Networking company Cisco Systems, Inc. (CSCO) announced in September the acquisition of software specialist Splunk Inc. (SPLK) in a major and transformative $28B deal. In a push to acquire artificial intelligence (“AI”) capabilities, large, deep-pocketed corporations like Cisco are willing to put billions of dollars on the table: the company offered a generous takeover premium of 31% for Splunk… and other acquisitions in the data analytics sector could follow.

I increasingly see Palantir Technologies Inc. (NYSE:PLTR) as a potential takeover candidate, as the company has also aggressively boosted its AI capabilities. The company’s CEO recently said that the software analytics company is seeing “unprecedented demand” from its (corporate) customer base for the integration potential of AI with its Foundry platforms. I believe the Cisco-Splunk deal has huge implications for Palantir, as more hardware companies may be interested in acquiring enterprise software capabilities!

Previous rating

The most recent rating I issued for Palantir was buy — in Palantir: Attractive Setup — due to the company’s commercial revenue momentum, clear pathway toward GAAP profitability in FY 2023, and improving customer monetization. Additionally, I believe the Cisco-Splunk deal puts Palantir on the map as a potential acquisition target, as the firm also heavily invested into the enterprise software market, like Splunk.

Cisco-Splunk deal and implications for other companies building AI/enterprise software capabilities

The AI revolution is in full swing, and the first big winner is Splunk which at the end of September secured a $28B takeover deal from networking company Cisco Systems. The key benefits of the deal are that Cisco will be able to focus on threat prevention, complement its core networking business, but also generate new income possibilities in the AI realm. The deal is transformational for Cisco Systems because it combines its hardware business with Spunk’s AI-enabled security (software) business.

Splunk operates a software platform that specializes in collecting, indexing, and analyzing large volumes of machine-generated data, and there are considerable similarities to Palantir’s business model which increasingly focuses on the merger of artificial intelligence and (business) intelligence. As I have said in the past, I see synergy potential between Palantir’s Foundry platforms, which help companies aggregate and centralize data, and AI-powered predictive analytics… which have applications both in the government world (which is where Palantir dominates) as well as in the commercial sector.

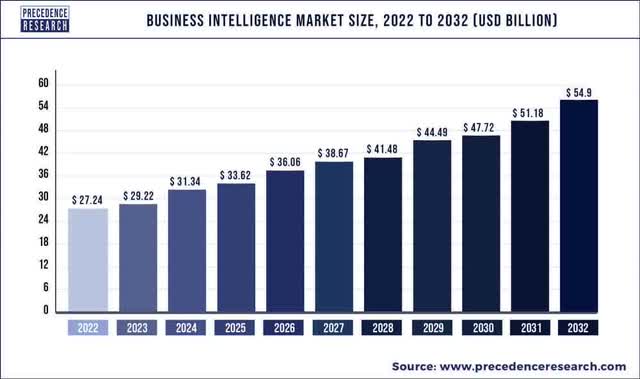

Business Intelligence is big business and, according to Precedence Research, a rapidly growing market for data analytics companies like Splunk and Palantir to tap into. The Business Intelligence market is expected to grow to $54.9B by FY 2032, potentially showing an average annual growth rate of 7% over the next decade.

Source: Precedence Research

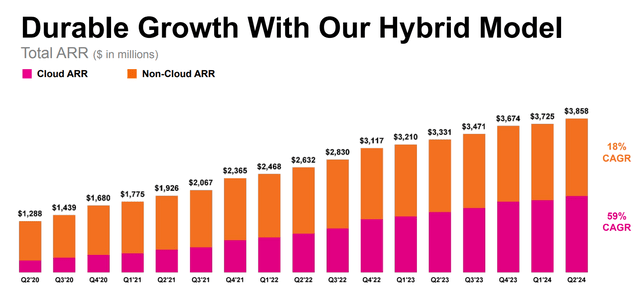

Splunk is hugely popular with companies in the U.S., and the firm has seen sustained revenue momentum in the last several years, which was in part driven by the company’s heavy investments into AI. In the last four years, Splunk has generated 59% average annual Cloud-related top line growth and increased its total revenues by a factor of three.

