2023 has generally been a good year for business development companies, as their debt investments have mostly floating interest rates, whereas the majority of debt borrowings usually have fixed rates.

TriplePoint Venture Group (NYSE:TPVG) is a BDC that focuses on companies which already are backed by venture capital firms, with a specific area of concentration on VC-backed firms in the venture growth stage, which haven’t yet gone public.

The Q1 ’23 collapse of Silicon Valley Bank and some other lenders impacted the VC industry, and subsequently affected TPVG. VC deal activity is way down in 2023, and underlying companies are having a harder time getting additional funding, depending upon their circumstances. Countering that as we move forward is that there’s a great deal of dry powder waiting to be utilized.

Company Profile:

TPVG is an internally managed BDC, headquartered on Sand Hill Road in Silicon Valley, with regional offices in New York City, San Francisco and Boston. Since inception, TPVG has committed over $10B to 900+ companies throughout the world. It generally does 3-4 year financings, with a loan-to-enterprise value of less than 25%. The portfolio companies are typically preparing for an IPO or M&A in the next 1-3 years.

Holdings:

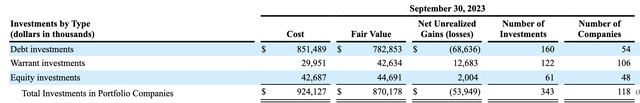

TPVG held debt investments in 54 portfolio companies, warrants in 106 portfolio companies, and equity investments in 48 portfolio companies. As of 9/30/23, the portfolio had a cost value of $924M and a fair value of $870M.

TPVG Q3 ’23 10Q

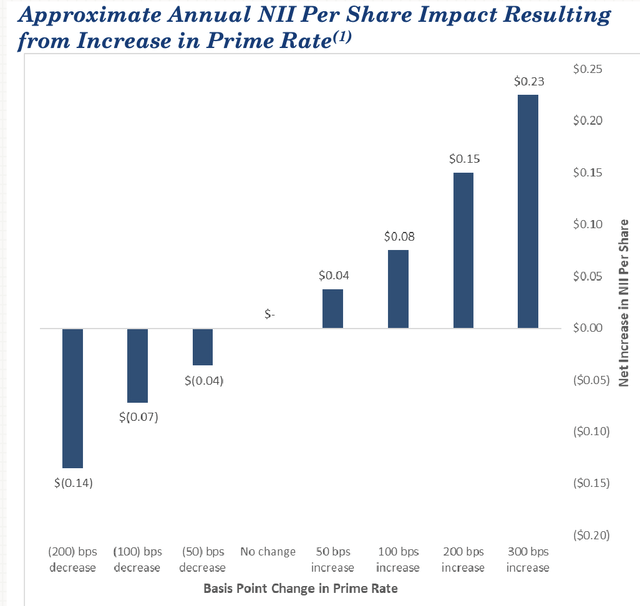

The loan portfolio is 62.1% floating rate and 37.9% fixed rate, not as much in floating rates as some other BDCs, but that mix has certainly increased TPVG’s NII over the past seven quarters. (See Earnings section below for more details.)

Management estimates that annual NII/Share increases $.08 for every 100 basis point increase in the prime rate, while a 100 basis point decrease would result in a $.07 decrease. However, BDCs can mitigate that decrease by increasing loan activity.

tpvg site

TPVG’s warrant and direct equity investments offer future potential upside to its book value. As of 9/30/23, its 122 warrant positions had an unrealized gain of $12.7M on a cost basis of $30M.

The average debt portfolio yield rose to 15.1% in Q3 ’23, vs. 14.7% in Q1-2 ’23, and 13.8% in Q3 ’22.

