Editor’s note: Seeking Alpha is proud to welcome Alex Leeder as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

In this article I will discuss why I believe Kelly Partners Group Holdings (OTCPK:KPGHF) is a great long-term buy, using the recent Earnings for up-to-date analysis.

My thesis for Kelly Partners rests on the following:

- A well-run company which is doubling its revenue every 3.2 years, will continue to compound at above average rates as it expands into the US and UK along with continuing success in Australia

- Depressed margins that are set to increase over the long term towards 35%

- Founder led and run CEO, Brett Kelly, who owns 50% of shares outstanding with superior capital allocation.

CEO, Brett Kelly had this to say in the recent investor presentation. “It’s taken nearly 20 years. We expect it will take another 30 years to KP Group to be anywhere near what we think is a flourishing of that full vision.”

Introduction

Kelly Partners Group is an Australian accounting firm that acquires other accounting firms. It has a market capitalization of approximately $200 million and is listed on the Australian Securities Exchange (ASX) and in the OTC under the ticker KPGHF. KPG provides accounting, taxation, and other services to private businesses and owners. It currently has over 80 accounting firms under its umbrella, with 19,000+ client groups across diverse industries. The company was founded in 2006 by Brett Kelly, who still runs the business today and owns 50% of shares outstanding. KPG’s strategy is to grow to be a top 10 accounting firm by revenue in Australia, while also expanding internationally to similar markets, such as the United States, Canada, and the United Kingdom.

Revenue

KPG derives 99% of its revenue from recurring sources, such as subscription fees and maintenance contracts. Of this, 91% is from accounting services, 6% from wealth management, and 2% from financial services.

Partner-owner driver model

Kelly Partners Group (KPG) has a unique acquisition model that incentivizes business operators to grow profits. When KPG acquires a firm, it owns 51% of the shares, while the previous owners retain 49%. KPG then receives 51% of the profits and 9% of total revenue. The 9% of revenue goes to the central services team, which uses it to invest in the operating platform that all businesses use, adding features and functionality.

This system is dramatically different from a traditional accounting firm, which would usually reinvest very little into the business and pay the rest out to partners. KPG’s model aligns the interests of its partners with those of the company, as partners are incentivized to grow profits in order to receive higher compensation. This incentive structure helps to ensure that KPG is always focused on delivering high-quality service to its clients.

In addition, KPG’s central services team plays a critical role in the company’s success. The team is responsible for developing and maintaining the operating platform that all KPG businesses use. This platform provides a number of benefits to KPG businesses, including:

- Increased efficiency: The platform automates many of the tasks that would otherwise be performed manually, freeing up partners to focus on providing high-quality service to clients.

- Improved quality: The platform ensures that all KPG businesses are using the same processes and procedures, which helps to ensure that clients receive consistent service across the board.

- Reduced costs: The platform helps to reduce costs by eliminating the need for duplicate systems and processes.

KPG’s unique acquisition model and central services team are two of the key factors that have contributed to the company’s success. These factors have helped KPG to grow its business and become a leading accounting firm in Australia.

Competitive advantage

KPG has several competitive advantages that have contributed to its superior profitability.

- Strong culture: KPG was founded on a culture of honesty and integrity, which has been instilled in the company from the beginning. This culture has earned KPG the trust of its clients, who are confident that they will receive high-quality service.

- Well-aligned incentives: KPG’s ownership structure is designed to align the interests of the company’s owners with those of its employees. Each operating firm is independent, which allows owners to make their own decisions. However, owners are also incentivized to grow profits for the parent company, as they are paid based on their 49% ownership stake. This alignment of incentives motivates owners and employees to work together to achieve the company’s goals.

- Central services team: KPG has a central services team that reinvests 9% of revenue into improving the company’s operating systems. This investment has freed up accountants to spend 40% more time with clients, which has improved the quality of service and allowed the company to handle more clients. As KPG grows, the annuity stream from its central services team will also grow, which will allow the company to continue investing in its services and further enhance its competitive advantage.

