Investors’ optimism around Qualcomm (NASDAQ:QCOM) has been running high after the recently announced deal with Apple (AAPL) to supply modem chips until 2026.

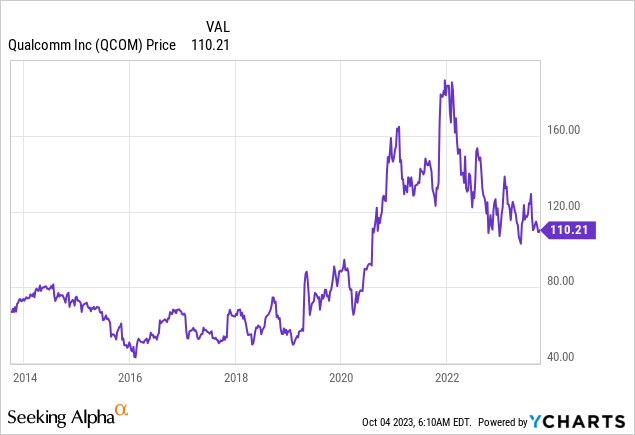

Value investors have also been circling around the stock as the share price fell sharply in 2022 and continues to make new multi-year lows (see the graph below). On top of all that, the nearly 3% forward dividend yield has been giving the illusion that one could get the best of both worlds – a high dividend yield and a growth stock.

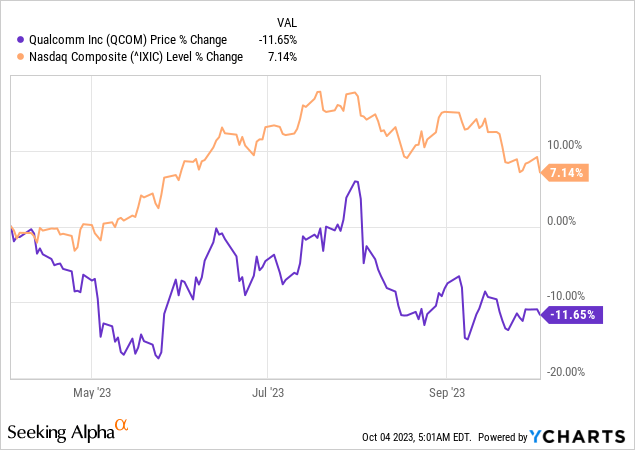

In the meantime, however, QCOM has continued falling through 2023 with the gap between the stock and the Nasdaq now approaching nearly 20%.

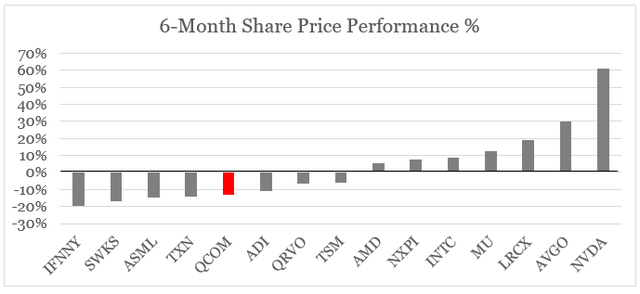

As most stocks in the semiconductors space benefited heavily in the past few months from the narratives around generative AI, QCOM also became one of the worst performers in its peer group.

prepared by the author, using data from Seeking Alpha

After hearing all that, one could either proclaim that the market has lost its mind and QCOM is significantly undervalued or look at the situation objectively and recognize the massive risk that the company is in a very bad position to deliver satisfactory returns over the medium-term.

Margin Problems

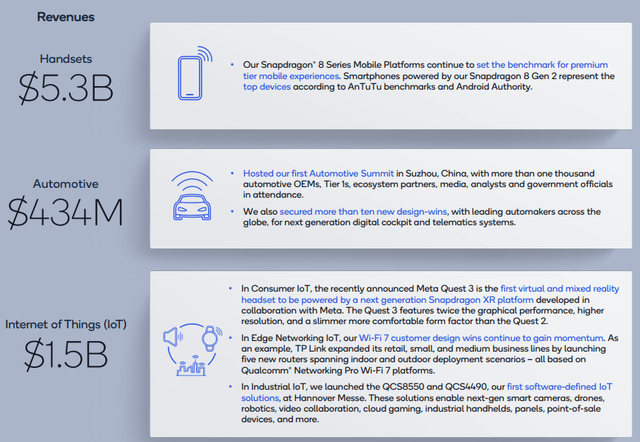

After many years of undisputed leadership in the handsets space with its iconic processors, Qualcomm is now forced to seek growth opportunities in adjacent categories, such as automotive and Internet of Things (IoT). This is hardly a problem, unless one considers the more intense competition in these areas which leads to more uncertainty regarding future revenue growth, but more importantly it is also associated with lower margins.

