The FAA published its roadmap of how it intends to develop the Advance Air Mobility (AAM), commonly known as air taxis, industry and integrate it into the existing National Air Space of the US Since the publication, Boeing (NYSE:BA) has made significant strategic moves that suggest it is trying to establish a monopoly position in this sector. Not by manufacturing all of the aircraft but by controlling the operating systems and network the industry will depend on. It could return Boeing to being the world’s most profitable aircraft company.

The FAA document Innovate 2028 (or I28 as it is now commonly referred to) presents a five-step plan for developing one or more integrated AAM sites in the US by 2028. These first sites will be the test bed for a rollout of the system across the US and the rest of the world.

In an earlier article, Boeing: The UBER of the 2030s, I presented my view that the limiting factor on the growth of the air-taxi market and eVTOLs, in general, will be the availability of pilots and controlling the safety of the airspace above cities, the FAA concurs.

The end goal for the FAA, Stage 5 of the plan (page 33), is described as a “Mature AAM system, high density scheduled, unscheduled and on-demand operations, geographically dispersed and served autonomously.”

I believe Boeing intends to be the only supplier of the technology (hardware and software) that can make stage 5 happen, and its recent strategic moves have made success in this goal extremely likely, even an inevitability.

The FAA timeline of 2025 and 2028

The I28 document follows an implementation timeframe from 2025 to 2028 (p 11). It moves through five stages, assuming that initial flights will be between existing helipads and airports using pilots and direct line-of-sight protocols.

Innovate28 (I28) is an FAA initiative that will culminate in integrated AAM operations with OEMs and/or operators flying between multiple origins and destinations at one or more locations in the US by 2028.

(P5) I28 document.

The I28 goes through 5 stages of operation (p33).

Stage 1: Exploratory minimal density flights by certified aircraft.

Stage 2: Low-density Scheduled flights around airports and in urban areas.

Stage 3: Medium-density scheduled and unscheduled flights, using increased numbers of vertiports and limited designated airspace. Remotely piloted with a safety pilot on board.

Stage 4: Medium-density scheduled and unscheduled flights use cooperative airspace widely. Fully remotely piloted operations supported.

Stage 5: Mature AAM system, high density scheduled, unscheduled, and on-demand operations, geographically dispersed and served autonomously.

2025 will be the start of the commercial operations for this industry, and by 2028, the FAA expects it to be fully operational at stage four or five at one or two sites.

AI: Datasets, resistance is futile

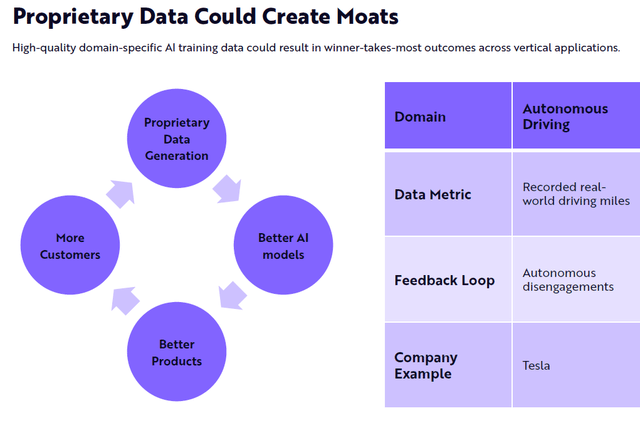

ARK Invest released its Big Ideas 2023 slide show in January this year. One of the sections was on Artificial Intelligence. ARK are great believers in this technology and state that the cost of training AI models is dropping sharply; they believe that by 2030, it should be possible to train models with extensive data sets and that the amount and quality of data will become the constraint as opposed to the current situation where available computing power is unable to process the amount of data available. From slide 26, we get this.

Proprietary data importance (Ark Invest Big ideas 2023)

ARK suggests that proprietary data used to build AI models will provide a moat around a business. A sustainable long-term competitive advantage, ARK uses Tesla (TSLA) as their example, believing that the number of Tesla cars on the road recording data is generating a proprietary data set so large that other companies will find it challenging to develop autonomous software as reliable as that created using the Tesla data set.