These competitive advantages have allowed KPG to achieve gross margins of over 60%, which are significantly higher than those of its competitors. KPG’s EBITDA margins are also significantly higher than those of its competitors, at 33% compared to 19% for the rest of the Australian accounting industry.

Competition

The accounting industry is highly fragmented, with a wide range of firms of varying sizes and scopes of services. KPG is a mid-sized firm that provides accounting services to private businesses. The firm’s focus on local markets helps to insulate it from competition from larger, international firms that may not have a presence in each region.

Clients tend to be loyal to their accounting firms, which is due in part to the personal relationships that develop between clients and accountants. Accountants come to understand the intricacies of each client’s business, which makes it time-consuming and costly to switch to a different firm. As a result, KPG experiences very low churn of clients.

Revenue Growth

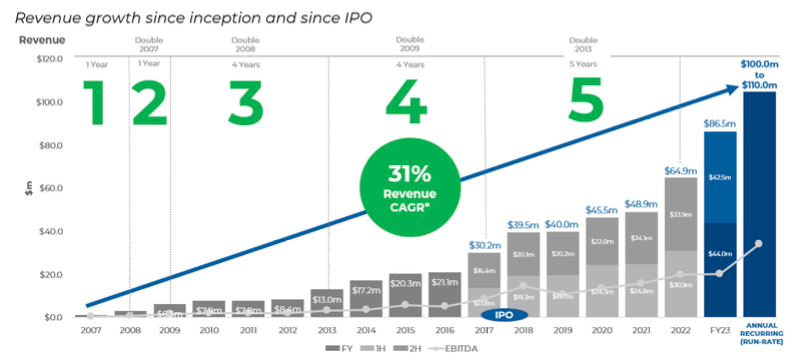

Revenue graph from IPO (H2 presentation)

KPG has a history of rapid revenue growth. Over the long run, the company has doubled its revenue every 3.2 years. In FY23, revenue grew 33.4% to $86.5 million, of which 28.7% came from acquired growth and 4.7% came from organic growth.

Due to acquisitions made in the latter part of this year, KPG has already locked in 30% growth for FY24. This means that over the past two years, KPG will have increased its revenue by 60% without any additional acquisitions. This puts the company on track to double its revenue in 3.2 years.

While I expect revenue growth to slow down over time, I believe that KPG has many more doubles in it at an above-average rate. This is because the company has recently expanded into the US market, specifically California. The company has opened two offices and has signed its first term sheet. KPG believes that there are 12,500 firms in California, which provides them with a very long runway for growth.

I believe that this expansion will be successful because KPG has entered the market slowly and thoughtfully. They have opened offices prior to making any acquisitions, which allows them to learn the market and build relationships before making a larger commitment. Additionally, the Californian market is very similar to the Australian market, where KPG has already been successful.

The fact that KPG is entering the market in a small way initially means that they are not risking much. This is a “heads I win, tails I don’t lose much” scenario. If the expansion is successful, KPG believes that the market in the US, UK, and Australia has a large total addressable market (TAM). CEO Brett Kelly has said,

“So there’s 28,000 firms that we are contacting consistently across the U.S., the U.K. and Australia. There’s 138 live leads. We are actively meeting with firms, we expect that we can very materially grow the group over a virtually unlimited runway unless governments decide that they are disinterested in taxing people in the future.”

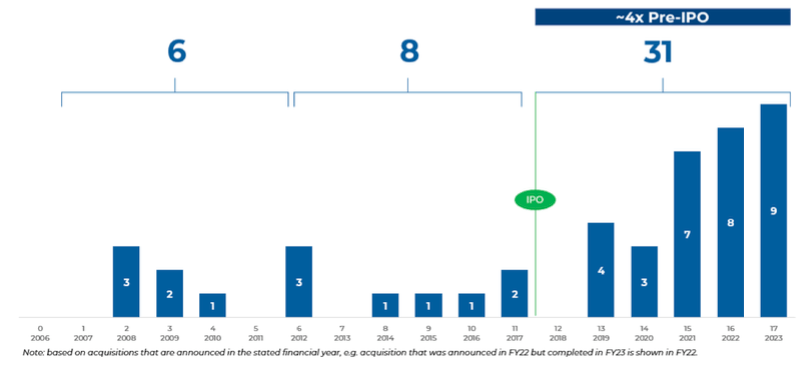

Acquisitions per year (H2 Presentation)

