BTI and Ray Dalio’s grand scheme of investing

The goals of this article are twofold. First, I want to share the key insights I’ve gathered from reading Ray Dalio’s writings that can be applied to passive income generation. And secondly, I will explain why British American Tobacco (BTI) is a nice fit into his grand scheme of investing.

Passive income seekers of course already know the basics – diversify your portfolio, invest consistently, and do not try to time the market, invest in dividend-paying stocks, et al. In the remainder of this article, I will explain why BTI fits all these criteria. Here, I want to share two key insights that I’ve learned from him.

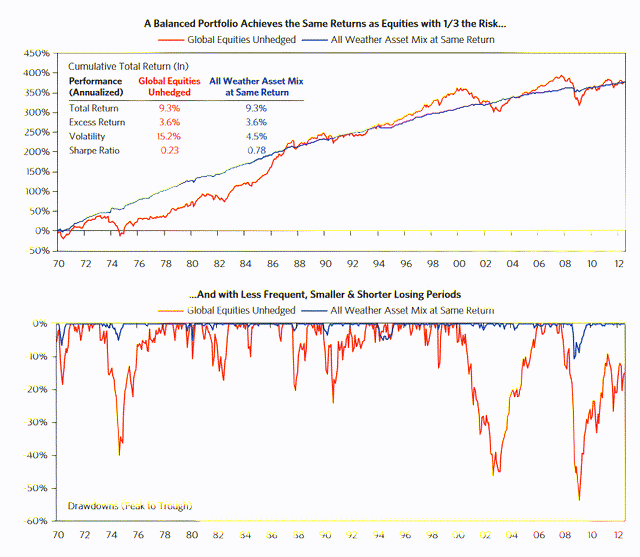

First, most people think of diversification as holding different stocks from different sectors. However, diversification across sectors is only ONE step – not the only one and not even the first one. The grand scheme, in Dalio’s mind, should begin with an awareness of the macrocycle and asset class allocation correspondingly (see the chart below). Second, avoiding loss is way more important than achieving gains, especially for investors who need current income and active withdrawals. That is why we could not emphasize this second point to our investing group members, many of whom actively withdraw. Simple math would show that a withdrawal when your account is 10% underwater hurts more than a 10% gain would help. That is why in the Dalio scheme, the starting point is to pick assets that are not only diversified across sub-sectors but also in other dimensions such as geographical exposure, exposure to commodities, bonds, et al.

Source: www.quantifiedstrategies.com

In the rest of this article, I will detail why I view BTI as a good fit into the above scheme. More specifically, I will explain how BTI could provide a hedge against the ongoing macrocycles, how it can also offer geographical diversification (I assume most of our readers are primarily exposed to U.S. stocks), and why it provides a good combination of current income and price appreciation potential at the same time.

BTI and macrocycles

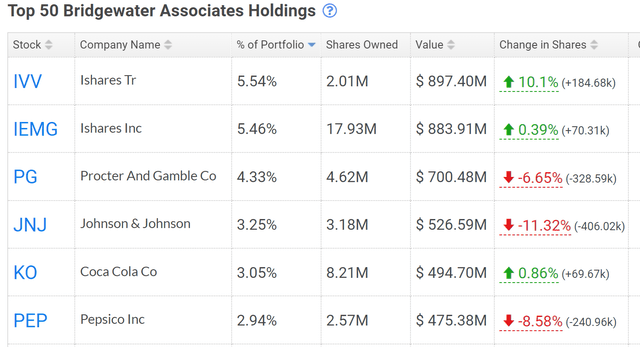

The chart below shows the top positions of Bridgewater Associates holdings, a good example of the above scheme in my view. As seen, the top 2 holdings are IVV and IEMG, a good example of geographical diversification balancing U.S. and overseas holdings. Then the next 4 top holdings are all consumer staple stocks such as Procter & Gamble (PG) and Coca-Cola (KO).

Source: hedgefollow.com

I interpret the above approach as a caution, and hence the right move, under the current market environment. Under current conditions, I believe focusing on downside protection through defensive investments is way more important than pursuing growth, especially for passive income seekers. Always remember – a withdrawal when your account is 10% underwater hurts more than a 10% gain helps.

Now, back to BTI, which is also a large-cap consumer staple stock. Furthermore, due to the unique nature of its products, BTI has demonstrated excellent resilience under various market conditions (inflationary, deflationary, recession, et al) in the long term.

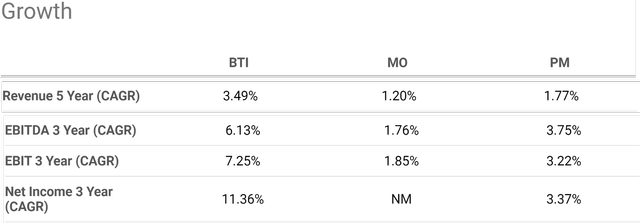

As you can see from the chart below, despite all the economic turmoil (inflation, COVID-19, et al) in recent years, the company has been performing well and both top and bottom lines maintained a positive trajectory. To wit, its revenue has grown at a compounded annual growth rate (“CAGR”) of 3.49% over the past 5 years. Net income has grown at an impressive CAGR of 11.36% over the past 3 years. Note that its net income growth has outpaced revenue growth, indicating that the company is becoming more profitable.

