A few weeks ago, I wrote about Coya Therapeutics (COYA) and their approach to neuroinflammatory disease. Part 2 of my neuroinflammation series will examine a company called INmune Bio (NASDAQ:INMB) which has a different promising approach to neuroinflammation compared with Coya. INmune is a phase 2 stage biotech company focusing on Alzheimer’s but also targeting a variety of other diseases with its lead asset, XPro, as well as some cancers with its endogenous NK cell activator, INKmune. INmune Bio has some striking similarities to Coya. First, it is focused on inflammation and neuroinflammation. Second, it has a cancer therapy that activates endogenous NK cells instead of administering engineered NK cells taken from the patient, like how COYA 301/302 works. So both companies have endogenously activating cell therapies, per se, but INmune’s neuroinflammation drug is a biologic not specifically targeting one certain cell type (i.e. Treg, macrophage, or NK cells, etc). In this article, I will outline INmune’s business, which I believe is very promising and, if successful in the clinic, could yield great upside.

Introduction

As explained in my previous article, inflammation is being increasingly understood as a cause or driver of many chronic diseases, from diabetes to cancer, and including neurodegenerative diseases such as Alzheimer’s, ALS, and Parkinson’s. INmune and Coya both target neuroinflammation as a means to treat neurodegenerative disease. INmune’s immediate focus is on Alzheimer’s as opposed to Coya with ALS (which could potentially see approval based on the potential robust results of their phase 2 trial). Although Coya is focusing on ALS, they recently released data from an open-label proof-of-concept study testing COYA 301 in 8 patients with Alzheimer’s, which showed by all available measures, disease stability or cognition improvement (ADAS-Cog, CDR-SB) along with expanded Treg populations and function in the 8 patients. This trial is followed by a double-blind, placebo-controlled phase 2 funded by the Gates Foundation and Alzheimer’s Association in 32 patients over 30 weeks which has completed enrollment.

INmune is also enrolling in a phase 2 early Alzheimer’s trial. Similar to Coya’s Alzheimer’s results (also a small, open label, non-placebo controlled phase 1 trial), INmune previously released Phase 1 Alzhiemer’s data using XPro, a next-gen TNF inhibitor, a few years ago which showed cognitive improvement and stability over a dose escalation trial. One might think that a simple cytokine-blocking agent has limited utility in a world where cell therapies that modulate many pathways are competing, but this doesn’t appear to be holding XPro back as it has shown great promise in AD with a nuanced mechanism of action and cutting edge biomarkers and imaging to back up those results. XPro’s mechanism of action as it pertains to AD has been detailed in great depth here. I’ll review INmune’s pipeline and some of the XPro/Alzheimer’s results and biomarkers below.

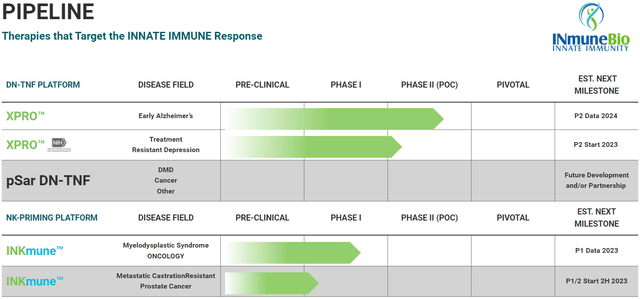

INmune’s Pipeline

INmune Bio’s Pipeline (INmune Bio Website)

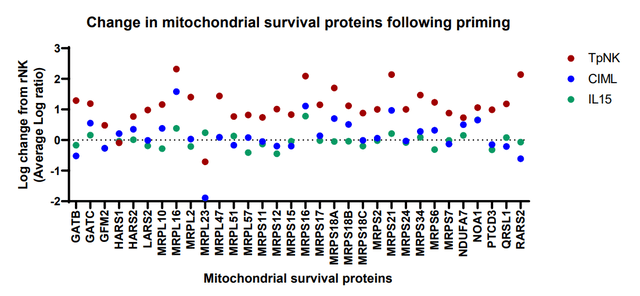

INmune focuses on the innate immune system unlike Coya which mainly focuses on modulating Tregs, part of the adaptive, or antigen-specific immune system. Falling under the umbrella of therapies that modulate the innate immune system is XPro (aka XPro1595) and INKmune. XPro is an inhibitor of soluble TNF which some consider to be the “master” inflammatory cytokine, while INKmune is a treatment made to prime natural killer cells using missing priming signals (as opposed to IL-15).