KPG’s acquisition engine has improved considerably over the past several years. The company has developed a programmatic approach to acquisitions, which has been successful due to the similarities between the different accounting firms that KPG acquires. KPG has the expertise and know-how from making 85 previous acquisitions. Since the company went public in 2017, the number of acquisitions has been increasing. This is partly due to the increased size of the company, as a larger number of acquisitions are needed to move the needle. However, it is also due to the company’s improved acquisition engine.

To further enhance the efficiency of its acquisition process, KPG has recently established a full-time acquisition team. This team is responsible for identifying, evaluating, and negotiating acquisitions. The team’s goal is to make the acquisition process as seamless and programmatic as possible. The company’s acquisition engine is a key driver of growth. KPG believes that it can continue to grow through acquisitions, and the establishment of a full-time acquisition team is a sign of the company’s commitment to this strategy.

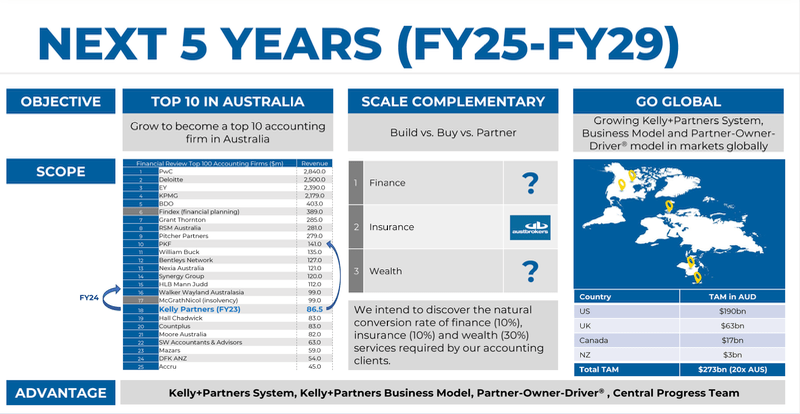

Over the next 5 years KPG has laid out these targets.

5 year targets 2025 – 2029 (H2 presentation)

has set ambitious growth targets for the future. The company plans to double its revenue in Australia alone, and it also sees significant growth opportunities in the US and UK markets. KPG’s track record shows that it is capable of achieving these targets.

Raising Margins

Over the last two years, EBITDA margins have shrunk from 35% to 22%. I believe that KPG can expand its EBITDA margins from its last reported 22.7% to near the long-term target of 35%.

There are two main reasons for this margin compression. First, operating expenses increased by 78.5% in the last year, compared to revenue growth of 33.4%. This was partly due to the increased number of acquisitions, which can drive down margins in the short term. However, the main driver of the increase in operating expenses was additional investments by the parent entity to support and extend the company’s capabilities.

I believe that KPG can reduce operating expenses as it integrates the acquired businesses and realizes synergies. Additionally, I believe that the company can continue to grow revenue at a faster rate than operating expenses, which will help to expand EBITDA margins.

Acquisitions

The average profitability of all new companies acquired by KPG in the past year was 16%, which is significantly less than the group average of 22.7%. This is due to the fact that KPG has recently adopted a more hands-off approach to acquisitions, allowing the acquired businesses to operate more independently.

Previously, KPG would take a more active role in managing the acquired businesses, making changes to the P&L to improve profitability. However, the company has now shifted to a more coaching role, providing guidance and support to the acquired businesses while allowing them to retain their autonomy.

This change in approach has led to a temporary drag on KPG’s profitability, as the lower-margin acquired businesses have not yet had time to mature. However, the company believes that this approach will ultimately lead to higher profitability, as the acquired businesses will be able to grow and develop more effectively.

