Levi Strauss (NYSE:LEVI) is fresh off their Q3 earnings release. In my last update following the Q2 print, I noted that much of the downside was already priced into the stock following a 8% decline immediately post-release. Shares have indeed traded flat since that update despite a 3% drop in the broader S&P (SPY) over the same period. Though investors were once again disappointed in the current period results, I still view LEVI as attractively priced with value potential, supported in part by their strong international operating presence.

LEVI Key Stock Metrics

Through nine months of the year, LEVI has generated +$176.6M in operating cash flows but is negative on a free cash flow basis. This is due primarily to higher CAPEX in conjunction with lower overall earnings. Their cash position, nevertheless, remains healthy with +$295M of cash and equivalents and over +$1.0B in total liquidity. Total leverage is up YOY but within range at 1.6x. And though total inventories are up 6% on a dollar basis, LEVI is still benefiting from a more favorable working capital position than last year.

LEVI Q3 Earnings Recap

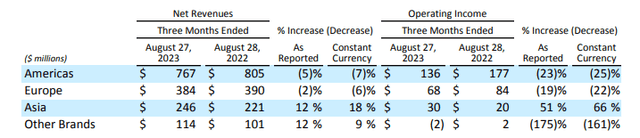

Total quarterly reported revenues were flat YOY and down 2% in constant currency, missing estimates by +$40M. From a regional standpoint, LEVI experienced weakness in the Americas and Europe, with net constant currency revenues down 7% and 6%, respectively. The weakness was offset by strength in Asia, which grew 18%, supported in part by growth in China.

LEVI Q3 Earnings: Operating Summary By Geographic Segment

As a percentage of total net revenues, total Direct to Consumer (“DTC”) made up a lower share of the total than in Q2, where it reached a record 44%. Q3’s 40% share, however, wasn’t much of a decline. And constant currency net revenues in the channel increased 13%, with 18% growth in e-commerce.

The continued strength in DTC again provided an offset to LEVI’s wholesale channel, which turned in a 10% decline on weakness out of their North American and European markets.

Operating margins improved sequentially to 2.3% from 0.7% last quarter. But it was still well below the 13.1% reported in the same period last year. This is due in part to an impairment charge relating to LEVI’s Beyond Yoga acquisition. Still, margins continue to be negatively impacted by rising SG&A expenses. Total SG&A expenses were up 7.7% in Q3.

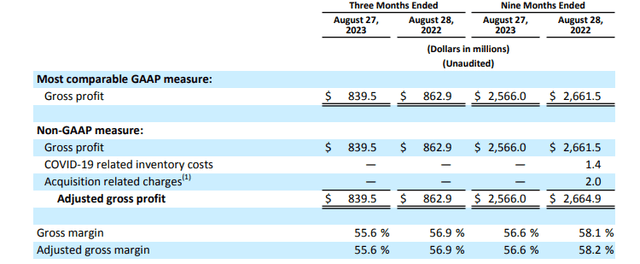

While operating margins were improved, gross margins took a hit from recent pricing actions, as well as higher product costs. Margins were down 130 basis points (“bps”) YOY to 55.6%. Sequentially, this represented a drop of 310bps.

LEVI Q3 Earnings: Summary Of Gross Margins

Overall adjusted diluted EPS came in at $0.28/share, in-line with estimates, though down significantly from $0.40/share reported in the same period last year.

Market Reaction To LEVI Q3 Earnings

LEVI shares dipped about 1.5% in the after-hours trading session immediately following the release. A cut to full-year expected sales was one factor behind the disappointment. Cautious commentary could have also spooked some investors.

During an interview with CNBC, CEO Chip Bergh mentioned the various economic headwinds and its impacts on their more value-oriented consumers, particularly in their wholesale channel, which is comprised of department retailers, such as Macy’s (M) and Kohl’s (KSS). The pullback was noted to be even more pronounced at Walmart (WMT) and Target (T), two carriers of their value-oriented brands, Signature and Denizen.

What Is The Outlook For LEVI Stock?

Despite a more concerning outlook for the wholesale channel, LEVI is still maintaining positive momentum in DTC. The management team, nevertheless, took a more conservative approach in setting guidance.

LEVI now expects total net revenues to be flat to up 1% YOY. In their Q2 release, they guided for growth of 1.5% to 2.5%, which, too, was a trim, albeit at the top end of the range. In addition, the team noted that EPS would likely fall within the low-end of their previously stated range of $1.10/share to $1.20/share.

While their operations in the U.S. and Europe may remain soft, the outlook appears more promising in their international markets. During their conference call, LEVI President, Michelle Gass, highlighted their opportunity in India, citing the country’s draw of being the fastest-growing major economy in the world, with a very young population in terms of age. She also reminded listeners that Mexico is the company’s largest market after the U.S. And in this market, she noted that sales have grown about 40% compared to pre-pandemic levels.

Is LEVI Stock A Buy, Sell, Or Hold?

The continued strength of their DTC model is promising and validates the company’s strategy of investing more in this channel. But it has come at the cost of greater SG&A and at the expense of wholesale, which remains the majority revenue driver for the company. A higher-for-longer rate environment with persistently higher food and energy prices will also likely continue weighing on their value-oriented consumers who tend to shop in these wholesale outlets.

Despite the near-term headwinds, I am optimistic about LEVI’s international operating presence. Current results showed strength in their Asian market; even in China, a market that has been under stress in recent periods. Looking ahead, I can see LEVI outperforming and gaining additional share in their international markets, particularly in India.

All considered, I still view LEVI as a buy despite a weaker-than-expected earnings release. At an expected EPS midpoint of $1.15/share, the stock trades at about 11.50x forward earnings, little changed from my last update following Q2 results. Then, I mentioned that the downside was already priced into the stock. I would say that this remains true. While I wouldn’t maintain an overweight position, I’d say it’s worth a small-medium stake in any long-term focused portfolio with retail diversification.

Read the full article here