A Quick Take On Manhattan Associates

Manhattan Associates, Inc. (NASDAQ:MANH) provides supply chain and inventory management software and related services to businesses worldwide.

I previously wrote about MANH with a Hold outlook.

Manhattan Associates, Inc. stock has performed quite well in the past year but looks pricey at its current level, and the company is not immune to increasing pressures on client decision-making in an uncertain macro environment with a higher cost of capital.

So, my outlook remains Neutral (Hold) for the near term.

Manhattan Associates’ Overview And Market

Atlanta, Georgia-based Manhattan Associates was created in 1990 to help companies optimize their increasingly complex supply chains, inventory management capabilities, and omnichannel order and fulfillment operations.

The firm is headed by Chief Executive Officer Eddie Capel, who has previously held senior executive positions at Real Time Solutions.

The company’s main offerings include:

-

Transportation Management

-

Warehouse Management

-

Point of Sale

-

Order Management

-

Customer Engagement

-

Store Inventory & Fulfillment

MANH seeks to obtain new customers through in-house direct sales and marketing efforts and through partner referrals and implementation assistance.

According to a 2021 market research report by Allied Market Research, the worldwide market for supply chain management software and related services was an estimated $18.7 billion in 2020 and is forecast to reach $52.6 billion by 2030.

This represents a forecast CAGR of 10.7% from 2021 to 2030.

The main driver for this expected growth is the growing demand for increased supply chain visibility, especially after the disruptions caused by the COVID-19 pandemic.

Also, there are several other growth opportunities within the supply chain technology sector, such as enterprise supply chain management technologies, e-commerce integration, warehouse automation, omnichannel capabilities, and last-mile delivery.

Major competitive or other industry participants include:

-

Epicor Software

-

HighJump

-

Info

-

IBM

-

JDA Software Group

-

Kinaxis

-

SPS Commerce

-

e2open

-

Oracle

-

SAP

-

Descartes Systems Group

-

Others

Manhattan Associates’ Recent Financial Trends

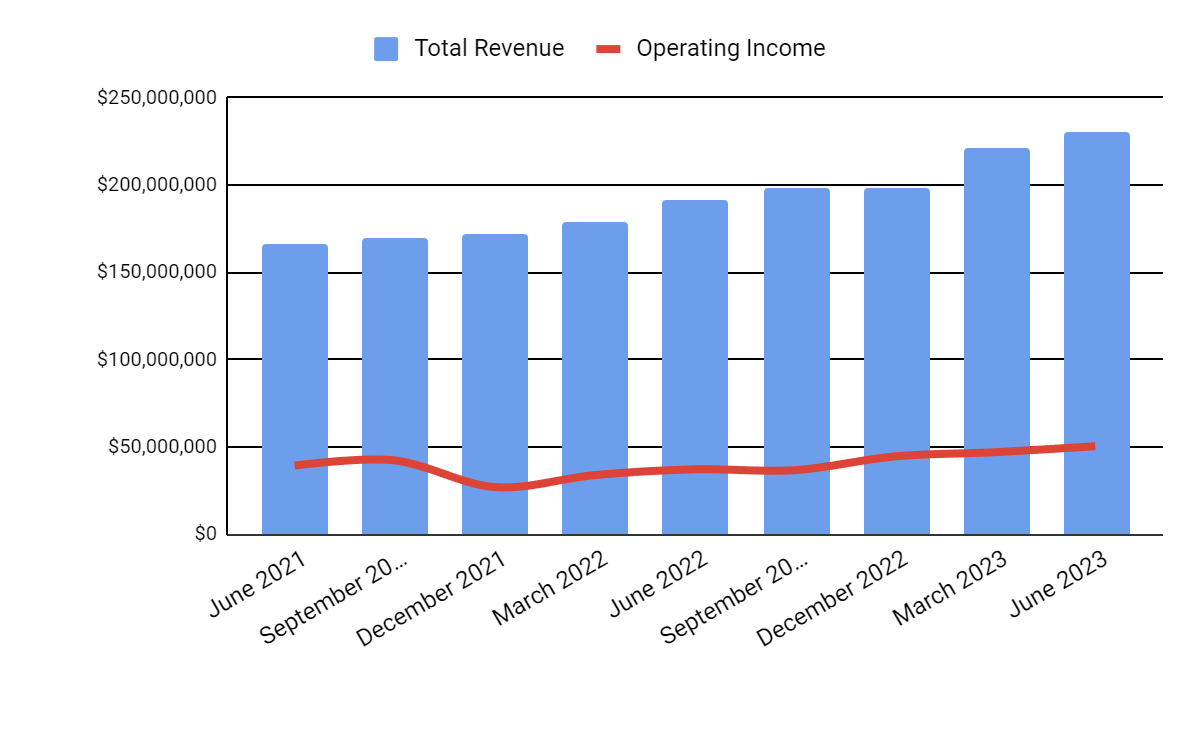

Total revenue by quarter has continued to rise impressively; Operating income by quarter has also trended higher:

Seeking Alpha

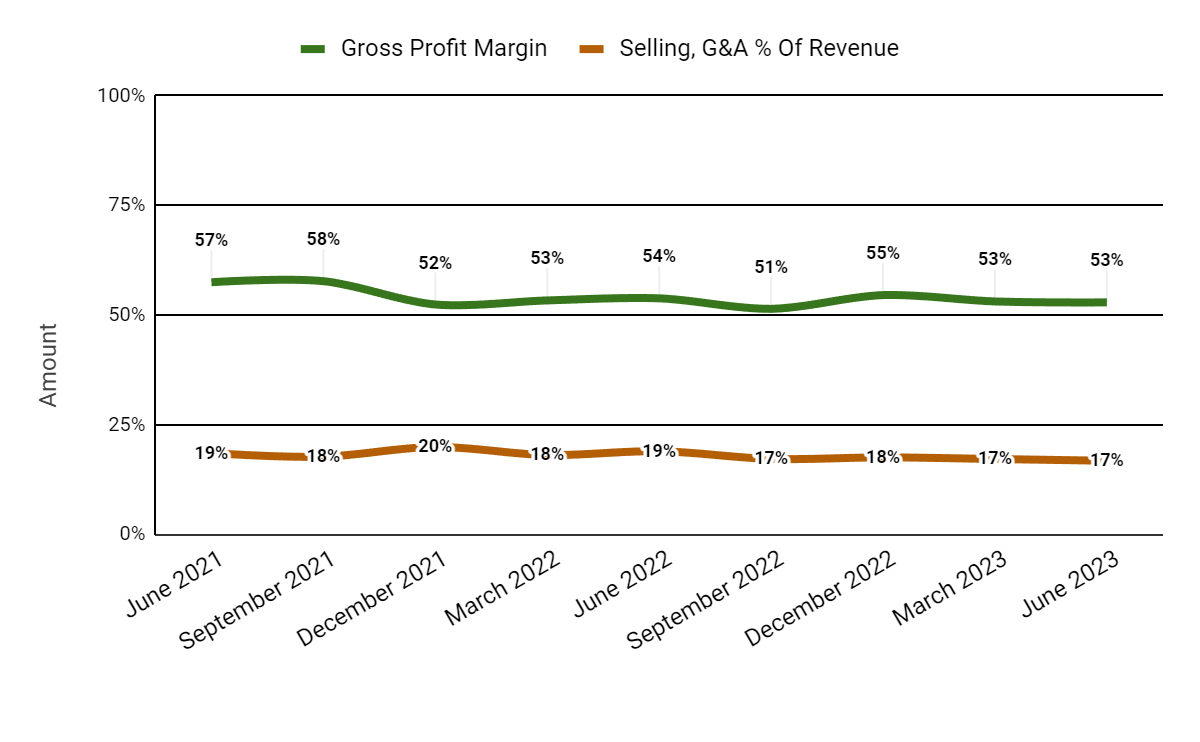

Gross profit margin by quarter has remained in a narrow range; Selling and G&A expenses as a percentage of total revenue by quarter have trended slightly lower in recent quarters:

