Over recent years, many investors have been attracted to ultra-high-yielding option strategy funds. Virtually all these funds pay very high distribution rates, not to be confused with true “dividends.” To some extent, these strategies have been popularized amongst retired investors looking to earn an abnormally high income yield on their investments. Indeed, these strategies can deliver decent returns, but investors must fully understand them before investing significant sums, particularly those with long-term income needs. Fundamentally, they are much riskier than basic dividend investing and, in the long run, will almost certainly result in the complete loss of initially invested capital.

One of the most extreme examples is the Tesla, Inc. (TSLA) centered call option fund YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY). TSLY has a stupendously high TTM dividend “yield” of about 75%, making it the market’s highest “yielding” ETF. This strategy fund owns TSLA indirectly through a synthetic option position, obtained by buying a call option and selling a put option at the same strike price. The fund then sells a call option at 0-15% above the current TSLA price to earn a premium on the stock. The ETF also owns a relatively large short-term Treasury bond position (~95% weighting) that accounts for essentially all of its true yield.

What is the result of this seemingly arcane (though relatively simple) strategy? A consistent distribution rate over 50% and often higher. Having such a high distribution rate, investors may consider TSLY to be the market’s equivalent of a “philosopher stone,” offering an extremely high rate of return, albeit with ample volatility. Of course, that is a fundamentally incorrect view based on common misunderstandings of the mechanics of option-selling strategies.

TSLY Does Not Have a 75% Yield

To be very clear, TSLY has a yield of 3.93% from an SEC standpoint; all other “distributions” are returns of capital, which inevitably come at the cost of capital values. In my view, it is problematic that SEC yields are not correctly used in marketing such funds as when conflated with “distribution yields,” it is familiar and easy for income-oriented investors to be dangerously misled. In the long run, virtually all covered call strategies will inevitably cause capital decay if most distributions are not continually reinvested, particularly for those like TSLY with high volatility.

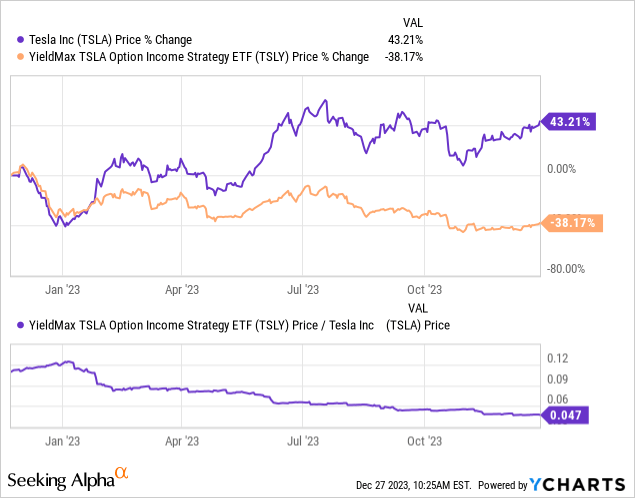

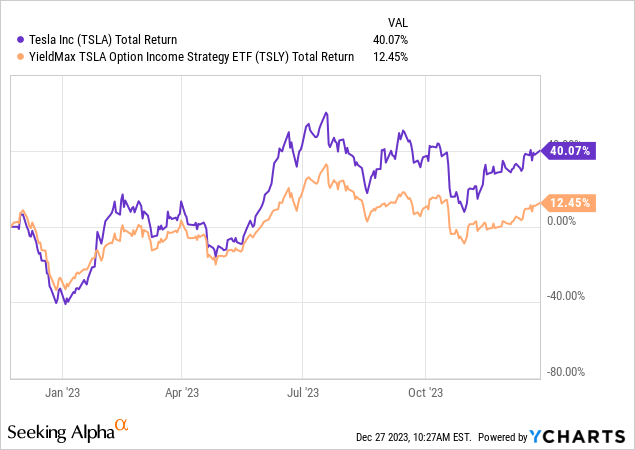

This issue is extremely clear in the price ratio of TSLY vs. TSLA since its inception a year ago. Since then, TSLY has decayed by around 55% vs. TSLA, which has risen significantly in value. See below:

For one, consider if TSLY has lost this much value during a bullish period for TSLA, what might it do during a bearish period? Of course, TSLY has had slightly positive returns from a total-return standpoint, which includes reinvestment of all distributions. TSLY has risen by ~12.5% from that standpoint, though it has still underperformed TSLA stock by a wide margin. See below:

So, why is it that TSLY has lost tremendous capital value during a bullish period for TSLA and has hardly delivered positive total returns over this period despite having a 50%+ distribution rate? The answer lies in TSLY’s fundamental strategy, potentially the worst approach for income-oriented investors looking to preserve capital and earn a decent return.