KPG’s management team has a strong track record of improving profitability, and I view the company’s new approach to acquisitions as a positive development. I believe that KPG’s profitability will continue to improve in the years to come, and I am confident that the company will achieve its long-term target of 35% EBITDA margins.

Additional investments

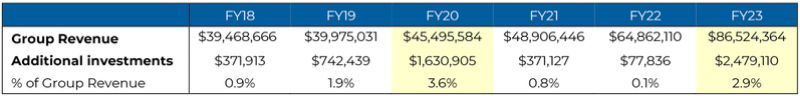

Additional investments per year (H2 presentation)

KPG receives 9% of revenue to invest in its central services team. At the company’s discretion they can also invest more. This investment can have a significant impact on the company’s profitability. For example, in FY23, net profit to the parent company was $5.4 million, which was down 14%. However, if the company had not made any additional investments in its systems, net profit would have increased by 25%.

As a long-term investor, I am willing to see these swings in profitability in order to see the company increase its long-term position. As the company grows, I also expect these investments to continue increasing in dollars, but to decrease as a percentage of revenue. This is because the company’s investment dollars will be split over a larger base of accounting firms.

During the earnings call, Brett Kelly, CEO of KPG, said that he expects operating margins to increase over time.

“I understand the compression in that margin in this period, but know that, that won’t continue.”

I agree with Brett Kelly’s assessment. I believe that KPG’s investments in its central services team are a good investment for the long term. These investments will help the company to improve its efficiency and profitability.

Superior Capital Allocation

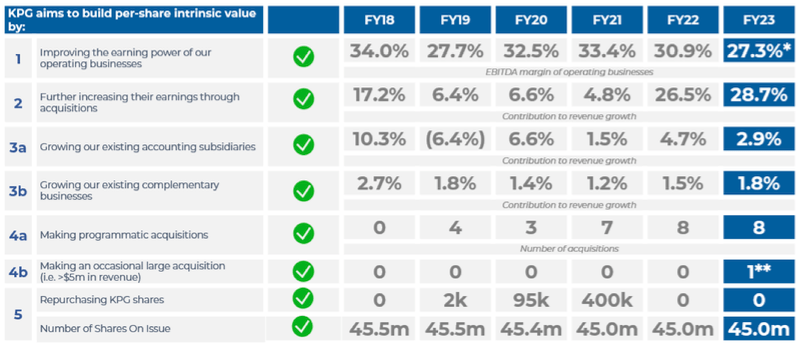

Capital allocation priorities (H2 presentation)

KPG CEO Brett Kelly has demonstrated his understanding of capital allocation, often citing the book “The Outsiders.” Recently, the board of directors announced that they will be undertaking a strategic review due to the belief that shares are trading materially below intrinsic value. The company has outlined three potential outcomes to this review:

- A stock listing change from Australia to the United States.

- Privatization.

- Removal of the dividend.

I believe that two of these outcomes would be very positive and one would be negative.

US Listing

KPG believes that they would receive a much higher valuation in the US market. This is supported by the fact that CBZ, a company with a similar business model but slower growth and slimmer margins, trades at a 50% higher multiple in the US market. A US listing would also make it easier for every part of the business to operate with more visibility.

Removal of Dividend

KPG believes that if they removed the dividend, they would be able to allocate that capital at a ROE of 38%. This would allow them to pay down debt and grow the business much faster with internally generated capital. I believe that this would be a very good move for the company.

Privatization

I believe that privatization is the biggest risk for the company. Although I think the likelihood of this happening is very small, the company has said that they cannot rule it out at this point. A private buyout would provide a short-term gain on the stock, but I believe that this stock has a long runway ahead and I would not want to sacrifice that for a short-term gain. Brett Kelly has repeatedly said that he has always wanted his company to go public and that the business is better off being public. Therefore, I believe that there is a very small chance that privatization will occur. Brett Kelly said,

I want our quality shareholders to share in the long-term compounding opportunity that we think we can provide our investing partners and we don’t want anyone to not — to not be able to participate in that over the next 30 years, it has been always my vision to build the business publicly.

