Investment thesis

Our current investment thesis is:

- Wix is highly attractive, owing to its high growth, rapidly improving margins, sticky customer base, scope for monetization, and global reach.

- We expect healthy growth to continue due to the growth in e-commerce, as well as the general digitalization of society. Wix is positioned well to partake in this due to its developed product suite and high-quality platform.

- Although the business looks expensive, we are seeing evidence to suggest it is executing its strategy. LTM margins have improved dramatically while customer monetization is improving YoY. With a FCF yield of 5%, we see the business as attractive.

Company description

Wix.com Ltd. (NASDAQ:WIX) allows users to create websites and web applications easily. Their offerings include the Wix Editor, a user-friendly platform for visual website development and editing, and Wix ADI, enabling tailored website creation. Users can also generate logos using AI through Wix Logo Maker and provide customer support with Wix Answers. Wix Payments facilitates secure payment processing on users’ websites.

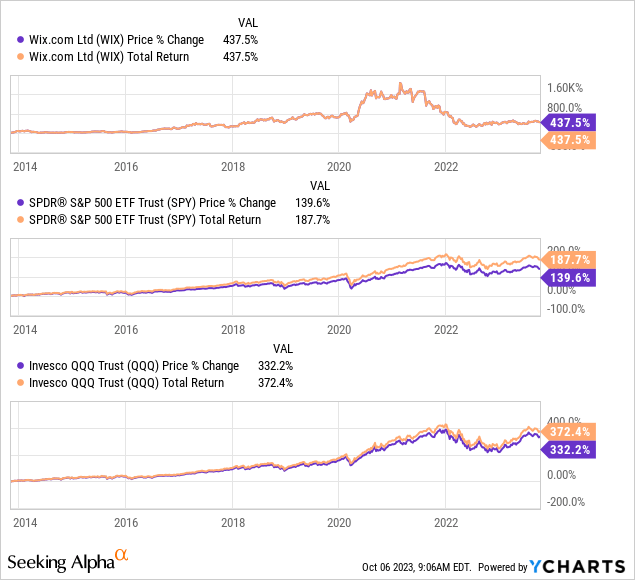

Share price

Wix’s share price has performed exceptionally well in the last decade, outperforming both the wider S&P 500 and the Tech sector in particular. This has been driven by strong commercial improvement, as well as high growth. Unlike the tech sector, however, Wix has not returned to its peak levels.

Financial analysis

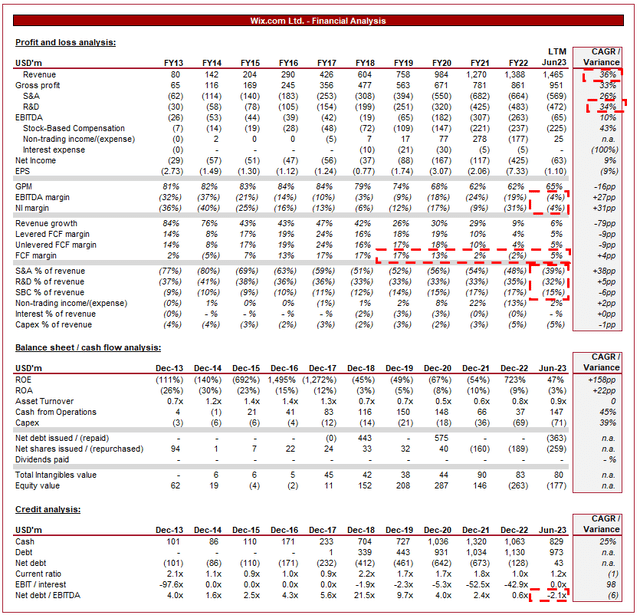

Wix.com financials (Capital IQ)

Presented above is Wix’s financial performance in the last decade.

Revenue & Commercial Factors

Wix’s revenue has grown at an astronomical rate, generating a CAGR of 36% into the LTM. During this period, growth has exceeded 25% in every financial year barring one, illustrating the consistency of its trajectory.

Business Model

Wix operates on a freemium business model. It offers a basic website-building service for free, with limited features, and generates revenue through premium subscriptions, domain sales, and additional features available at various price points. Unlike its peers, Wix has focused on broadening its product offering, seeking to maximize the monetizability of its platform, as well as to develop a one-stop-shop for consumers.

