In my previous report from August, I downgraded Spirit AeroSystems (NYSE:SPR) stock to a hold. Since then, some positive events did occur which made some of my confidence in the company return. In this report, I will be discussing the CEO transition as well as the most recent quarterly results along with a discussion on the rating and price target for Spirit AeroSystems stock.

A Word On The CEO Transition At Spirit AeroSystems

Before discussing the quarterly results, I want to briefly discuss why I think the CEO transition is a positive. Effective the 30th of September, Tom Gentile resigned from Spirit AeroSystems and Patrick Shanahan took over on an interim basis. While I generally am not a big fan of CEOs resigning instead of solving the mess they might have created, I think in the case of Tom Gentile it was simply the case he was no longer the man with the right competencies to solve the challenges at Spirit. My confidence in the CEO faded when he seemed to be open to a take-over from Boeing (BA), which to me was a sign that he no longer saw a convincing path forward for Spirit AeroSystems as a stand-alone company.

Whether Patrick Shanahan will be the right man to help Spirit AeroSystems back on track remains to be seen, but he is generally seen as a problem solver that was once on a short list to become Boeing’s next CEO. As a Boeing veteran, Shanahan knows what Boeing needs and can more closely align the company and with his knowledge from Boeing’s side he also has a stronger position with Boeing that could lead to better deals for Spirit AeroSystems and perhaps it is no coincidence that the company reached a tentative agreement with Boeing on better pricing going forward. Shanahan has a background in engineering, which combined with his previous work experience, can aid Spirit AeroSystems. At Boeing, he was known as a problem solver tasked with getting the Boeing 787 supply chain mess back on track and while the Boeing 787 had issues in recent years, he did a good job in my view and is the kind of man that goes on the factory floors to witness things with his own eyes. So, I believe his background and experience should suffice to get Spirit AeroSystems back on track.

Spirit AeroSystems News: Improvement In Shipset Deliveries

Spirit AeroSystems

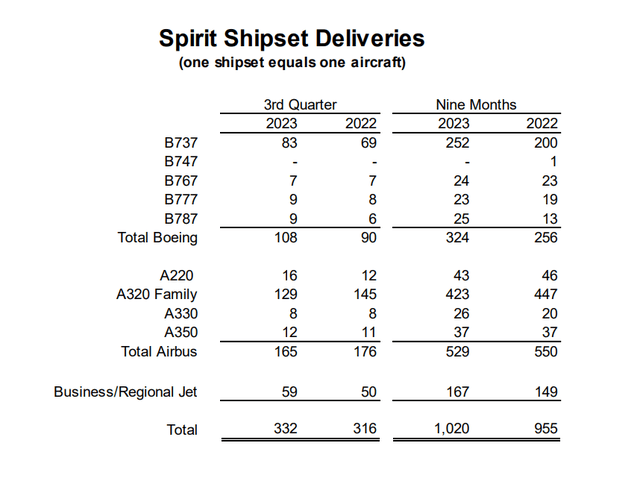

While you might get the impression that Spirit AeroSystems is pushing out no shipsets to Boeing, that is not the case. Shipsets deliveries were 14 units higher compared to a year ago, but it is simply not good enough and triggered a downward revision of the number of Boeing 737 shipset deliveries from 370-390 to 345-360 units and the former range was already significantly lower than the 390-420 figure guided at the start of the year. We see that all other programs except for the Boeing 787, Airbus A220, Airbus A320neo and Airbus A350 are more or less stable with the A320neo seeing year-over-year reductions. So, it is not much of a surprise that Spirit AeroSystems has been looking at a better pricing for the Dreamliner.

