Canopy Growth Corporation (NASDAQ:CGC) saw its stock price rally last week, gaining nearly 50% at peak rally, based on the rally among cannabis stocks amid reports DEA may reclassify drug as less risky – that the US Department of Health and Human Services (HHS) had finally advised the US Drug Enforcement Administration (DEA) to reschedule cannabis to Schedule III of the Controlled Substances Act (CSA). The rally cooled off by market end Friday with Canopy still up 37% for the week.

Other Canadian cannabis LPs and US cannabis support stocks saw rallies over the week including Tilray (TLRY) up 28%, Village Farms (VFF) up 18%, and GrowGeneration (GRWG) up 25%. United States multi-state cannabis operators (MSOs) also saw rallies this week, since the news will benefit them the most. Trulieve Cannabis Corp. (OTCQX:TCNNF) was up 62%; Green Thumb Industries (OTCQX:GTBIF) was up 40%; and Curaleaf Holdings, Inc. (OTCPK:CURLF) was up 37%.

The news is good all around, but the cannabis sector has been on a severe downtrend for over a year. Canopy’s stock price has declined 84% over the last year and 98% over the last five years. The question on the mind of investors is whether this is the final dip and now is the time to buy as this new uptrend or accumulation phase emerges. For now it seems the rally is over since the plant has not been officially rescheduled yet. The Safe Banking Act is on the agenda for the year, but there is no further progress.

If the plant were to be rescheduled and the Safe Banking Act passed, then a much larger cannabis stock rally would emerge. Canadian LPs will continue to rally on such news because most of them have US cannabis entry strategies, including Canopy Growth. US MSOs have the most to gain with the Safe Banking Act and investors should be weighing the different companies’ valuations. It should be noted that MSOs have been on an equally severe downtrend over the last year. This week’s rally may have changed the climate.

Because of Canopy Growth’s current position to enter US markets, I would rate the company’s stock as a buy, but with a high-risk rating. If the company’s stock price returns to $1 per share, then gains of 80% or more may be realized. It is very possible that the stock will see a reverse split before these gains are realized. Canopy Growth is undergoing intense restructuring and its earnings reports for the rest of the year will only be lukewarm. With this having been said, the company’s stock has been bullish over the last month with the price tempting the $0.60 per share resistance point.

The Rescheduling of Cannabis

The announcement of recommendation this week came after HHS completed an eleven-month research study on the safety of cannabis and whether it deserves rescheduling. The federal government had asked HHS to complete such a study and make recommendations. Now that the agency has reported its recommendation, the DEA makes the next move. For now the psychoactive plant still remains a Schedule I drug. There is much debate surrounding the pros and cons of rescheduling the plant and most people want to see it completely de-scheduled and decriminalized. In this way, cannabis products may be manufactured and sold like alcohol. Some opinions may be found here and here at Marijuana Moment.

Some analysts have said that rescheduling cannabis to Schedule III could invoke additional regulations from the US Food and Drug Administration (FDA) and harm the current US cannabis sector. There is no obvious evidence of this regulation occurring. It would be in the interest of the government to leave US medical and recreational markets in their current framework. If new regulations did appear, then it could spell disaster for the fragile ecosystem. It is a risk to consider and keep in mind.

If the plant is rescheduled, then US MSOs will see some regulations in their sector relaxed. There will be some federal tax benefits, which are currently off limits because of the Schedule I status. Rescheduling the plant would indicate that the federal government sees it as less harmful than previously thought, which should cause more general acceptance and support for legalization or decriminalization.

Rescheduling the plant will not immediately change the US medical and recreational cannabis landscape. Although it will cause the cannabis stocks and support stocks to rally and gain in valuation. The passage of the Safe Banking Act will radically change the scene and it is recommended to be prepared investment- wise to capture the news and steam from such an event. It is unlikely that these outcomes will be resolved over the next year, so risk in cannabis investments remains high. The idea would be to position oneself for future events, while the stock prices are undervalued.

Restructuring of Canopy Growth

Canopy Growth has seen great turbulence in its financial performance over the last year. In return, the company has undergone restructuring and is still finishing the process. The company has ended national cannabis product retail sales and only sells its products wholesale. Canopy growth has sold off eight of its grow facilities so that it may focus on its more successful ones. It is outsourcing the production of cannabis vapes, edibles, beverages, and other packaged products. The new model according to the company is asset light and more focused on its successful strains and brands.

The company is considering a sale of its BioSteel Sports Nutrition brand in order to alleviate the cash burden or high costs of maintaining the brand. The company is focused on returning to a positive EBITDA and free cash flow, as well as lowering debt. Canopy is now distributing in Canada the WANA edibles brand, one of its US assets. The company is focused on better financial performance through brand development, better plant cultivation, and cutting down its operating costs.

Entry into US Cannabis Markets

Canopy Growth has a unique strategy for entering US cannabis market earlier than legalization. The company will establish a US shell company, Canopy USA, which will cash in on its indirect ownership of Acreage Holdings (OTCQX:ACRHF), Jetty Extracts, Wanna Brands, and TerrAscend (OTCQX:TSNDF).

