Since earlier this year, I have been recommending investors increase their ‘cash’ allocations with treasury bill funds like the US Treasury 3 Month Bill ETF (NASDAQ:TBIL), not only because of the uncertain macro environment, but also because treasury bills are now paying a very respectable 5%+ yield.

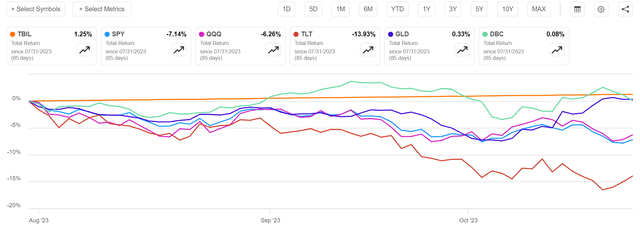

In fact, since July 31st, treasury bills like the TBIL ETF have been the best performing asset, outperforming the stocks, bonds, gold, and commodities (Figure 1). Cash is King!

Figure 1 – TBIL total return performance vs. major asset classes since July 31, 2023 (Seeking Alpha)

U.S. Government Has An Out Of Control Spending Problem

Readers might wonder why I chose July 31st as the date of measurement. Am I cherry picking the dates to flatter treasury bill returns? Actually, there is a good reason for choosing July 31st as the start date.

