Investment Thesis

ESAB Corporation (NYSE:ESAB) is experiencing good demand for its equipment and automation product solutions driven by its good execution including leveraging new product offerings through investments in marketing, advertising, and sales training. In addition, the company’s revenue growth is poised to benefit from good end market demand fueled by secular trends like near-shoring, reshoring and sustainability, and tailwinds from IIJA funding. Further, the company’s strong position in emerging markets should also drive revenue growth in the long term.

On the margin front, benefits from product-line simplification, increased efficiencies from footprint rationalization and manufacturing consolidation, and improved mix from a shift towards higher margin equipment sales should contribute to margin expansion in the coming quarters. The company’s valuation looks attractive when compared to its peers Illinois Tool Works (ITW) and Lincoln Electric Holdings (LECO). This, coupled with good revenue growth prospects and margin expansion potential makes ESAB stock a buy.

Revenue Analysis and Outlook

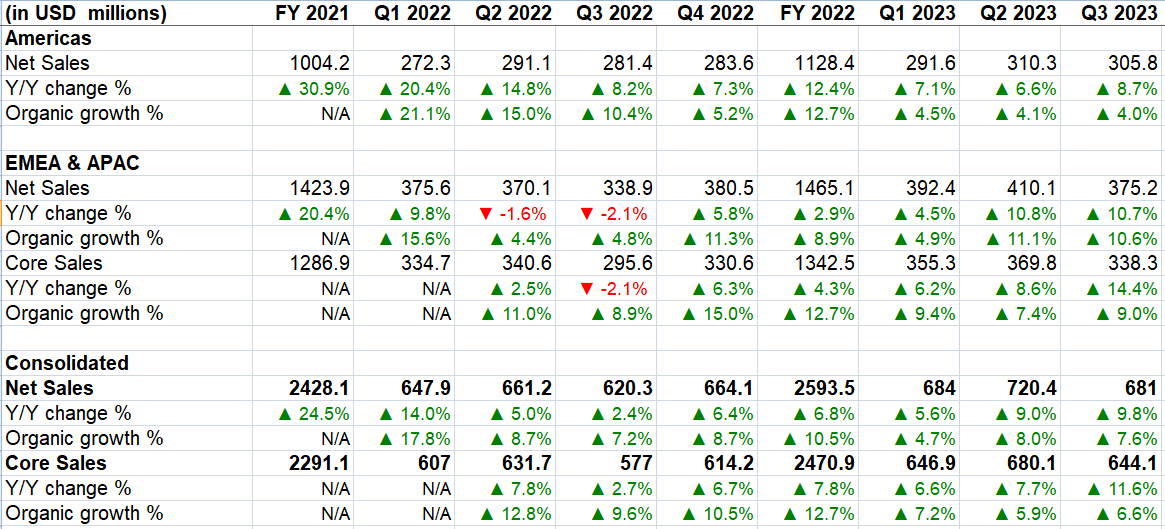

ESAB has seen a good revenue growth in the last couple of years driven by post covid-recovery, strong end market demand, good execution and M&As. In the third quarter of 2023, ESAB reported net sales of $681 million, up 9.8% Y/Y or 7.6% Y/Y organically, driven by volume increase of 4.8%, customer price increases of 2.7% and a 3.4% contribution from the Ohio Medical, Swift-Cut Limited and Therapy Equipment acquisitions. These positive factors were partially offset by a 1.3% negative impact of FX translation. Core sales ( Net Sales excluding Russia) increased 11.6% Y/Y to $644.1 million in the quarter.

The Americas segment’s net sales grew 8.7% Y/Y ( 4% Y/Y organically) attributed to strong pricing of 7% and contribution from Ohio Medical acquisition of 5.2% which effectively offset the adverse impact from FX transition of 0.5% and a 3% decrease in sales volumes, primarily as a result of a product line simplification initiative. Excluding the product line simplification initiative, volumes grew in low single digits.

