Fragility is the quality of things that are vulnerable to volatility. – Nassim Nicholas Taleb.

Those who have tracked me for a while know I’m very much against shorting or making outright directional bets on the stock market. Why? Because you can be right and still lose money. If you’re going to short the stock market, your timing has to be perfect given the path behavior of equities over time. I’m more a fan of imperfect hedges that allow you to be wrong in your timing but at least give you a chance to make money if wrong.

To that end, that line of thinking also applies to long volatility products that try to play the S&P VIX Index (VIX). The ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY) is a leveraged exchange-traded fund, or ETF, that aims to provide investors with exposure to short-term volatility. And it’s incredibly dangerous.

How Does UVXY Work?

UVXY provides 1.5x leveraged exposure to short-term VIX futures, effectively aiming to profit from increases in the expected volatility of the S&P 500 Index (SP500). It achieves this by holding positions in the first and second month VIX futures contracts. As these futures contracts approach their expiration dates, they are sold and the proceeds are used to purchase futures contracts for the following month, maintaining a constant one-month rolling long position.

This rolling process is crucial to understanding UVXY’s performance. It can result in what is known as a “negative roll yield’ when the VIX futures market is in a state of ‘contango,” which is when futures contracts are priced higher than the expected future spot price. This constant decay of futures prices in UVXY’s portfolio, combined with the daily rebalancing to maintain 150% exposure, is a key factor behind UVXY’s long-term performance.

UVXY Performance: A Cautionary Tale

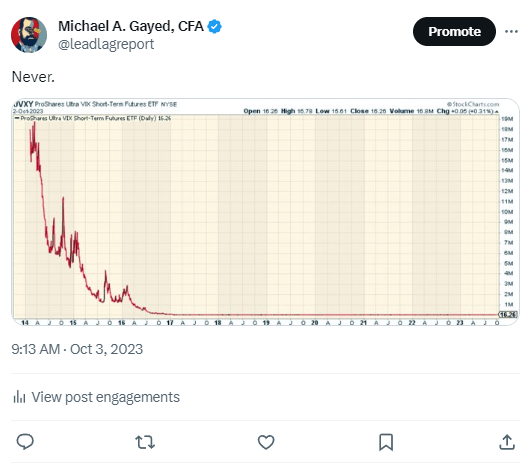

Despite its potential for significant short-term gains during periods of market stress, UVXY has a track record of poor long-term performance. Since its inception in 2011, UVXY has produced negative cumulative returns, even as the VIX Index itself has fluctuated.

x.com

This underperformance can be attributed to two main factors: the structure of the VIX futures market and the daily rebalancing of UVXY’s portfolio.

Why Trade UVXY?

Despite its long-term underperformance, UVXY can still be attractive to certain traders. In particular, those who are skilled at market timing may be able to profit from short-term increases in market volatility. UVXY can deliver substantial returns during market downturns, as these periods are often associated with spikes in volatility. However, it’s important to note that these opportunities are rare and difficult to predict. Unless investors are able to accurately time these market events, holding UVXY for the long term is likely to result in significant losses.

UVXY vs Other Volatility ETFs

When compared to other volatility ETFs, UVXY stands out for its use of leverage and its focus on short-term VIX futures. However, these features also make UVXY more risky and potentially more volatile than its peers.

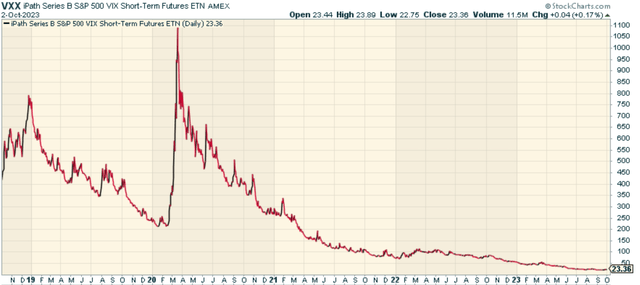

Other volatility ETFs, such as the iPath® Series B S&P 500® VIX Short-Term Futures™ ETN (VXX) offer different levels of exposure and may be more suitable for traders with different risk appetites. The lack of leverage there makes it comparatively less volatile, but the contango dynamic is a constant as well as the longer-term losses.

stockcharts.com

Conclusion: UVXY is Not for Everyone

ProShares Ultra VIX Short-Term Futures ETF offers a unique way to profit from increases in market volatility. However, its long-term performance, structural issues, and high level of risk make it a potentially dangerous investment for many investors.

Unless you are highly skilled at market timing and can closely monitor your UVXY positions, it may be best to steer clear of this ETF. Instead, consider other strategies to manage risk and enhance returns, such as diversifying your portfolio, investing in low-volatility assets, or using other risk-off assets that tend to work over time like Utilities, Treasuries, Gold, and the Dollar. Remember, while UVXY can provide substantial returns during periods of market stress, its long-term performance has been overwhelmingly negative. Credit event or not, it’s not worth the risk.

Read the full article here