Dear readers,

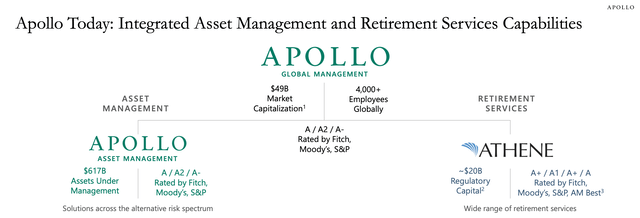

Apollo Global Management (NYSE:APO) is a major alternative asset manager that consists of a traditional asset-light asset management business and an asset-heavy retirement services/insurance business called Athene. Each of these comes with its pros and cons, but overall they complement each other beautifully and make APO a fee-earning machine and a net beneficiary of high interest rates (as high rates increase demand for Athene’s products and enable higher spread related earnings).

Apollo Presentation

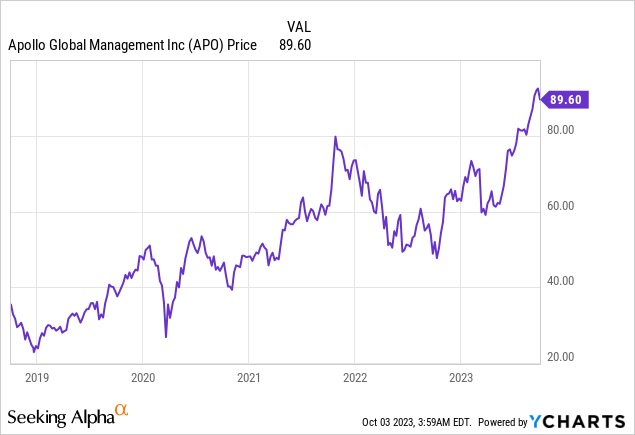

I started coverage on this stock in May with a BUY rating of $64 per share, because the stock seemed undervalued based on my “back of the envelope” calculations.

Since then, the stock has been on a run, returning over 40% and reaching $90 per share. Despite the steep increase in price, I think APO is still a good buy today, which is why I want to provide you with an updated thesis and dive a little bit deeper than last time.

I understand that from a technical perspective, the chart below doesn’t scream buy, but my hope is to objectively explain what Apollo does so that you can decide for yourself whether to buy into the bull trend or at least be more confident buying on a pullback.

Asset management

Let’s start with an overview of the asset management business, which is all about growing fee-related earnings (‘FRE’) and assets under management (‘AUM’). This is a very similar business to that of Brookfield Asset Management (BAM) or Blackstone (BX) with one key difference. The difference is in the kind of products that the company invests in. We know that Brookfield funds are roughly equally spread between investments in renewable energy, infrastructure, real estate, private equity, and insurance. While for Apollo, there is a heavy focus on private credit, which accounts for over 80% of fee-earning AUM.

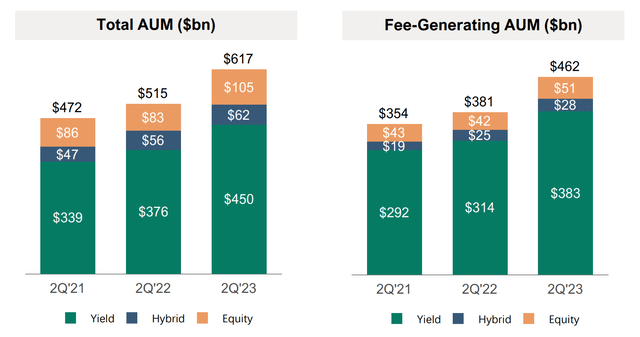

Most recently during Q2 2023, Apollo’s AUM increased by 20% YoY to $617 Billion, driven primarily by inflows to Athene. You see, one of the ways that Apollo benefits from Athene are that it gets to manage the money that future retirees deposit with Athene and, of course, Apollo gets to charge a fee for the service.

The increase in AUM has driven a nearly proportional 19% YoY increase in management fees, but fee-related earnings increased more, nearly 30% YoY to $442 Million. FRE have increased far more than AUM (and FGAUM), because Apollo’s margin has improved from 54% to 56% and because the capital solutions business which mainly syndicates and off-loads Apollo’s loans to other institutions (for a fee of course), has grown by a whopping 34%.

Apollo Presentation

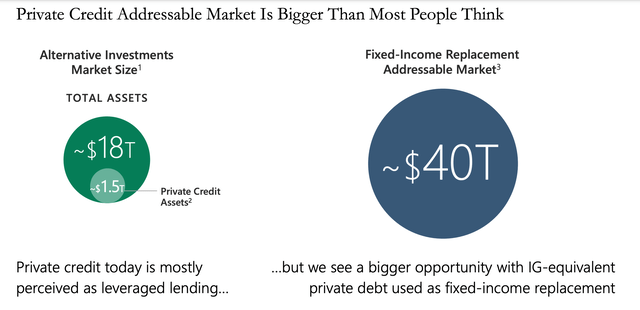

I really like the fact that the vast majority of management fees come from private credit, which has been on the rise since the Great Financial Crisis, when regulation fundamentally changed the role of banks. Since then, the proportion of private credit as a portion of total credit markets has increased from 4% to 20%, but there’s still a very long growth runway. Moreover, the recent banking crisis sparked by the collapse of Silicon Valley Bank tightened bank credit further, pushing many borrowers to private credit.

Apollo Presentation

I think it’s not an overstatement to say that private credit is to alternative asset managers what AI is to tech, as it has the ability to significantly supercharge their growth for the rest of their decade as they tackle this vast market. And luckily for Apollo, it’s likely to have the funds to do so because of Athene.

