presents a more nuanced picture. TTM revenues for the company have decreased by 9.7% relative to 2022. Specifically, revenues for the first half of 2023 were $767.475 million, a noticeable reduction from the $951.941 million in the corresponding period 2022. The company’s EBITDA margin has shrunk by 4.2% YoY, which could signal operational inefficiencies or a heightened competitive landscape impacting profit margins.

ANGI’s latest 10-Q.

The Ads and Leads segment is a major contributor to ANGI’s revenues, making up over 60% of the total. Meanwhile, the Services segment’s revenue has dropped to just 15%. This decline is largely due to a change in revenue recognition from January 1, 2023. Previously, Services recorded revenue on a gross basis. From 2023, Angi Inc. adjusted its terms, making service professionals, not Angi Inc., the primary contract holders with consumers. Now, Angi’s role is mainly to connect consumers to these professionals. Consequently, revenue is now the net amount after paying the service professionals. This change doesn’t affect the operating loss or Adjusted EBITDA. For context, if this net basis were applied in the first half of 2022, revenue would’ve been reduced by nearly $194 million. I think this shift, possibly coupled with market saturation and changing consumer habits, provides insight into the Services segment’s current state.

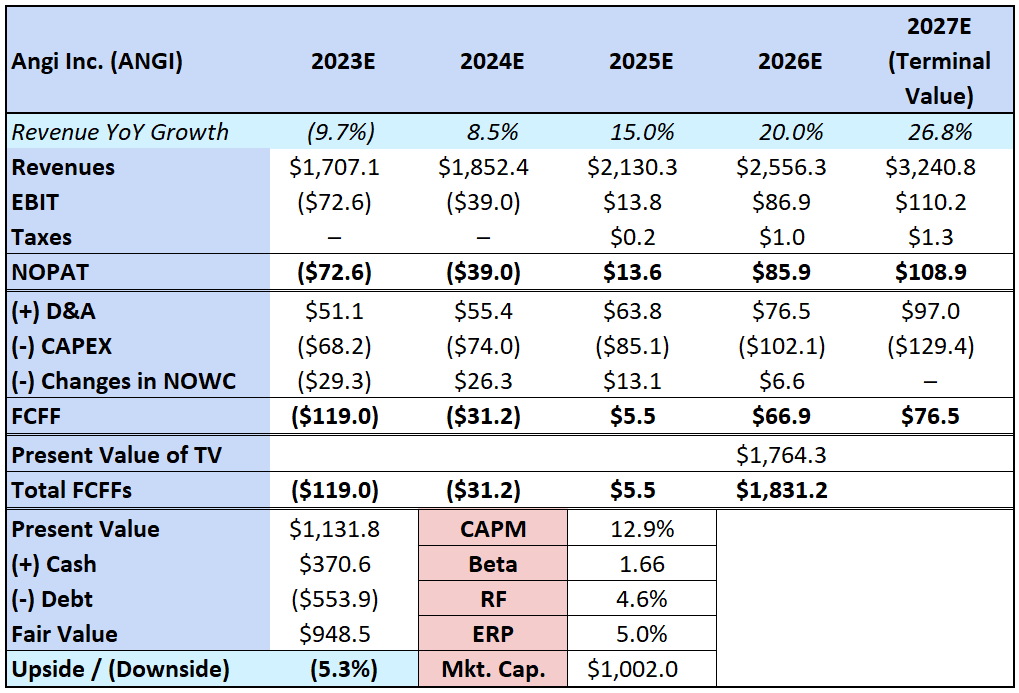

Thus, on balance, I believe ANGI has established a notable position in the market for dependable home service professionals. Based on its past performance, I’ve projected the company to revert to its historical revenue growth rate of 26.8% in my valuation model. I’ve also incorporated historical EBIT margins, tax rates, and metrics like D&A, CAPEX, and changes in NOWC relative to total revenues. To determine the present value, I discounted the forecasted FCFs using ANGI’s CAPM rate of 12.9% through the FCFF DCF method. I believe these assumptions provide a balanced perspective on ANGI’s potential trajectory.

Author’s elaboration.

Based on my valuation model, ANGI appears to be trading at its fair value, presenting limited opportunities for bullish and bearish investors. The ongoing recovery, despite its challenges, combined with the potential risks stemming from IAC’s significant economic and voting control, leads me to assign ANGI a neutral rating. I believe that for ANGI to compensate for these inherent risks adequately, its valuation would need to show a more pronounced undervaluation. Consequently, I believe ANGI might not be a compelling investment for now.

Conclusion

Building on ANGI’s commendable strides in the home services domain, its strategic brand evolution and expansion into international markets are promising. The company’s diverse service portfolio, from local service professional connections to direct roofing solutions, is a testament to its adaptability. However, a closer look at its financials reveals certain intricacies. The dual-class stock structure, for instance, concentrates decision-making power, potentially influencing Class A stock liquidity and market value. Furthermore, recent segmental revenue shifts and operational expenses underscore ANGI’s dynamic challenges. My valuation analysis indicates that ANGI currently trades close to its intrinsic value, suggesting a limited upside or downside at these levels. Consequently, I reiterate my neutral position on ANGI.

Read the full article here