Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Hewlett Packard Enterprise (NYSE:HPE) core compute and storage businesses would once again experience growth. I am reiterating my buy rating for HPE as the business continues to grow as expected, demonstrating flawless execution.

Financials / Valuation

HPE’s revenue for 3Q23 was $7 billion, with the Intelligent Edge being the best performer while Compute and storage saw declines. HPC & AI were flattish vs last year. One key takeaway is that quarterly orders improved across all business segments. Positively, operating margins increased to 10.3% and gross margins came in at 35.9%. Earnings per share came in at $0.49, which was just a tad higher than consensus estimates.

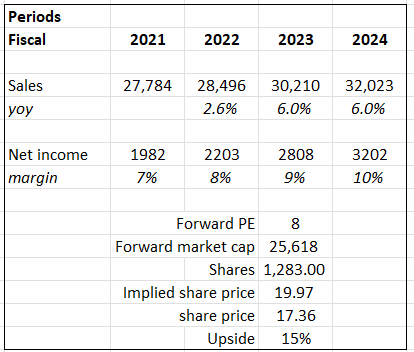

Based on author’s own math

Based on my view of the business, HPE should be able to grow 6% in FY23, which is management guidance, and see a similar growth rate in FY24 given the backlog situation and management confidence that revenue will see growth in FY24. I expect growth to be driven by the higher-margin segments of the business, which should translate to a higher gross margin and ultimately a higher net income margin. I also expect HPE to continue trading at the current level of 8x forward PE (the stock’s historical average), which is a discount to peers like Oracle, IBM, Cisco, etc., which all have better margin profiles, growth outlooks, and scale (revenue size). That said, investing at HPE today does not require any change in multiples to make the returns attractive; simply through organic earnings growth, I expect to see a 15% return.

Comments

In my view, the focus should be that management provided assurance of upcoming revenue growth in FY24 even after experiencing growth in FY23 which is driven by the backlog clearing process (which means FY24 growth is likely to be really strong); and secondly, the ability to maintain strong top-line growth despite a challenging economic environment. The latter point is important as HPE was able to prove to the market that they can produce strong results despite being in a down cycle and making multi-year investments.

But that said, we’re going to talk to this at the Security Analyst Meeting, we expect revenue to continue to improve in fiscal year ’24. We’re going to tell you exactly what that will look like, but I will say that while revenue will improve year-over-year and remember, in Q1, we’re also going to have a big lap because Q1 revenue was $7.8 billion. Source: 3Q23 earnings

These results also pointed out the successful ventures HPE has made in rapidly expanding sectors such as AI and Intelligent Edge. These endeavors are aiding in broadening the company’s sources of revenue and profit. To put this growth in context, Intelligent Edge’s EBIT margins came in at 29.7%, while management had aimed for growth in the mid-teens and margins of mid-20%. As a result of its rapid growth, HPE’s Intelligent Edge division now accounts for 20% of the company’s revenue and 50% of segment EBIT. Additionally, HPE’s investments in AI are expected to contribute positively to the company’s growth. I am particularly enthusiastic about the AI contribution, as it offers improved revenue predictability, facilitating more accurate forecasts for HPE’s growth and margins in the market. The recurring nature would also elevate margins over time. My optimistic growth expectations are a result of HPE finishing FY23 with backlogs that were twice what they were prior to the pandemic, which management cited as proof of the value that AI orders added to the company’s pipeline as a whole. Given the elevated order book extending into FY24, I am confident that despite challenging comps due to backlog digestion tailwinds in FY23, HPE will experience growth in FY24.

On the other hand, I am aware of the pessimistic narrative that the growth of Intelligent Edge revenues appears to continue to be inflated by an expanding backlog, with HPE anticipating continued elevated order book in F2024. In this sense, growth might be muted for certain periods as backlog normalizes. Certainly, this is a valid concern, but it seems to be more of an optical issue rather than a fundamental one where growth structurally slows.

Risk & Conclusion

HPE has demonstrated impeccable execution, aligning with my earlier buy rating. Despite challenges, HPE’s revenue growth and strong margins stand out. Management’s confidence in sustained growth for FY24, supported by robust backlogs, fuels my optimism. Notably, HPE’s strategic investments in AI and Intelligent Edge are diversifying revenue streams successfully. While concerns arise regarding Intelligent Edge growth driven by backlog, it seems more a temporary optical matter than a structural slowdown.

Read the full article here