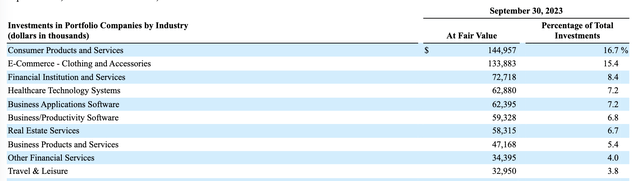

TPVG’s largest industry exposure is Consumer Products & Services, at 16.7%, followed by E-Commerce, at 15.4%, Financial Institutions & Services, at 8.4%, Healthcare Tech and Business Applications Software, both at 7.2%, with Business Productivity Software, Real Estate Services, Business Products & Services, other Financial Services, and Travel & Leisure accounting for 26.7% of its exposure.

TPVG Q3 ’23 10Q

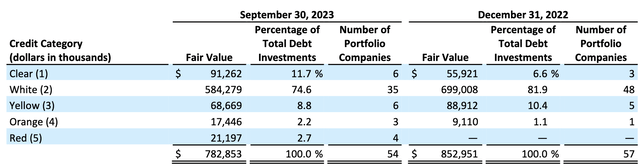

Like other BDCs, TPVG’s management rates the creditworthiness of its held companies each quarter. It has a 5-tier grading system, Clear, or 1, being the highest rating and Red, or 5, being the lowest.

As of Sept. 30, 2023, the weighted average investment ranking of the TPVG’s debt investment portfolio was 2.10, vs. 2.07 at the end of Q4 ’22.

As of 9/30/23, there were seven companies in the bottom two tiers, valued at $38.65M, ~5% of portfolio fair values vs. 1 company valued at $9.1M, 1.1% of fair value, at 12/31/22.

As of 9/30/23, the top two tiers had 41 companies, valued at $675.5M, (86.3% of the debt portfolio), vs. 51 companies, valued at $755M, (88.5%), at 12/31/22.

TPVG Q3 ’23 10Q

Earnings:

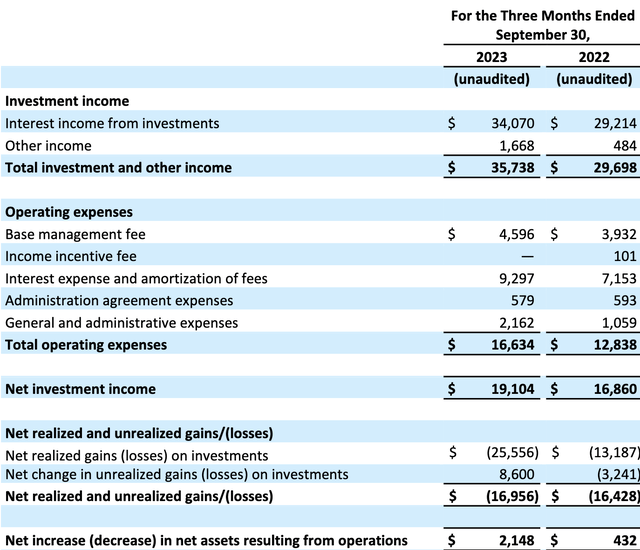

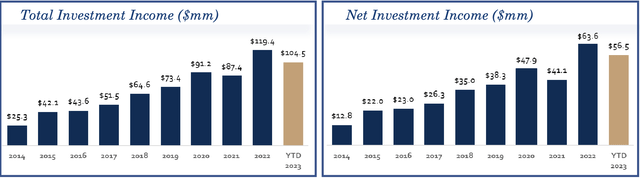

Q3 ’23: Total investment income rose 20%, mainly due to $4.8M more in interest income. On the flip side, interest expense rose only $2.1M during the quarter, reflecting the benefit of higher interest rates on TPVG’s portfolio.

Net investment income, NII, rose 13.3%, to $19.1M.

Net realized losses were $25.56M, primarily from the write-off of Hi.Q, Inc., which was rated Red in TPVG’s rating system, and removed from its portfolio. There was an $8.6M change in unrealized gains.