Wix provides a user-friendly, drag-and-drop website builder that allows users to create visually appealing and professional websites without any coding skills. This is a critical requirement for a large portion of the addressable market, many of whom have expertise in other areas and would like to have a website up and running quickly. The intuitive interface and extensive customization options cater to a wide range of users and designs, from individuals to small businesses and even larger enterprises. The broad approach and continued investment in designs and capabilities ensure Wix continues to be a good option for a wide variety of users.

Wix operates on a subscription-based model, offering different pricing plans based on users’ needs and requirements. The tiered pricing structure makes the platform accessible to users of varying budgets and business sizes. From a financial perspective, this allows the business to earn recurring revenue, which it can incrementally rebase with price changes in the future.

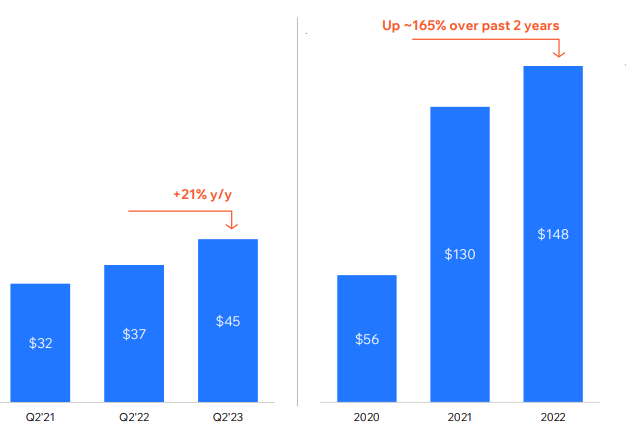

Wix enables users to set up and manage online stores. The platform offers robust e-commerce features, including product catalogs, shopping carts, payment gateways, and order management, catering to businesses seeking to sell products online. The business earns fees based on transactions, allowing it to further monetize the websites created on its platform. Growth in Transaction revenue has been strong, continuing to gain QoQ despite the current economic conditions. We consider this a key driver of long-term success, particularly as we see a continued preference for e-commerce shopping relative to other options. Once expansionary fiscal/monetary policy returns, likely in 2024/25, this segment is well positioned to outperform.

Transaction growth (Wix)

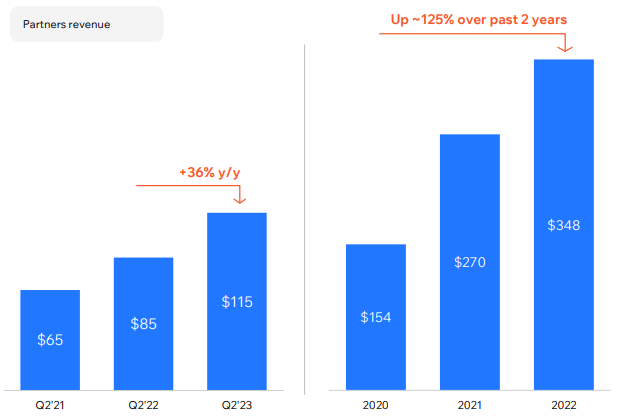

Further, Wix has expanded the capabilities of its platform to allow “Partners” to build sites or applications for other users (as well as, B2B partnerships), generating further income for Wix. Growth in this segment has been impressive, outperforming the wider business as a whole.

Partners (Wix)

These are just two examples of the vertical and horizontal innovation Wix has conducted to increase its earning potential (Also Wix Logo Maker, Wix Search, Wix Payments, etc). We like this approach as the industry is highly competitive, with no material way of developing a moat. For this reason, a business can rely on marketing (like some of its peers), or it can develop a better value proposition, which Wix is seeking to do.

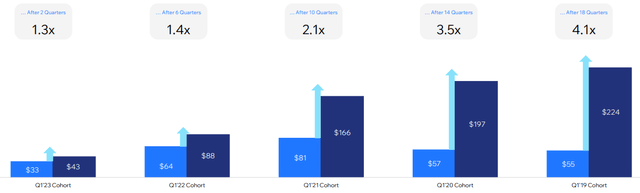

Wix has invested heavily in marketing to raise brand awareness and attract new users (appreciating that its freemium model in itself is marketing). In the LTM period, the company spent 39% of its revenue on S&A, illustrating this substantial financial outlay. This investment is required, however, for the factors discussed above. Given the high level of competition in the industry, the only way to achieve growth while maintaining (and increasing) market share is to outspend peers. The success of this is illustrated below, with returns improving over time with customer retention.