Spirit AeroSystems Losses Mount As Expected

Spirit AeroSystems

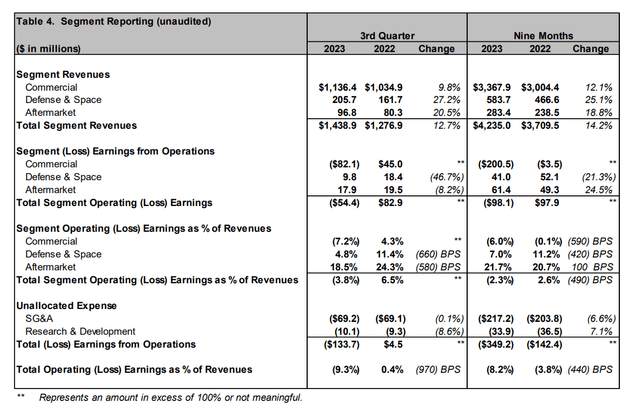

For the Commercial segment, revenues increased 9.8%, which was lower than the 7.5% increase in commercial shipments. During the quarter, Spirit recognized a $86.5 million in forward losses related to the Boeing 787 and Airbus A350 program, net unfavorable $59.1 million catch up adjustments for Boeing 737 and Airbus A320 and $54.3 million in excess capacity costs related to the Boeing 737 program. Compared to $49 million in forward losses, $5 million in unfavorable adjustments and $29.9 million in excess capacity costs in the same quarter last year. I wouldn’t want to adjust for these cost components as they by now are inherent to the business, but it is important to take note of the $116 million rise on these cost and loss components.

Defense & Space revenues grew 27% driven by KC-46A tanker volume and development program volumes. Earnings declined to $9.8 million from $18.4 million. The company booked a $14.6 million forward loss related to the CH-53K while there were unfavorable cost adjustments of $4.9 million on the Boeing P-8 program and $2.1 million in excess capacity costs. Last year these numbers were $1.7 million, $2 million and $1.5 million.

Aftermarket sales grew 20.5 percent to $96.8 million segment operating earnings declined from $19.5 million to $17.9 million driven by mix.

Spirit AeroSystems Continue To Bleed Cash

Spirit AeroSystems

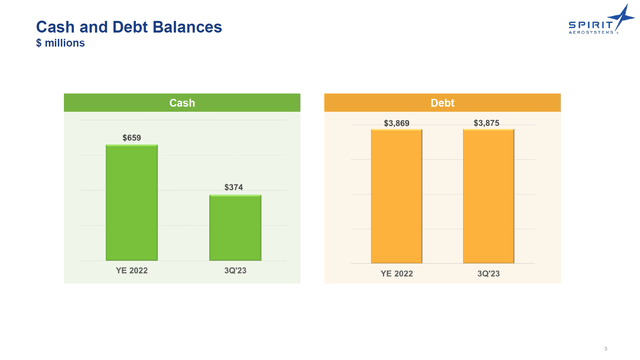

During the quarter the free cash flow usage was $136 million related to disruptions due to a strike in the third quarter, rework on disruption costs on the Boeing 737 and higher working capital related to increases in production rates. The company now expects free cash flow to be in the range of negative $275 million to negative $325 million pointing at a positive fourth quarter of $140 million to $190 million which includes an advance of $100 million from Boeing. So, the cash position is going to recover somewhat by year-end but still down compared to the start of the year. There is $64.2 million of debt maturing in the coming twelve months so I don’t see a huge issue there but what is clear is that the company has to start performing and with a positive cash flow expected for 2024 it looks like it is going to happen. It should, however, also be pointed out that over the last quarters, it always seemed to get better and got worse first before it got better, and perhaps with the new CEO we see a new mindset and proactive stance that will break that downward spiral.

Is Spirit AeroSystems Stock A Buy?

I previously pointed out the following for Spirit AeroSystems:

The investment thesis for Spirit AeroSystems has been rather straightforward: As production rates would go up, the unit profits and total profits on the Boeing 737 program would go up while on other programs the unit losses would reduce as Spirit AeroSystems could amortize fixed costs over a bigger number of shipsets. The business should have been able to get back to 16.5% margins with 7 to 9 percent free cash flow margin. However, inflation and higher input costs have significantly deteriorated the picture and Spirit AeroSystems seems to be unable to negotiate a way out of OEM pressure which leaves the company a long stretch away from its targets and for the foreseeable future we don’t see major success for the company in the commercial airplane industry other than on the Boeing 737 program.

That still holds with the exception of that the company, probably with the help of the new CEO, has been able to arrange more favorable near term pricing.

The Aerospace Forum

I added the expectations for Spirit AeroSystems in my model and based on those numbers there is 9% upside this year and 91% for 2024. If I were to apply the company EV/EBITDA median, I would put a $35.78 price target representing 47% upside and pulling 2025 earnings into the stock price.

Conclusion: Spirit AeroSystems Small Positives, Big Upside

After downgrading the stock in my previous report, I am now upgrading the stock again. That is not so much driven by a strong improvement in outlook for the coming years as EBITDA estimates towards 2025 have only increased low single digits and free cash flow estimates have come down, but it is more driven by the change in leadership and the amended agreement with Boeing for the Boeing 737 and the Boeing 787. Execution risk remains, but I believe that Patrick Shanahan is better equipped to resolve the issues at Spirit AeroSystems.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here