Multiplan Empreendimentos Imobiliários (OTCPK:MLTTY) is a Brazilian real estate development company specializing in shopping malls with a 50-year history. The company boasts a substantial portfolio of 751,000 square meters of Gross Leasable Area (“GLA”) spread across seven states in Brazil.

With a strategic focus on high-quality assets catering to a predominantly high-income audience, making it less sensitive to macroeconomic conditions, Multiplan strategically positions its assets in states such as São Paulo, Rio de Janeiro, and Minas Gerais, which collectively contribute to over 50% of Brazil’s GDP. In addition to its shopping centers, the company pursues a multi-use strategy, evidenced by its ownership of two commercial towers, contributing to a diversified portfolio that includes 22 projects.

The Brazilian company shows post-pandemic recovery, reflected in good operating results and excellent cash generation. In addition, its strategic participation in developing commercial and residential real estate, with multi-use projects, strengthens its position. Furthermore, Multiplan appears to have its indebtedness under control, with reduced financial leverage and margins remaining high.

The latest financial results reflect the company’s aligned operation, discipline with capital allocation, and effective management. With its low leverage, the company managed to weather the pandemic and the Brazilian interest rate hike cycle without significant setbacks, positioning itself well to benefit from a potential interest rate cut cycle.

In 2023 alone, the company’s shares on the Brazilian stock exchange, the Ibovespa, rose by 37%, outperforming the iShares MSCI Brazil ETF (EWZ), which tracks the Brazilian stock exchange index.

TradingView

However, the sensitivity of shopping center sales to macroeconomic factors and the potential slowdown in the retail sector, coupled with e-commerce competition, pose challenges that could impact Multiplan’s operating margins. The recent growth in the company’s share price also suggests limited short-term appreciation potential, which appears reasonably priced in my assessment.

It’s essential to note that Multiplan Empreendimentos’ shares trade under the radar as an unsponsored ADR in pink sheet markets outside Brazil, indicating limited company involvement, low liquidity, and restricted information. This scenario requires diligent monitoring of market conditions and alignment with risk tolerance.

Overview of the Shopping Center Sector in Brazil

The shopping center sector in Brazil is characterized by its dispersion, currently comprising 17.5 million square meters of Gross Leasable Area spread across 628 properties nationwide. Over the past decade, this sector has experienced a growth of 37%, averaging 17 launches per year in the last decade.

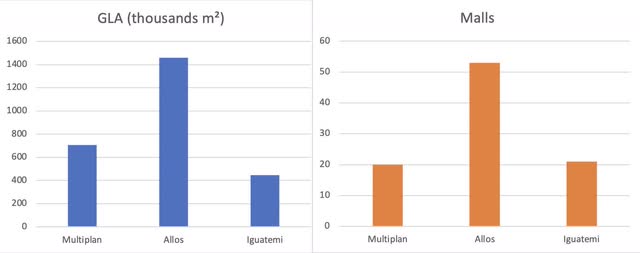

Due to this dispersion, significant players like Multiplan, Allos SA, and Iguatemi hold a relatively small share in the number of malls and GLA-owned. Multiplan, for instance, manages 53 malls with a GLA of 1,458,000 m², while Iguatemi has 21 malls with a GLA of 448,000 m². Multiplan stands in the middle with a GLA of 706,000 m² across its portfolio of 20 shopping centers.

Company’s filings, compiled by the author

Currently, Multiplan commands approximately 4% of the market share in GLA and the number of shopping centers, while Iguatemi and Allos hold 3% and 8%, respectively. The three publicly traded shopping center companies collectively contribute 40% to the sector’s total turnover, with 10.4% from Multiplan’s malls, 20.9% from Allos’ establishments, and 8.9% from Iguatemi.

The remaining 85% of the sector is distributed among privately held companies, indicating the potential for consolidation. A notable example is Multiplan’s acquisition of an additional stake in Diamond Mall.

The COVID-19 pandemic led to closures and restrictions for most malls throughout 2020 and part of 2021, resulting in a decline in absolute sales values. In 2022, the sector saw a revenue of R$191.8 billion, signaling recovery.

Despite the fragmentation in GLA and the number of properties, the sales in 2022 showed significant growth, up by 20.5% compared to 2021. A swift rebound in visitor footfall drove this recovery.