TPVG Q3 10Q

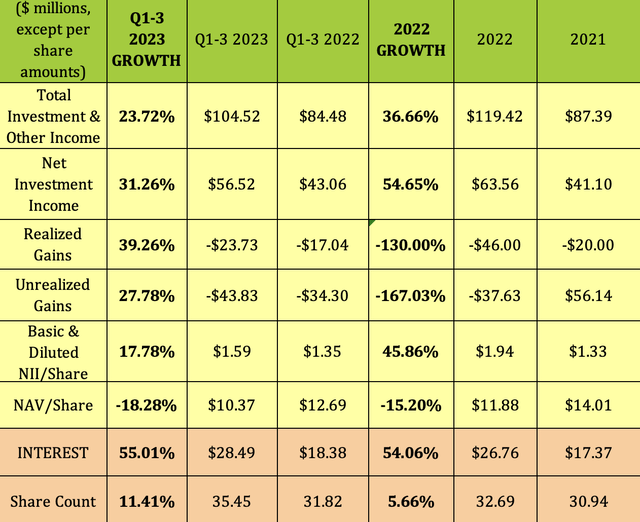

Q1-3 ’23: Total investment income rose by $20M, up 23.7%, while NII rose 31.26%, up ~$13M. NII/share rose 17.8%, with the share count up by 11.4%. TPVG has an ATM stock program, which it used to raise $6.2 million of net proceeds during Q3 ’23.

As noted above, TPVG had $25.56M in realized losses in Q3 ’23, which brought the Q1-3 total to $23.73M, up $6M vs. Q1-3 ’22.

NAV/share dropped 18.3%, to $10.37.

Hidden Dividend Stocks Plus

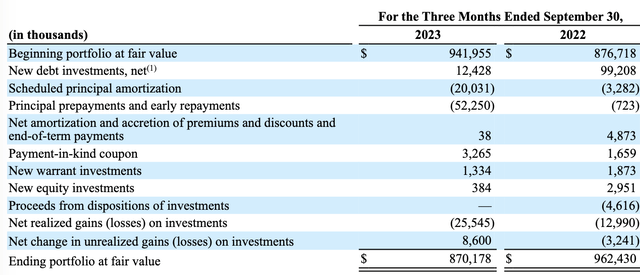

In addition to the $25.545M in realized losses in Q3 ’23, TPVG also had two other items which affected its portfolio value – $20M in scheduled amortization, and $52.2M in prepayments. The ending portfolio value was $870.18M:

TPVG Q3 ’23 10Q

With 23.7% total investment income growth, and 31.26% NII growth so far in 2023, TPVG is on a pace to easily surpass its 2022 full-year figures.

TPVG site

New Business:

TriplePoint Capital LLC signed $58.1M in term sheets with venture growth stage companies in Q3 ’23, vs. $114M in Q2 ’23. TPVG closed $5.6M in new debt commitments to three venture growth stage companies.

TPVG funded $12.7M in debt investments to five portfolio companies with a 14.2% weighted average annualized yield, and received $37.3M in loan principal prepayments. There was a 15.1% weighted average annualized portfolio yield on total debt investments in Q3 ’23.

Management continues to expect fundings in the $25M to $50M range in Q4 ’23, with $10M funded so far this quarter.

Dividends:

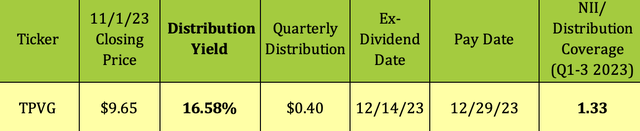

Management declared a fourth quarter distribution of $0.40/share, payable on Dec. 29, 2023, which brings the total declared distributions to $14.65/share since its 2005 IPO.

When asked about The $.40 quarterly dividend on the Q3 ’23 earnings call yesterday, CEO Jim Labe said, “We still see $0.40 as a solid number going forward, given the fully scaled up portfolio and the yields that are being generated and the level of fixed rate leverage we have, we think it bodes well for long-term coverage.”

Hidden Dividend Stocks Plus

Indeed, Nii/dividend coverage has been strong in 2022, at 1.25X, and even stronger in Q1-3 ’23, at 1.33X, in the higher tier of BDC dividend coverage.

