We previously covered C3.ai (NYSE:NYSE:AI) in September 2023, discussing its mixed prospects at a time of generative AI boom, with the management electing to pivot to a lower margin consumption-based pricing model to grab market share and consumer base.

Combined with its sustained cash burn and deteriorating balance sheet, we had preferred to rate the stock as a Hold then.

In this article, we will be highlighting C3.ai’s improved near-term prospects, attributed to the reduced sales friction with lower average contract value (lower price points) and shorter sales cycle.

Combined with the growing ratio of subscription revenue and higher projected conversion rate, it appears that the management’s new business model is working as intended.

Despite so, we maintain our Hold rating, since we believe that there is a minimal margin of safety at these inflated levels, with the stock overly buoyed by the generative AI hype.

The Generative AI Investment Thesis Remains Overly Inflated Here

For now, C3.ai has reported a bottom line beat in the FQ2’24 earnings call, with revenues of $73.23M (+1.2% QoQ/ +17.3% YoY) and adj EPS of -$0.13 (+44.4% QoQ/ +18.1% YoY).

On the one hand, the transition to a consumption-based pricing model has directly impacted its path towards profitability, attributed to its declining adj gross margins of 69% (inline QoQ/ -8 points YoY).

The same has been observed in C3.ai’s revised FY2024 guidance, with revenues of $307.5M (+15.2% YoY) and adj loss from operations of -$125M at the midpoint (-83.6% YoY), as its losses accelerate from the previous offered guidance of -$62.5M at the midpoint (+8.1% YoY).

On the other hand, the SaaS company reports growing subscription revenues of $66.4M (+8.1% QoQ/ +11.5% YoY) and 404 in customer engagements (+81% YoY), further underscoring its successful customer wins thus far thanks to the reduced sales friction.

The growing ratio of subscription revenues at 91% (+6 points QoQ/ -4.3 YoY) is highly encouraging as well, attributed to the improved predictability of its sales and expanded consumer base, likely to further contribute to its long-term top/ bottom line fly wheel.

However, with great demand, also comes great competition.

It remains to be seen how competitive C3.ai’s offerings will be against well funded Big Tech companies whom are offering similar generative-AI based analytic SaaS, such as Microsoft (MSFT) through OpenAI, Nvidia (NVDA), Palantir (PLTR), and Alphabet (GOOG).

Perhaps this explains the new business model’s lower average contract value of $0.8M (-20% QoQ/ -94.7% YoY) in the latest quarter. This is on top of the shorter sales cycle of approximately 24 hours, with the application expected to go live within four to eight weeks.

Based on C3.ai’s completed contracts thus far, the management has also confidently guided a rather aggressive “pilot to production conversion rate of about 70%,” implying its growing opportunity to monetize its AI offerings at a much faster rate.

This is on top of the deepened partnership with Amazon’s (AMZN) AWS, with the new C3 Generative AI application allowing “users of all technical levels to begin using generative AI within minutes of signing up,” available with a 14-day free trial.

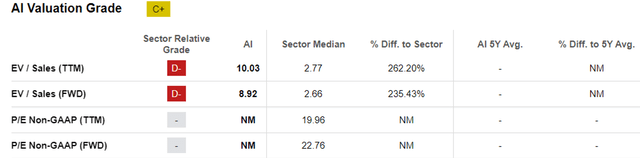

C3.ai Valuations

Seeking Alpha

Perhaps this is why Mr. Market has awarded the C3.ai stock with the premium FWD EV/ Sales of 8.92x, still relatively higher than its 1Y mean of 7.16x and the sector median of 2.71x.

The same premium has also been observed in its SaaS provider peers, such as CrowdStrike (CRWD) at 18.05x, MSFT at 11.24x, NVDA at 19.42x, and PLTR at 16.60x, implying their relatively stretched valuations at a time of Generative AI hype.