While sales in 2022 are comparable to 2019 levels, it is essential to note that foot traffic is still below the 2019 figures. Monthly visitor flow to shopping centers in 2022 was 443 million, 12% less than the 2019 level that exceeded 500 million.

The accelerated growth in sales, outpacing the recovery in foot traffic, indicates a substantial increase in the average ticket. Consequently, two key indicators shape the expectations of shopping center companies: the gradual recovery of foot traffic and the potential for GLA expansion through new developments or mergers and acquisitions amid a more favorable economic scenario. Nevertheless, uncertainties persist, with high interest rates and the risk of an economic slowdown posing challenges to robust sector growth.

Financial Overview of Multiplan

Most of Multiplan’s revenue is primarily generated through leasing contracts for commercial spaces within shopping centers. Typically, these contracts have an average duration of five years. They are indexed to the IGP-DI, a Brazilian economic indicator that measures the country’s general price index with annual adjustments and includes contractual increases throughout their term.

In addition to store leasing, the company generates revenue through mall management fees. These fees are categorized into the condominium fee, calculated as a percentage of total condominium expenses, and a development fund fee. Multiplan also accrues revenue from parking fees and the sale of commercial and residential units it develops.

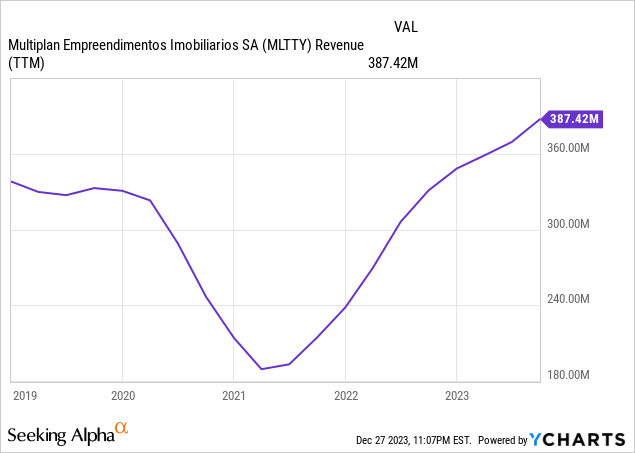

Last year, Multiplan’s net revenue reached R$1.82 billion, equivalent to $387.4 billion, as reported by YCharts. Historically, the company derives between 75% and 85% of its revenue from rent, with 90% being minimum rent and the remaining 10% variable rent. Additionally, parking lots contribute to over 10% of the total revenue.

In conjunction with the readjustments stipulated in the rental contracts, this characteristic has enabled the company to demonstrate revenue growth closely tracking or slightly surpassing inflation. This trend is evident in the SSR indicator (same-store rent), which has exhibited reasonable growth in recent years, barring the exceptional circumstances of 2020 caused by the pandemic. One aspect that may favor robust SSR growth in the coming years is Multiplan’s mall portfolio diversification, which currently boasts an impressive occupancy rate of 96%.

Multiplan’s IR

When examining expenses, a significant portion of the company’s expenditures is attributed to head office and property-related costs. The former encompasses administrative, operational, and development expenses for the head office and branches. The latter includes commissions paid to brokers, condominium fees, and taxes.

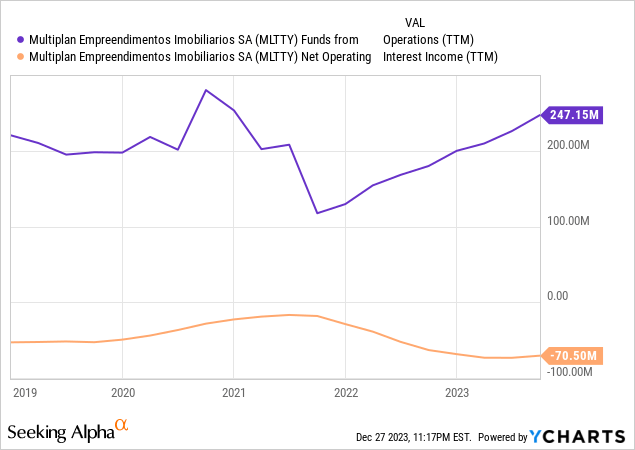

Over the last five years, as costs have expanded with revenues, the margins for NOI (net operating income) and FFO (Funds from operations) have experienced slight growth. Despite this, their margins have remained relatively stable, hovering around 92.9% and 61%, respectively.