Source: Seeking Alpha

Broaden our horizon even further, the picture remains unchanged. Over the past 10 years, its revenues have grown at a CAGR of 2.5% and dividends have grown at a rate of 4.5%. I view dividends as the best approximation of its owners’ earnings in the long term. Under this approximation, its earnings have again grown faster than revenue and implied improved profitability in the even longer term too.

Valuation near a cyclical bottom

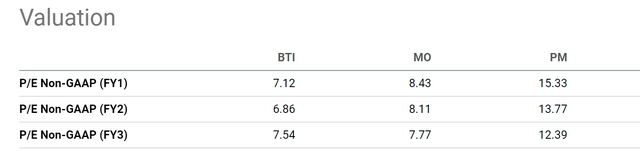

The combination of the above earnings improvement and its stock price corrections have resulted in extreme valuation compression. The chart below shows the valuation of BTI compared with the other two major tobacco companies: Philip Morris International (PM) and Altria Group (MO). As seen, all three are trading at P/E far below the market average. And BTI has the lowest P/E ratios among the three companies.

Source: Seeking Alpha

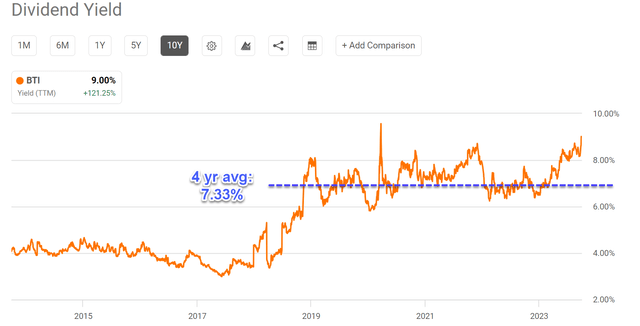

As mentioned above, for companies that pay dividends consistently in the long term, I view dividends as the best approximation for their owners’ earnings. That is why I will examine its dividend yield as another valuation metric. As seen in the chart below, BTI is currently yielding far higher than its historical averages. To wit, it’s currently yielding 9% on a TTM basis, compared to a 4-year average yield of 7.33%.

Source: Seeking Alpha

BTI: asymmetric return profile

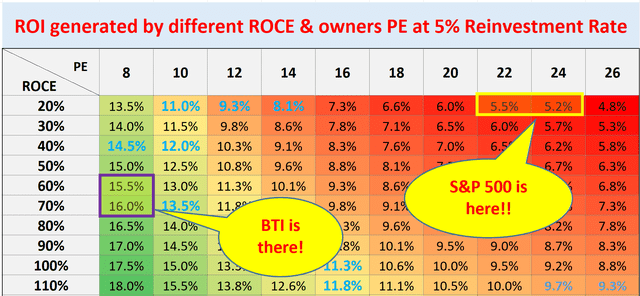

Such compressed valuation, when combined with the improving fundamentals, has created a very asymmetric return profile in my view (see the next chart below). In a nutshell, under the current conditions, I expect BTI to deliver far superior returns for long-term investors than the overall market.

More specifically, BTI is projected to provide a long-term annual return on investment (“ROI”) up to 15%~ 16%, while the overall market represented by the S&P 500 is only about 5.5%. The large difference in their return potential is caused by two key drivers. First, BTI has a much higher return on capital employed (“ROCE”) than the market average (close to 70% compared to about 20% for the overall market). A higher ROCE enables BTI to grow without needing too much capital and return most of its earnings to shareholders (such as the generous dividends mentioned above). Put another way, the same amount of capital reinvested (assumed to be 5% in my chart below) can support a much higher growth rate (2 to 3 times higher) at BTI than the general economy as an average. Second, the lower valuation also provides a much higher owners’ earning yield (“OEY”). At BTI’s current price levels, the P/E FY1 is only about 7.1x, compared to about 24x for the S&P 500.

Source: Author

Risks and final thoughts

BTI faces risks that are both generic to the tobacco sector and also risks that are more unique to itself. The generic risks include declining smoking rates, regulations (including bans on advertising and marketing), and competition from new products. In recent years, e-cigarettes and vaping devices are gaining attention because these products are often perceived as being less harmful than traditional cigarettes. BTI is developing its own alternative products but so are its other main competitors.

The risks that are unique to BTI include its concentration in emerging markets. BTI generates a significant portion of its revenue from emerging markets, such as Asia, Africa, and Latin America. These markets are often more volatile. BTI also has a significant presence in Russia. The war in Ukraine has led to a number of sanctions being imposed on Russia, which could have a negative impact on BTI’s business in the country. However, my view is that these impacts have been more than priced in at this point. As a contrarian, I see its geographical exposure as a positive at this point – one of the central arguments in this article.

To conclude, I consider BTI a good fit for the grand investing scheme that Ray Dalio has developed. The key considerations are geographical diversification, as just mentioned, and a hedge against the ongoing macrocycles, given the resilience of its business model. Finally, the generous dividends, the consistency, and the compressed valuation are additional appeals for passive income seekers.

Read the full article here