Investment Thesis

Daktronics, Inc. (NASDAQ:DAKT) is interesting because the Company controls a dominant position in a market where they do business against industry titans like Samsung and LG. These companies have significantly more financial resources than Daktronics and a more recognizable brand name. There are multiple advantages that Daktronics has over its larger competitors.

The tech giants that Daktronics competes against are conglomerates that deal in multiple industries, all of which are magnitudes in size compared to digital signage. The market is just not big enough to move the needle for the giants. It, therefore, garners less of its attention, giving Daktronics a leg up when it comes to attracting talent and executing its strategy.

The Company’s long list of spectacular scoreboards has made the Company the gold standard when it comes to digital scoreboards. With the increasing role of in-stadium video replay for highlights and challenged calls, having the best and brightest video board has almost become essential.

Daktronics’ products are big-ticket items, but high schools, colleges, and live events customers can sell advertising space on their video boards and earn a return on their investment. What sets Daktronics apart from its competition is its dedicated sales team, which works with customers and prospects to help procure advertisers and maximize their returns.

We maintain a Buy rating and increase our price target to $12.80.

Q2 FY24 Financial Performance

Revenue. Daktronics reported second-quarter revenue of $199.4 million, which represented 6.4% growth compared to last year’s second fiscal quarter but was shy of our estimate of $213.7 million. The Q-O-Q sales growth was reflective of favorable pricing actions, shorter lead times, and execution on its backlog.

Gross Margin. The Company reported a gross margin of 27.2%, which is a 1,030 BP increase from Q2 FY23. Though the year-over-year increase was impressive, it fell short of the Q1 FY24 gross margin of 35.3%, which was well above historical levels. The sequential reduction in revenue and Daktronics’ fixed cost structure contributed to the sequential contraction.

Operating Income. Higher revenues and gross margin than Q2 FY23 allowed operating income to jump to $19.4 million from $1.5 million a year ago. In addition, operating expenses were $4.6 million higher than last year. The higher expenses were driven by higher headcount and associated wages and benefits.

Earnings Per Share for Q2 FY24 were $2.2 million, which is a vast improvement over the $13 million loss the Company reported in the year-ago quarter. The Q2 FY24 earnings included a $4 million tax charge for the $10.7 million adjustment to the fair value of Daktronics’ convertible note liability. Earnings per share increased to $0.05 for the quarter, which was short of our estimates, but well above the $(0.29) that it generated last year.

Balance Sheet. Daktronics ended the quarter with $73.5 million in cash, restricted cash, and marketable securities, which is significantly higher than it has been historically. In the coming quarters, management may use the cash to reduce debt or other strategic initiatives. It also had $56.6 million in long-term debt consisting of a convertible note and a mortgage. In addition, inventory was down slightly since the end of the last fiscal year.

Backlog. At the end of the quarter, Daktronics’ backlog was $306.9 million. That is a notable decrease from the end of the fiscal year when the Company reported a $401 million backlog. The decreased backlog was due to continued operational improvements and supply chain stability. New orders for the quarter were similar to last year’s second quarter. Growth in new orders from the International and Transportation segments offset declines in the Commercial segment.

Commentary and Forecasts

- Major shareholder Prairieland Holdco’s board representative, Andrew Siegel, replaced Kevin McDermott as lead independent board member. We view this news as a positive to have a shareholder gain increased responsibility on the board of directors.

- Shares were down over 14% on the day of the Q2 FY24 earnings report due in part to the revenue and earnings miss. Given the inherently lumpy nature of the Company’s business, we are confident that Daktronics will continue to grow revenue and EPS in the long term.

- Moving forward, management’s focus will remain on profitable growth and improved operational efficiency.

- Management did not provide guidance.

Risks

- There is the risk of an economic slowdown and decreased new order flow. Because Daktronics Live Events and High School, Parks, and Rec boards come with a return on investment, we expect an economic downturn to be minimized. Still, the upfront investment may cause potential customers to delay orders.

- The long lead times for many of its large-scale video boards, the inflationary pressures endured in late 2021 and throughout 2022, and COVID-related shutdowns in its Shanghai facility pressured the Company’s margins for products that had yet to be shipped. The situation came to a head in December 2022. Daktronics has largely worked through these issues by reducing lead times and opportunistic financing. But there is a risk the same issues could come about again in the future.

Valuation

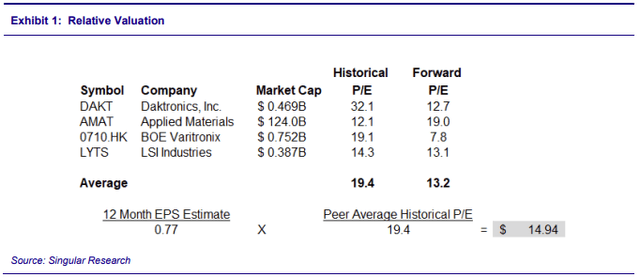

We derive our price target for DAKT using a blended valuation methodology, 50% of which comes from a relative P/E multiple valuation and the other 50% from DAKT’s DCF model.

In our relative valuation in Exhibit 1, we assume the current forward P/E ratio for DAKT to expand towards the average historical ratio of 19.4x over the next 12 months. The peer group includes Applied Materials, Inc. (AMAT), BOE Varitronix, and LSI Industries Inc. (LYTS).

Despite Daktronics’ smaller size compared to its industry peers, we believe its competitive advantages, industry-leading market share, growing business, and working capital improvements should allow its P/E to move toward the industry average. Based on relative valuation, our model produces a price target of $14.94.

Singular Research

In our DCF model, we estimate the firm would earn a return on capital of 10%, reinvest 20% of this return into their business, and grow after-tax operating income by 2% over the next seven years. These assumptions lead to a DCF price target of $10.66.

We then equally blend the relative valuation price target, $14.94, and the DCF valuation price target, $10.66, to come to a final target price of $12.80.

Read the full article here