Investment thesis

I have closely monitored the daily trading activity of Molson Coors Beverage Company (NYSE:TAP) since mid Q2 when a quant that I developed uncovered a pronounced diversion between the Seeking Alpha “buy” quant ratings of 4.09 and the Wall Street “hold” quant rating of 3.00. Of the 4,500+ stocks tracked by this metric, I estimate that less than 10% of the time the SA QR is higher than the WS QR. As a result of this anomaly, I did a “deep dive” into the financial and operational metrics of TAP to help me determine whether the stock deserved a buy, sell or hold rating. This article attempts to acquit my thesis that TAP is worthy of a buy” rating.

About the Company

According to the company’s website the history of Molson Coors Beverage Company can be traced back to 1764. TAP, which trades on the NYSE, is a Canadian-American multinational drink and brewing company headquartered in Chicago, IL is presently structured as a holding company. The company’s 2022 global sales of $10.7B rank #1 in the brewing industry.

Stock performance

www.seekingalpha.com

As the above chart shows, TAP closed at $69.32 on 11/8/21, the day before their Q2 earnings release. However since then, the stock price has trended lower and closed at $57.68 on 10/25/23, which is a decrease of 8.3%. Of particular significance is that the 30 day average volume of 970K is far less than the 90 day average volume of 1.7M which suggests to me TAP may be range bound until there is more clarity from management about the 2024 outlook. The company will release Q3 earnings on 11/2/23 which may alleviate to some degree the recent price pressure assuming management provides positive guidance. Despite the recent froth, TAP YTD 16.7% increase is significantly better than the 9.5% increase of the S&P 500 Index.

TAP vs. their peer group

TAP compares very favorably to the five stocks in their peer group. Their Seeking Alpha quant rating of 4.09 is #1, and only Ambev S. A. (ABEV) has a “buy” rating among the group. TAP also fares well in terms of EV/EBITDA, P/OCF and P/S which is discussed in the valuation section of this article.

Q4 items of interest

I took serious note of the rational exuberance of TAP CEO Gavin Hattersley, who stated in a Mad Money interview with Jim Cramer on 10/4/23:

‘We’re moving beyond beer, we’re moving into ‘non-alcoholic’ products, whether those are energy drinks, whether they’re nonalcoholic beers’

I strongly believe that a focus on the younger consumer, who favor a healthier lifestyle, will prove an impactful and shrewd marketing strategy. I foresee that the Q1 2024 sales of the Blue Moon Non-Alcoholic Belgian White will be a hallmark indicator going forward. This niche product may become meaningfully accretive to earnings on or before Q4 2024. TAP has been successful this year in gaining shelf space, and this product will in due time carve out their own presence on store shelves. Based on my review of 20 analysts who cover TAP, I believe that Wall Street does not fully appreciates the game- changing potential of Blue Moon Non-alcoholic Belgian White, which supports my bullish theses for TAP.

Another event worth mentioning as a bullish indicator was the 10/3/23 annual Investor Day and the introduction of “The Acceleration Plan” which the company “expects to generate average annual top-line growth of 4-6% and annual bottom-line growth of 6-8%” gives me confidence that management is laser-focused on an aggressive cost-cutting program. TAP also announced a $500M share repurchase plan for the upcoming months. I would surmise that this will be accretive to earnings on or before Q4 2024.

Risks

On a macro (industry-wide) level, TAP will continue to face high inflationary pressures, and a downturn in the economy would affect sales to an unknown extent. But TAPs strong brand recognition will be an advantage over its lesser-known compactors. On a micro (company-specific) level, TAP clearly needs to address their debt burden. However, given the robust nature of the company’s public statement about the future, I believe that management is confident that they can remediate this issue in due time.

Q2 Form 10-Q

Key takeaways from my review of TAPs three core financial statements filed with the SEC on 8/1/23 are as follows:

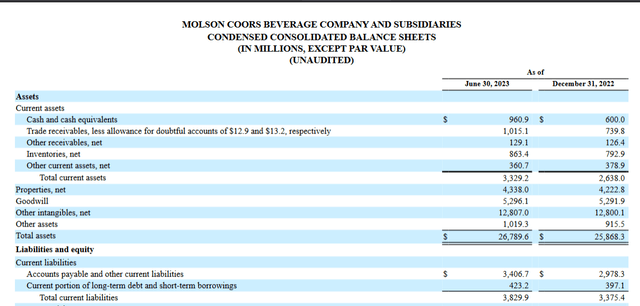

Condensed consolidated balance sheets

www.seekingalpha.com

As shown above, the cash balance of $960.9M as of 6/30/23 compared to the cash balance of $600.0M as of 12/31/22 increased by $360.9M or 60.1%. In my view, this means that TAB may implement their recently-announced buyback program sooner, rather than later.

The company’s current ratio of 0.87 as of 6/30/23 compared to the current ratio of 0.78 as of 12/31/22 increased by 0.09 or 11.5%. TABs working capital balance of ($503M) as of 6/30/23 compared to their working capital balance of ($737M) as of 12/31/22 increased $235K or 31.9%. While these two metrics are below industry averages, I believe that improvement is on the horizon.

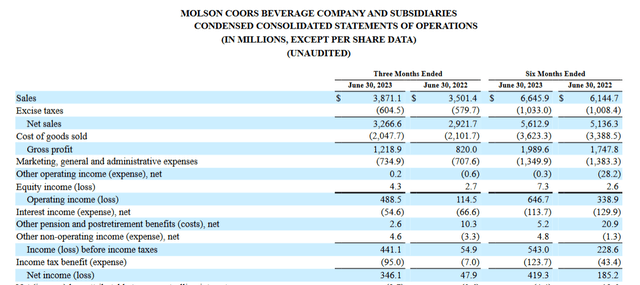

Condensed consolidated statements of comprehensive income (loss)

www.seekingalpha.com

As shown above, TABs net sales for the six months ended 6/30/23 of $5,612.9M compared to the net sales for the six months ended 6/30/22 of $5,136.3M increased by $476.6M or 9.3%. The company’s cost of goods sold for the six months ended 6/30/23 of 64.6% was marginally better than their cost of goods sold for the six months ended 6/30/22 of 66.0%.

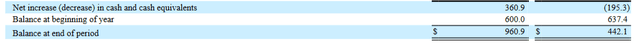

Condensed consolidated statements of cash flows

www.seekingalpha.com

www.seekingalpha.com

The $600.0M increase in the cash balance from 6/30/22 to 6/30/23 was primarily driven by the $234.1M (or 39.0%) increase in net income.

Valuation

As a former CPA with significant audit experience, including public companies, I prefer quantitative analysis as it focuses on objective data. My preferred metric in this regard is the price/sales. My modeling work in this regard included several analytical tools, and assumptions about TAPs prospects going forward based on P&L ratios and other relevant financial metrics. This yielded a 6-8 month price target of $66.33, which represents a premium of ~ 17.5% based on the current stock price of $57.68.

Conclusion

Based on the foregoing financial and operational review, Molson Coors Beverage Company has a reasonable chance of achieving its stated goal of 6-8% bottom-line growth. Their success will be enhanced by their veteran management team and vast array of well-known and well-liked product portfolio. The continued progress of TAPs rebranding and restructuring initiatives will also accelerate their growth trajectory. In my view, the company’s sustainability commitments make it an excellent candidate for ESG EFTs and other socially-responsible funds. For these reasons, I rate TAP as a “buy” and worthy on investment consideration by long-tern value investors..

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here