Seeking Alpha

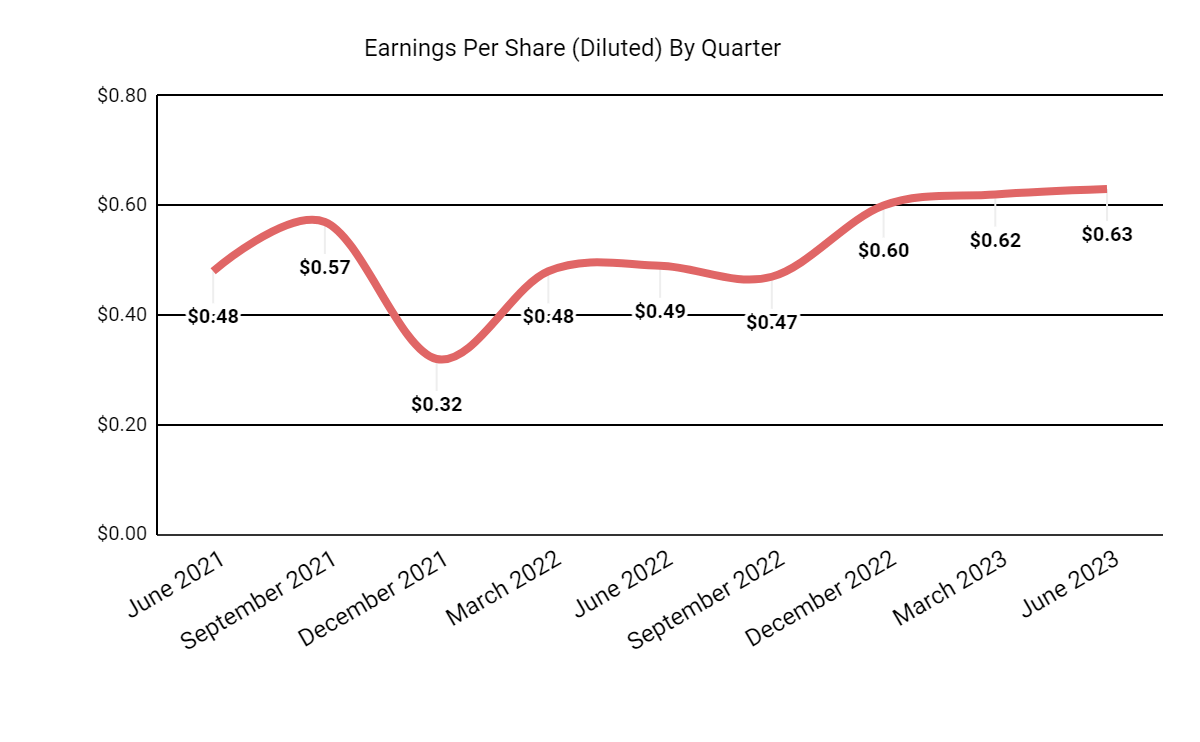

Earnings per share (Diluted) have grown in recent quarters:

Seeking Alpha

(All data in the above charts is GAAP.)

