Arbor Realty Trust, Inc. (NYSE:ABR) has seen short interest north of 30%, with a capstone short piece by Viceroy Research released in November 2023. The stock has enjoyed a bit of a rally off of the lows along with many other REITs since October, despite follow-up pieces from Viceroy.

Arbor is an internally managed REIT with a multi-family-focused origination platform. There are concerns over decreases in future rent increases, along with higher costs of maintenance and insurance, as well as borrowing costs, that have weighed on the stock.

With that said, we have warmed up to the space. Recall in September and October we turned tactically bullish on the REIT space after having a short bias for nearly a year in a rising rate environment. The thesis was simple: rate hikes were on pause and cuts were on tap for 2024, and so 2024 we see as a good year for REITs, particularly in H2 2024. Arbor has been cautious in recent reports and calls that the environment will be challenging for the next year, but we believe the company will emerge stronger.

Overall, sector-wise, admittedly, while we became bullish a few months ago, the degree of the rally from October was stronger than we expected. Now, we start 2024 with some early selling. We view this selling in the markets overall as healthy, and with it, we are seeing some normalization in a number of REITs. Arbor Realty Trust stock certainly is a topic of debate, with bulls and bears alike expressing their opinion.

While the short report raised a number of concerns, we believe 2024 is setting up for a strong year for the company. While the stock may be viewed as “trash” to some, as the saying goes, one man’s trash is another man’s treasure. We view shares as a buy on weakness. We expect shorts to continue to circle the wagons, but we are making this buy call before full-year results are put out later this month (expected on January 16th).

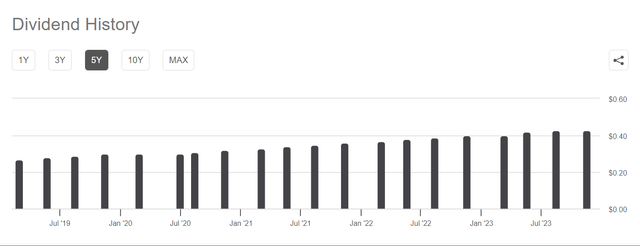

Let us first talk some positives. Let us begin with price action and the dividend. Folks, while some growth can be had if you tactically time your investments or add-ons properly, this is an income name. We encourage investors to buy it and sell covered calls about two months out at a strike price 2-3 points out. This can continue to be executed to significantly increase your income while collecting the dividend.

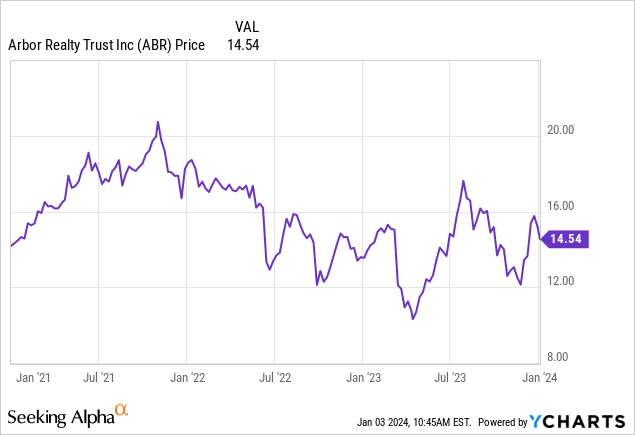

Looking to the 3-year chart above, we see the stock has largely been rangebound between $12 and $16. As shares are approaching $14 again, we think this is a good level to buy, and would add in $0.30-$0.35 dips from here down to about $12.50 and then hold for income. With the relatively well-defined trading range, we believe this is attractive for income investors. Currently, the dividend yield is 11.5% on a forward basis. There is also a strong period of consistent dividend growth:

Seeking Alpha

So we need to ask now, is the dividend covered? Well, Arbor’s payout ratio has consistently remained in the range of roughly 65%-75%, reflecting strong distributable earnings. When we factor in the ongoing growth of the dividend, we do not view the 11.5% dividend yield as a warning.

Another positive is that management has approved a $150 million additional buyback authorization. It is important to note that just because it is approved does not mean it will be executed, however. The flipside of this positive is that there has been dilution. We saw in 2022 Arbor raised over $400 million in capital by selling over 26 million shares. Thus, despite repurchase authorizations, even if exhausted, it does not keep pace with the capital raises. This is a longer-term negative. Something to keep in mind.

We also have to point out that Arbor is one of the only companies in this space that has generated significant book value appreciation over the last 3 years, with roughly 40% growth from around $9 a share to nearly $13 a share in the most recent reporting period.

Operationally, we like the structure of this REIT. Specifically, Arbor is an mREIT, and generates its cash flow as a direct lender which provides loan originations and servicing, primarily for commercial real estate assets. The trust operates a structured loan origination and an Agency business. We all know that commercial real estate has been a very risky asset space and one with controversy, stemming largely from vacancies and rent pressures, largely stemming from a work from home push since the COVID-19 pandemic, among other reasons. However, this company focuses on rental properties, which are commercial in nature, but not office commercial real estate where the real pressure lies.

In terms of the operations more specifically in their structured loan origination business, Arbor navigates the complexities of structured finance by specializing in bridge loans primarily on multi-family properties, though they also venture into single-family rentals, which is less than 10% of the business. When it comes to Agency lending, Arbor excels at originating, selling, and servicing multi-family finance products through established channels like Fannie Mae and Freddie Mac. The company also has some land and office interests.

Make no mistake, the environment has been tough. Loan originations have slowed with higher rates. But the company continues to build up its cash position, which is nearly $1 billion. The company is also building up its pipeline for future Agency Business. In the Agency Business, the company had another solid quarter, originated $1.1 billion of loans in the third quarter. Right now it looks like Arbor’s 2023 originations when reported should be in line with 2022 originations numbers. When you factor in this rate environment and agencies’ mortgage loan originations are down 20% to 25% year-over-year, this is impressive.

The business model is diversified relative to the competition because they are not exclusively focused on Agency mortgage-backed securities. With the multi-family investments and a single-family rental platform, we think earnings are less exposed to fluctuation. The residential rental market remains competitive and strong, as it is much harder for borrowers to purchase new homes. Thus, rentals continue to thrive. And Arbor is one of the only companies still in the single-family rental space, which it is investing in more and more.

From a valuation standpoint, we think you can start buying on this pullback, though we are trading at a premium-to-book. Book value was $12.73 at the end of Q3, and we are trading at $14.54 at the time of this writing. This is a $1.81 or 14.2% premium-to-book. With the company coming into what it views as the toughest 2-3 quarters of this cycle, having shares reprice lower allows investors to get a better price here. We think you start adding in $0.30-$0.35 blocks here.

We have a growing dividend, and one that is well-covered. We have expanding book value. We have a repurchase authorization which could provide some buying support on a major pull back. While there are short reports out there and heavy short interest against the business, we take the other side of this trade. We like buying Arbor Realty Trust, Inc. stock.

Read the full article here