For the first time in several months, I’m seeing some bargains beginning to appear in the market. Of course, I’m more conservative with purchases now that cash is paying 5%.

In 2021, it made sense to chase mediocre deals. Missing out on a dividend or, even worse, missing a dividend raise meant falling behind in income compounding rather quickly. Today, it is a different world.

With cash safely earning 5% and no risk to the capital, I can hold cash for three to four years before missing out on income. Capital appreciation is a different animal, but fortunately, I invest for income growth, so that’s one less set of variables to worry about, although the overall state of the market plays a vast unknown.

As I’ve written many times, I’m not in a rush to deploy cash. While I did finally do a tiny bit of buying this month, I’m continuing to let dividends accumulate. I just don’t see any reason right now to reach for bargains.

Changing gears, Lockheed-Martin (LMT) failed to raise its dividend last month. For at least the last decade, they have announced the dividend increase on the last Friday in September. There could be a lot of reasons why they failed to do so this time, but it is a bit disconcerting when a company that raises like clockwork skips a beat. I’m expecting to see an announcement soon.

Portfolio Goals

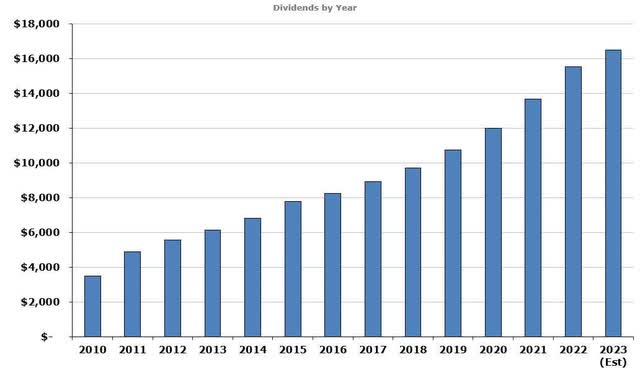

The portfolio goals are simple: Grow the income by 10% annually with dividends reinvested and 7% annually without reinvesting. This goal allows my income to double approximately every seven years while reinvesting and every ten years after I begin withdrawing the dividends. It’s important to know that this portfolio has been closed to new capital since 2016. The graph below shows the steady progress of income growth.

Wyo Investments

Portfolio Guidelines

I use guidelines to achieve my goals rather than rules. Rules imply something hard and fast, whereas guidelines are flexible but give a general direction to follow. I keep these simple, as I have found that complexity adds time without any real benefit. These have evolved over the years, the most recent being the addition of selling covered calls in certain circumstances.

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. The growth is critical as it’s impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. This burned me in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I follow a few other items but don’t see them as integral to my investing. Instead, these tend to be more personal preferences. They include avoiding foreign companies because I don’t enjoy accounting for the taxes and FX rates causing fluctuating dividends.

Current Holdings

Below is a list of the portfolio’s current holdings and the percentage of income each currently contributes. The income from cash, held in money market funds, isn’t included. Nor are the annual special dividends from CME Group (CME) or Diamond Hill Investment Group (DHIL).