Retirement Services (Athene)

Athene (simply put) sells annuities to future retirees, who pay Athene a certain amount every month in exchange for an agreed set of payments in the future, many years, or even decades from now. This is a very stable business with very few unknowns because early redemptions are heavily penalized and therefore quite rare. As a result, it’s a great source of capital for relatively illiquid private credit strategies.

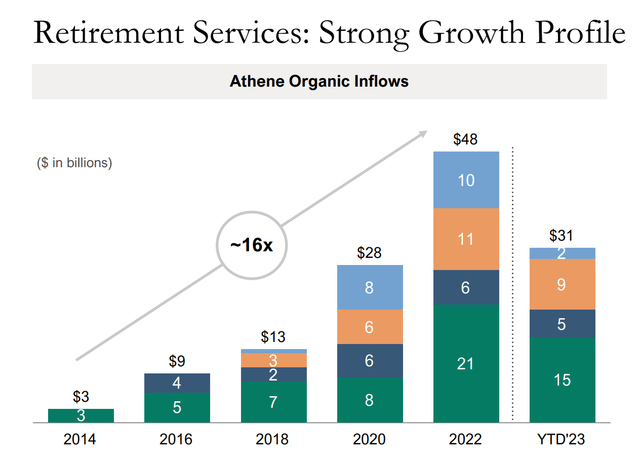

Athene is good at what it does, it is the biggest annuity provider in the US and sells an important product that many people are interested in, especially now that they can get high interest rates of 5%. Not only that, but future prospects are good as Athene will be a direct beneficiary of an aging population, as it increases the number of potential customers. The company has seen its annual inflows increase 16 times over the past 8 years and going forward, 20%+ organic growth is expected.

Apollo Supplement

Having a growing annuity provider such as Athene as part of Apollo’s business has been and will continue to be extremely profitable because it allows APO to charge fees on multiple fronts. Here’s how it works.

When future retirees deposit money to Athene, it quickly turns around and reinvests that money into high-grade (usually IG) loans, through the asset management business which gets a management fee. Athene then gets to keep the spread between the yield on the originated IG loan and the rate promised to future retirees + the asset management fee + its own OPEX. This may not sound like much is left, but trust me there is a lot of left. Last quarter alone, Athene was left with spread related earnings (‘SRE’) of $799 Million. That’s almost double what the asset manager made in fees! And things don’t end there as the capital solutions business can then package a bunch of the originated IG loans together and off-load them to hedge funds, banks etc. for yet another fee.

As you can see, Apollo is a fee-earning machine and as long as it can successfully continue to grow its retirement services business and attract new customers to their annuities, it’s likely to do extremely well. So far, growth prospects are looking very good as during the second quarter management has reiterated their FRE growth guidance for this year of 25% and has increased their SRE growth guidance from 20% to 30%.

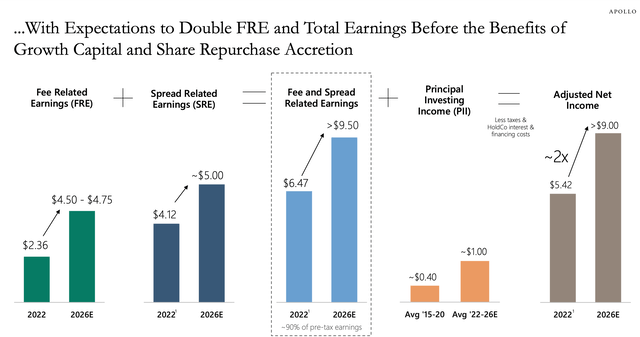

And beyond 2023, guidance is equally aggressive, as the company is expected to capture a higher share of the private credit market.

Apollo Presentation

Valuation

Asset managers typically trade around 20-25x FRE with the best of the best such as Brookfield Asset Management and Blackstone currently trading as high as 27-28x FRE.

The insurance segment is harder and perhaps controversial to value. Many only see it valued at 5-6x earnings, which would correspond to the price which Apollo paid for Athene several years ago when they merged. But I’d argue that Apollo gets major synergies from integrating Athene into its business, which I discussed above (three layers of fees and a very predictable capital source). As a result, I have no doubt that a certain premium is justified here.

Moreover, this is a business that has grown at a 16% CAGR since 2008 and is expected to grow by 30% this year alone and by 20% beyond this year. That to me seems too good to only be valued at 6 times earnings. I realistically see Athene worth at least 8-10x SRE.

I will use 2023 guidance, which Apollo is well on track to meet. That means 2023 FRE of $2.95 per share and SRE of $5.54 per share. Note that APO also earns a carry (Principal Investing Income) which is expected to be just under $1 per share, but because it’s very volatile and tends to attract a low multiple I will exclude it from my calculation for simplicity and consider it as more potential upside.

Using mid-point multiples of 22.5x FRE and 9x SRE yields a fair value today of $116 per share, which is still 28% above today’s price of $90 per share. And remember, this is a company that expects significant double-digit earnings growth around 20% for many years to come.

As such, I see Apollo as one of the best value alternative asset managers and therefore reiterate my BUY rating here at $90 per share. At the same, as mentioned at the start of the article, I realize that it may be difficult to buy into the bull trend for conservative investors who have not initiated a position yet. Moreover, income investors may find a sub-2% dividend yield unappealing. In that case, I recommend you look at Athene’s preferred shares.

In particular, I like Series A (ATH.PR.A) which is BBB-rated and will yield 7.5% until June 2029 when it will reset (unless called at $25) at 3-month LIBOR+4.253%. At $21.21 per share today, there’s an opportunity to lock in solid income for 6 years, plus substantial upside if/when interest rates potentially decline two to three years from now.

Read the full article here