Hidden Dividend Stocks Plus

Profitability and Leverage:

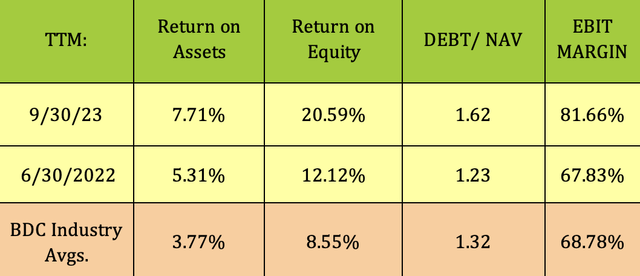

TPVG’s ROE jumped to a company record in Q3 ’23, rising to more than 20.0%. ROA and EBIT margin also improved, and all three metrics are far above industry averages.

Debt/NAV leverage improved a bit in Q3 ’23, declining from 1.67X in Q2, 23 but still above the industry average of 1.32X.

Hidden Dividend Stocks Plus

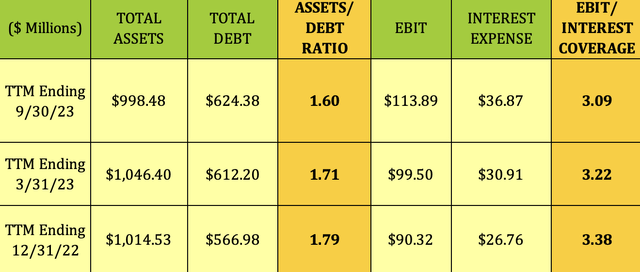

The asset/debt ratio slipped from 1.71X to 1.6X in the past six months, as did the EBIT/interest coverage factor, which declined a bit, from 3.22X to 3.09X.

Hidden Dividend Stocks Plus

Debt and Liquidity:

TPVG had total liquidity of $262.5M and total unfunded commitments of $141.9M, as of 9/30/23.

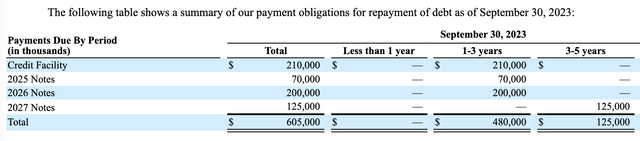

TPVG’s debt is comprised of a Credit Facility, and Senior Notes. 79% of its debt, $480M, including its credit facility, matures in 1-3 years, with the $125M balance coming due in 3-5 years.

TPVG site

TPVG’s debt is rated BBB by Dun & Bradstreet.

Performance:

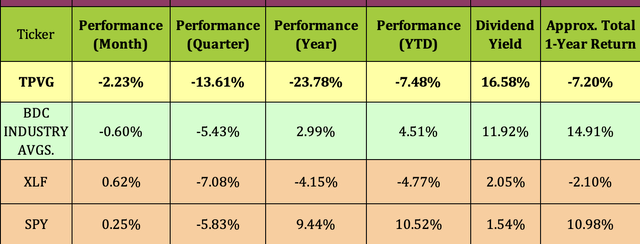

TPVG has had a rough time of it so far in 2023, falling -7.5%, and lagging the BDC industry the broad Financial sector and the S&P 500. It has also trailed over the past month, quarter, and past year.

Hidden Dividend Stocks Plus

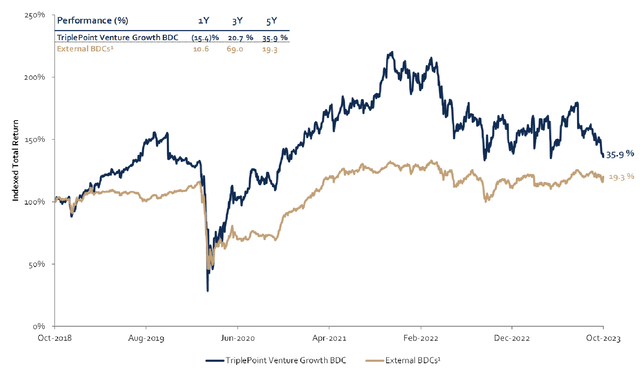

Looking back further in time, TPVG has outperformed externally managed BDC’s by a wide margin over the past five years, gaining 35.9%, vs. 19.3%.