XPro for Neuroinflammation

INmune has gathered a very robust and diverse dataset to support XPro’s use in Alzheimer’s, including cognition data in its Phase 1 trial, where XPro was able to stabilize disease or improve cognition in all but one patient (who had the lowest dose in the study, although I cannot recall for certain).

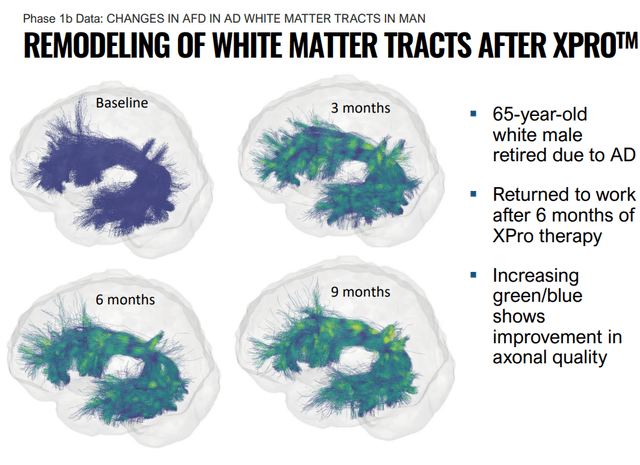

A lot of this is well-explained in a set of videos the company has put on their site, and for more detail, there are 81 cited publications on the site, most or all of which study XPro in a wide range of studies. Frankly, there is no way all of this can be covered in this article, but the overarching ideas and some highlights can be explained. Some of the data generated by INmune has been gathered with cutting-edge industry technology, such as measuring apparent fiber density (AFD) in white matter tracts, a new MRI technique.

Remodeling of White Matter tracts after XPro Treatment (INmune Bio July 2023 Corporate Presentation)

The company elaborated in a press release:

Using a novel MRI metric called Apparent Fiber Density (AFD), patients treated with 1 mg/kg of XProTM (N=6) had increased AFD in 34 out of 35 white matter tracts. The largest improvements (>6%) were within tracts impacted by Alzheimer’s disease, including the Arcuate Fasciculus (AF), where an improvement of 10% was observed by three months, an effect that persisted and increased through the last timepoint measured, nine months (+16%). AFD is a cutting-edge technique that allows for the measurement of myelinated axons that connect neurons together. The company has previously shown that the AF, a region of the brain critical for language processing, a key symptom in AD, was the white matter tract with the greatest reduction in inflammation (-40.3%).