The operating result, aligned with the company’s current share price, indicates that Multiplan was traded at an NOI yield of 19.81% in 2022, considering an interest rate in Brazil of 13.75%. This signifies an appealing return on the cost of capital.

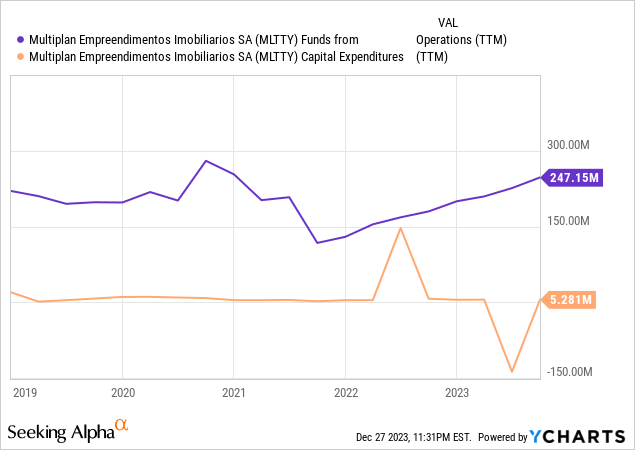

To conclude, it’s essential to recognize that the company is a robust cash generator thanks to its business model. This model ensures a monthly influx of rental income with a certain level of predictability, coupled with costs that escalate in line with revenue and relatively low maintenance expenses.

Additionally, it’s worth emphasizing the company’s potential for cash generation, derived from the variance between adjusted FFO and maintenance CapEx.

In practical terms, a positive difference indicates that the company is generating more resources than it is expending on maintenance, reflecting a positive sign of financial health.

Hence, based on these figures, the company’s potential cash generation is estimated at $241.72 million. This amount represents the funds available to the company after factoring in the capital expenditure required to uphold its assets.

As for leverage, measured by the net debt/EBITDA ratio, which had previously exceeded three times, it has now reduced to 1.3x, hitting the lowest point in the last 11 years. This decline can be attributed, in large part, to the pandemic, which prompted the company to pause its project expansion.

Multiplan’s IR

Considering all these factors, the current robust position of the balance sheet empowers the company to utilize these resources for further investments in or rewarding shareholders through dividends or buybacks.

In recent years, the company has allocated this amount to reinvestments, debt repayments, and distributions. This is evident in the acquisitions of stakes in shopping centers, such as the more recent addition of Diamond Mall, and a historically low dividend yield ranging between 2% and 3%.

Multiplan’s Encouraging Third Quarter 2023 Results

Multiplan has disclosed encouraging results for the third quarter of 2023, buoyed by non-recurring effects and robust operational figures.

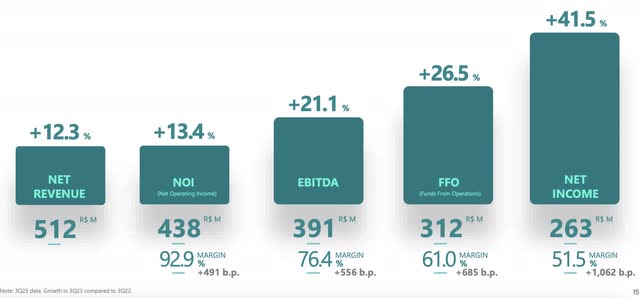

In Q3, Multiplan’s revenues soared to R$512 million, marking a substantial 12% year-over-year (YoY) increase.

Multiplan’s IR

The company experienced growth in all three key verticals, showcasing its resilience and adaptability. Rental revenue saw a solid increase of 4% in real terms, even after accounting for inflation. The parking segment demonstrated robust growth, with revenue surging by an impressive 14%. Additionally, services revenue experienced remarkable growth, soaring by 64%.

On the expenditure front, the quarter witnessed the reversal of provisions, with the recovery of previously unpaid rents, resulting in property expenses totaling R$33 million. Consequently, FFO (Funds from Operations) reached R$312 million, indicating a robust 27% surge compared to last year.

