First Trust High Inc Long/Short Fund (FSD) is an income-focused closed-end fund, or CEF, that is overlooked by most investors who are seeking to earn a very high level of income from the assets in their portfolios. The fund’s very attractive 12.05% current yield stands as evidence of its relative quality and potential as an income vehicle.

There are plenty of closed-end funds on the market that have the potential to serve as an income vehicle. This one differs a lot from other funds due to its strategy, however. As the name suggests, this fund employs short sales as an essential part of its investment technique, which is an absolute return strategy that we frequently see employed by hedge funds but very rarely by anything that is available to non-accredited investors. As such, this fund may offer the potential to add a certain amount of diversity to your portfolio, or at least reduce the correlation of assets across your portfolio.

As long-time readers may recall, we last discussed the First Trust High Income Long/Short Fund back in August of 2021. At the time, I noted that the fund was short U.S. Treasuries and even praised it for that position. This move certainly paid off more rapidly than I expected, as U.S. Treasuries are quite likely to decline in value this year, which would represent the third year in a row that Treasuries have gone down. This has not happened since the American Revolution, but it provides the fund with an attractive source of profits.

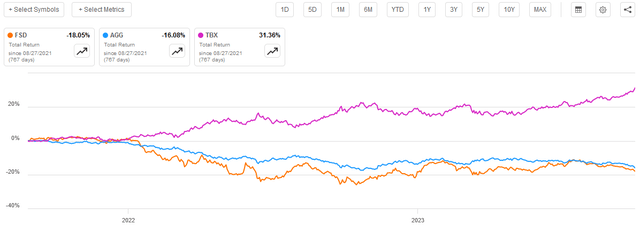

The market appears to have completely missed the fund’s potential in a rising rate environment, as it has driven down the fund’s shares by a whopping 34.30% since my previous article was published. That is substantially worse than the 20.41% decline of the Bloomberg U.S. Aggregate Bond Index:

Seeking Alpha

However, as I have pointed out in other articles, it is much more important to look at the total return provided by a closed-end fund, rather than simply its price return. This is because these funds pay out nearly all of their capital gains and investment income to the shareholders. This gives these funds very high yields compared to the indices, and the payments that they make can frequently offset share price declines. Overall, investors in this fund have lost 18.05% since my last article was published compared to a 16.08% loss had they invested in the bond index:

Seeking Alpha

This is still a very disappointing showing for the fund considering that the short positions should have been immensely profitable. Then again, the fund’s short positions probably were not large enough to offset losses from elsewhere in the portfolio. This is something that we should investigate over the course of this article, along with discussing the changes in the market that have taken place over the past two years and the fund’s overall financial condition.

About The Fund

According to the fund’s website, the First Trust High Income Long/Short Fund has the primary objective of providing its shareholders with a high level of current income. As mentioned in the introduction, the fund uses a somewhat novel strategy to accomplish this objective. The webpage describes it:

First Trust High Income Long/Short Fund is a diversified, closed-end management investment company. The Fund’s primary investment objective is to provide current income. The Fund’s secondary objective is capital appreciation. The Fund seeks to achieve its investment objectives by investing, under normal market conditions, a majority of its assets in a diversified portfolio of U.S. and foreign (including emerging markets) high-yield corporate fixed-income securities of varying maturities that are rated below-investment grade at the time of purchase. For purposes of this strategy, “corporate fixed-income securities” include corporate bonds, debentures, notes, commercial paper and similar types of corporate debt instruments, including instruments issued by corporations with direct or indirect government ownership, as well as asset-backed securities, preferred shares, senior floating-rate loan participations, commitments and assignments, payment-in-kind securities, zero-coupon bonds, bank certificates of deposit, fixed time deposits, bankers acceptances and derivative instruments that provide the same or similar economic impact as a physical investment in the above securities. Below-investment-grade fixed-income securities are commonly referred to as “high-yield” or “junk” bonds and are considered speculative with respect to the issuer’s capacity to pay interest and repay principal. As part of its investment strategy, the Fund intends to maintain both long and short positions in securities under normal market conditions. The Fund will take long positions in securities that the Fund’s Sub-Advisor believes offer the potential for attractive returns and that it considers in the aggregate to have the potential to outperform the Fund’s benchmark, the ICE BofA US High Yield Constrained Index (the “Index”). The Fund will take short positions in securities that the Sub-Advisor believes in the aggregate will underperform the Index. The Fund’s long positions, either directly or through derivatives, may total up to 130% of the Fund’s Managed Assets. The Fund’s short positions, either directly or through derivatives, may total up to 30% of the Fund’s Managed Assets.