I believe that Boeing is pursuing this path; they are developing a proprietary data set for autonomous air taxi operations so large and complex that other suppliers will be unable to compete. I also think they are already years ahead of the competition, and the gap between Boeing and the rest is growing to a point where Boeing will be the only supplier in this multi-billion dollar industry.

Ark said it would be “a winner takes most” situation, and I think Boeing will be the winner. (ARK own 3.6% of Archer)

Boeings Data Set: A moat for the next 30 years

WISK Air

In my first article on Boeing, I discussed the motives they may have had for acquiring a 50% stake in WISK after the Boeing CEO said he didn’t think autonomous tech would move the needle much. After investing $450 million in January, Boeing acquired the remaining shares in Wisk in July.

WISK has been flying for 12 years and has always intended to be an autonomous eVTOL manufacturer. Describing their approach as autonomy first, they have manufactured and flown six generations of their aircraft and have collected a significant amount of proprietary data to learn from.

WISK has an advantage over Tesla; they are the only eVTOL manufacturer I know who has taken an autonomy-first approach. All of the others focus on crewed flights. (EHang (EH) is also working on autonomous flight and building a data set, but only in China and for sightseeing services. I have written about EHANG twice and will publish a third article in the coming days)

WISK will take to the skies in 2028 (WISK website), while the FAA envisages the first stage 4/5 mature system to operate in the same year. By then, WISK will have the most extensive data set worldwide, and Boeing will have the only US-certified autonomous flight network.

Wisk and Archer (ACHR) had an ongoing legal dispute that was days away from going to trial when the news broke of a settlement. I was stunned by the settlement news. I thought Wisk had a solid case and outlined my views in this article, Archer: Missing the Target. The judge seemed to agree that Boeing had a significant chance of winning when they threw out Archer’s motion to dismiss the case. The deal is Boeing’s coup de grace, the moment they made their tech the de-facto standard for the future.

Archer is Progressing to industry leader

Since my Article on Archer, they have made excellent progress. They designed a new plane, the Midnight (not subject to the lawsuit), and had secured a big order from United Airlines ($1 billion). United paid a deposit for the first 100 aircraft and is a major Archer shareholder. United and Archer have published details of their first planned air taxi routes.

Q2 Archer earnings CEO remarks:

The team at United is working with us hand in hand in important markets such as New York and Chicago, where United is developing innovative approaches to operating our aircraft.

Archer has moved ahead of the previous leader, JOBY, in key areas. Archer has begun constructing its volume manufacturing site, whereas JOBY has delayed deciding where its site will go. Archer has already started making six conforming vehicles that it says will be ready this year. Joby has one conforming aircraft under manufacture. JOBY and Archer are targeting 2025 as the date of the first commercial flight. JOBY has significantly more flight experience; Archer’s aircraft has yet to fly, and JOBY has moved further along the certification path.

The COO said in his remarks in the Q2 call:

This intentional strategy has allowed the team to advance rapidly through our certification program to date and just why I believe that we will take the lead over the next 12 months in the race to bring the first commercial and retail aircraft to market in the US.

I will assume that Boeing, United Airlines, and Stellantis think that Archer can make this timeline or they would not have just invested $250 million in Archer.

In the Archer Q2 2023 earnings call, Boeing was mentioned 19 times; in the equivalent Boeing Q2 call, Archer was not mentioned once.

Boeing Snares Archer

The two key terms of the settlement are.

1. Boeing invests in Archer’s latest funding round.

2. Boeing will be the exclusive provider of autonomous tech for all future variants of Archer aircraft (Q2 earnings call CEO remarks)

Archer painted this as a win for them, and it is. The lawsuit is no more; they get the advanced WISK autonomous tech. Archer discussed in the earnings call how this fits within their overall strategic plan of using existing aero tech wherever possible and focusing on the bits of tech they need to get the Midnight aircraft flying. When it comes to batteries, engines, controls, and fuselage, the argument is a good one. Regarding autonomous tech, my father, whom I often quote, would have said, “Boeing has them by the goolies.”

When the Midnight becomes available for sale in 2025, when the FAA plans to allow eVTOL flights, the Archer aircraft will be the only one available for sale. They have a customer and operator in United Airlines and an identified stage 1/stage 2 operation. I think that will be the world’s first commercial eVTOL taxi service.

