JPMorgan Chase & Co. (NYSE:JPM) investors who braved the pessimistic selloffs in March and October have been duly rewarded, as JPM led the recovery against its financial sector (XLF) peers. Based on my Buy ratings on JPM in March and September, they have substantially outperformed the S&P 500 (SPX, SPY), notwithstanding JPM not being a growth play. Despite that, JPM has proved its resilience, as its 10Y total return CAGR of 14.4% outperformed its XLF peers significantly (10%) over the same period.

Given the normalization in JPM’s earnings multiple, I believe it’s timely for me to update JPM investors on whether it’s appropriate to wait for a healthy pullback before buying more shares.

JPM is still expected to maintain its 17% RoTCE target, notwithstanding an expected 20% to 25% increase in capital requirements. Given the strength of JPM’s market-leading deposit franchise and well-diversified revenue segments, it’s reasonable to expect the preeminent U.S. bank to “optimize its business in response.”

In an early November 2023 conference, CFO Jeremy Barnum stressed that the bank is “over-earning” against its normalized NII growth cadence. As a result, JPM reminds its investors to remain focused on a “through-the-cycle” approach and “not becoming accustomed to unusually high returns.” In other words, I believe JPMorgan has started preparing its investors for a much slower earnings growth cadence in 2024, as the Fed telegraphed three rate cuts.

Wall Street analysts have already penciled in a growth normalization phase in 2024. Accordingly, JPMorgan is estimated to post an adjusted EPS of $15.43, down 7% from this year’s $16.66 estimates. In addition, growth in 2025 is also anticipated to remain languid, with a 1.6% YoY increase in adjusted EPS. Therefore, JPMorgan investors are reminded to prepare for a peak in JPMorgan’s earnings growth cycle that could extend past 2025.

Interestingly, the resurgence in JPM shares, as it broke decisively above its early August 2023 highs, likely stunned the naysayers. The critical question is, given its over-earning phase if the market is expected to price in steep growth normalization headwinds, why did JPM still post such a significant surge?

I believe the answer is straightforward. The market allowed JPM’s valuation to revert toward its long-term average as it unleashed the shackles on JPM, anticipating the peak in the Fed’s rate hikes. Notwithstanding the recent recovery, JPM last traded at a forward adjusted EPS multiple of 11x. It’s still slightly below its 10Y average of 11.6x. In other words, JPM still isn’t in the implied overvaluation zone. Therefore, the market re-rated JPM’s valuation, suggesting it believes the worst in JPMorgan’s headwinds are over.

However, it’s also critical to note that we aren’t expected to return to the low interest rate pre-COVID days that could spur a surge in lending growth. In addition, the tough comps against JPMorgan’s earnings growth in 2024 could put a lid on further potential upside as the market assesses the outcome of the increase in capital requirements. In other words, it’s reasonable to assume that JPMorgan Chase & Co. stock shouldn’t be expected to trade well above its 10Y average in the near term, even though JPM’s price action remains bullish. Let me explain.

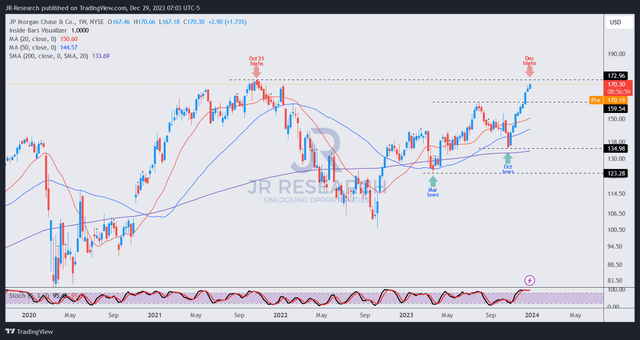

JPM price chart (weekly) (TradingView)

JPM’s nearly vertical surge as it closes in against its October 2021 highs is still bullish, as there’s no bull trap assessed. The breakout against its August highs was also successful and decisive (no false traps). In addition, it could continue to grind higher to re-test its 2021 highs before finding selling resistance.

The current breakout also indicated a higher high and higher low price structure, ascertaining JPM’s medium-term uptrend bias. In other words, JPM’s next pullback should be capitalized by investors who failed to add on its March and October 2023 lows.

JPM’s surge has likely attracted momentum investors into the fray. However, my assessment suggests the risk/reward upside is much less attractive at the current levels if you have not added it.

With my bullish thesis on JPMorgan Chase & Co. playing out as the market re-rated and normalized its valuation against its 10Y average, I believe moving to the sidelines from here is timely.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here