As mentioned in the introduction, the fact that this fund can short bonds should have allowed it to outperform substantially over the past two or three years. After all, a short position in U.S. Treasuries did fairly well. For example, we can take a look at the ProShares Short 7-10 Year Treasury ETF (TBX), which simply takes a short position in mid-term Treasuries. If we overlay this onto the total return chart provided in the introduction, we can see that it completely dominated both the First Trust High Income Long/Short Fund and the Bloomberg U.S. Aggregate Bond Index since the date that my previous article on the fund was published:

Seeking Alpha

A short position in mid-term Treasuries would have returned 31.36% over the period compared to the losses that this fund took.

The big reason why the fund’s strategy did not allow it to deliver the strong positive returns that it should have been able to can be seen in the above quote from the fund’s webpage. The fund is limited to only dedicating 30% of its assets to short positions. Thus, it will always have a net long position, which was a terrible portfolio to have in the bond market over the period. This is because the losses from the long positions will more than offset the positive performance from the short positions. However, we should still be able to expect somewhat better performance from the fund compared to a fund invested in similar assets on the long-only side. With that said, the Bloomberg High Yield Very Liquid Index (JNK) outperformed the fund over the period as well:

Seeking Alpha

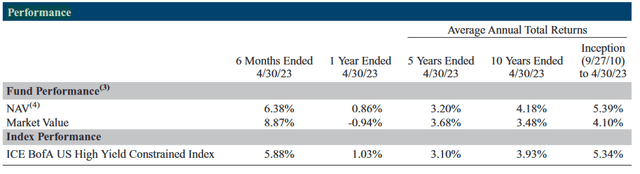

Admittedly, this is not exactly the same index as the one that the fund uses as its benchmark, but it should have delivered relatively similar performance. Curiously, the fund does not actually provide performance information on its website or in its fact sheet that compares its performance against its benchmark. Fortunately, it does provide this information in its financial reports, but this data is several months out of date at this point. Nevertheless, here is the fund’s performance data compared to its benchmark index as of April 30, 2023:

First Trust

Here can see something very interesting. The fund’s performance against the index tends to vary, with it beating it during certain periods and underperforming during others. However, in both of the longer periods (the trailing ten-year period and since inception), the fund’s portfolio delivered a better performance than the index, but its market performance was somewhat worse.

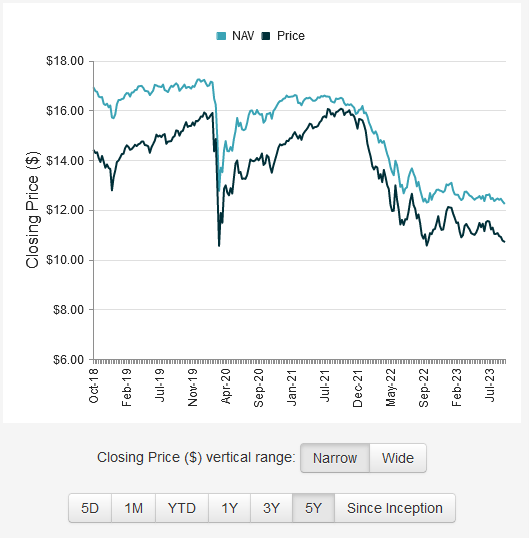

I will admit that I am not especially surprised by this, as the fund’s long/short strategy is somewhat unorthodox. Thus, it is possible that the market somewhat undervalues the ability of the short position to generate gains during challenging market conditions, since most closed-end funds do not have this component of their strategy. However, as we can see here, the fund’s market price performance has generally tracked its net asset value over the past five years, although there were a few cases in 2019 and 2021 where the market price performance was better than the portfolio actually delivered:

CEF Connect

Thus, the conclusion that we have to draw is that the fact that the fund can only take a very limited short position relative to the size of its assets prevents it from being able to take advantage of a bear market like a fund with much more flexibility could accomplish. This is disappointing, although short positions are not especially good for income-seeking investors due to the fact that the fund would have to actually pay the bond coupons on a short position. It, therefore, does make sense given the primary objective of income generation, but it is still a bit disappointing.