In the EMEA & APAC segment, net sales increased 10.7% Y/Y (10.6% Y/Y organically) driven by increased sales volume of 11% attributed to resilient demand in Europe and robust demand in Middle East, India and Asia. Further, Swift-Cut Limited and Therapy Equipment acquisitions contributed 2% to the overall sales increase. However, the Y/Y sales increase was somewhat offset by a 1.9% negative impact from FX translation. Excluding Russia, net sales saw a 14.4% Y/Y growth.

ESAB’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the company’s revenue outlook remains solid. The company is executing really well and is getting a good response for its innovative equipment and automation solutions. Over the last few years, the company has worked on revitalizing its equipment portfolio and improving distribution and the results are now showing in its sales numbers with the company performing better than its peers. The company’s 7.6% Y/Y organic growth last quarter dwarfed ITW welding segment’s 2.4% Y/Y organic revenue decline and Lincoln Electric’s 0.4% Y/Y organic growth. With continued focus on product vitality and investments in marketing, advertising and sales training to leverage its new product offering, the company is well set to outperform its end market growth.

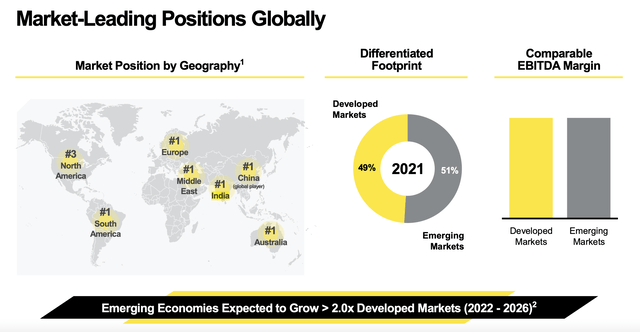

The company’s end markets are also poised to benefit with trend towards reshoring and nearshoring benefiting U.S., Mexico and South American business. Further, the company also has a good exposure to the infrastructure end market (~13% of revenues) which is poised to benefit from IIJA funding. In addition, markets like renewables are seeing secular growth tailwinds with trends like sustainability. The company also has a leading position in several developing markets like India and China where there is a good long term growth opportunities.

ESAB Leading Positing in Various Geographies (Company’s Investor Presentation)

So, if we think about end market growth prospects and add to that good execution by the company which should drive outperformance, the organic growth outlook is good.

In addition, the company has net leverage of less than 2.2x and I expect bolt-on acquisitions to add to the company’s growth.

