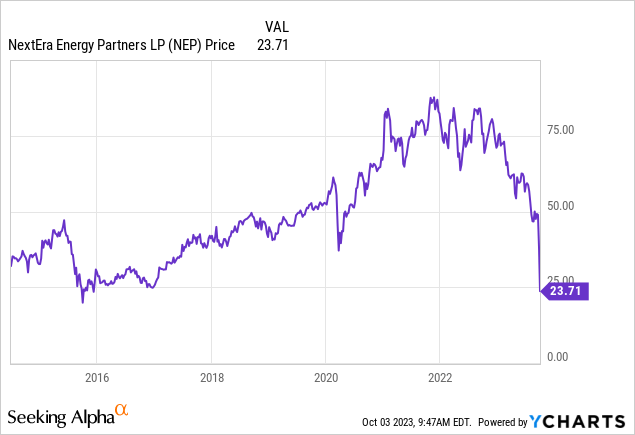

From its listing in 2014 until the last year, NextEra Energy Partners (NYSE:NEP) was one of the great success stories within the renewable energy industry. Through the end of 2022, NEP generated total returns of more than 280%, well outpacing the S&P 500.

I published on NEP back in May with a buy rating after management announced that NEE would suspend IDR payments and that the company was pursuing a sale of its pipeline assets in order to prevent any needed equity raises through the end of next year. This was a positive development in my opinion as it eliminated an equity overhang.

However, since I last published, the U.S. 10 year treasury yield has risen 1.2% from 3.51% to 4.71%. As this sell off began to gain steam in August, we discussed selling NEP in my investing group a few months ago. The increase in yields in combination with a declining stock price puts the company in a position where it can no longer efficiently finance acquisitions.

Due to these circumstances, I am now moving to the equivalent of a “hold” rating as the stock is just a couple of dollars above my bear case. However, for those that happen to still own the stock, it’s probably time to move on as the case for a recovery in the stock is highly unlikely in my opinion.

What Happened?

On September 27th NextEra Energy Partners announced that it was revising its distribution growth rate expectations from 12% to 15% per annum to 5% to 8%. Since the announcement, the stock has subsequently fallen 40% and now sits below its 2014 IPO price at approximately $24 at the time of writing.

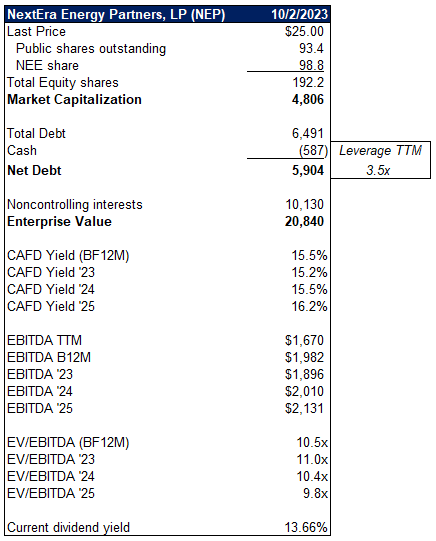

The decline in the stock price has resulted in a spike in its dividend yield to 14.4%. While this level of yield may seem enticing (even in an environment with 5%+ money market yields), we still believe the stock should be avoided as the company’s leverage, refinancing risk and payout ratios all remain far too risky.

Updated Growth Targets

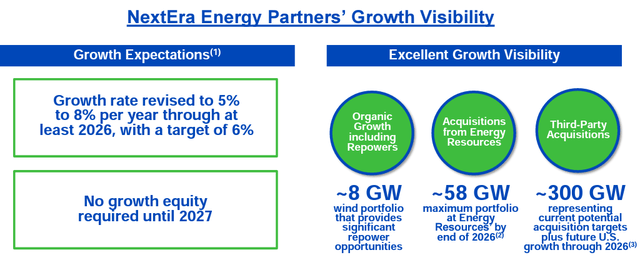

NextEra Energy Partners’ decision to cut its growth guidance was a necessary step towards ensuring the company’s long-term viability. Maintaining the initial 12% to 15% growth target would have required the company to pursue an additional acquisition from NextEra Energy (NEE) this quarter.