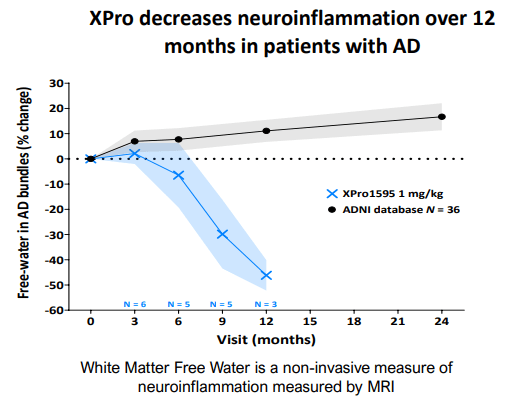

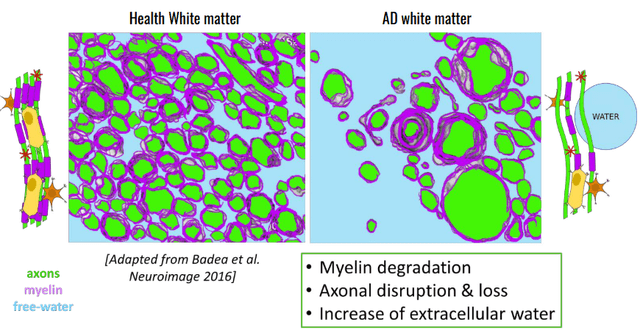

Other data gathered to support XPro’s signs of efficacy include broad reductions in neuroinflammatory cytokines (including NFL) as well as increases in synaptic plasticity proteins. These are promising biomarkers, but the issue with biomarkers like these is that companies can easily cherry-pick them. However, XPro also was found to decrease “white matter free water”, an advanced MRI measurement that measures the amount of water surrounding axons. Free water around the white matter increases as axons degrade. The results are shown in the graph below, along with a graphic to explain the white matter free water measurement on a microscopic scale. These data taken together provide fairly robust evidence for a phase 2 asset that the drug is likely working. INmune is further increasing their chances of success by enrolling patients that have elevated markers of inflammation.

Decrease in Neuroinflammation After 12 Months of Xpro Treatment (INmune Bio July 2023 Corporate Presentation)

White Matter Free Water: Healthy vs AD (INmune Bio July 2023 Corporate Presentation)

Hidden Pipeline-In-A-Drug

XPro has also shown promise in preclinical models of multiple sclerosis (EAE) and the cuprizone model, consistently showing remyelination in various studies. This underscores the potential of the drug to potentially do everything traditional TNF inhibitors can do, without the side effects, and while improving the CNS instead of abusing the CNS. If XPro is approved, why would any doctor who is aware of XPro keep a patient on any traditional TNF inhibitor? The global TNF inhibitor market size is over $40 billion and XPro could be crowned king of this market. This includes: Pfizer’s (PFE) Abrilada, AbbVie’s (ABBV) Humira, Amgen’s (AMGN) Enbrel, Janssen’s (JNJ) Simponi, and Novartis’ (NVS) Hyrimoz.

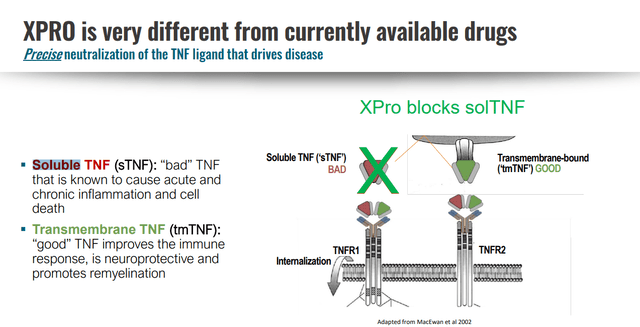

XPro’s Mechanism of Action

XPro accomplishes this by selectively targeting soluble TNF. Basically, soluble TNF increases inflammation through the TNFR1 and ends up outcompeting transmembrane TNF (tmTNF) interactions with TNFRs, which is a beneficial interaction. sTNF is cleaved from tmTNF under inflammatory conditions, and increases CNS inflammation by interacting with TNFR1, whereas tmTNF has affinity for TNFR2, an interaction which is important for remyelination. That, and the roles of TNFR1 and TNFR2 are switched in the CNS and periphery, so the solution is not to block TNFR1 or TNFR2, but to block soluble TNF (sTNF), which again, competes with tmTNF on immune cells.

XPro: Differentiated TNF Inhibitor (INmune Bio July 2023 Corporate Presentation)

Alzheimer’s is on track to be a trillion-dollar problem and currently costs the U.S. $345 billion, and XPro has some of the most promising early data generated in the space. It has been estimated in other analyses that 40% of Alzheimer’s patients have high inflammation markers

INKmune

INKmune is derived from a human tumor cell line owned by INmune (INB16) that is made replication incompetent and contains missing priming signals to provide priming for unactivated endogenous natural killer cells. This inert suspension of tumor cells can help provide these missing signals for patients whose tumors do not express these activating signals. NK cell activation and INKmune’s role in treating NK-avoiding residual cancer is explained in a video here.