Risks

- Privatization: This is a risk because Brett Kelly, the CEO, owns 50% of the shares outstanding. However, I have assigned a low risk to this outcome because KPG has touted the benefits of being public when acquiring smaller firms. If the company were to go private, it would lose this advantage.

- Key man risk: Brett Kelly is the founder and CEO of KPG. There is always a risk of what would happen if he were to step down or become incapacitated. However, KPG has taken steps to mitigate this risk by structuring the company so that each operating business has autonomy. Additionally, there is an acquisition team that is working full time to complete programmatic acquisitions.

- Acquisitions: KPG is a serial acquirer. If the company cannot find companies at attractive valuations, it will either have to slow down its growth or pay expensive prices for acquisitions. This would not be good for the company. However, I do not believe that this is a near-term risk. A bigger risk would be KPG biting off more than it can chew in an outsized acquisition or taking on too much debt.

- Global expansion: KPG is expanding into new markets. If this expansion does not pan out as expected, it could significantly reduce the company’s future growth potential. However, this is not a dependency for the company’s future growth.

Valuation

Here are some of the key growth drivers for the stock:

- Strong revenue growth: The company has a track record of delivering strong revenue growth, and I expect this to continue in the future, with next year revenue growing 30% and 10-15% beyond that.

- Expanding margins: Margins are expected to expand from 22% to near 35% over the next 10 years, which will boost earnings per share.

- Low share count: Shares outstanding are expected to remain constant or decrease, which will help to drive earnings per share growth.

- EV/EBITDA multiples: I believe that the EV/EBITDA multiples for similar companies is higher than KPG, I think this will re-rate over time, which will benefit KPGHF’s valuation.

Kelly Partners is trading at a EV/EBITDA of 9x today, a low multiple for such a high quality business,

| FCF CAGR | current FCF | Year 2 FCF | Year 4 FCF | Year 6 FCF | Year 8 FCF | Year 10 FCF |

| 5% | $0.25 | $0.28 | $0.30 | $0.34 | $0.37 | $0.41 |

| 10% | $0.25 | $0.30 | $0.37 | $0.44 | $0.54 | $0.65 |

| 15% | $0.25 | $0.33 | $0.44 | $0.58 | $0.58 | $1.0 |

This chart shows the current FCF/share, and the different FCF values we would get using different compound annual growth rates for the next 10 years,

We can use a discounted cash flow (DCF) to estimate the intrinsic value of (KPGHF). Assuming a 10% discount rate and using this year’s FCF per share of $0.25, the stock is currently priced for a 5% CAGR of FCF per share. However, I believe this is far too low considering the significant runway ahead, depressed margins, and superior capital allocation displayed in the past.

Over the next 10 years, I expect a base case of 10% CAGR in FCF per share. This would result in a year 10 FCF per share of $0.65, which would result in a fair value today of $4.40, 46% upside to today’s price. A still conservative but ideal case would be, 15% FCF growth rate over 10 years. This would result in $1 of FCF per share in year 10, resulting in a fair value today of $6.17, or a 105% upside.

Over time, I believe that KPG’s intrinsic value will also compound at a mid-teens rate resulting in significant upside going forward. I believe this shows that KPGHF is undervalued today. Due to its strong business and superior capital allocation, I would argue that it deserves a premium valuation rather than a low teens FCF multiple.

Conclusion

In conclusion, I believe that KPGHF is one of the best compounding opportunities in the market today. The company has a strong operating model that has been successful in aligning the operating businesses to the targets of the parent company. This has resulted in strong revenue and earnings growth over the past 20 years. I believe that this can continue over the next 20+ years, as the company continues to expand into new markets and acquire complementary businesses.

The company is also trading at an attractive price for a fast-growing company in a slow-moving industry. The market is currently pricing the stock for a 5% CAGR of FCF per share. However, I believe that the company can achieve significantly more than this and provide good returns for long-term investors. I believe that KPGHF is a buy at the current price. Investors who are looking for a long-term compounding opportunity should consider adding this stock to their portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here