Qualcomm Investor Presentation

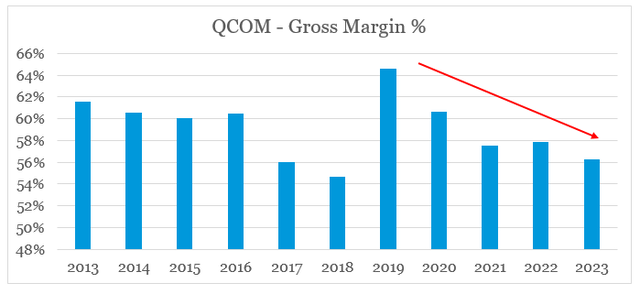

This is hardly a speculation as Qualcomm’s gross margin is already at its lowest levels for the past 10-year period, with the exception of 2017-18. The strong downward trend for the past 5 years is also a cause of concern as we are currently undergoing a period of unprecedented demand which should drive record high margins.

prepared by the author, using data from Seeking Alpha

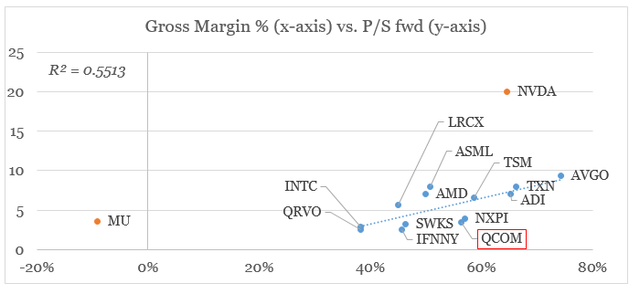

The reason why this is so important is that gross margins are the key driver of sales multiples on a cross sectional basis within the semiconductors space. With the exception of Nvidia (NVDA) and Micron Technology (MU) all other companies shown below exhibit a very strong relationship based on their margins and forward P/S multiples.

prepared by the author, using data from Seeking Alpha

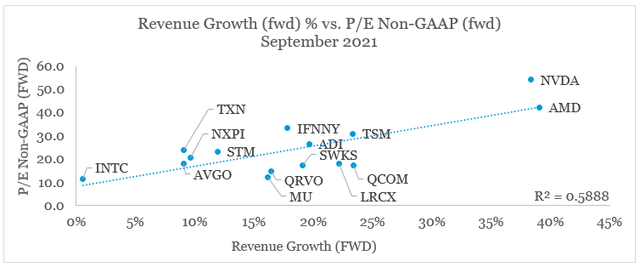

Earlier this year I showed that expected revenue growth rate has been a key driver of Price-to-Earnings multiples in the sector during 2021 when we had a cyclical upswing in valuations due to exceptionally high liquidity in the markets.

prepared by the author, using data from Seeking Alpha

Even if we assume that we are headed for yet another period of liquidity inflows and exceptionally high revenue growth rates in the sector, QCOM is hardly the best play in the expanded peer group we see above.

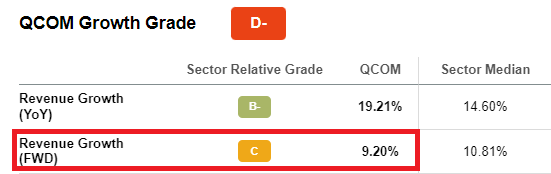

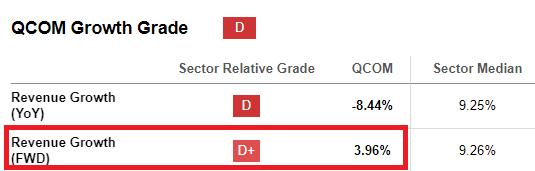

Down below is the company’s forward revenue growth rate at the time when I first covered the stock back in March of this year.