Margin Analysis and Outlook

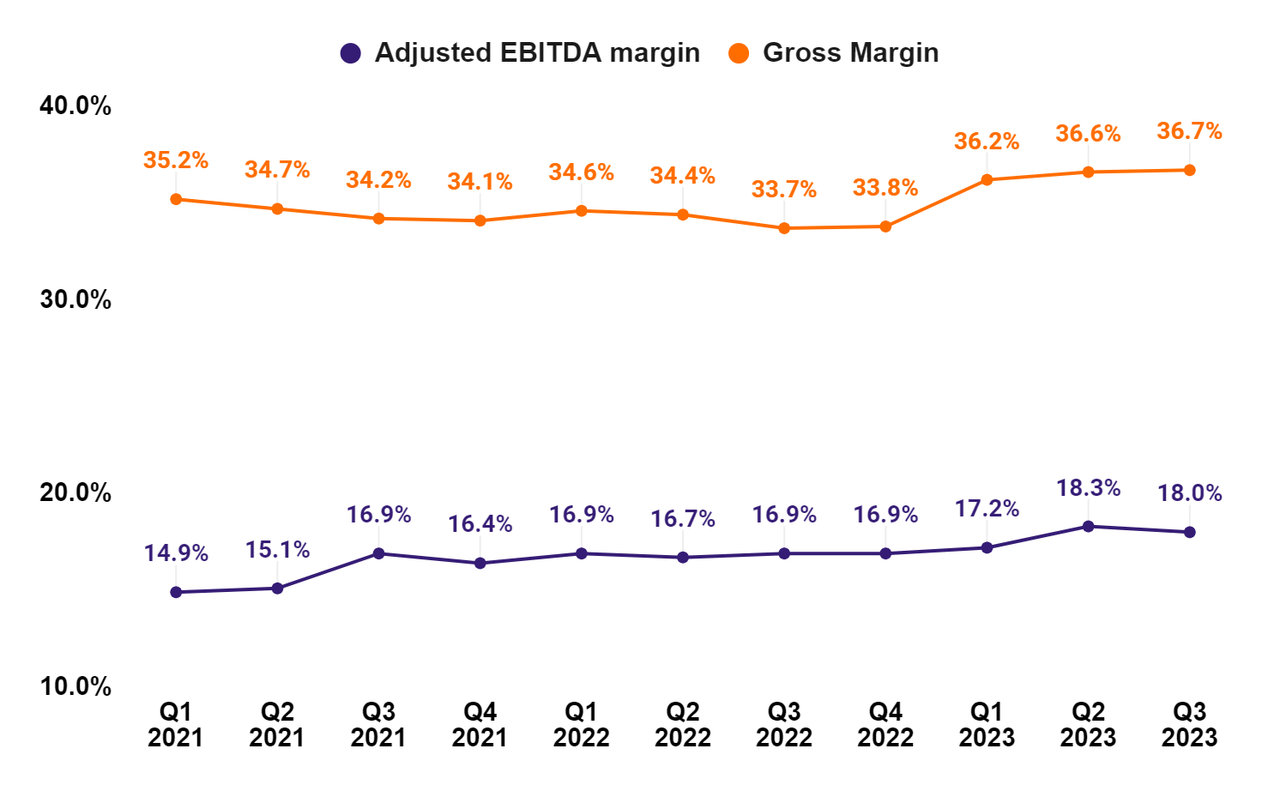

In Q3 2023, the company saw a 300 bps Y/Y expansion in gross margin to 36.7% driven by higher sales volume, accretive acquisitions and strong pricing which more than offset the impact from inflationary costs and unfavorable FX translation. The strong gross margin performance effectively offset the higher SG&A expenses and resulted in a 110 bps Y/Y improvement in adjusted EBITDA margin to 18%. Core adjusted EBITDA margin expanded 170 bps Y/Y to 18.3%.