According to INmune’s website,

NK cells play a critical role in killing cancer cells that remain after surgery/radiation and/or chemotherapy, so-called “residual disease.” Modern cancer therapy can effectively eliminate most of cancer in a patient. To eliminate all cancer cells, the patient’s immune system needs to do its part and kill the residual disease. For instance, patients with AML often receive an induction chemotherapy regimen called 7+3 (7 days of cytarabine and 3 days of daunorubicin). Of these patients, 40% are cured (“survivors”) while 60% relapse (“relapsers”). The difference between a survivors and relapsers is the patient’s immune system. The NK cells of the survivors kill the residual disease while the NK cells of relapsers do not kill the residual disease. The failure of the immune system to eliminate residual disease is the cause of the cancer relapse.

INmune has provided data showing that INKmune has induced memory like NK cells which lasted over 100 days when treating AML/MDS. In addition, these cells appear more active than IL-15 stimulated NK cells according to their data. The company’s CSO conducted a detailed webinar on how INKmune arms NK cells which is worth the watch.

INKmune NK cells vs. IL-15 NK cells (INmune Bio July 2023 Corporate Presentation)

INKmune should provide some interesting opportunities for business development in oncology especially since Fate Therapeutics (FATE) and Janssen (JNJ) terminated their high-profile NK cell partnership in oncology. Word on the street was that the engineered cells didn’t persist (or expand like T cells) in the body. Endogenous activation might solve that problem, especially given the tumor-killing persistence INmune has observed when treating AML/MDS patients with INKmune. Early-stage trial readouts or additional data dissemination in AML/MDS or mCRPC could provide grounds for moving the programs forward and could serve as a catalyst.

Financials

INmune had about $48 million in cash and cash equivalents as of its Q2 10-Q filing (June 30, 2023). Their TTM burn rate is about $13 million. This might change based on an FDA hold being lifted and U.S. sites opening in their AD trial. However, the trial is already well underway so any change in burn rate shouldn’t be drastic. So the company has about 3.5 years of cash in the bank according to their current burn rate, which is very helpful in this current environment where cash-strapped biotechs are sometimes left with no other options but to raise money via stock offerings at sometimes very low valuations, which can result in significant dilution for current stockholders. At some point, INmune will have to raise money again if they do not execute some significant business development such as a licensing agreement.

Management

Management is heavily aligned with shareholders, with “insiders” owning about 35% of the company. I have a high opinion of David Moss, RJ Tesi, and CJ Barnum (I have not spoken personally to Mark Lowdell or any others). If one dismisses Xencor (XNCR) as a real “insider,” then the rest of management and the board own about 25% of the company. Notably, Edgardo (Ed) Baracchini has 80 deals for a total of $5.3 billion in transactional value under his belt.

Business Development

There are licensing opportunities for INmune to explore, like with XPro in oncology to reduce resistance to immunotherapies, as well as XPro to treat DMD, which there is a notable amount of chatter about among investors. If XPro turns out to be promising enough, a company like Sarepta (SRPT) might be interested in working with INmune, since the company has shown that data“presented to date suggests DN-TNF may improve treatment from boys with DMD by promoting muscle fiber regeneration and eliminating the need for corticosteroids. Corticosteroids, the current standard-of-care, is responsible for many of the metabolic and physical complications suffered by boys with DMD.” Also in cancer, the company is furthering its endogenous NK cell improving therapy, INKmune, a biologic product that stimulates the patient’s own NK cells through a variety of activation markers, some of which may be missing in the context of certain cancers. It’s worth noting that the company has been able to reactivate and revitalize anergic or unactivated NK cells within patients with cancers, inducing memory-like, long-lasting NK cells. According to Inmune, “The company believes that this is the first ever successful generation of mlNK cells in patients.”