| Company | % of Portfolio | % of Income |

| Ameriprise (AMP) | 7.0% | 3.5% |

| Blackstone (BX) | 6.4% | 6.7% |

| Microsoft (MSFT) | 6.1% | 1.7% |

| AbbVie (ABBV) | 4.4% | 5.5% |

| Phillip Morris (PM) | 4.4% | 7.5% |

| Visa (V) | 4.3% | 1.1% |

| Altria (MO) | 4.0% | 11.3% |

| Apple (AAPL) | 4.0% | 0.7% |

| Broadcom (AVGO) | 3.8% | 2.7% |

| Lockheed Martin (LMT) | 3.8% | 3.5% |

| Texas Instruments (TXN) | 3.7% | 3.6% |

| Cash | 3.7% | |

| Enterprise Products Partners (EPD) | 3.2% | 7.0% |

| Cincinnati Financial (CINF) | 3.2% | 2.8% |

| Aflac (AFL) | 2.6% | 1.8% |

| Medtronic (MDT) | 2.5% | 2.8% |

| BlackRock (BLK) | 2.2% | 2.2% |

| PepsiCo (PEP) | 2.1% | 1.9% |

| MSA Safety (MSA) | 2.0% | 0.7% |

| Phillips 66 (PSX) | 2.0% | 2.1% |

| Duke Energy (DUK) | 1.9% | 2.7% |

| Johnson & Johnson (JNJ) | 1.9% | 1.7% |

| Starbucks (SBUX) | 1.7% | 1.2% |

| Automatic Data Processing (ADP) | 1.4% | 0.9% |

| CME Group (CME) | 1.4% | 0.9% |

| Home Depot (HD) | 1.4% | 1.1% |

| Abbott Laboratories (ABT) | 1.3% | 0.9% |

| A.O. Smith Corp (AOS) | 1.3% | 0.7% |

| Omega Healthcare Investors (OHI) | 1.2% | 3.1% |

| CVS Healthcare (CVS) | 1.1% | 1.0% |

| The J. M. Smucker (SJM) | 1.1% | 1.1% |

| Prudential Financial (PRU) | 1.0% | 1.7% |

| Intercontinental Exchange (ICE) | 1.0% | 0.5% |

| Unilever (UL) | 0.9% | 1.1% |

| Simon Property Group (SPG) | 0.9% | 2.0% |

| Fortune Brands Innovations (FBIN) | 0.9% | 0.4% |

| Best Buy (BBY) | 0.9% | 1.4% |

| Ladder Capital (LADR) | 0.8% | 2.1% |

| Walgreens Boots Alliance (WBA) | 0.5% | 1.3% |

| Realty Income (O) | 0.5% | 0.9% |

| Honeywell (HON) | 0.4% | 0.3% |

| National Retail Properties (NNN) | 0.4% | 0.7% |

| Snap-on (SNA) | 0.4% | 0.3% |

| Diamond Hill Investment (DHIL) | 0.3% | 0.4% |

How Am I Doing So Far In 2023?

Currently, I am projecting dividend growth of 7.7% for 2023, below my goal of 10%. As I previously reported, this is a function of holding a large cash position. The yearly income growth is close to 11% if I include interest income. Since it appears that cash will continue to provide a decent yield, I am determining how to incorporate this income in my reports, and will probably begin next year.

While this portfolio’s goals only revolve around income, many readers are interested in the total return. Year to date, the portfolio is up 6.4%, significantly trailing the S&P500, although the gap has closed since peaking towards the end of July. On a one-year basis, the portfolio is still ahead of the S&P, although this difference is also closing.

September’s Dividend Increases

Honeywell

For the third consecutive year, Honeywell increased the dividend by 5%. This is below the 5-year growth rate of over 7% and the 10-year dividend growth rate of better than 10%. However, the company does look poised to bring more significant increases in the upcoming years.

Lockheed Martin

There was no announcement from Lockheed Martin last month. Let’s hope this doesn’t mean anything. I’m looking forward to raise early in October.

Phillip Morris

There were no surprises from Phillip Morris this year. At the beginning of September, they raised the dividend by 2.4%, consistent with their last several raises. While I love the safety of PM, its dividend growth since splitting from Altria has been disappointing, with no chance for larger increases in sight.

Texas Instruments

The increase from Texas Instruments was largely in line with my expectations, although the sub-5 % increase seems disappointing compared to their 5-year average increase of over 15%. However, smaller growth was expected, mainly due to the company’s capital commitments, which will pay larger future dividends for shareholders.

This year’s increase was 4.8%, bringing the current yield to over 3%. Anytime TXN is available at over a 3% yield is an excellent time to buy for long-term investors, although I would like to see it below $160.

Microsoft

If there was ever a company firing on all cylinders, it’s Microsoft. And, as part of its consistency comes the annual 10% dividend increase. This year’s checked in at 10.3%. While I don’t see the company as anywhere near a bargain, it’s an outstanding dividend growth stock for long-term holders.

Starbucks

I love Starbucks as a dividend growth company! Last month, they increased the dividend by 7.5%, in line with expectations. While smaller than the 5-year average of over 13%, this raise is in line with the last couple of years, and they appear poised to be able to provide double-digit increases again soon.

What makes me pause about the company is that they’re seemingly going all in on China. I would be a cautious buyer today at a historically good yield if I were more comfortable with this strategy. While I can’t find specific numbers on their revenue from China, it appears to be relatively small yet fast growing.

October’s Expected Increases

AbbVie

Since splitting from Abbot Labs in 2013, AbbVie has grown the dividend at a rapid clip. While the 10-year growth rate is impressive at better than 15%, much of this was on the back of the now patent-expired Humira. Despite this loss, the company has shown resiliency, but the days of double-digit increases are behind it for the foreseeable future. I’m looking for low to mid-single-digit increases going forward, with a 5% average.

I originally acquired ABBV in the spin-off from ABT and have added shares a couple of times over the years. Today, AbbVie is the portfolio’s fifth largest income producer, accounting for 5.5% of the income.

A.O. Smith Corporation

A.O. Smith Corporation is a smaller dividend growth company with a market cap of around $10B. However, this company looks to hit three decades of dividend growth with this year’s increase. AOS has an impressive 5-year dividend growth rate of over 15%, although the last couple have been in the 7-8% range. The company does look set for double-digit increases in the future but look for this year’s to be around 8% again.

AOS is just breaking into my first buy point of a 1.8% yield, making it a good but not great buy.