TPVG site

Analyst Price Targets:

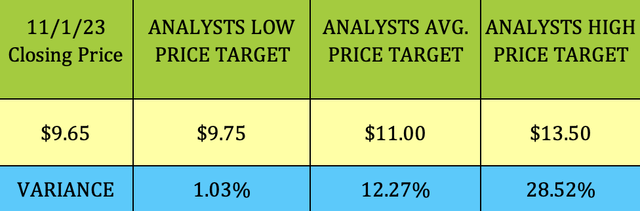

At its 11/1/23 $9.65 closing price, TPVG 12.27% below Wall Street analysts’ average price target of $11.00.

Hidden Dividend Stocks Plus

Valuations:

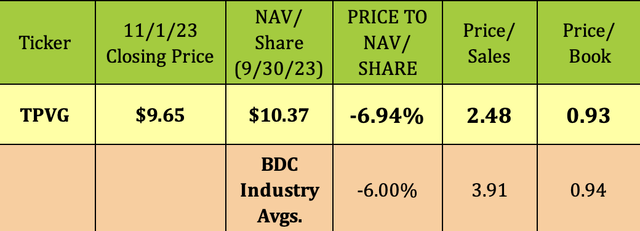

At $9.65, TPVG is selling at a 6.94% discount to its 9/30/23 NAV/share of $10.37, vs. the industry average discount of 6%. It also has a lower P/sales of 2.48X.

Hidden Dividend Stocks Plus

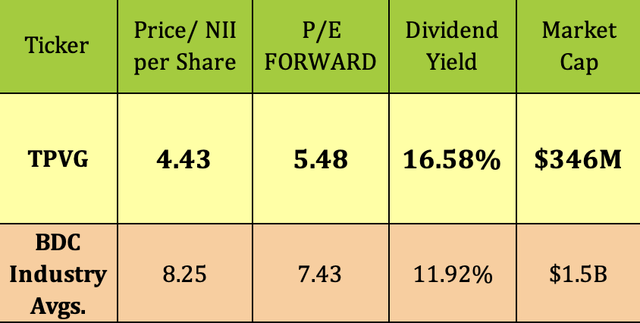

However, TPVG’s earnings multiples are much lower than industry averages – Its trailing price/NII is 4.43X nearly 50% cheaper than the industry average; and its forward P/E is 5.48X, ~25% lower than average:

Hidden Dividend Stocks Plus

Parting Thoughts:

A positive result of tightening credit in the VC world is that now firms are focusing more on cash burn than growth at all costs. This improved discipline should result in stronger underlying companies, and, subsequently, improved outcomes for V’s and BDCs.

BDCs have terms in their loan contracts which can aid them in recovering some of the investment losses when a company’s finances turn lower. These often involve restructuring/refinancing options. So, although TPVG has an increased amount of companies in its lowest four and five tiers, there can still be opportunities to recover those investments.

There’s a short float of 6.95% vs. TPVG, and it’s only ~5.5% above its 52-week low. It looks very oversold on its long term stochastic chart.

While it’s correct that TPVG is having difficulties due to a tough overall environment, one thing to remember is that BDC risk exposure is much smaller than that of the VCs and equity funds which sponsor the underlying companies.

The top two tiers of held companies in TPVG’s rating system was pretty stable, at 86.3% as of 9/30/23, vs. 88.5%), at 12/31/22.

We rate TPVG a buy. This is a seasoned management, which has been through various business cycles, and has consistently produced value for shareholders.

We intend to buy new shares of TPVG, which selling at their lowest price level since the 2020 COVID pullback.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted

Read the full article here