Main Thesis & Background

The purpose of this article is to evaluate the Vanguard Utilities ETF (NYSEARCA:NYSEARCA:VPU) as an investment option at its current market price. The fund’s stated objective is “to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector” and is managed by Vanguard.

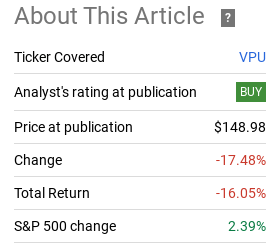

To start with the obvious – this has not been the play of the year! I have long been a believer in the Utilities sector for a host of reasons. These include income, stability, and diversity, as they are under-represented in my primary S&P 500 and NASDAQ 100 mega-cap funds. While this has generally served me well over time, it sure hasn’t this year. Looking back to when summer was getting underway, I had some concerns about market valuations and thought Utilities may provide some defense. To say I was wrong is an understatement:

Fund Performance (Seeking Alpha)

Clearly, this sector has been a loser short-term. And, to be fair, risks remain elevated so hanging on to a “buy” thesis is challenging in this environment. But part of that reality is why I see merit to adding to my position. I wouldn’t get carried away and suggest readers “back up the truck” (or other similarly overused phrases that we see every day). But the fact is this market is pressuring Utilities (and VPU by extension) to the point where I see carnage and blood in the streets.

Those types of scenarios can end up burning investors at times, but other times they can be welcomed buying opportunities. Given the large-cap and generally stable make-up of the underlying index, I think that over time we will see this trade work out favorably because these companies are not going anywhere. This tells me to keep the faith, and I will explain some of the rationale behind this decision in detail below.

Let’s Consider Where We Stand In 2023

Expanding on the first paragraph, I want to emphasize why I am reaffirming a buy call here despite all the weakness. The point is pretty simple – I love to buy when others hate the idea (within reason). Standard contrarian theory suggests that corrections or bear markets can make great buying opportunities if the longer term story is positive. With respect to large-cap Utilities, I believe that is the case as the world continues to have a growing and evolving demand for energy production and distribution.

With that in mind, what prompted me to write this review today is that VPU is in near bear market territory. Its price drop alone is almost 20% – so that results in a loss near the 17-18% mark after dividends are considered:

VPU’s 2023 Performance (Seeking Alpha)

In the paragraphs that follow, I will discuss why this has occurred, whether or not I feel this is an unjustified move, and what my forward outlook is. But I wanted to highlight why I felt now was the time to write about VPU again. The fund is sitting near that textbook “bear” market level, and that is a signal that always registers with me. This time around is no different.

Why The Poor State of Affairs?

So I like to buy bear markets. Makes sense – right? Well, maybe not all the time. There are instances where indices or sectors fall by the 10% or 20% threshold for correction or bear market and still have much further to go. Even large-cap Tech is not immune from this – as 2022 showed us. And if we look in to single stocks, on a micro-basis bear markets are often not as appealing. But with sectors, an across the board drop can often be unwarranted and 20% drops (or more) tend to even out over time.

Despite this confidence in the strategy, we always have to consider why something is dropping as much as it is. That helps with gauging the risk and making an appropriate conclusion as to whether or not a buy-in strategy makes sense. Just a simple “it dropped so I love it”, isn’t very scientific. We need to get a sense of the factors behind the drop and then gauge whether or not that will continue. Only then can we have some real insight in to why buying in to the weakness is a smart play.

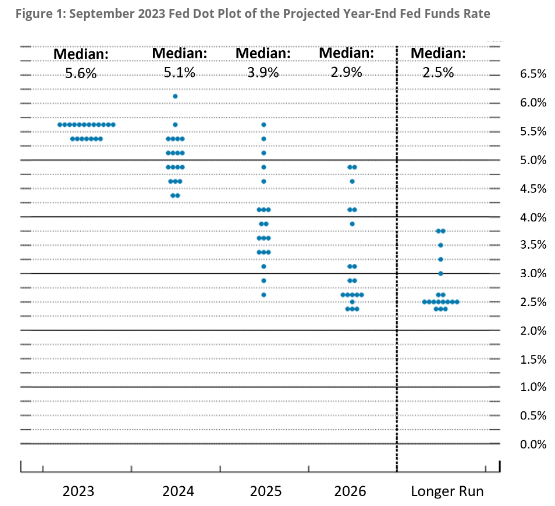

For Utilities, there are a couple of reasons the past few months have been filled with pain. The primary reason for the sector as a whole is interest rates. This sector tends to be very sensitive to rates, although the last couple of years has tested this long-term trend. What is putting pressure on the sector near term is not so much the recent rise in rates but the fact that rates may stay elevated. It is the “higher for longer” mantra that we keep hearing about from the Fed. The market has started to take notice and the result hasn’t been kind to VPU:

September Fed “Dot Plot” (Federal Reserve)

What this is showing is that rates are now anticipated to be elevated throughout 2024. This reassessment for the next 12-15 months helps to explain the macro-issue for VPU. Rising – and higher for longer – rates are hurting rate-sensitive Utilities stocks chiefly because of the sectors’ heavy reliance on debt financing to grow their respective businesses.

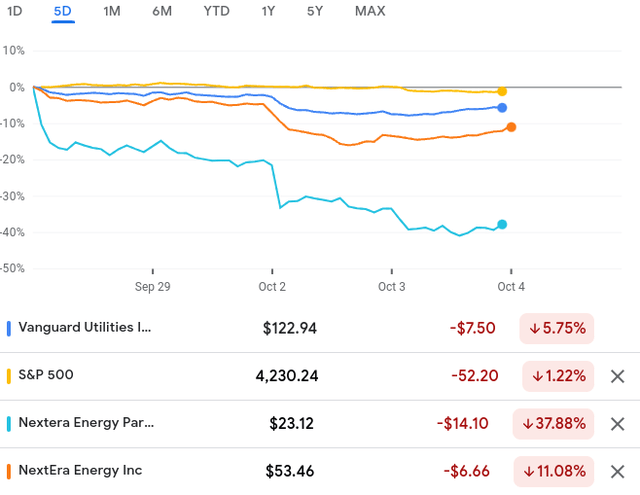

Another reason is a few utility companies have rattled the market with their growth and dividend projections. This has weighed on broader sector sentiment and has hurt VPU and other passive ETFs that own these select companies. But we have to put this in perspective. Whether it is banking, retail, or utilities, no sector investor wants to see large-cap names announce bad news. But this actually highlights why someone wants to own a diversified basket like VPU. While a couple stocks have been punished (and dragged down VPU a bit), all drops are not created equal:

5-Day Return (through 10/4) (Google Finance)

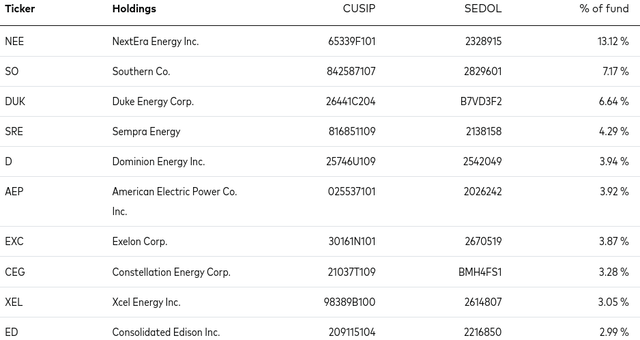

My intention here is not to understate the impact on VPU. I want to highlight that both NextEra Energy Partners, LP (NEP) and NextEra Energy, Inc. (NEE) are held within VPU. While NEP has a relatively small position, NEE is the fund’s largest by quite a margin:

VPU’s Top Holdings List (Vanguard)

So the impact of negative news on the wrong tickers surely impacts VPU. I am not suggesting otherwise. And while NEP is not a major holding, NEE is the parent company of it – hence the downtrend despite no “direct” news from it.

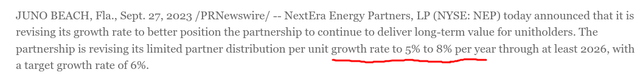

But just how “bad” was the news out of NEP? While I’m not going to sit here and somehow spin this as a positive, their press release wasn’t the end of the world. Is it what investors want to see? Of course not – limiting growth expectations is never a positive. But does it warrant a drop of almost 38%? That is where the subjectivity comes in:

NEP’s Press Release (NEP Investor Center)

What I am trying to convey here is this isn’t a disaster or calamity. Is a downward growth revision a net negative? Absolutely. Should the stock (and therefore the sector) see some weakness because of it? Absolutely. But is the scope of this news justifiable for Utilities (and VPU) to be in bear market territory? That is where I disagree – and why I see the current weakness as a reasonable spot to add to my position.