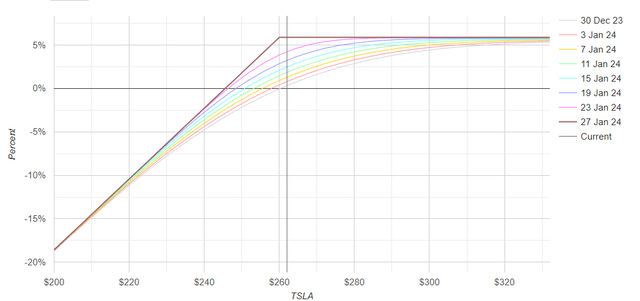

Fundamentally, selling call options is akin to selling risk insurance for a premium. TSLY investors fundamentally act as loss-risk providers for TSLA. TSLY will absorb most of the downside risk of TSLA for a relatively large and variable risk premium. Further, TSLY will forego any positive appreciation in TSLA beyond around 0-15%, depending on the option strike price. To illustrate, consider the current profit and loss graph for an “at the money” covered call on TSLA based on its actual option prices today:

TSLA Covered Call P&L ATM One Month (OptionsProfitCalculator.com)

This option P&L graph is about where we expect TSLY to roll its options forward over the coming days, given they continue to use at-the-money strike prices. As you can see in the chart, the maximum total return over one month is ~5.9%, which should be obtained as long as TSLA maintains its price or rises higher. That said, if TSLA rose to ~$277 or above, this strategy would technically be a loser with a lower total return than its underlying equity. However, this strategy offers a small buffer, with a breakeven of 5.9% lower than TSLA’s current price, meaning it should not lose money until TSLA falls below that level.

Still, TSLA often rises and falls by more than 5.9% in a given month, so this strategy only marginally limits volatility from TSLA. Because TSLY absorbs most of the downside while preceding most of the upside, it will naturally lose value over time through volatility decay. Indeed, given it has lost so much value this year in a bullish TSLA period, its losses during a bearish year will likely be well over 50%. Technically speaking, if all, or almost all, distributions from TSLY are reinvested, then TSLY should perform similarly to TSLA in the long run; however, many TSLY investors are unlikely to do this, as it is marketed as an income strategy (see its name), which, to me (and the SEC), it certainly is not (as explained in the fine print).

Investing vs. Speculation

I believe TSLY is absolutely unsuitable for retired investors looking to earn an income while maintaining their invested capital. To me, the cornerstone of investing, first and foremost, is the maintenance of initial capital, ideally in inflation-adjusted terms. The second goal of investing is earning a return above inflation but never compromising the first aim. To me, if the priority of those aims is reversed, prioritizing returns over capital protection, that is speculation, not investing. I enjoy speculation as a pastime, but it is not a sound strategy for income investors, particularly those with long-term retirement needs.

I emphasize this point because I personally feel that options strategies are too often mis-marketed to people to whom they are fundamentally unsuitable, one of the most basic FINRA obligations. This is not to say that “YieldMax” is being misleading (though I disagree with its “income” terminology), as it appropriately covers capital loss risks in its fund documentation. My point is that many third-party analysts and websites inappropriately gear option funds toward income-oriented retired investors.

When Can TSLY Be Valuable?

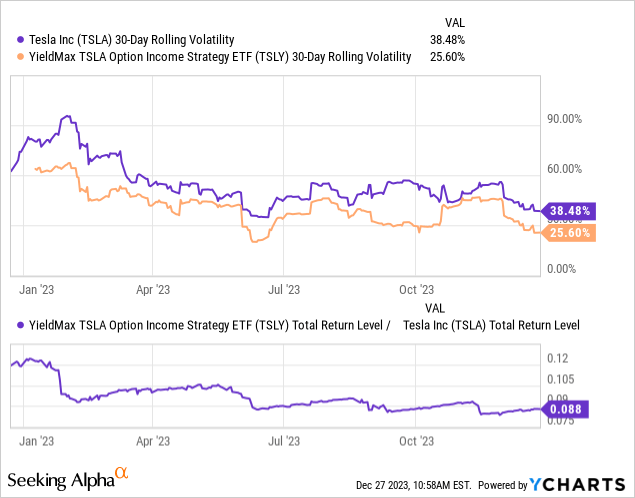

So, what is the true value of an exchange-traded fund, or ETF, like TSLY? Indeed, in certain circumstances, TSLY can follow a meritorious approach, assuming total reinvestment of all distributions. Compared to TSLA, we can expect TSLY will typically carry lower volatility because its premiums limit upside and buffer risk. Further, unlike TSLA, TSLY should earn a decent total return in a flat market. In other words, TSLY benefits from a decline in TSLA volatility over a short-term basis. As you can see below, TSLY has consistently lower volatility than TSLA and has briefly outperformed on a total return basis when TSLA was in a range:

From this standpoint, TSLY is marginally lower risk than TSLA while offering lower total return potential in a bull market but higher total return potential in a flat market. Of course, TSLA is seldom in a range and usually experiences tremendous price action in either direction, making the latter point of minimal value. TSLY’s premiums are directly tied to implied volatility on TSLA, which is currently 48% today. That implied volatility level is high compared to most stocks but is low compared to its historical range. It is likely best to buy TSLY when its implied volatility is above its historical range, given you expect it to decline. That is often the case during a “capitulation” period in a correction or crash. In other words, TSLY may have the best return profile for those who can “pick bottoms” on TSLA. Again, that shows how TSLY is an instrument for speculative traders, not income investors.

The Bottom Line

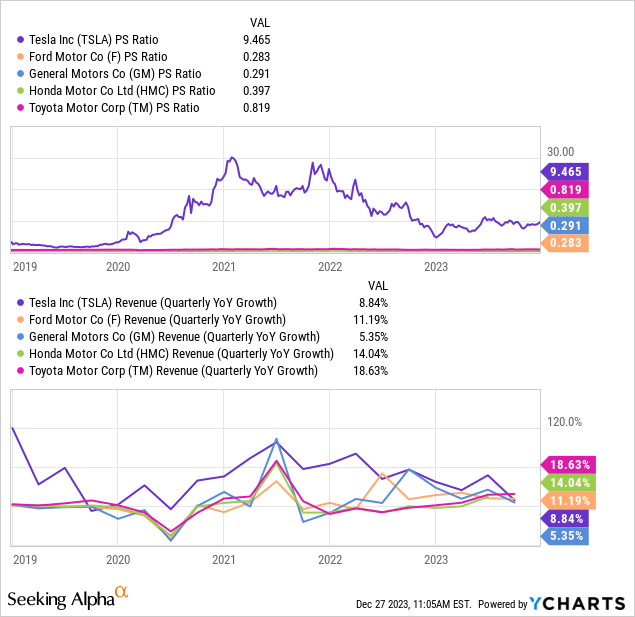

Lastly, we must remember that TSLA is not a cheap company. Tesla is one of the most popular emerging electric vehicle (“EV”) companies today, but its growth rate is low compared to its valuation. TSLA trades at a price-to-sales of 9.45X, around 20X above the mid-range level for other top auto stocks. Usually, such a vast valuation premium would come with very high sales growth; however, Tesla’s sales growth is inferior to its peer group. See below:

Years ago, Tesla was the only major EV company on the market. Today, it is one of many. It will likely lose considerable market dominance over the coming years as its larger competitors (from a capital base standpoint) begin to scale into the field. While Tesla may maintain brand value – though that is uncertain given CEO Elon Musk’s questionable brand value – Ford (F), Honda (HMC), General Motors (GM), and others may have a remarkable ability to leverage their old and integrated supply chains. Indeed, from a price standpoint, arguably most of the best electric vehicles today are from these companies, not Tesla. Of course, Tesla also hardly converts its sales into income, while its older competitors have maintained profit margins despite volatility in recent years.

Fundamentally, I believe TSLA is overvalued by a considerable figure. Indeed, I expect it will eventually lose over 90% of its current price once speculative investors meet reality. TSLA has not correlated to its reality for many years, so that may not occur soon, but I expect it to happen by 2025 as it becomes clear that Tesla is no longer the king of electric vehicles. TSLY only has slight isolation from this risk due to its premium buffer. In reality, a prolonged bear market with large intermittent rallies should cause TSLY to underperform TSLA as it takes on the downside while losing that appreciation, likely resulting in an eventual complete loss of capital for TSLY.

On top of that, TSLY has a nearly 1% expense ratio, which is abnormally high. Investors could easily replicate its strategy by selling covered calls directly, avoiding this ~1% fee. Further, if TSLY eventually decays tremendously, there is some risk in its liquidity strategy since its assets under management may become unstable, particularly in a TSLA crash.

Overall, I am very bearish on YieldMax TSLA Option Income Strategy ETF because I am very bearish on TSLA and have a negative view of its options strategy. Further, while I admit TSLY may be of added value for technical and speculative traders, I caution income investors from this fund, as it will almost certainly cause immense capital decay over time regardless of TSLA’s performance.

Read the full article here