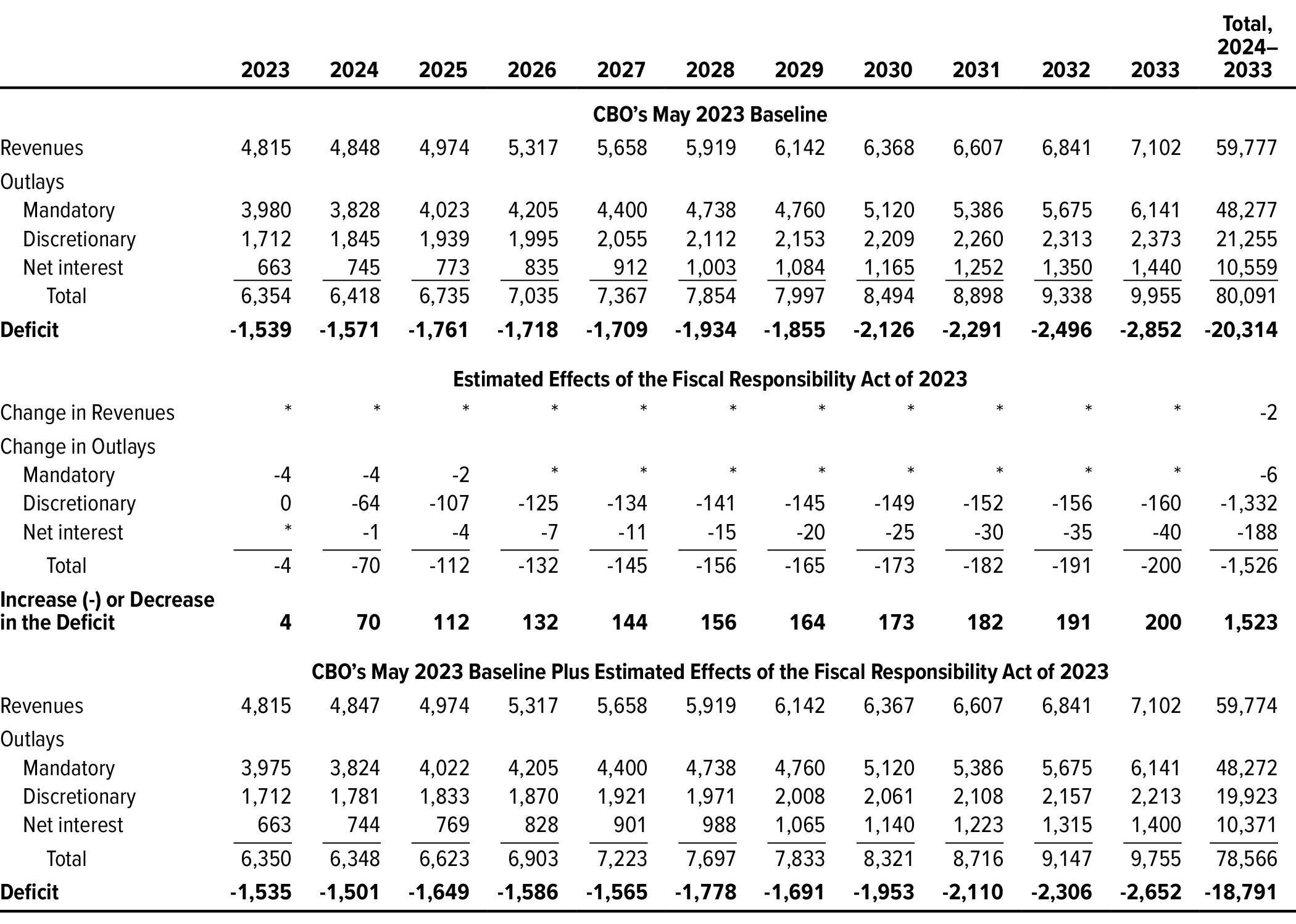

If investors can recall, during the summer, I wrote an article summarizing the credit rating agency Fitch’s downgrade of the sovereign rating of the United States. At the time, I noted that the U.S. government has an ‘out of control’ spending problem with expanding deficits for the foreseeable future (Figure 2). Over the next decade, the U.S. government is expected to add more than $18 trillion to federal debt.

Figure 2 – U.S. government is expected to run ~$2 trillion deficits for the foreseeable future (CBO)

As I alluded to in my article, on an annual basis, the U.S. government will have to issue ~$2 trillion in debt. More importantly, who would be the buyer of that debt, and at what rates?

Treasury Funding Sucks Liquidity Out Of Financial System

While I do not buy into the thesis that the U.S. government will go bankrupt because of these deficits (since the United States is the only issuer of U.S. dollars and the treasury can print an unlimited amount to satisfy U.S. dollar-denominated debts), the mechanical process of the treasury funding the government does have a market impact.

In fact, if we look at the Treasury department’s most recent Quarterly Refunding Announcements (“QRA”), the Treasury department was forecasted to need to borrow over $1 trillion in debt in the July – September quarter. This borrowing figure is $274 billion more than previously estimated due to a lower beginning-of-quarter cash balance, a higher end-of-quarter projected cash balance, as well as projections for lower receipts and higher outlays (i.e. worse deficits).

According to notable Twitter macro analyst Andy Constan, the Treasury’s refunding operation acts as a drain on liquidity in the financial system. In order for the Treasury to raise the required amount of debt, it must pay higher yields. Furthermore, investors buying these newly issued treasuries must sell other assets, causing stocks and commodities to decline.

The market impact since July has been especially pronounced because of the large ($274 billion) surprise, forcing investors to demand dramatically higher yields on long-term treasuries (10 year yields are ~100 bps wider), as well as large sell-offs in stocks (S&P 500 is down 7% since July 31st).

While I am not 100% convinced this liquidity-driven model of the financial system is the only driver behind the recent weakness in asset prices, it does neatly explain the market action and no doubt has partly contributed to price declines.

Looking forward, the Treasury is currently estimating $852 billion in debt issuance for the October to December quarter. However, we also have President Biden recently requesting more than $150 billion in additional spending for domestic (disaster relief and childcare funding) and foreign agendas (to support Ukraine and Israel), so actual treasury issuances could be significantly higher than the $852 billion estimated. The next QRA update is scheduled for October 30th and hopefully, I will be provide an update post announcement.