However, the decline in the stock price earlier this year, coupled with rising interest rates, rendered the financing of such an acquisition as value-eroding. By adjusting the growth rate, NEP can now sidestep the need to raise external equity through the end of 2027.

The challenging fundraising environment is pressuring management to pivot towards organic growth projects instead of deals/dropdowns from NEE. Moving forward, the company suggests that they will focus mostly on repowering their wind assets, which entails upgrading existing wind turbines with newer and more efficient technology to boost energy output.

NEP Investor Presentation

The Externally Financed Capital Intensive Model is Not Viable in This Environment

The decision to lower growth guidance is largely attributable to higher interest rates and made worse by a low stock price. Traditionally, NEP has grown via acquiring $1 to $2 billion of assets annually from the renewable development arm of NextEra Energy, NextEra Energy Resources (NEER). This highlights the capital-intensive nature of NEP’s growth model. It is rare to find businesses that can generate long-term sustainable returns for shareholders when they are capital-intensive, have a high distribution payout ratio, and heavily rely on external financing. NEP pulled it off for years, but the rapid rise in interest rates has essentially broken this model.

The trajectory of interest rates might be a topic of debate, and a precipitous drop in rates could save the stock. But there’s no doubt that NEP finds itself in a precarious position in a higher for longer interest rate environment.

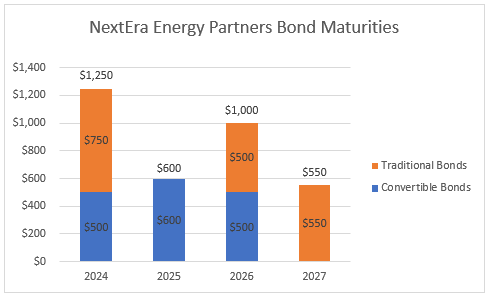

Beyond the escalating costs to finance future growth, the company is facing several near-term bond maturities. These bonds are likely to be refinanced at significantly higher coupon rates (especially the low rate converts), potentially adding around $100 million in interest expense cumulatively between 2024 and 2027. This additional financial burden could further strain NEP’s ability to meet even its new distribution growth targets.

NJV, Company Filings

Updated Model and Valuation

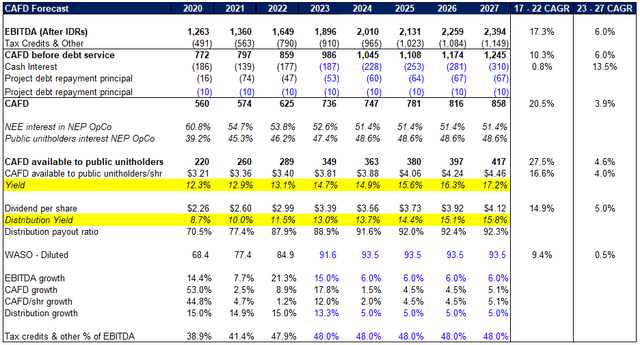

Incorporating the revised assumptions into our model suggests that CAFD per share will grow modestly, at around 4.8%, from 2023 to 2027. That is lower than the company’s dividend growth guidance of 5-8% and poses a problem.

The combination of the surge in average shares from equity issuances earlier this year and debt refinancing is projected to stymie CAFD growth, leading to negligible growth in 2024 and a mild 4.5% uptick in 2025 and 2026. Growth in CAFD might be 5.1% in 2027.

Though management remains dedicated to distribution growth, this decision is risky. The anticipated distribution payout ratio for NEP hovers in the mid to low 90% range, presenting little room for error.

NJV, Company Filings

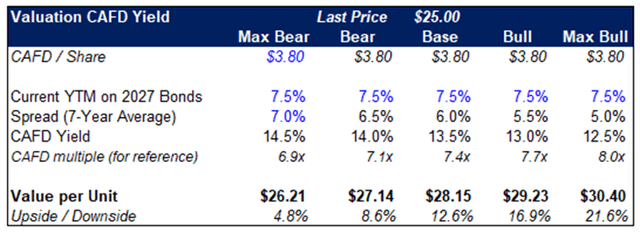

Given updated growth / acquisition / financing expectations, our base case suggests NEP’s stock price is worth somewhere between $26 and $30. However, it’s important to recognize that in the near-term there’s significant technical pressure on this stock given the updated growth guidance and the continued sell-off in rates. The risk of the stock continuing to drop without any care for valuation is high.

