Edwards Lifesciences (NYSE:EW) announced their Q3 FY23 results on October 25th. They delivered a 10.9% organic revenue growth, as the market expected, and reiterated their full-year guidance. Their recent strong trial data releases reinforced my confidence in their $10 billion revenue opportunity by 2028. I maintain my ‘Strong Buy’ rating with a $83 target price.

Clinical Trials Updates

On October 25th, 2023, Edwards Lifesciences released their five-year data from the Partner 3 Trial, demonstrating excellent survival rates for patients receiving the SAPIEN 3 valve. The five-year data indicates that all-cause mortality was 10%, cardiovascular mortality was 5.5%, and disabling stroke was 2.9% at five years. As Larry Wood, Edwards’ Corporate Vice President, stated: ‘The SAPIEN 3 valve has demonstrated 99% freedom from death and disabling stroke at one year, 90% survival at five years, and is the only valve with a THV-in-THV indication.’

In my opinion, the five-year data of SAPIEN 3 demonstrates the technological advancement of Transcatheter Aortic Valve Replacement (TAVR) with the SAPIEN platform. As I pointed out in my initiation article, the SAPIEN platform is crucial for Edwards Lifesciences’s future growth. It’s worth noting that Transcatheter Aortic Valve Replacement represents 65% of the group’s revenue, and the innovation of SAPIEN maintains Edwards Lifesciences’s dominance in the structural heart area.

During the Q3 FY23 earnings call, their management also expressed their intention to present a six-month analysis of their EVOQUE tricuspid valve, the first-of-its-kind therapy for tricuspid valve disease. Additionally, they are going to release the one-year full cohort results of the CLASP IID pivotal trial with PASCAL. The PASCAL system represents an innovation for degenerative mitral regurgitation.

In summary, I am excited about all these clinical trials and data presentations, which prove Edwards Lifesciences’s continuous innovation in the structural heart space with market-leading technologies.

Q3 FY23 Review and Outlook

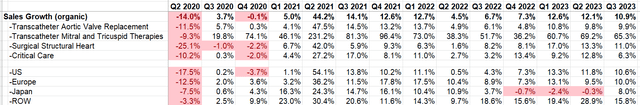

Their Q3 results met market expectations, and they reiterated their full-year guidance. They achieved a 10.9% organic revenue growth and maintained the full-year 2023 financial guidance of 10 to 13% constant currency sales growth.

EW Quarterly Results

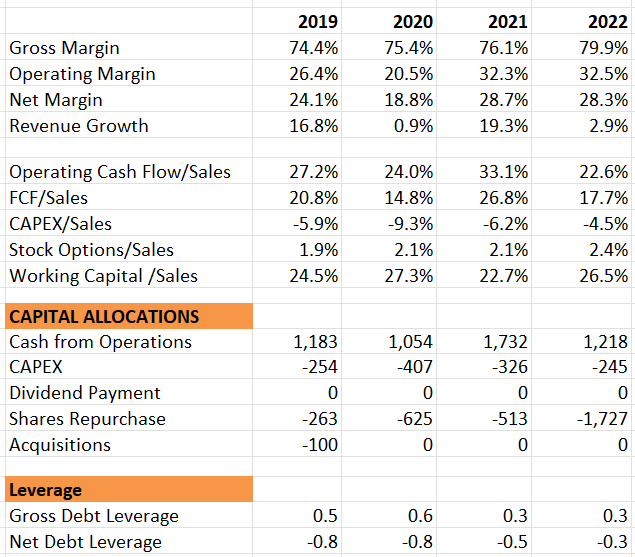

Their adjusted gross margin dropped from 81% in Q3 FY22 to 76.4% in Q3 FY23, primarily due to foreign exchange factors. They have maintained their full-year gross margin guidance at 76-78%. Regarding cash flow, they have reiterated their guidance of $1 billion to $1.4 billion of free cash flow for the full year. Overall, there hasn’t been significant change in the outlook for this quarter. There was no guidance raise this quarter, which, in my opinion, disappointed the market a little bit. However, I believe their remarkable double-digit top-line growth, coupled with a strong pipeline and data releases, is noteworthy.

They maintain a very strong balance sheet, with $1.9 billion in cash and equivalents, and they are in a net cash position.

Their management pointed out that the company grew faster than the overall procedure growth in Q3, and they are confident about achieving $10 billion in revenue by 2028. This indicates a compound annual growth rate of 10.8% from 2022 to 2028. I find the growth projection reasonable for several reasons. Firstly, Edwards Lifesciences delivered an average annual organic revenue growth of 11.2% over the past six years. This solid track record gives me confidence in their future growth. Secondly, while they continue to strengthen their dominant position with the SAPIEN valve, the company is also investing in other areas such as mitral and tricuspid valve disease. These new areas expand their total addressable market and provide multiple growth opportunities for the company. Lastly, as I mentioned in my initiation article, Edwards Lifesciences is still primarily a US-centric company, with nearly 60% of total revenue exposure. International expansion could bring tremendous growth opportunities for the company.

EW 10Ks

Valuation

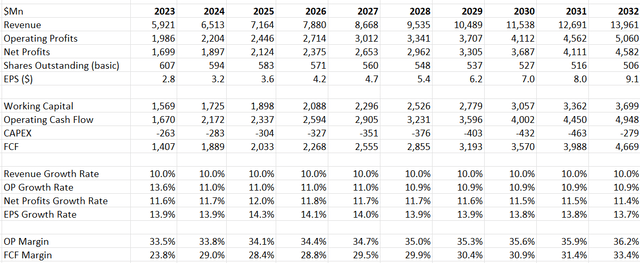

I have updated the DCF model and adjusted the revenue growth rate to 10% for FY23, which seems to be a more reasonable assumption based on their performance in the first three quarters. My free cash flow projection falls within the higher range of their full-year guidance, considering Edwards Lifesciences has historically been conservative with their guidance. The assumptions for the period from FY24 to FY32 remain unchanged.

EW DCF- Author’s Calculations

After updating the financial model, the fair value of their stock price is calculated to be $83 per share. The stock price is undervalued at the current price.

Key Risks

Regarding foreign exchange, the management has alerted about potential headwinds in FY24 due to foreign exchange fluctuations. During discussions with analysts, they indicated that foreign exchange could negatively impact both topline and EPS growth for FY24.

Regarding the investigation in Europe, media reports stated that one of their facilities in Europe was raided by EU antitrust regulators as part of an ‘unannounced inspection’ related to suspected anticompetitive practices. In the Q3 FY23 earnings call, the management clarified that there is no financial impact on the company. I don’t believe this EU antitrust investigation could harm the company significantly, as there are no better alternatives for their products to serve these heart disease patients.

Regarding GLP-1 Drugs, the company has stated that recent anti-obesity GLP-1 drugs do not affect their TAVR business. There is no evidence linking weight loss to aortic stenosis disease. I agree with their management that these cases of aortic stenosis are genetically derived and driven, with minimal connections to weight.

Conclusions

I think the overall Q3 result is quite as expected by the market, and I like their clinical trial updates and double-digit growth rate. I am confident that they can achieve $10 billion revenue target by 2028. I reiterate “Strong Buy” rating for Edwards Lifesciences.

Read the full article here