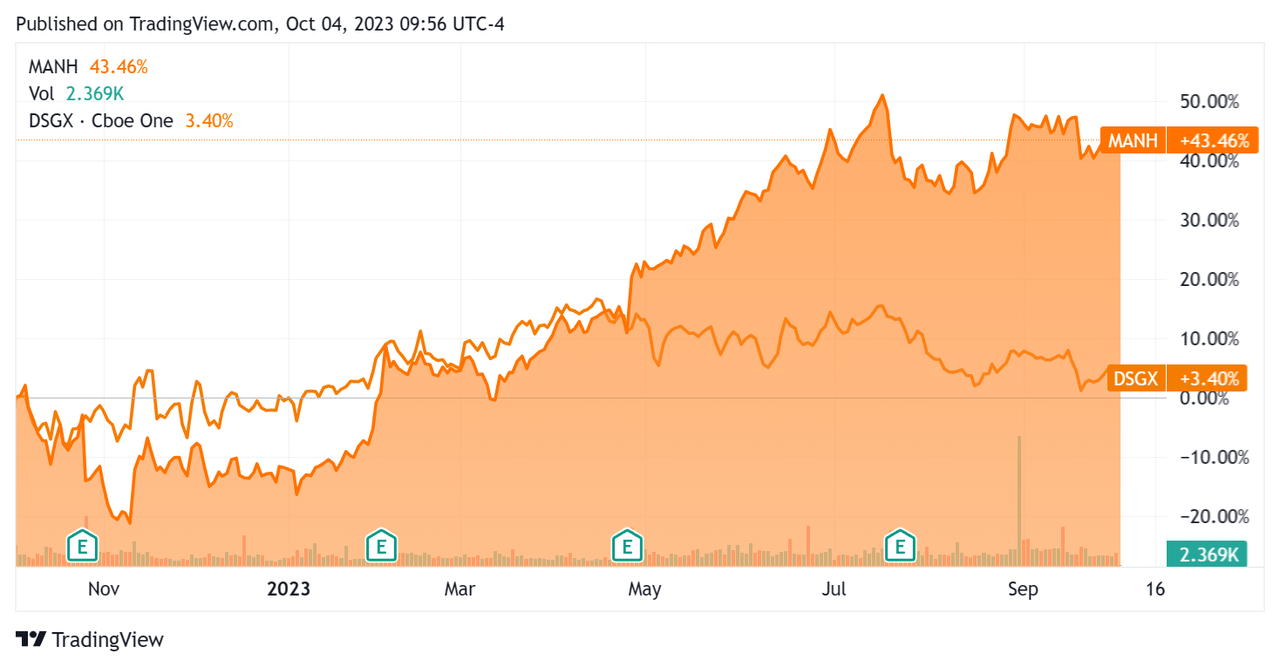

In the past 12 months, MANH’s stock price has risen 43.46% vs. that of The Descartes Systems Group’s (DSGX) rise of only 3.4%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $153.3 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was $188.4 million, during which capital expenditures were $6.0 million. The company paid $64.3 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Manhattan Associates

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

14.2 |

|

Enterprise Value/EBITDA |

65.1 |

|

Price/Sales |

14.6 |

|

Revenue Growth Rate |

19.2% |

|

Net Income Margin |

17.2% |

|

EBITDA % |

21.8% |

|

Market Capitalization |

$12,190,000,000 |

|

Enterprise Value |

$12,050,000,000 |

|

Operating Cash Flow |

$194,430,000 |

|

Earnings Per Share (Fully Diluted) |

$2.32 |

|

Free Cash Flow Per Share |

$3.03 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Descartes Systems:

|

Metric (TTM) |

Descartes Systems |

Manhattan Associates |

Variance |

|

Enterprise Value/Sales |

11.2 |

14.2 |

26.7% |

|

Enterprise Value/EBITDA |

27.7 |

65.1 |

135.3% |

|

Revenue Growth Rate |

14.3% |

19.2% |

34.2% |

|

Net Income Margin |

21.6% |

17.2% |

-20.3% |

|

Operating Cash Flow |

$202,430,000 |

$194,430,000 |

-4.0% |

(Source – Seeking Alpha)

MANH’s most recent unadjusted Rule of 40 calculation was 41.0% as of Q2 2023’s results, so the firm has performed well in this regard, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q1 2023 |

Q2 2023 |

|

Revenue Growth % |

18.0% |

19.2% |

|

EBITDA % |

21.3% |

21.8% |

|

Total |

39.3% |

41.0% |

(Source – Seeking Alpha)

