“The problem with people who have no vices is that generally you can be pretty sure they’re going to have some pretty annoying virtues.” – Elizabeth Taylor

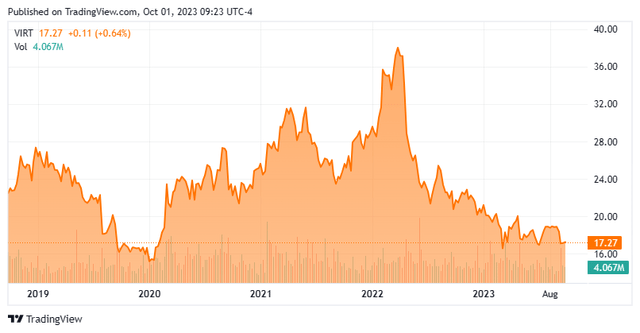

It has been over 15 months since our first and only look at Virtu Financial, Inc. (NASDAQ:VIRT). The shares were recommended as a potential small, covered call candidate in that article. The stock has some new insider buying in September, and the shares look like they are trading at longer-term technical support levels. An updated analysis follows below.

Seeking Alpha

Company Overview:

This Gotham-based financial services firm provides offerings in execution, liquidity sourcing, analytics and broker-neutral, and multi-dealer platforms in workflow technology. Virtu Financial has two main business segments, Market Making and Execution Services. The stock currently trades just above $17.00 a share and sports an approximate market capitalization of $2.8 billion.

Virtu’s sales stream is made up of commissions, fees, and revenue from execution/market-making services. Virtu Financial makes money on the bid/ask spread when they buy or sell securities. Obviously, the firm’s business model is affected by the level of trading volumes as well as the realized volatility in the different markets.

The company has been impacted by the SEC since we last visited. Early this year, the government agency implemented changes that in essence cut the standard settlement cycle for broker-dealer transactions in securities in half. These rules were fully executed in May of this year.

Then, three weeks ago, the SEC filed a lawsuit against Virtu Financial, which alleged that the company “made false and misleading statements regarding information barriers to prevent misuse of confidential trade information of customers.”

Second Quarter Results:

The company reported its second quarter numbers on July 26th. Virtu Financial delivered non-GAAP profits of 37 cents a share. Revenues fell just over 16% on a year-over-year basis to a tad under $507 million. The bottom line results were in line with expectations while revenue was over $200 million above the consensus at the time.

The company’s Market Making services had $3.1 million a day of adjusted trading revenues while Execution Services ran at a $1.4 million daily rate. Management noted on its second quarter conference call that its Market Making business:

saw decreased opportunity as the overall bid offer spread and retail participation levels declined relative to the prior quarter‘ and Execution Services suffered as ‘institutional activity remained muted as our clients continue to look for more clarity from the macroeconomic environment.

Analyst Commentary & Balance Sheet:

Since the company reported second quarter results, Morgan Stanley assigned a new Hold rating on the stock with a $21 price target while JPMorgan downgraded the stock to Neutral from Overweight with a $19 price target. JPM’s analyst noted that the “firm’s entrance into new markets hasn’t panned out as expected.” As we noted in our article in June, the company had just announced it was partnering with Citadel Securities to build a “cryptocurrency trading ecosystem.” This appears to have vastly underperformed initial expectations in regard to trading volumes.

Meanwhile, Piper Sandler stuck with its Buy rating and $26 price target on the stock and Citigroup upgraded Virtu Financial last week to a Buy but with a tepid $20 price target. Citi’s analyst had this to say about the company and its stock:

“While the SEC case will remain an overhang for some time, we would expect any settlement/fine to be financially manageable.”

Just over two percent of the stock’s outstanding float is currently held short. Virtu’s CFO and CEO bought just over $1.1 million worth of new shares on September 13th. This follows share purchase of just over $840,000 by the company’s CEO in early May.