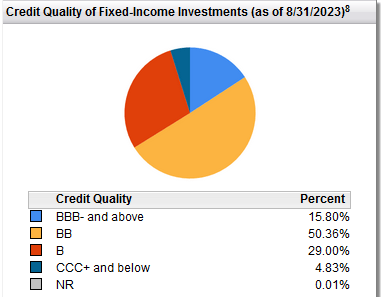

As noted in the fund’s description above, the First Trust High Income Long/Short Fund invests its long positions primarily in high-yield bonds. These are the securities that are colloquially known as “junk bonds,” which may concern some investors. After all, we have all heard stories about how risky these securities can be. The fund itself hints at this, stating that these securities are considered speculative with respect to the issuers’ capability to pay interest and principal. However, we may be able to find some comfort by looking at the credit ratings that have been assigned to the bonds in the fund’s portfolio. Here is a high-level overview:

First Trust

A high-yield bond is anything with a credit rating of BB or lower. That obviously accounts for 84.20% of the fund’s total assets. Thus, the overwhelming majority of this fund’s holdings are indeed in junk bonds, which fits well with its own description of its strategy. However, we can see that 79.36% of the fund’s assets are invested in bonds that carry a BB or B rating, with most of them carrying the higher of the two ratings. This is nice because the official bond ratings scale states that bonds with either a BB or a B rating are issued by entities that have sufficient financial strength to carry their debt at the time of issuance and have balance sheets and income statements that should allow them to continue to do so even in the event of a short-term economic shock.

Thus, the risk of losses due to default here should be relatively low, although it has ticked up a bit this year as the effects of higher interest rates work their way through the economy. When we combine this with the fact that the fund does not have any individual long position exceeding 1.13% of its assets, we can see that the actual risk of a default hurting the fund’s investors is likely to be quite negligible. The biggest risk here is interest rates, just like any other bond fund.

Leverage

As is the case with most closed-end funds, the First Trust High Income Long/Short Fund employs leverage as a method of boosting the effective yield of its portfolio. I explained how this works in various previous articles. To paraphrase myself:

In short, the fund borrows money and then uses that borrowed money to purchase junk bonds, preferred stock, and other income-producing securities. As long as the yield on the purchased securities is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case. With that said though, the beneficial effects of leverage are less today than they were two years ago when interest rates were at 0% because the difference between the rate at which the fund can borrow and the yield that it receives from purchased assets is less than it once was.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like a fund’s leverage to exceed a third as a percentage of its assets for this reason.

As of the time of writing, the First Trust High Income Long/Short Fund has levered assets comprising 33.54% of the portfolio. This is just slightly over our desired one-third level, but it is just barely over it. It is still quite a bit lower than most other fixed-income funds possess, especially many of the John Hancock and Flaherty & Crumrine funds, which tend to have leverage in the 40% range. Overall, this fund’s leverage is probably pretty reasonable right now, although we do want to keep an eye on it as we do not want it to get too much higher and begin exposing us to outsized amounts of risk.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the First Trust High Income Long/Short Fund is to provide its investors with a very high level of current income. In order to accomplish this, it primarily invests in a portfolio of junk bonds while shorting U.S. Treasuries in an attempt to earn some extra capital gains and generate some investment profits from the yield difference between the two types of security. It also applies a bit of leverage to boost the effective yield of the portfolio. As junk bonds themselves have pretty high yields right now and the fund employs leverage to boost it further, we can probably assume that this fund would have a remarkably high yield right now.