Splunk has seen considerable revenue momentum, driven by strong production adoption in the enterprise market as well as growing interest in data analytics solutions. Splunk achieved 16% year-over-year revenue growth in the second quarter and reported $3.86B in total annual recurring revenues in Q2’23.

Source: Splunk

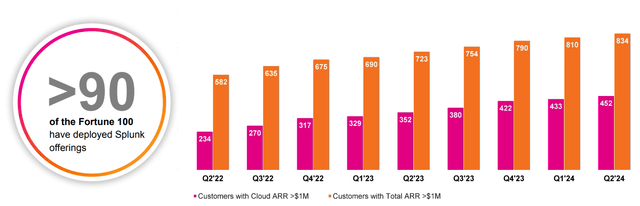

Splunk’s revenue growth has been driven chiefly by client acquisition momentum in the high-value customer category. These customers tend to spend at least $1M annually on Splunk’s products and services. In the last year, Splunk added an average of 28 high-value clients per quarter to its business portfolio, and the firm ended FQ2’24 with 834 customers paying more than $1M in revenues a year.

Source: Splunk

Cisco valued Splunk at $157 per share, implying a 31% takeover premium. I believe the deal makes sense for Cisco, but it also has implications for Palantir, which I increasingly see as a potential takeover target for other corporations such as Oracle (ORCL)… which has a large business intelligence segment and end-to-end Enterprise Performance Management System.

Amazon (AMZN) might be another company that could afford a major transaction, in my opinion. Amazon last year collaborated with Palantir to integrate Foundry capabilities with Amazon SageMaker in a bid to develop and integrate artificial intelligence into its product offering.

With Splunk getting married to Cisco Systems, I see interest in other data analytics companies only growing moving forward. Salesforce (CRM), which paid top dollar ($27.7B) for chat platform Slack in 2020, is another company that I could see as a potential suitor of Palantir.