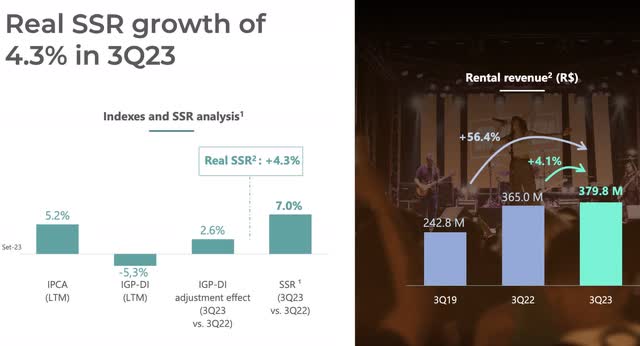

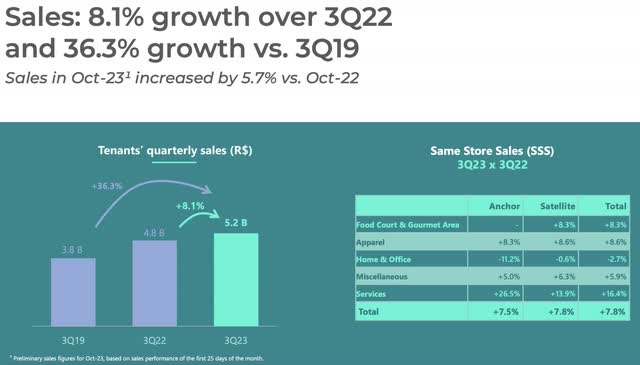

Examining the operational outcome, same-store sales (SSS) experienced an 8% YoY growth, nearly three percentage points above the inflation rate in Brazil. This growth was primarily propelled by an impressive 38% increase in cinemas’ SSS. Meanwhile, the SSR (Same-Store Rent) expanded by 7%, excluding inflation, representing a natural growth of 4.3%. However, the decline in the IGP-DI began to be impacted.

Multiplan’s IR

Consequently, the occupancy cost maintained a healthy level of 13.6%, just above the historical average and likely to align even closer to the historical average due to the impact of the IGP-DI.

The occupancy rate exhibited an astounding 70 basis points growth, reaching 96.1%, setting the stage for a potentially robust fourth quarter. It’s noteworthy that Multiplan hasn’t achieved an occupancy rate above 96% since the onset of the pandemic. Additionally, the sales pace in October appears satisfactory, aligning with the momentum of the retail sector in Brazil, growing at 5.7% annually, marginally above inflation.

Valuations

When evaluating Multiplan using an adaptation of the Graham method, there appears to be little justification for deeming its shares attractive.

I am considering Multiplan’s historical metrics, including a price-to-earnings ratio of 22.8x and a price-to-book ratio of 2x, applying a coefficient of 46.7 yields an intrinsic value of $11.63 per share. This calculation incorporates an annual EPS of $0.32 and a book value per share of $2.26.

With a margin of safety accounting for the Brazil equity premium risk set at 9.6%, the resulting intrinsic value is approximately 15% below the current trading price of Multiplan’s ADR at $12.15, taking into consideration the 2:1 ratio between the company’s ordinary securities and depositary receipts.

Company’s filings, calculations by the author

On the other hand, as reported by the company, Multiplan internally assesses its Investment Properties at Fair Value using the Discounted Cash Flow (“DCF”) methodology, determining the present value with a discount rate based on the Capital Asset Pricing Model (CAPM). Risk and return assumptions are considered, relying on studies published by Aswath Damodaran, the Company’s shares (beta) performance, market prospects (Central Bank of Brazil – BACEN), and country risk data.

Hence, according to the company’s calculations, Multiplan’s Enterprise Value (‘EV’) is approximately 70% below its estimated Fair Value, suggesting a potential undervaluation.

Multiplan’s IR

The Bottom Line

Multiplan stands out as a robust company with a remarkable trajectory and promising future, aligning with Brazil’s overall positive outlook for the shopping center sector. However, investors must acknowledge the complexity of Multiplan’s industry, particularly its sensitivity to the broader economic landscape in Brazil, marked by a history of elevated interest rates.

Despite delivering outstanding results in 2022 and maintaining strong performance into 2023, Multiplan’s stock remains approximately 20% below its pre-pandemic levels, even though it has surged by over 40% since the beginning of 2023. Given the potential pricing of this 2023 rally in the market, my valuation analysis suggests that the current shares may not be particularly attractive for a more bullish position for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here