Where’s The Silver Lining?

With the challenges facing the Utilities sector it may seem daunting to buy now. I wouldn’t fault anyone for deciding it is a bit too risky right now – we have to know our own risk tolerance, make a plan, and stick to it. Buying in to bear markets may not fit with everyone’s strategy as a result. Further, just because a sector is in a bear market doesn’t make it an automatic buy. There have to be some other positive fundamentals to really warrant the risk.

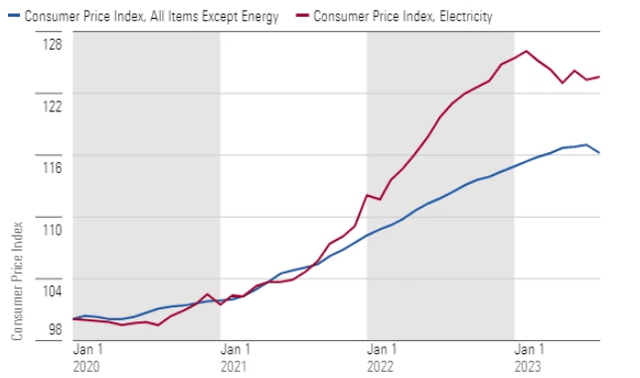

Fortunately, some of those fundamentals do exist in the broader Utilities space. One that comes to mind is rising electricity prices – which utility providers are (mostly) able to pass end to their end users (consumers and businesses). While they do have to absorb some of the rising prices, the reality is that prices are rising swiftly and consumers are paying the price. In fact, end consumer prices for electricity are rising much faster than broader inflation:

Inflation Readings (EIA)

This is not something to get wildly excited about in isolation. But it does show there are some underlying positives within the Utilities sector to consider. Ultimately, a graphic like this is not something to base a buy case on by itself – especially during a bull run. But when a sector is seeing a bear market and it may seem unjustified – then these types of facts provide a lot of value.

An Area Drawing High Levels of Investment

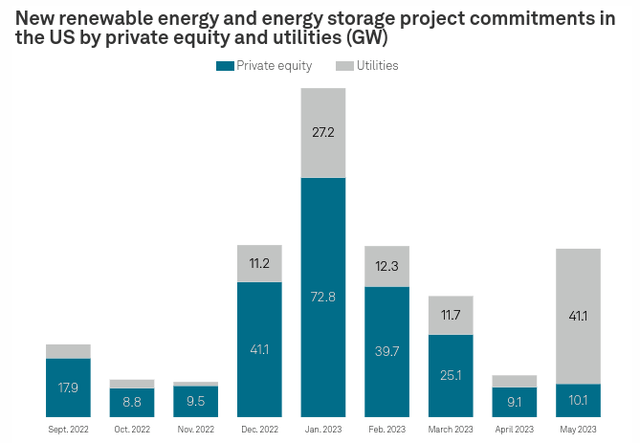

Another factor to consider is that this remains a sector poised to benefit from ever increasing levels of direct government and private investment. Utility (and energy companies) are on the front-lines of transitions in how the world develops, distributes, and uses energy and power. In fact, the past year has seen consistent net positive investment for development and storage of energy and power across the US:

Investment Dollars By Month (S&P Global)

What this shows me is that the underlying companies in VPU remain on the front-lines of a continued trend across America (and the world) and that they will draw in public and private investment in the months to come. This story is bigger than any near-term headwind and supports why I am bullish even now.

Bottom-line

VPU has been hit hard due and that is likely making investors uneasy. The broad weakness in Utilities is indeed something to keep an eye on – but we should reflect that there are some unusual moves coming from a handful of names (think NEE and NEP) that were overweight some utility funds. The drops have not been as dramatic for the average utility company and I expect a relief rally to be forthcoming.

It is true that some risks remain. An elevated interest rate environment and bearish momentum are two major headwinds. But with VPU sitting in bear market territory, I think these risks are reflected in the share price. Therefore, I am reaffirming a “buy” rating, and suggest my followers give this sector some consideration at this time.

Read the full article here