Sentiment Analysis

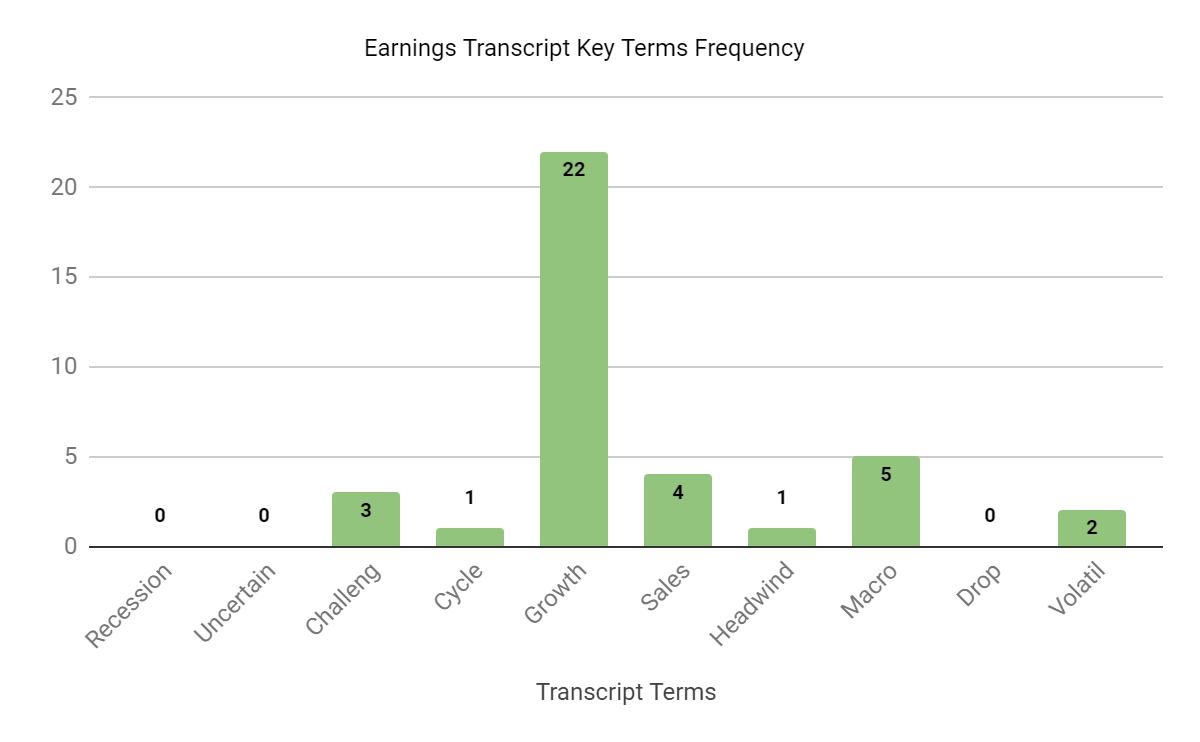

The chart below shows the frequency of certain keywords in the latest earnings conference call with management and analysts:

Seeking Alpha

The call featured references to a “challenging macro environment” the firm and its customers face as clients and prospects contend with slowing growth rates.

Analysts asked leadership about new deal slippage, the impact of generative AI, and its point-of-sale business opportunity.

Management responded that deal slippage is common and that visibility into future years is good with a strong pipeline.

Generative AI has large potential, both internally and with customers, and the firm’s API-centric architecture positions it to leverage these new capabilities.

The company believes its point of sale opportunity is as large as its WMS (Warehouse Management Software) business is, over time.

Commentary On Manhattan Associates

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management’s prepared remarks highlighted “robust” demand for its solutions despite “persistent” global macro volatility in business conditions.

RPO (Remaining Performance Obligations) were up 38% YoY, to $1.2 billion.

80% of the company’s new bookings were from the industry verticals of retail, manufacturing and wholesale, and competitive win rates stand at 75% year-to-date.

Total revenue for Q2 2023 rose by 20.4% YoY, while gross profit margin fell 0.9%.

Management did not disclose any retention rate metrics.

Selling and G&A expenses as a percentage of revenue fell 2.2% year-over-year, a positive signal indicating greater efficiency in generating incremental revenue.

Operating income rose by an impressive 35.4% YoY, to $50.5 million for the quarter.

The company’s financial position is strong, with ample liquidity, no debt, and impressive free cash flow.

MANH’s Rule of 40 performance has been excellent.

Looking ahead, consensus revenue estimates for 2023 suggest a potential growth rate of 16.3% over 2022.

If achieved, this would represent a slight increase in revenue growth rate versus 2022’s growth rate of 15.6% over 2021.

In the past twelve months, the firm’s EV/EBITDA valuation multiple has increased by only 7%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

The stock’s valuation looks pricey relative to its expected free cash flow growth and to peers such as Descartes.

MANH is not immune to slowing business conditions and greater hesitancy among clients and prospects.

While the stock has rallied in recent quarters, I’m concerned about the firm’s ability to continue outperforming over the coming quarters.

My outlook for Manhattan Associates, Inc. stock is Neutral (Hold) for now.

Read the full article here