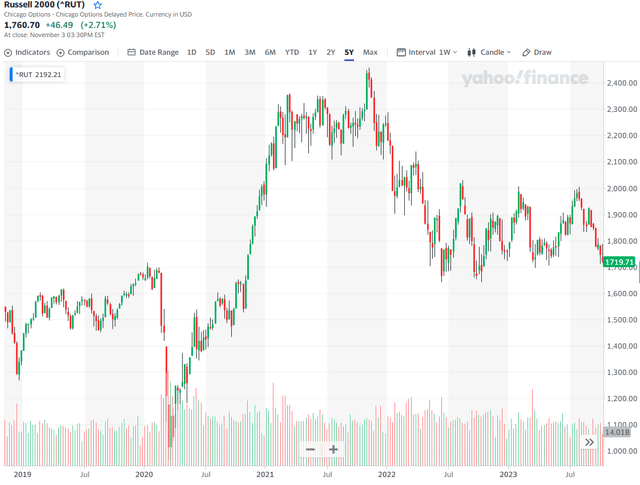

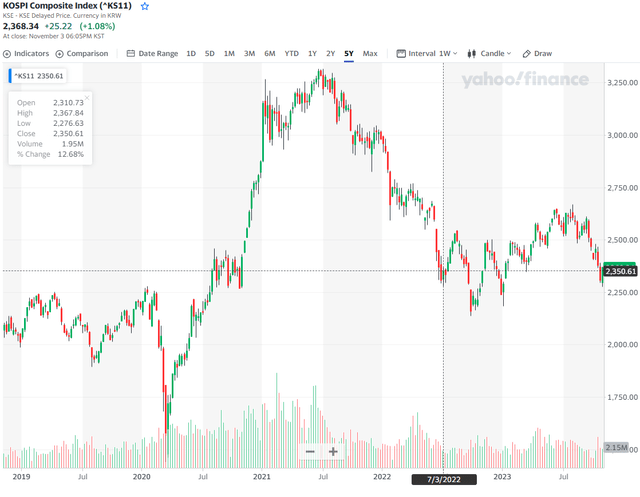

Today I explain why I’ve added a small position in DoubleDown Interactive (NASDAQ:DDI) to my value portfolio. But before I discuss the company itself, let me say that part of the reasoning is macro, as I believe that both small-cap stocks and international stocks have greatly lagged behind the high-flying tech and large-cap stocks that have led the market for several years now. Below are 5-year charts of the Russell 2000 and the Korean Composite Index for some perspective.

finance.yahoo.com

finance.yahoo.com

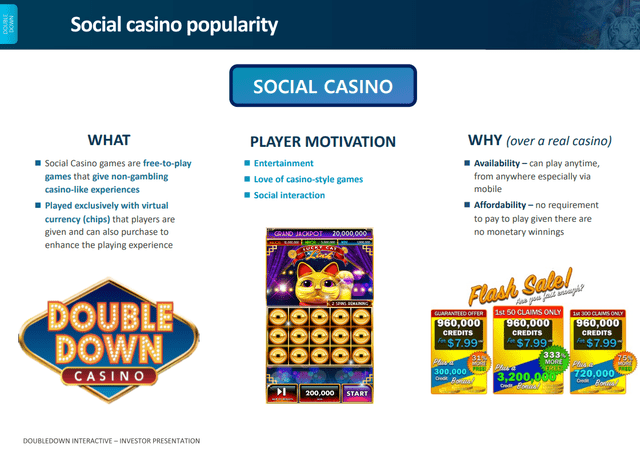

DDI is a South Korean company with a relatively long-historied, but niche business of providing social gambling games for mobile phones and other devices. Their most recent investor presentation has a few slides that help understand this business.

First, we see the virtual nature of this software, which is all offered for free (but with opportunities for DDI to monetize users).

investor presentation

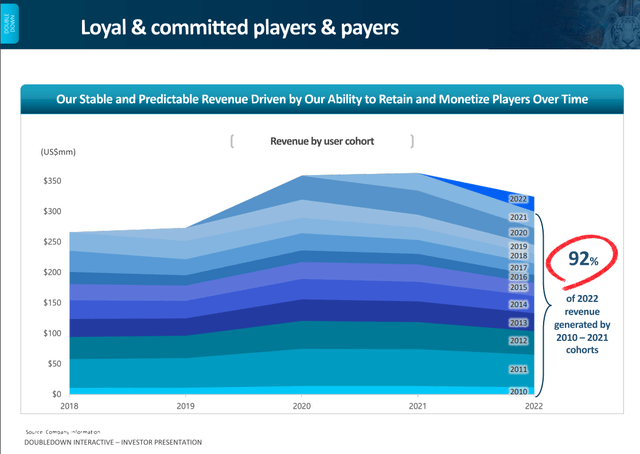

Importantly, DDI tends to have very strong retention, as can be seen from this revenue graph which shows the total revenues based on the year the user was first acquired.