Visa

Despite the small yield, Visa is among my favorite dividend growth stocks. Visa has 5 and 10-year dividend growth rates of 18 and 20%, respectively. Last year’s increase was 20%. But more importantly, the company has maintained a steady 20% payout ratio on adjusted earnings and a sub-20% on operating cash. I’m expecting an increase of 15% or better this year.

At a current yield approaching 0.8%, Visa isn’t for everyone. However, the increase will likely push the yield to its all-time high, making it a great time to buy for the dividend growth investor that can hold for a long time.

Sales In September

There were no sales in September, but I continue to look for an exit from my Walgreens position.

Purchases in September

There are two types of purchases I make. The first is the reinvestment of dividends. I try to stick with good bargains for these purchases, generally adding to companies I already hold. However, I will start a new position if enough funds are available to open a meaningful one and the right opportunity presents itself. The second type of purchase is the reinvestment from a sale. I focus on replacing the income with a higher overall quality dividend for these.

Last month, there were no replacement purchases.

Regular Purchases

In September, I did a little buying towards the end of the month as many bargains began reappearing. However, cash accumulation is still massively outstripping purchases—the companies I most want to add remain stubbornly expensive. However, I am considering starting a new position in the coming months, with Kroger (KR) and UPS (UPS) as the leading candidates.

Below is a summary of purchases for the month; the price shown is the average price paid per share.

Best Buy (BBY), 2 shares @ $69.91

NNN REIT (NNN), 4 shares @ $36.99

What Else Am I Watching

Since this is a closed portfolio, I can only buy some of the companies that look interesting. This section covers what I purchase and consider in my other portfolios and the bargains I am watching for this portfolio. My other portfolios have different goals and rules but are also dividend growth portfolios.

Quite a few companies on my watch lists are in my buy ranges. However, many of them have concerns, especially as the economy slows. This is particularly true of retail stocks. I have added small amounts to my Tractor Supply (TSCO) position, but it could still go much lower. Lowe’s (LOW) and Home Depot are in the buy zones, but I am holding off on adding to my Home Depot position in this portfolio. I want to get it closer to a 3% yield. Finally, Target is attractive at a 4% yield as it has rarely offered such a high yield.

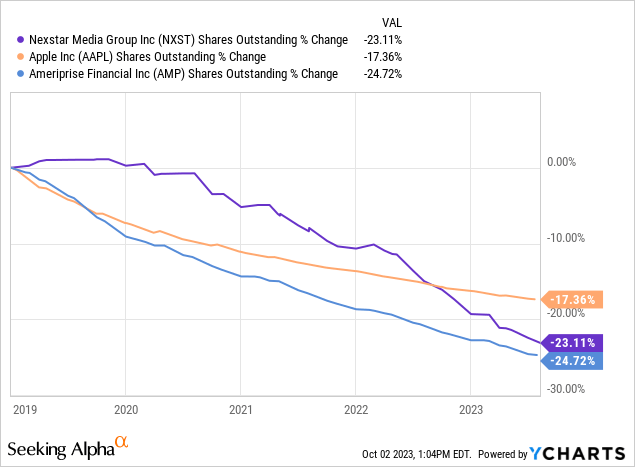

I started a position in Nexstar (NXST) at close to a 4% yield. I consider this a bit speculative, but it’s worth the chance, given the massive buybacks over the last five years, the very low payout ratios, and the huge cashflows. The chart below shows their change in share count compared to two other companies known for buybacks over the past 5-years.

I’m considering starting a position in this portfolio in Kroger or UPS. Kroger is in my top buy range at better than a 2.5% yield, but I would like to get it at October 2022 prices. UPS is much more susceptible to a slowing economy but is tempting for the long run at better than a 4% yield.

If I were looking for high-yield right now, Verizon (VZ), Altria, and Enbridge (ENB) are very attractive right now. These three alone would make a nice, safe base for a high-yield portfolio. Even with my considerable exposure to MO, I will consider adding a little if it falls below $40.

Quite a few other companies are reaching my first buy points, which are showing as good but not great bargains. As mentioned above, Starbucks and Visa are attractive, and it’s hard to go wrong picking up Johnson & Johnson at a 3% yield.

Final Thoughts

I don’t have much to add this month. There is still a lot of risk to the economy. Nobody seems to be talking about the high oil prices as a risk, but this trickles into everything.

People I talk to are feeling stretched pretty thin right now. I can’t believe the starting up of student loan repayments will go well. Interesting data point from my life: From 2016 to 2020, my weekly grocery spending was flat. Since then, it has risen steadily; today, my weekly average for 2023 is double that of 2020.

It is hard to say what the rest of this year and the following year will bring. It would be unusual to have a lousy stock market year heading into an election. But, with so many storm clouds on the horizon, I’ll continue to let dividends accumulate and collect my safe return.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here