Returns from customers (Wix)

The expectation is for the business to benefit from declining marketing spending relative to revenue as it approaches a mature level, relying more greatly on its freemium model and benefiting from sticky customers.

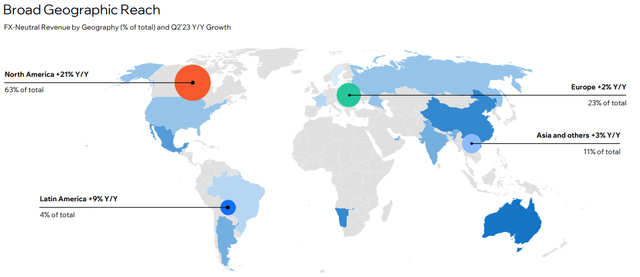

Given the dynamics of the services provided, Wix has expanded its reach globally, catering to users in different countries and languages. Its localization efforts and customer support in multiple languages have allowed it to tap into international markets successfully, outperforming its peers. Our expectation is for growth to remain strong overseas.

Geographical reach (Wix)

Competitive Positioning

The attractiveness of Wix to consumers is based on the following key factors. Our biggest concern with this industry is that most of these factors are replicated by peers.

Wix offers a diverse selection of modern and aesthetically pleasing templates across various industries and niches. Users can choose from a wide range of templates and customize them to match their branding and design preferences. The business is focused on continually updating these to ensure Wix continues to offer attractive and intuitive websites.

All websites created on Wix are automatically optimized for mobile devices, ensuring a modern approach to how individuals interact with websites.

Wix has an “App Market” that allows users to enhance their websites with additional features and functionalities, with new apps regularly added. The marketplace offers various apps for e-commerce, bookings, forms, social media integration, and more, making it a one-stop solution for different website needs. This helps sell the deep capabilities of Wix’s platform, lending well to those looking for more complex functionalities.

Wix continuously introduces new features and updates to its platform, keeping it competitive and relevant in the ever-evolving web development landscape. Most recently, the business touted that it was at the forefront of AI technology, introducing a range of AI products including AI Site Generator and AI Assistant for Business. It remains to be seen how successful this will be but the use case is there.

Wix faces competition from other website-building platforms, including Squarespace (SQSP), Shopify (SHOP), and WordPress. Each business operates a slightly different business model, contributing to a differing strategy and level of success, despite the similarities in service provided.

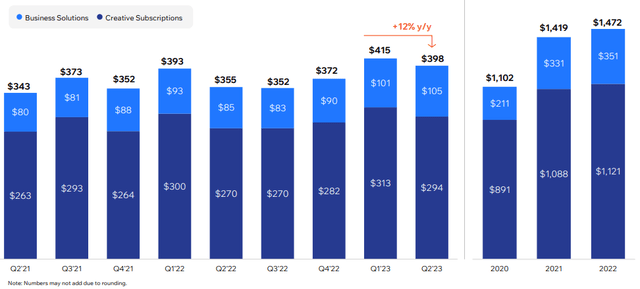

Quarterly

Wix’s quarterly growth has noticeably slowed since the end of FY21, with lump bookings QoQ. The business has seen some improvement in H1-23, but there has certainly been a slowdown in the overall trajectory of the business.

We believe this is due to two key factors. Firstly, there is inevitably going to be an impact from the current economic weakness, even if the company’s target market is not materially impacted. Further, there has been a particular focus on transitioning toward profitability, leading to cost cutting (S&A spending is down relative to revenue in the LTM period, as is R&D).

Total Bookings (Wix)

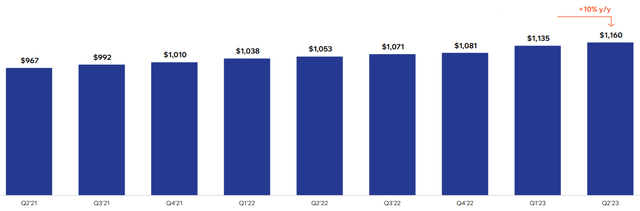

Despite this, ARR growth continues, up 10% YoY. Based on this, we believe growth will likely land between 10-15%, as the Q2 outperforms continues into the following quarters.

ARR (Wix)

Margins

Wix has continuously lost money for most of the decade, although has generated strong cash flows. This is partially due to its high SBC, sitting at 15% of revenue in the LTM.