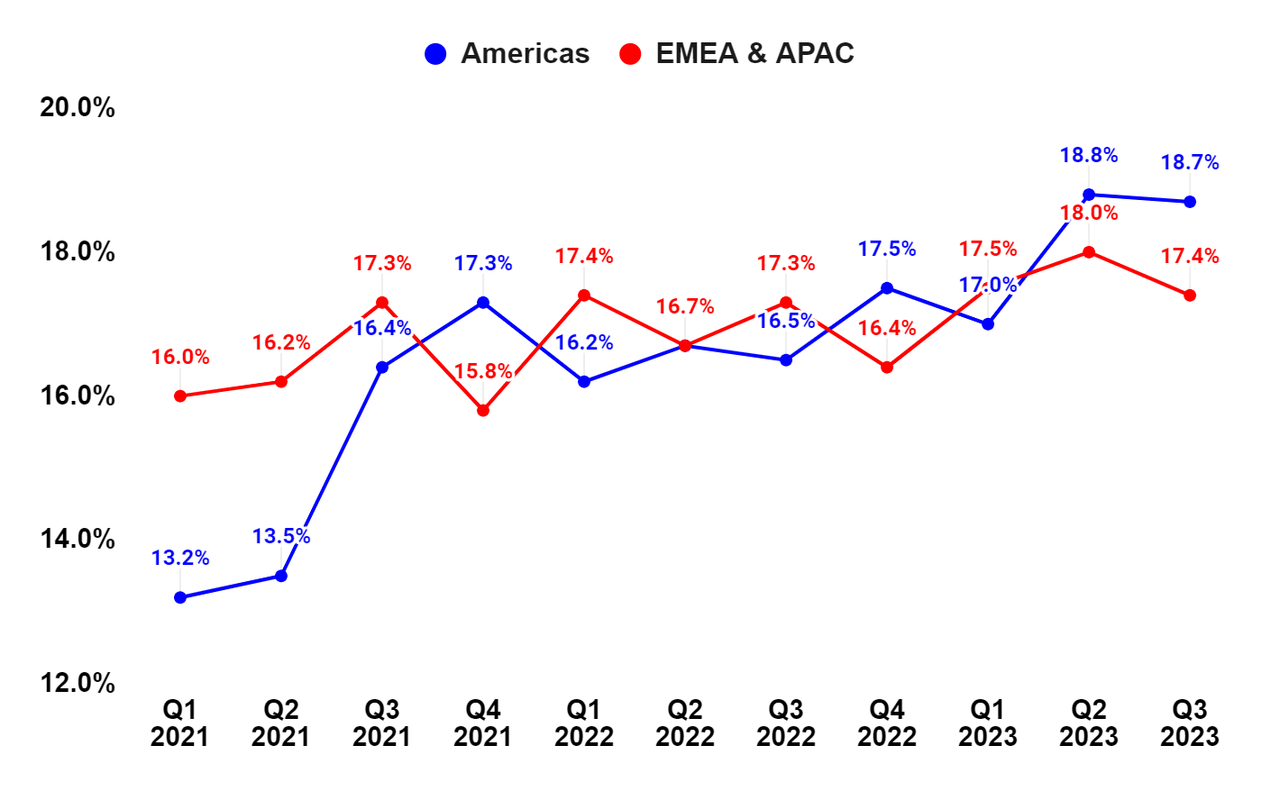

On a segment basis, the Americas segment’s adjusted EBITDA margin increased 220 bps Y/Y attributed to price increases, benefits from r EBX initiative, including product line simplification, productivity improvements, and the accretive impact of the Ohio Medical acquisition. The EMEA & APAC segmet’s adjusted EBITDA margin increased 10 bps Y/Y while excluding Russia, core adjusted EBITDA margin expanded by 130 bps Y/Y due to higher sales volumes, accretive acquisitions, and benefits from restructuring initiatives.

ESAB’s Gross margin and Adjusted EBITDA margin (Company Data, GS Analytics Research)

ESAB’s Segment Wise Adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking forward, the company’s margin outlook looks good. The company is taking steps like product line simplification by eliminating low volume SKUs and aligning customers with similar SKUs to enhance customer value and reduce complexity. ESAB is also focusing on footprint rationalization and manufacturing consolidation to improve efficiency. The company did a couple of large projects in its European operations in this regard and management sees a good funnel of opportunity.

The company’s margin should also benefit from a mix shift towards equipment sales. In the welding business, equipment carries a higher margin than consumables and the company is focusing on increasing equipment sales. It has made good progress in this regard but equipment as a percentage of total sales is still ~31% and there is a good potential to increase it further.

The company has a long term target of ~20% EBITDA margins and I see a potential of continued margin improvement.

Valuation and Conclusion

ESAB is trading at 16.74x FY24 consensus EPS estimates and 15.46x FY25 consensus EPS estimates. Despite posting better organic growth than its peers, the company’s valuation is relatively low with Illinois Tool Works trading at 23.50x FY24 consensus EPS estimates and Lincoln Electric Holdings trading at 20.40x FY24 consensus EPS estimates.

The company has both the good near and long term growth prospects supported by good execution, solid end market demand fueled by trends like reshoring, sustainability and government infrastructure funding, long-term growth opportunities in emerging markets, and accretive M&As. The margin outlook is also favorable with benefits from simplifying product lines, increased efficiency from footprint rationalization and manufacturing consolidation and a mix shift to higher margin equipment sales. Further, the valuation looks attractive when compared to its peers. This, coupled with good revenue growth prospects and margin expansion potential makes ESAB stock a buy.

Read the full article here