investor presentation

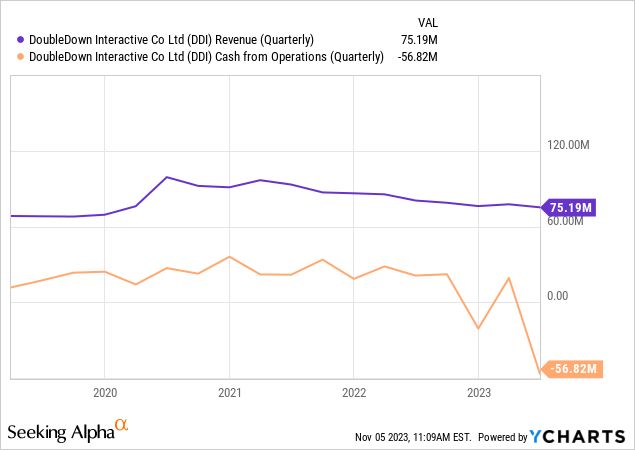

As shown by that chart and the following one, revenues have been relatively steady, but slightly declining over time. The one quarter of large cash losses came from a settled lawsuit that has now been paid off. Here is what the company said in its earnings release with respect to that topic:

Net cash flows used in operating activities for the second quarter of 2023 were $56.8 million, compared to net cash flows provided by operating activities of $21.1 million in the second quarter of 2022. The decrease was primarily due to the final payment of $95.25 million towards the Benson litigation settlement. Excluding such payment, net cash flows provided by operating activities was $38.4 million.

New Acquisition as Catalyst

One of the reasons I’m long the stock is because, due to a recent acquisition, DDI is very likely to embark on a new growth path. This is the catalyst to start realizing some of the value in this heretofore “value trap”. (I discuss valuation further below.)

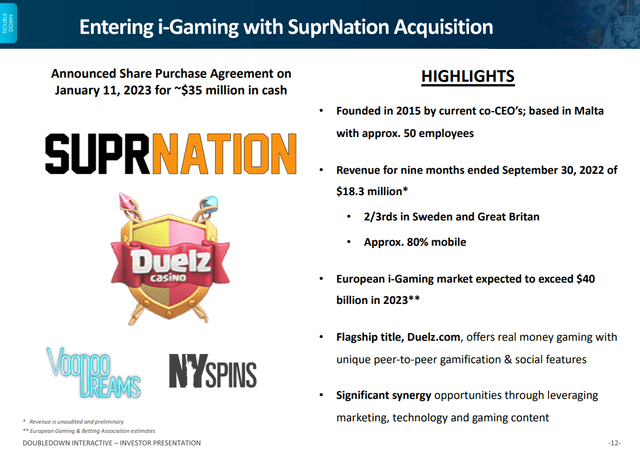

In particular, DDI recently closed on the acquisition of a real-money i-gaming company, SuprNation, which operates mainly in Sweden and the UK. Here is how the company described the logic behind the acquisition:

“The acquisition of SuprNation is an important step in establishing our presence in new high-growth gaming categories that are complementary to our core social casino operations where we can leverage our game developers’ expertise in game creation and our marketing platform to scale the business profitably,” said In Keuk Kim. “SuprNation has a strong and loyal player base in several European markets such as Sweden and the U.K., and we expect to add more regulated jurisdictions over time. We are confident in our ability to leverage our broad portfolio of casino game content and development expertise to further expand SuprNation’s differentiated online casino gaming experiences, such as their flagship title, Duelz.com, to drive growth in the business.

“In addition, to anticipated revenue growth opportunities which will benefit from both DoubleDown’s and SuprNation’s significant player engagement and monetization expertise, we expect to realize synergies in our player acquisition activities as well as other costs such as marketing, back office in-sourcing and potential native Apple/Android app development. We are delighted to welcome the SuprNation team members to DoubleDown and look forward to working collaboratively on our initiatives to drive growth across the business.”

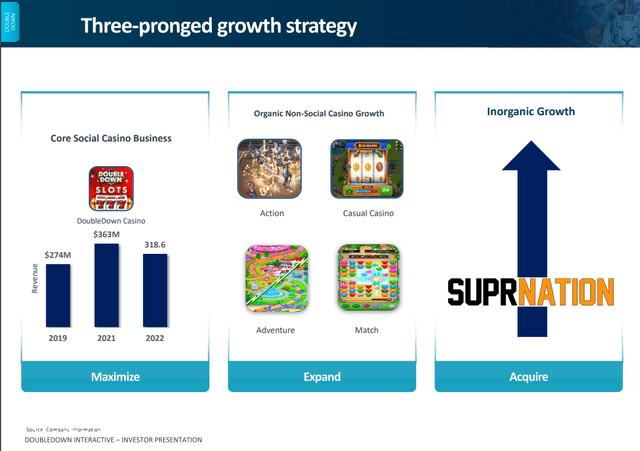

The company’s growth plan is now based on this (inorganic) acquisition and several organic expansion initiatives:

investor presentation

The purchase of SuprNation, which occurred at about 1.43X sales ($35M / (4/3*$18.3M)), should allow the company to meaningfully leverage its current skill set to expand in the real-money i-gaming world. Here’s a little more info on the SuprNation transaction:

investor presentation

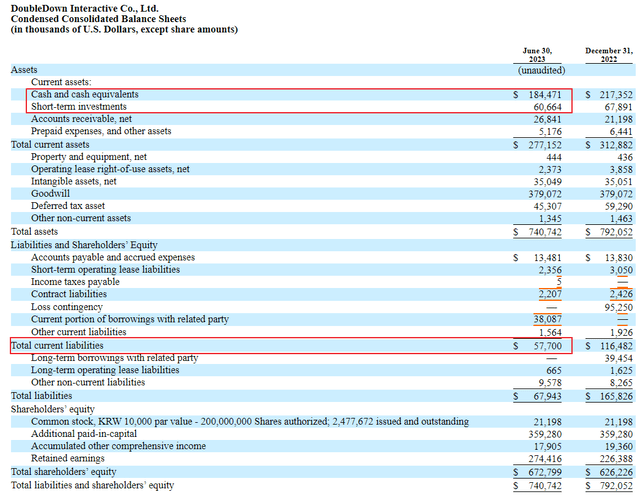

Cash on Hand

DDI has approximately 50M shares outstanding, cash of $184M (with short-term investments roughly equal to current liabilities). Thus it has about $3.68 of cash per share versus its share price of $8.19. In my view, this large cash position significantly de-risks the stock and allows investors the confidence that the company will have sufficient funds available to pursue its strategy and growth plans.

sec.gov

Valuation

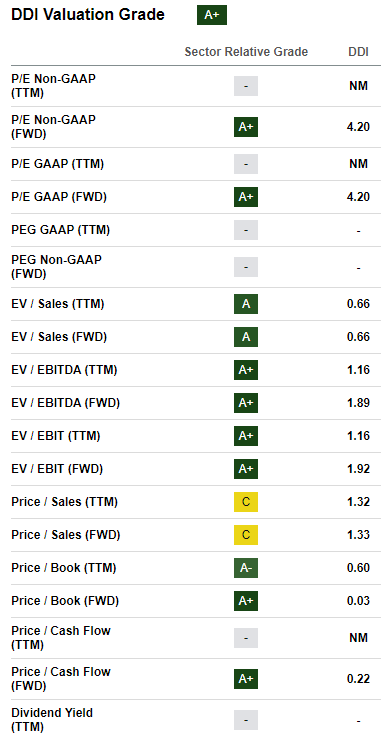

Similarly, DDI valuation metrics are exemplary. Here’s a snapshot from Seeking Alpha’s very helpful valuation tab. Note in particular the EV/sales, EV/EBIT and P/B ratios:

Seeking Alpha

These metrics are self-explanatory as to why I consider DDI a premier valuation play.

Quant Ratings

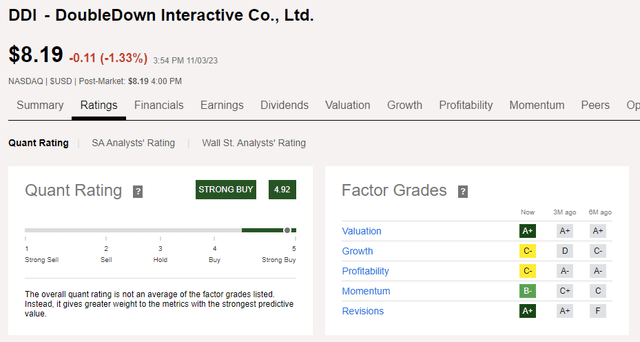

I also always check Seeking Alpha’s quant ratings when evaluating a stock, and again, they are stellar for DDI.

Seeking Alpha

Options

One strike against DDI is that it doesn’t currently have options listed.

Risks

I think the cash on hand and valuation metrics greatly de-risk DDI, but there is certainly a risk of DDI continuing to act as a value trap. If the recent acquisition doesn’t return the company to a growth path, then there is risk that the stock just keeps trending down. (I will be watching the growth trajectory closely for the next 18 to 24 months, and may exit my position if there are no uptrends.)

There are also new regulatory risks associated with entering the real-money i-gaming field. In particular, DDI is based in South Korea, but its acquisition operates in Europe, so the company leadership may not be very familiar with, or prepared for, European regulations.

Summary

I believe that DDI has substantial underlying value and a potentially meaningful growth path which warrants it being included in my valuation portfolio. All positions in the portfolio are small (less than 2% of the account) which allows me to be patient with these types of companies. I will probably give the company 18-24 months to execute, at which point I will revisit and re-assess my position.

Read the full article here