JOBY (JOBY) intends to launch the same year, but they intend to run a taxi service; they are only planning to produce planes for their own use and have not yet released information about the first routes and appear to have lost ground to Archer in recent months.

Three years later, Boeing will arrive with its WISK aircraft and the autonomous tech working on both WISK and ARCHER aircraft. It will be the only autonomous tech available; no one else has the data set to train the AI models, and without planes in the sky, nobody can develop a data set.

Almost by default, the first stage 5 AAM systems will be running on the Boeing autonomous tech.

Once Boeing installs its system in an area, other systems are precluded. It seems inconceivable that two separate systems could control autonomous air taxis running in the same airspace.

Other eVTOL makers, including JOBY, will likely move to the Boeing platform. By 2030, I think we will have an eVTOL air-taxi service in several major cities in the US operating planes manufactured by WISK Archer and JOBY, all running on the Boeing autonomous tech. There may not be room for anyone else!

By acquiring the whole of Wisk and tying Archer into a long-term exclusive arrangement regarding autonomous technology, Boeing has guaranteed it will be the only player in the US autonomous air taxi system market and, as a result, probably the only one in the world.

Boeing Autonomous Air Taxi system

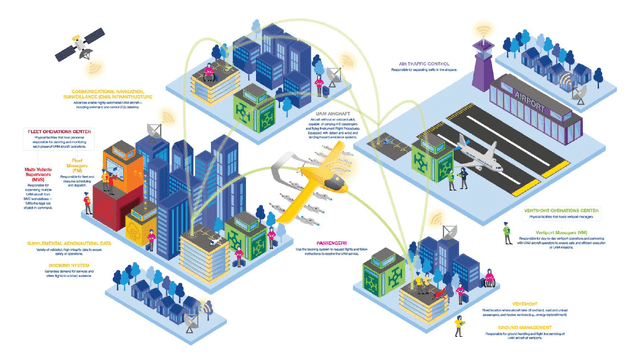

In March 2023, Boeing published a white paper, “Concept of Operations for Uncrewed Urban Air Mobility”.

Boeing Air Taxi Concept (Wisk)

Page 6 of the document above provides an overview of the system.

It involves scheduled, unscheduled, and on-demand flights from multiple locations dispersed across a city or operating area. Due to the proximity of an airport, the eVTOL aircraft must be integrated with air-traffic control at the airport and, hence, the National Air Space of the US. The Boeing system is the FAA stage 5.

The executive summary is very similar to the I28 document covering the same issues and safety concerns in the same way.

The ConOps is for the safe initiation of uncrewed UAM passenger operations in the NAS by the end of this decade…

Minimal conflicting traffic, to avoid in-air collisions, the software will minimize or eliminate intersecting flight paths, controlling the flight from beginning to end…

Dedicated UAM routes are not required, but they will contribute to efficiency. This means that people will be able to book a flight from almost anywhere and be directed to where a plane can land (p15)

The size of the market and the competition

The competition for the Boeing system comes from two areas: firstly, the eVTOL manufacturers who will compete with the WISK aircraft, and secondly, the Unmanned Traffic Management (UTM) companies producing platforms to integrate drone flights with traditional air traffic arrangements.

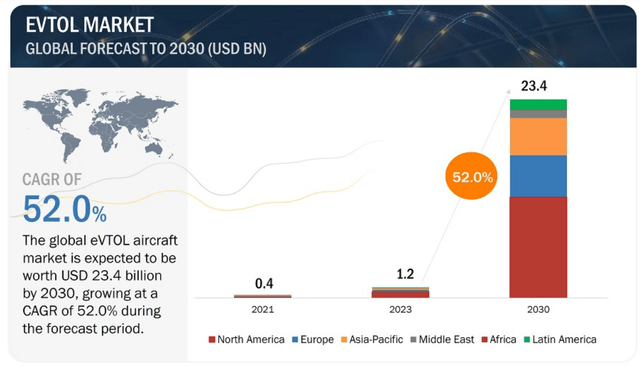

Market size (MarketsandMarkets)

Source eVTOL Aircraft Market Size, Share, Industry Report, Revenue Trends and Growth Drivers

A truly astonishing CAGR, it is expected to become a large industry very quickly. As a reference point, the global commercial aircraft market forecast is a CAGR of 4%. 2030 will only be the start of this industry. I28 dictates that only one or two cities in the US will be operational in 2028; after that point, every major city in the world will probably start planning a system.

