The 10-year Treasury yield, which serves as a benchmark for mortgage rates and as an investor confidence barometer, on Tuesday surged to its highest level since 2007.

The 10-year Treasury yield was last up about 8 basis points to 4.758%. The 30-year Treasury yield rose as high 4.874%, also the highest since 2007.

The 2-year Treasury yield, which is sensitive to expectations around where the Federal Reserve will set its own key borrowing rate, increased slightly to 5.129%.

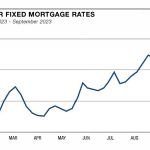

10-year yield

Yields and prices move in opposite directions and one basis point equals 0.01%.

August’s Job Openings and Labor Turnover survey released Tuesday showed a still tight labor market, giving the Federal Reserve the green light to keep lifting rates.

In recent public remarks, Fed policymakers have indicated disagreement about whether another rate hike is needed before the end of the year, but concur that rates will have to stay elevated for what could be a prolonged period of time.

The central bank’s Federal Open Market Committee has been using rate increases to bring down inflation that officials consider to be too high even though the rate has come down considerably from its peak in mid-2022.

“Inflation continues to be too high, and I expect it will likely be appropriate for the Committee to raise rates further and hold them at a restrictive level for some time to return inflation to our 2% goal in a timely way,” Fed Governor Michelle Bowman said in prepared remarks Monday.

Also speaking Monday, Fed Vice Chair for Supervision Michael Barr said it’s less important to focus on another hike and more critical to understand that rates likely will remain elevated “for some time.” And Cleveland Fed President Loretta Mester, a nonvoter this year on the FOMC, said “we may well need to raise the fed funds rate once more this year and then hold it there for some time.”

Market uncertainty remains about when and whether a rate increase may be implemented. Two central bank policy meetings remain this year, Oct. 31-Nov. 1 and Dec. 12-13. Market pricing Tuesday morning was pointing to just a 25.7% chance of a hike on Nov. 1, but a nearly 45% probability in December, according to futures pricing measured in the CME Group’s FedWatch Tool.

Rising yields come even though U.S. lawmakers were able to avoid a government shutdown as they passed a last-minute spending bill on Saturday night. That has bought them time to finish the necessary government funding legislation. A shutdown could have negatively affected the U.S. credit rating as well as the country’s economy.

The jump in rates has rekindled talk about market “bond vigilantes,” a term coined by economist Ed Yardeni to describe the impact when fixed income investors leave the market because of worries over U.S. debt.

Persistently high fiscal deficits are one factor in the rising costs of borrowing. Public debt has risen past $32.3 trillion this year. Debt has risen to nearly 120% of total gross domestic product.

“The worry is that the escalating federal budget deficit will create more supply of bonds than demand can meet, requiring higher yields to clear the market; that worry has been the Bond Vigilantes’ entrance cue,” Yardeni wrote Tuesday morning in a note titled “The Bond Vigilantes Are On The March.”

“Now the Wild Bunch seems to have taken full control of the Treasury market; we’re watching to see if the high-yield market is next,” he added. “We are still counting on moderating inflation to stop the beatings in the bond market.”

Read the full article here