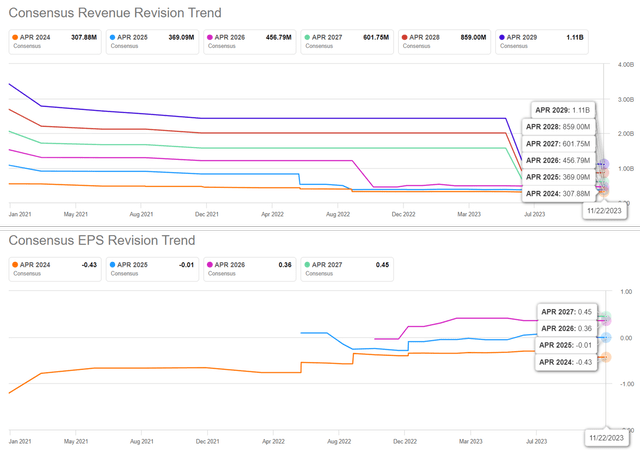

The Consensus Forward Estimates

Seeking Alpha

Then again, herein lies the dillemma.

C3.ai’s top-line prospects have been notably downgraded to a CAGR of +19.6% through FY2026, with a prolonged adj EPS/ FCF profitability. This is compared to the previous estimates of +22.1% and FY2025 adj EPS/ FCF profitability, respectively.

Given their efforts to restructure its global sales organization mostly composed of technical domain experts, it is apparent that the management has elected to grab market share and consumer base first, before focusing on its bottom line.

For now, the downgraded top line estimates and prolonged profitability imply that the C3.ai stock may have pulled forward most of its upside potential, with the premium valuations offering a minimal margin of safety at current levels.

This also means that the SaaS company’s reliance on stock-based compensation may remain elevated over the next few years, further accelerating its share dilution from the 118.65M reported in the latest quarter (+2.97M QoQ/ +9.77M YoY).

Despite the supposedly large generative AI TAM of up to $1.3T by 2032, it also remains to be seen how much of it may fall on C3.ai’s lap, with its FQ4’23 revenue guidance of $76M at the midpoint (+3.7% QoQ/ +13.9% YoY) appearing to be underwhelming.

This is compared to PLTR’s accelerating QoQ/ YoY growth, with FQ3’23 revenues of $558.16M (+4.6% QoQ/ +16.8% YoY) and FQ4’23 guidance of $601M (+7.6% QoQ/ +18.1% YoY).

Only time may tell.

So, Is C3.ai Stock A Buy, Sell, or Hold?

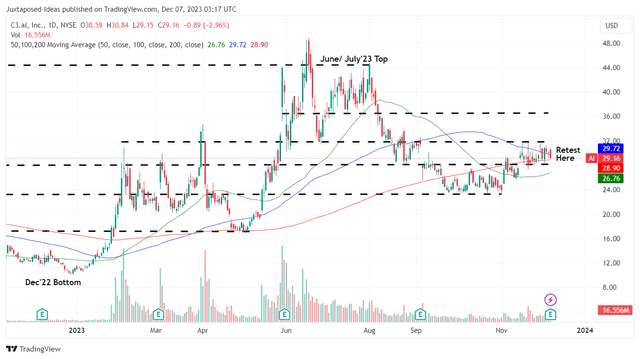

C3.ai 1Y Stock Price

Trading View

For now, C3.ai has already rallied over optimistically by +21.6% from the November 2023 bottom, with the stock appearing to be well supported at $28s while meeting immense resistance at the $30s.

However, we are not convinced about its long-term upside potential, with the stock trading way above its book value per share of $7.91 and the minimal reversal in its adj EPS profitability of $0.36/ FCF of $39.22M by FY2026.

While C3.ai has reported accelerating pilot/ adoption, we believe that the ongoing consumption-based pricing model may pose near-to-intermediate-term headwinds to its balance sheet, with a net cash position of $762.3M (+1.5% QoQ/ -9.2% YoY), with it remaining to be seen if the previous cash burn may continue.

Combined with the potential volatility associated with its immense short interest of 34.35% at the time of writing, we prefer to continue rating the C3.ai stock as a Hold (Neutral) here.

Read the full article here