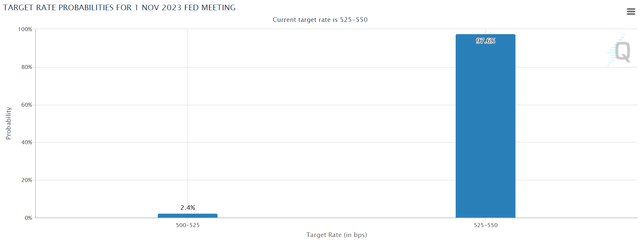

Fed Likely On Hold In November

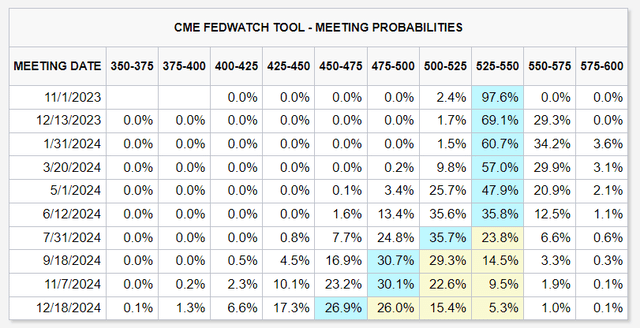

Another factor impacting returns on treasury bills is the Federal Reserve’s monetary policies. On this front, it is looking increasingly likely that the Fed will be on hold at the upcoming FOMC meeting scheduled for November 1st. The market broadly expect the Fed to remain on hold, with a tiny probability assigned to a rate cut (Figure 3).

Figure 3 – Fed expected to remain on hold in November (CME)

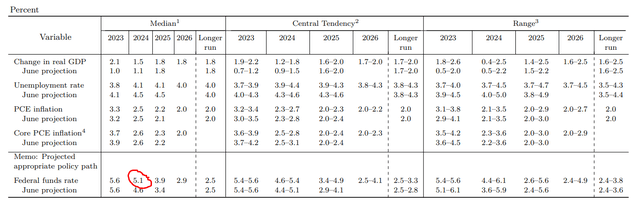

More important for the TBIL holders is the question of how long will the Fed’s restrictive policies last? If we look at the Fed’s September Summary of Economic Projections (“SEP”), FOMC participants forecasted 2024 year-end Fed Funds rate at 5.1% versus the current 5.25-5.5% range. So the Fed does not expect to be cutting interest rates anytime soon (Figure 4).

Figure 4 – FOMC September Summary of Economic Projections (Federal Reserve)

Being eternal optimists, market participants are more dovish than the Fed, expecting the Fed to begin cutting rates in July 2024 and ending 2024 at around 4.5-4.75% (Figure 5). However, even here, market participants appear to have bought into the Fed’s ‘higher for longer’ mantra and do not expect many interest rate cuts in the coming year.

Figure 5 – Market participants expect higher for longer policies (CME)

Therefore, for treasury bill funds like the TBIL ETF, investors should expect current high short-term yields to last for another few quarters.

Risks To TBIL

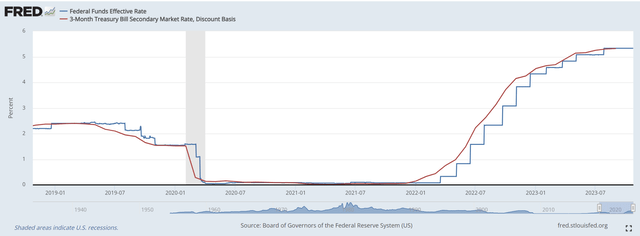

Of course, what we have discussed above is current market forecasts on expected Fed Funds rates. If the economy weakens materially in the next few months or if some exogenous shock like a Middle East war occurs, the Fed may cut short-term interest rates to buffer the economy. If that were to occur, then TBIL’s returns will suffer, as treasury bill yields are closely tied to Fed Funds rates (Figure 6).

Figure 6 – Treasury bill yields closely track Fed Funds rates (St. Louis Fed)

However, investors should note that if the Fed were to cut interest rates, it would be because of an economic shock. ‘Risk-on’ assets like stocks and commodities are unlikely to perform well in that scenario and investors may be able to sell their treasury bills and redeploy into risky assets at a discount.

Conclusion

In summary, with the Treasury sucking liquidity out of the financial system, ‘cash’ has actually been the best performing asset in the past few months. As long as the U.S. government continues to spend money like a drunken sailor, there will be upward pressures on treasury yields to entice investors to buy them and sell other assets. With the Fed likely on hold until mid-2024, treasury bill funds like the TBIL continues to be a good place to hide until the dust settles or we get a big reset in asset prices. I reiterate my buy rating on the TBIL ETF.

Read the full article here