Base Case

The stagnant growth morphs the stock into something akin to a bond but bearing equity-like risks. Due to this, valuing NEP’s equity at a spread relative to the company’s bonds seems reasonable. The furthest maturity bond in NEP’s portfolio is set for 2027, with a yield-to-worst of around 7.5%. Factoring in the inherent risks associated with equities, a spread of 500 to 700 basis points over the company’s 4-year bonds appears reasonable.

This seems like the most probable scenario once the technical headwinds abate and we assign a 40% to 50% probability to this outcome.

NJV, Bloomberg

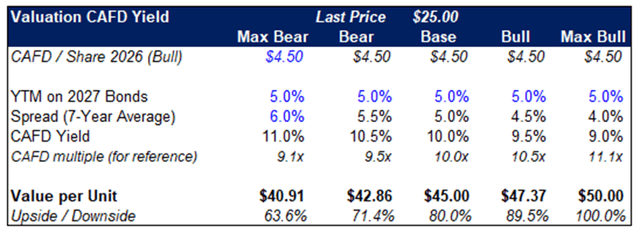

Bull Case

The main risk to our bearish view on the stock is inflation falls back to 2%, prompting the fed to cut rates and stimulate the economy without stoking further inflation. This would likely result in a recovery in NEP’s stock price as well as give the company access to cheaper debt financing. In this scenario NEP is likely to begin pursuing acquisitions, which would boost growth and result in a much better valuation. This scenario in highly unlikely in our opinion, perhaps a 10% to 20% probability.

NJV, Bloomberg

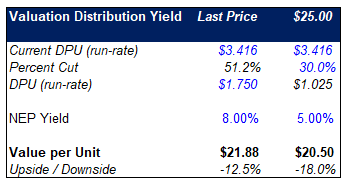

Bear Case

If the company desires to pursue inorganic growth in the future, they are going to need to be able to have more internally generated cash flow available to them. Given the still high payout ratio, a dividend cut of 30% to 50% is well within the realm of possibilities some time over the next couple of years. This scenario has a 30% to 40% chance of happening in our opinion. In addition to the technical pressures. The significant drop in the stock is also a potential signal to management that a dividend cut is needed.

Should the dividend fall to $1.75 say from $3.416 today, then at an 8% yield NEP would trade at $21.88.

NJV, Company Filings

In addition to the growth concerns, NEP is levered 8x on a net debt to CAFD basis. High leverage at Kinder Morgan (KMI) and Energy Transfer (ET), which had similar capital structures and growth strategies at their peaks in 2016, resulted in these names falling 75% from peak to trough.

Renewable assets have historically traded between 10 and 15x EBITDA. Today NEP is trading at 11.1x 2023 EBITDA and 10.5x 2024 EBITDA. At 12x, NEP would be worth about $40. But again, these EBITDA multiples are perhaps more appropriate in a world with artificially low interest rates.

At 10x EBITDA, which is possible in a higher for longer world, NEP would trade at $19.70 per share.

NJV, Company Filings, Bloomberg

Conclusion

Investors contemplating an investment in NextEra Energy Partners (NEP) should be aware of the challenges that lie ahead. The company’s business model relies on high levels of financing, as NEP requires tons of capital to grow. But this very strategy is now under pressure due to rising interest rates. The additional interest expenses (especially from refinancing cheap converts), estimated at around $100 million between 2024 and 2027, could significantly hamper the company’s operational flexibility.

Moreover, with substantial existing debt and a commitment to sizable cash flow payouts, NEP is in a tight spot. Unless interest rates come down significantly, NEP is going to take several years to adjust to a new interest rate regime. NEP is tethered to paying a high distribution, and a reduction could jeopardize the stock’s performance even further.

In conclusion, NextEra Energy Partners finds itself navigating a complex situation. Rising interest rates are a hurdle for NEP’s growth model. While management’s decision to recalibrate growth targets and focus more on organic avenues is noteworthy, the company has a long road ahead.

For the foreseeable future, the stock carries too much risk in our view to own.

Read the full article here