Mortgage rates ticked down this week, snapping a seven-week streak of increases.

The 30-year fixed-rate mortgage fell to an average of 7.76% in the week ending November 2, down from 7.79% the week before, according to data from Freddie Mac released Thursday. A year ago, the 30-year fixed-rate was 6.95%.

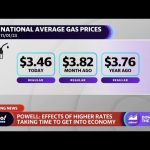

The news comes a day after the Federal Reserve said in a widely anticipated move that it would leave its benchmark lending rate at the highest level in 22 years.

“The 30-year fixed-rate mortgage paused its multi-week climb but continues to hover under 8%,” said Sam Khater, Freddie Mac’s chief economist.

“The Federal Reserve again decided not to raise interest rates but has not ruled out a hike before year-end,” he said. “Coupled with geopolitical uncertainty, this ambiguity around monetary policy will likely have an impact on the overall economic landscape and may continue to stall improvements in the housing market.”

Although the rate for a 30-year fixed-rate loan ticked down slightly, it remained elevated in the leadup to the two-day monetary policy meeting, which concluded Wednesday, said Hannah Jones, economic research analyst at Realtor.com.

“Though the committee chose to take a pause from further contractionary policy in this week’s meeting, Chair [Jerome] Powell made the point that the committee will remain open to further policy action to bring inflation down to 2% over time, dependent on incoming data,” she said.

Although the Fed does not set the interest rates that borrowers pay on mortgages directly, its actions influence them.

Mortgage rates tend to track the yield on 10-year US Treasuries, which move based on a combination of anticipation about the Fed actions, what the Fed actually does and investors’ reactions.

When Treasury yields go up, so do mortgage rates; when they go down, mortgage rates tend to follow.

This story is developing and will be updated.

Read the full article here