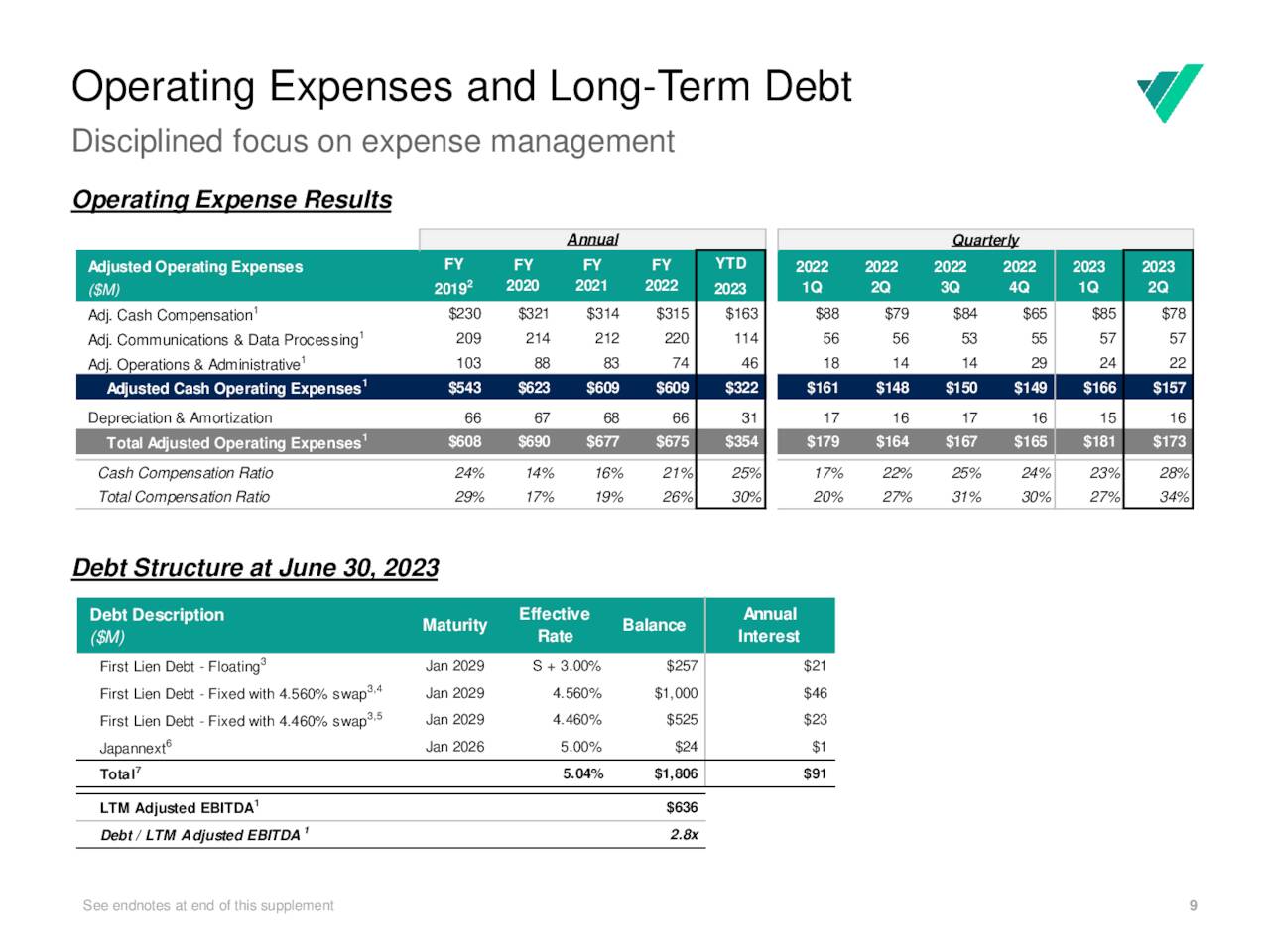

July Company Presentation

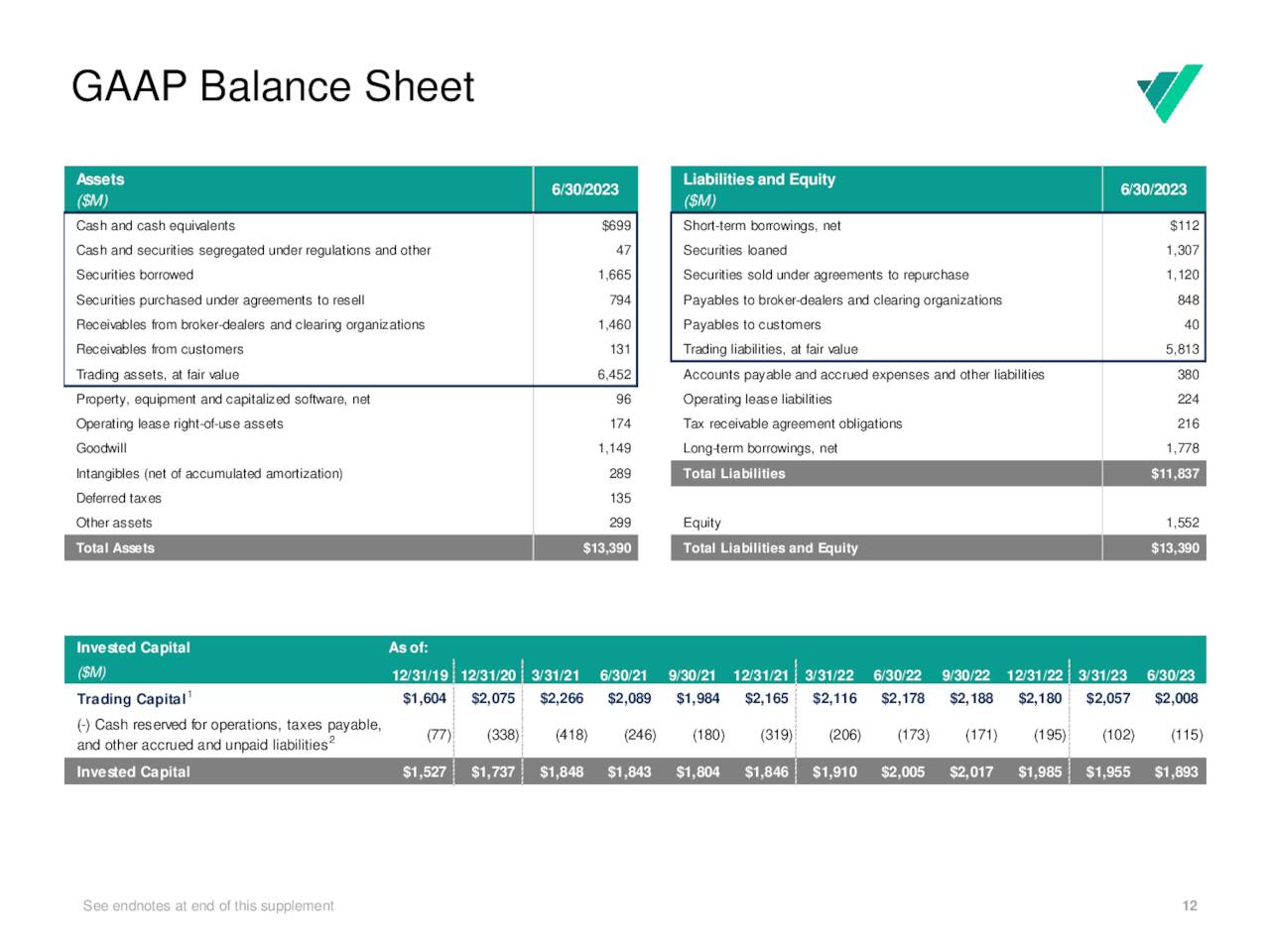

The company debt structure at the end of the first half of 2023 is presented above, while its balance sheet is highlighted below.

July Company Presentation

Verdict:

Virtu Financial made $2.36 a share in FY2022 on $2.36 billion in revenues. The current analyst firm consensus has sales falling just over 45% in FY2023 and profits dropping to $2.12 a share. They also see growth return in FY2024 as the company earns $2.43 a share on a revenue increase in the mid-single digit.

The stock sells at a reasonable just over eight times forward earnings and sports a robust 5.5% dividend yield. The recent insider buying is also a nice vote of confidence. That said, the recent SEC action is likely to be a negative overhang until resolved, and given my non-sanguine view of the overall market, trading volumes could remain punk. The analyst firm community is also tepid on the company and stock’s near-term prospects. Given the shares’ dividend yield and high-single-digit P/E valuation, Virtu Financial, Inc. still makes sense as a covered call holding, but not much else at this time.

“The virtuous man contents himself with dreaming that which the wicked man does in actual life.” – Sigmund Freud

Read the full article here