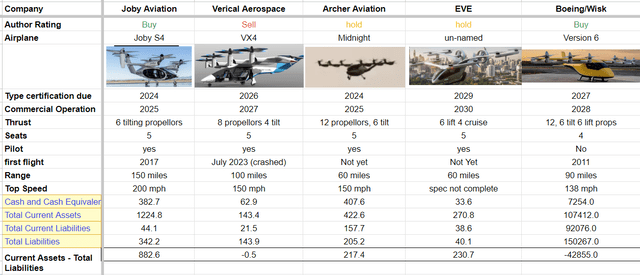

The FAA said (in I28) that more than two dozen companies have informed it that they are working on potential products in this area. It is challenging to follow the private companies exploring the space, but the public companies we can invest in are as follows.

eVTOL competition (author)

The UK-based Vertical Aerospace (EVTL) is running very low on cash; its first and only aircraft has recently crashed, and EVTL is now building a second one. I wrote a very negative article on EVTL and have not changed my rating of Sell.

Eve (EVEX) announced in Q2 that it has finalized the design of its aircraft and has begun to select suppliers of key parts. They have LOIs for 850 aircraft; EVE has started to build a manufacturing site in Brazil adjacent to an Embraer site.

Both EVTL and EVE are well behind JOBY and ACHR. They might become local suppliers in South America and Europe, but breaking into the US market will be difficult. They will likely have to incorporate Boeing’s technology to fly autonomously.

I have not included Lilium (LILM) in this discussion. My recent article presented my view that the Lilium jet will not fly as an eVTOL. It may make an eSTOL (Short Take Off and Landing), but the recent reserve battery requirements presented in the FAA roadmap make this unlikely. The chosen technology of Lilium is so power-hungry at take-off and landing that without a significant improvement in battery technology; I do not believe it will get certified. (eSTOL aircraft are covered in the I28 document, so I am not discounting Lilium entirely yet, but I need to see the tech first.)

In conclusion, we have two front runners in the eVTOL space: JOBY has the most flight experience, extended range, and fastest aircraft. Archer has the largest order book, high-profile backers, and a manufacturing facility under construction, but it has not yet flown.

UTM Platforms

Currently, the many operators in this market are focused solely on the safe and efficient operation of drones in and around cities and airports. There is scope to extend these systems to the eVTOL market. The key players are Altitude Angel, Thales Group (OTCPK:THLEF), Airmap, Airbus (OTCPK:EADSF), and Unifly. I have read through all of these players’ websites, and they are currently focused exclusively on drone flight. It is a growing and underserved industry, with many countries and cities looking to integrate drone corridors and areas in the next year or two.

Obviously, some of these companies could repurpose their software and start looking at eVTOLs that are effectively drones. The limiting factor will be the data set to enable the software to learn. Boeing is well ahead in this area, and the UTM companies are not collecting the data needed to land eVTOLs safely. Many of the most significant issues for eVTOLs are not necessary for the safe flight of a drone, and as a result, the data set will not be sufficient.

Conclusion

The air taxi market has its road map provided by the FAA, and by 2028, the FAA wants fully autonomous eVTOL aircraft providing on-demand services in more than one city in the US.

Several companies are developing aircraft and moving down the certification path; the two market leaders, JOBY and Archer, have highlighted 2025 as the start of small-scale, low-density services in line with the FAA document.

Since it acquired WISK, Boeing has been the only company developing the autonomous technology needed to allow high-density services to begin. UTM companies remain focused on Drone delivery services, not air taxi services.

Boeing will have a large proprietary data set that will put a moat around its business and make it the winner that takes the most in this industry.

Once the Boeing tech is in place, I believe cities and regions will likely insist that UAMs use that system. I do not believe a city will have multiple flight control systems for air taxi services.

It probably won’t matter which company makes the best eVTOL. Boeing wins whatever and monopolizes a large and significant worldwide market in my opinion.

Read the full article here