This is noteworthy since Fate Therapeutics (FATE), once considered the darling of NK cell therapy oncology companies, peaked at a valuation of over $10 billion in 2021 before falling victim to its inability to expand and dose adequate numbers of activated NK cells, resulting in a terminated partnership with Janssen. This highlights the importance, again, of being able to fix the endogenous NK cells (or Tregs) instead of expanding ex vivo and administering the expanded cells themselves. This under-the-radar platform could be worth a lot, but the oncology space is particularly competitive. It would best be licensed out in the future to a company with a presence in the oncology space?

Valuation

XPro has impressive results and data showing that it can be a platform technology. If the company were valued like other Alzheimer’s companies like Denali (DNLI) or Alector (ALEC), a discrepancy which might be explained by those companies’ somewhat famed founders and management, it might have a valuation closer $500 million, if not in the billions. Even Cassava, which has undergone much controversy, has a valuation near $600 million. While Denali has a larger pipeline than INmune, these companies are fairly good comparables, and for some reason, INmune has a much lower valuation despite generating extremely robust early stage data. When comparing to Cassava and Alector, the company has a bigger pipeline that’s just a few years behind as Cassava and Alector are in phase 3 trials. After all, INmune is also pursuing treatment resistant depression funded by a grant, and has a robust oncology pipeline and potential in rare disease, DMD. One can calculate some really unbelievably big numbers when forecasting Alzheimer’s sales with XPro, but it’s best to remain conservative and simply say that, if the company were to be valued near its peers, it would make sense to have a valuation in the $450 million range, in my opinion. $450 million, or about half the value of INmune’s comps, would translate to $25/share using 18 million shares outstanding, and $19.18/share using a fully diluted share count.

It has been estimated that 40% of Alzheimer’s patients have active neuroinflammation and 18% of the current population has mild to moderate AD. Thus given a modest market penetration in this segment of AD patients (15%), BTIG in 2020 with their initiation note modeled almost $2.5 billion in peak revenues in the U.S. The drug could be useful in patients without active neuroinflammation (or less active) given its neuroprotective and observed white matter regenerating properties, but this serves as a nice base case scenario for Alzheimer’s. Either way, this calculated value isn’t far from BTIG’s initiation note which gave the shares a $23 price target at the time when there were 14 million shares outstanding. I don’t put too much effort into the forecasting on this since XPro is ultimately a pipeline-in-a-drug opportunity with massive off-label use potential, given it accomplishes the same task as other TNF inhibitors without the side effects including immune suppression. The important thing is for INmune to have their first clinical and commercial success, so they can springboard the drug into other indications.

Perhaps removal of the FDA hold will help with the valuation discrepancy. I believe the company is severely undervalued based on the quality of their current data. After all, Biogen’s market cap increased by ~$20 billion upon Aduhelm approval, and Aduhelm has questionable efficacy in only slowing cognitive decline, while causing high rates of brain edema and bleeding.

Risks

INmune is an early-stage, pre-revenue biotech like Coya and many others. Their lead asset is currently under an FDA hold. Being a small biotech comes with risks including but not limited to dilution, funding concerns, clinical and preclinical study failures, regulatory risks, and high market volatility. Biotech is in a bear market and small biotech companies have been closing up shop frequently recently. Investors should weigh all biotech positions appropriately as investments can be almost completely lost. The company is also experiencing an FDA hold due to product manufacturer changes that are expected to be resolved soon. I don’t think INmune is particularly risky as a small biotech investment, but it is a small biotech company and that category is extremely high risk in general.

Conclusion

INmune (along with Coya as mentioned in my prior article) is a very promising biotech company focused on neuroinflammation. Their management team and board have the business experience and scientific expertise investors want to see in small biotech companies, along with strong insider ownership that can provide peace of mind to shareholders that they will be making decisions in shareholders’ best interests. INmune has some of the most impressive early-stage data for XPro in Alzheimer’s as well as an array of other applications, the totality of which suggest potential label expansion potential across disease indications. I believe the potential upside weighed against the risks is very favorable for INmune. It could be a multi-bagger from these levels if the FDA hold is removed and their Alzheimer’s trial reads out positively.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here