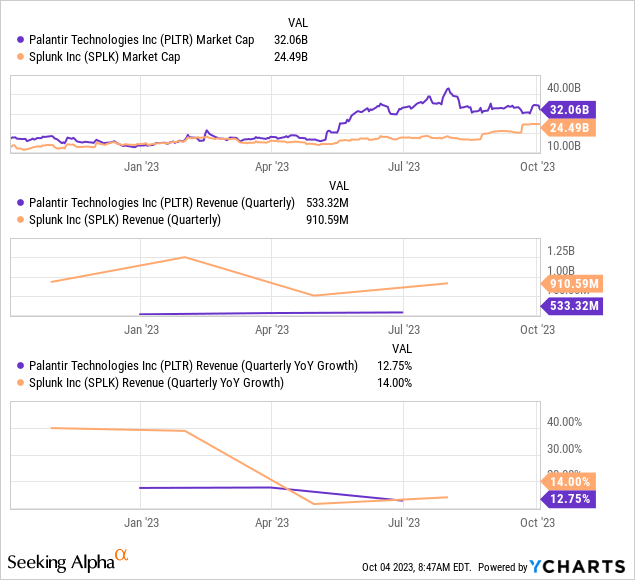

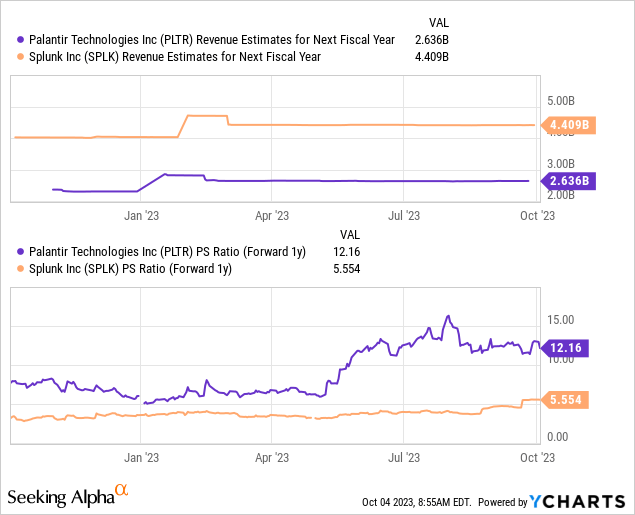

Splunk, following the deal announcement, has an equity value of $24.5B, while Palantir has a market cap of $32.1B. Splunk achieved 70% higher revenues in the last quarter and is growing revenues slightly faster than Palantir (14% to 13%).

Valuation decline has made Palantir more attractive as a takeover candidate

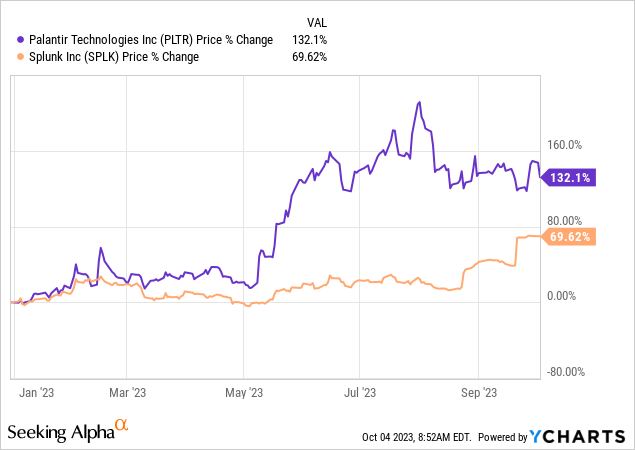

Palantir’s share price has been volatile, but the company’s market value increased by 70% in the first nine months of the year, chiefly because Palantir guided for GAAP profitability on a full-year basis, which caused a change in investor sentiment.

Palantir, like Splunk, is valued highly based on its expected revenue potential in the future… but this hasn’t deterred Cisco from tabling a highly lucrative takeover offer: Cisco valued Splunk at $157 despite the data analytics company trading between $80-100 for most of the last year.

Palantir is currently trading at a forward P/S ratio of 12.1X, while Splunk’s top line potential is valued at a forward price-to-revenue ratio of 5.6X. Palantir is expected to grow revenues 19% next year compared to a projected top line growth rate of 12% for Splunk.

Risks with data analytics investments

The Cisco-Splunk deal is a low-risk value proposition for Splunk and a no-brainer for shareholders. However, the deal falling through would be a headwind for Splunk, as the takeover premium would likely disappear. The deal is also favorable for Cisco, as the company can tap into Splunk’s portfolio of AI products and potentially accelerate its revenue growth. Additionally, I believe the deal also creates some implicit upside in Palantir, in my opinion, as other large corporate suitors might be interested in acquiring Palantir’s Foundry/AI capabilities.

Final thoughts

The $28B Cisco-Splunk mega deal makes a whole lot of strategic sense, especially for Cisco as it is a legacy hardware company seeking to generate new revenue streams and moving into enterprise software. The deal included a generous takeover premium, and Splunk is now valued at close to $25B… and the deal could further put Palantir on the map as a potential acquisition candidate which operates in the data analytics business as well and is heavily investing in AI.

Companies with deep pockets such as Oracle, Amazon, or Salesforce could, in my opinion, show an interest in Palantir in a bid to diversify their operations, add new AI capabilities to their portfolios and boost their top line growth. Cisco might have kicked off a race for new mergers in the enterprise software market. Although I already liked Palantir without any takeover fantasy, I believe the Cisco-Splunk $28B mega deal only serves to add yet another factor to the bullish thesis here!

Read the full article here