Seeking Alpha

From an expected growth rate of above 9%, QCOM is now expected to grow at a rate of less than 4%. This is a drastic change in just a couple of months.

Seeking Alpha

At the same time, analysts have not capitulated yet. Quite the opposite they remain bullish on the stock as they have ever been by just riding the wave of optimism.

Seeking Alpha

Although some optimism is justified with the latest deal with Apple (AAPL), in reality Qualcomm is not in a very good position over the long-term with falling revenue from licensing and a strong trend to on-shoring capacity.

In spite the fact that the two companies reached a settlement that involves Apple paying QCOM, the latter’s revenue from licensing (QTL segment) fell from $7.7bn in 2016 to $6.4bn in fiscal 2022. In addition to Apple, Samsung is also among one of the major customers of QCOM that are also its main competitors. (…)

And as more countries vie for on-shoring of semiconductors capacity, Qualcomm could face sustained headwinds going forward.

Source: Seeking Alpha

Squeezing The Cash Flow

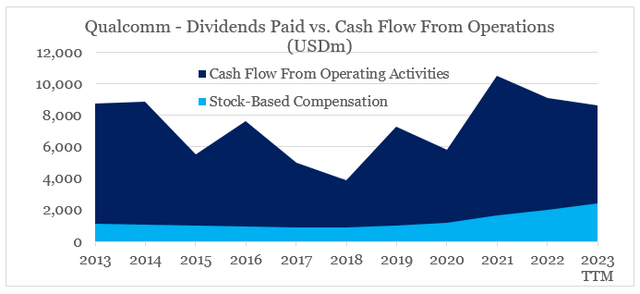

Qualcomm is also not in a very good position as far as its cash flow and capital allocation decisions are concerned.

The level of stock-based compensation as a share of cash flow from operations continues to increase and is now one of the highest within the sector at 28% for the past 12-month period.

prepared by the author, using data from Seeking Alpha

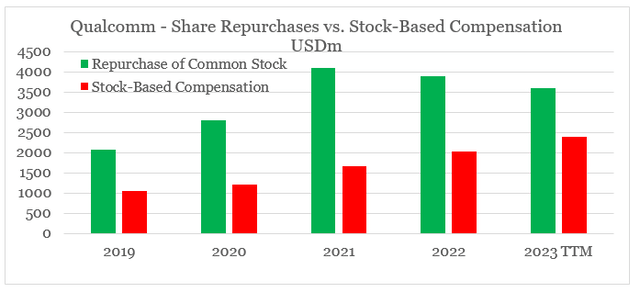

That is why QCOM will have to continue buying back billions worth of its own shares in order to avoid shareholder dilution. As we see down below, the level of stock-based compensation and share repurchases have been converging in recent years.

prepared by the author, using data from Seeking Alpha

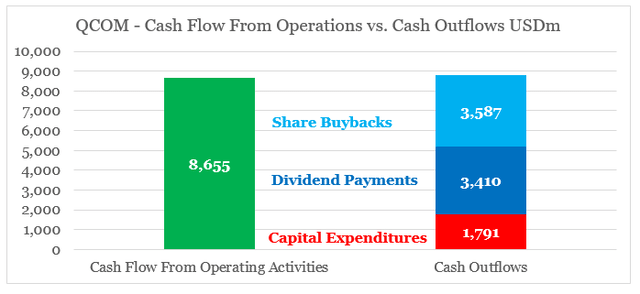

This could bring addition problems for the company as its cash flow from operations is enough to just cover the company’s current level of capital expenditures, its much needed share repurchases and the generous dividend.

prepared by the author, using data from Seeking Alpha

This might not sound as a big deal now, but it highlights the company’s limited ability to increase its shareholder disbursements or expand capacity through higher capex.

Conclusion

In spite of its low price, Qualcomm does not appear to be a bargain at this moment. Even though returns remain speculative in the short-run due to the possibility of a pivot in the currently restrictive monetary policy, QCOM is not in a good position to expand its margins going forward and is not in a good strategic position either. At the same time, generous shareholder disbursements are limiting the company’s ability to grow and could bring additional problems for the stock in a more adverse scenario for the industry.

Read the full article here