FCF is slightly depressed in the current year due to an outsized movement in Accounts Payable. Once this normalizes, FCF will likely return to double-digits.

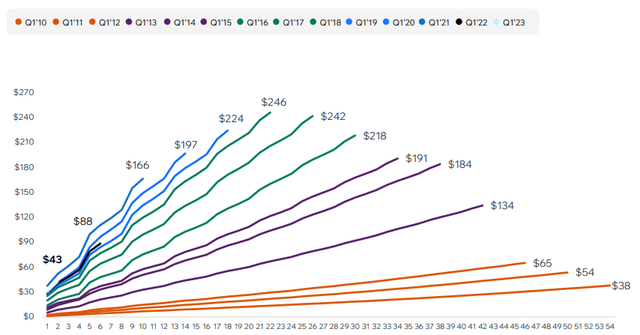

Management looks to be increasingly focused on finally making the transition, with the business sufficiently large to benefit from scale. Although the industry does not benefit from wide moats, Wix is positioned well to benefit from sticky customers (who do not want to lose their websites). This should mean as it softens marketing and R&D investment, and is more aggressive with price increases, its paying users should be inelastic. In conjunction with this, we expect GMV from e-commerce to continually improve, as will revenue from its other related services. The net impact is rapid margin appreciation.

Much of the points discussed in the above paragraph are already happening, as the following graph mapping monetization of customer cohorts illustrates.

Monetization of cohorts by quarter (Wix)

Outlook

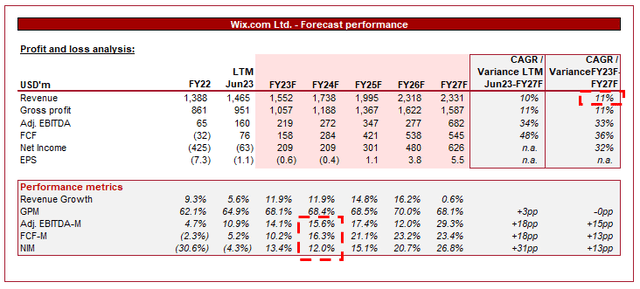

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a rapid expansion in margins alongside a reduction in growth rate. Given the transition we have seen and Management commentary on the topic, this aligns with our expectations.

Valuation

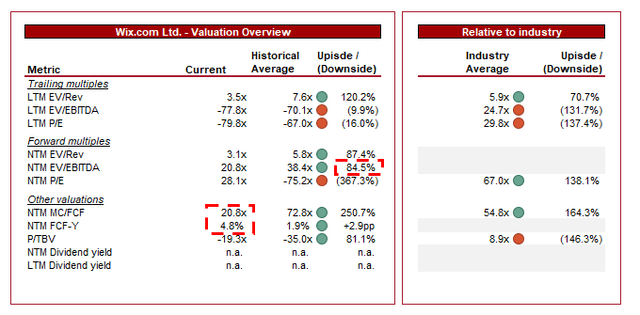

Valuation (Capital IQ)

Wix is currently trading at 21x NTM EBITDA. As a comparable, we have compared Wix’s valuation to a cohort of 19 IT Tech businesses.

Wix has seen a rapid contraction of its margins, in part due to improved profitability, but also a change in investor sentiment as its margin outlook has soured.

Wix’s FCF yield has improved to 4.8% while trading at 21x NTM FCF. This is an attractive level for a tech business, as illustrated by the 132% discount to the peer group chosen. The discount is likely a reflection of the difficulties that remain in the coming years, as Management looks to achieve strong margins without foregoing market share, as well as the inability to create a wide moat.

This said, we see some value here. Squarespace is trading at a similar FCF multiple while being a smaller business and having fewer capabilities. We do believe Wix’s customers will remain sticky and even if EBITDA-M does not reach the 17.5-27.5% level, its cash flows will mean strong distributions are possible.

Final thoughts

Wix is an impressive business. The consistency of its growth rate alone illustrates this. We like the company’s suite of services, the stickiness of customers, its global model, and product development. Our expectation is for margins to improve while growth slows, with this being a net benefit to the business.

Uncertainty (/risks) remain, particularly around where margins will land, whether bookings will continue to remain modest in the coming quarters and whether Transaction and Partner revenue can continue to outperform.

Wix is expensive, particularly following the >20% rally in the YTD period, but with a FCF-Y of 5%, the stock looks attractive.

Read the full article here