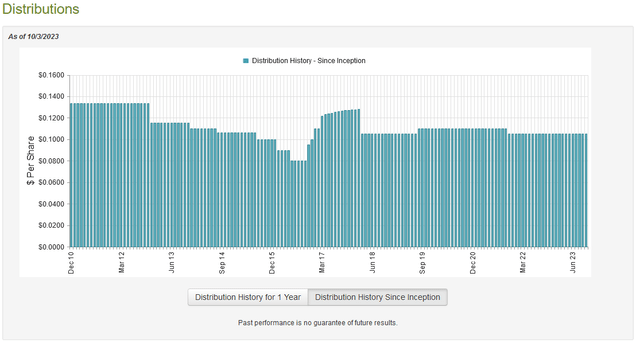

That is certainly the case as the First Trust High Income Long/Short Fund pays a monthly distribution of $0.1050 per share ($1.26 per share annually), which gives it a 12.05% yield at the current price. Unfortunately, the fund has not been especially consistent with respect to its yield over the years. In fact, it has frequently changed its distribution, especially prior to 2018:

CEF Connect

This performance history is likely to be a bit of a turn-off for any investor who is seeking to earn a safe and secure income that can be used to pay their bills and finance their lifestyles. However, this fund has done better than many of its peers in the current environment, as its distribution has been stable since November 2021, and it did not have to cut in reaction to the Federal Reserve adopting a less accommodating stance. It is one of the few funds to have managed to accomplish this feat though, so we should investigate and attempt to determine exactly have sustainable its distribution is likely to be going forward. After all, we do not want to be the victims of a sudden distribution cut!

Fortunately, we do have a relatively recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. This is the report that was mentioned earlier when we compared the fund’s performance to its benchmark index. It is obviously a much newer report than the one that we had available to us the last time that we discussed this fund, as that was a few years ago. The period that this report covers is also a pretty good one to look at as it includes both the incredibly challenging conditions that existed in November and December 2022 as well as the bear market bounce during the first half of this year.

The latter of these events provided some profit potential if the fund took advantage of it by selling off appreciated junk bonds, and even the former market provided opportunities for some gains from the short position. Thus, the report should give us a good idea of how well the fund managed to take advantage of these differing conditions.

During the six-month period, the First Trust High Income Long/Short Fund received $17,707,329 in interest and $6,359 in dividends from the assets in its portfolio. When we combine this with a small amount of income from other sources, we see that the fund had a total investment income of $18,839,029 during the period. It paid its expenses out of this amount, which left it with $10,609,865 available to shareholders. This was, unfortunately, nowhere close to enough to cover the $21,000,444 that the fund actually paid out in distributions during the period. At first glance, this is quite concerning as we typically like fixed-income funds to be able to fully fund their distributions out of net investment income. This one clearly failed at this task.

However, the fund does have other methods through which it can obtain the money that it needs to cover the distribution. For example, it might have been able to take advantage of market conditions to close out some of its long or short positions at a profit. This would, of course, result in capital gains that the fund can pay out to its investors. Unfortunately, the fund had mixed results here as it reported $9,337,637 in net realized losses, but this was more than offset by $22,771,687 net unrealized gains.

Overall, the fund’s net assets went up by $1,610,172 after accounting for all inflows and outflows during the period. This was particularly impressive because the outflows included not only the distribution but also a share buyback that cost the fund $1,433,499. This fund is apparently attempting the same strategy that First Trust’s energy infrastructure funds have been using to try and prop the share price up in an unfriendly market.

Regardless, overall, the fund’s finances were fine during the six-month period. However, it is important to note that net unrealized gains can easily be erased by the market and the fund did not manage to cover its distribution without these unrealized gains. As such, its long-term sustainability does depend somewhat on how well it does in converting these into realized gains. We should therefore take a close look at the fund’s next financial report when it is eventually released around the end of this year.

Valuation

As of October 3, 2023 (the most recent date for which data is currently available), the First Trust High Income Long/Short Fund has a net asset value of $11.95 per share but the shares currently trade for $10.47 each. This gives the shares a 12.38% discount on net asset value at the current price. That is much more attractive than the 11.24% discount that the shares have averaged over the past month. The current price is certainly very reasonable for anyone who is interested in this fund today.

Conclusion

In conclusion, the First Trust High Income Long/Short Fund is an interesting fund that employs a rather unorthodox strategy. In theory, the strategy should allow the fund to outperform in challenging bond markets, but the fact that it can only have a limited proportion of its assets dedicated to the short position handicaps it. It did still manage to beat its benchmark during the first half of its fiscal year, though. Overall, though, the fund’s recent market performance is somewhat disappointing as it loses to multiple bond index funds. With that said though, this is one of the few bond funds that appears to be sustaining its distribution in the current environment. The fund is also trading at a very attractive valuation, so it might be worth considering for purchase today.

Read the full article here