The plan is for Canopy Growth to hold non-voting shares in Canopy USA, which will ultimately be exchanged in the future into common shares. Canopy Growth will hold a shareholder vote in order to create this new class of exchangeable shares in Canopy. The other US cannabis companies and brands involved would have to hold their own shareholder votes in order to approve the different agreements. For instance, Acreage would have to vote to allow Canopy to acquire its current share agreement.

Canopy already has standing share agreements with these companies which go into effect when US legalizes or decriminalizes cannabis. The company’s strategy to enter the US markets through a US Canopy shell will still need approval and the process will be in the works until the end of the year. If all goes through, then the company will be positioned to gain on the Safe Banking Act and other developments in the US cannabis markets.

Q1-2024 Financial Performance

While Canopy Growth is undergoing restructuring, its financial performance has been showing signs of readjustment. The numbers are sub-par for now, but improvement should occur as the company rebalances. Canopy Growth reported revenues of US$82.1 million for Q1-2024. The company completed its divestiture of national cannabis retail sales as of Q3-2023.

The company’s revenue breaks down into the following segments, reported here in Canadian dollars.

|

In millions of Canadian Dollars |

Q1-2024 |

Q1-2023 As restated |

Vs. Q1-2023 |

|

Canada cannabis Canadian adult-use cannabis |

|||

|

Business-to-business |

24.2 |

26.6 |

(9%) |

|

Business-to-consumer |

0 |

12.4 |

(100%) |

|

total |

24.2 |

39.0 |

(38%) |

|

Canadian medical cannabis |

14.4 |

13.4 |

7% |

|

total |

38.6 |

52.4 |

(26%) |

|

Rest-of-world cannabis |

10.2 |

13.8 |

(26%) |

|

Storz & Bickel |

18.1 |

15.6 |

16% |

|

BioSteel |

32.5 |

13.7 |

137% |

|

This Works |

6.0 |

5.5 |

9% |

|

Other |

3.3 |

4.9 |

(33%) |

|

Net revenue |

108.7 |

105.9 |

3% |

Source: Canopy Growth Q1-2024 Press Release

Adult-use business to business cannabis revenue decreased 9% YoY due to lower sales volumes. The company says that this is a result of its shift away from low-margin value-priced products. Canadian medical cannabis increased 7% YoY. The rest-of-the-world segment includes the company’s cannabis exports to Israel and Australia, as well as its US CBD operations. This segment is down due to lower sales to Israel and lower sales in the US CBD market.

Storz & Bickel sales have increased 16% YoY, due to higher demand and greater distribution in its US sales channels. BioSteel reported the largest gain, showing 137% increase YoY. The company attributed the growth to a massive expansion of distribution of its sports drink products throughout Canada. Canopy Growth indicates that it wants to sell its BioSteel asset due to its high costs of operations. This revenue stream may soon disappear. Market consensus for Canopy Growth’s next revenue report is US$75.96 million, which will represent a decrease YoY.

The following chart contains earnings for the last five quarters in $US dollars.

|

Amounts in Millions of $US Dollars |

Q1-2024 |

Q4-2023 |

Q3-2023 |

Q2-2023 |

Q1-2023 |

|

Revenues |

82.1 |

54.5 |

74.8 |

85.3 |

82.3 |

|

Cost of Revenues |

77.6 |

76.2 |

73.9 |

76.8 |

83.5 |

|

Gross Profit |

4.5 |

(21.6) |

0.9 |

8.6 |

(1.3) |

|

Operating Expenses |

65.1 |

81.6 |

85.5 |

87.7 |

81.3 |

|

Operating Income |

(60.6) |

(103.2) |

(84.6) |

(79.2) |

(82.6) |

|

Net Income |

(28.8) |

(526.5) |

(193.2) |

(160.6) |

(1,620.8) |

|

Cash and ST Investments |

432.5 |

580.3 |

588.6 |

834.0 |

953.2 |

|

Total Receivables |

97.0 |

69.5 |

77.3 |

78.4 |

75.1 |

|

Total Current Assets |

666.7 |

797.1 |

866.3 |

1,113.7 |

1,237.9 |

|

Total Assets |

1,653.6 |

1,804.7 |

2,230.6 |

2,463.3 |

2,732.5 |

|

Total Current Liabilities |

340.6 |

594.8 |

501.3 |

392.7 |

314.2 |

|

Total Long Term Liabilities |

1,013.8 |

1,242.4 |

1,167.3 |

1,258.5 |

1,425.2 |

|

Book Value Per Share |

$1.02 |

$1.08 |

$2.13 |

$2.45 |

$3.06 |

Source: Seeking Alpha

The company reported a net loss of $US28.8 million for Q1-2024. The net loss has decreased YoY and QoQ. Operating expenses have decreased YoY. It is possible that the revenue numbers will decrease further and net loss will increase before there is marked financial improvement.

Stock Price Downtrend and Recent Rally

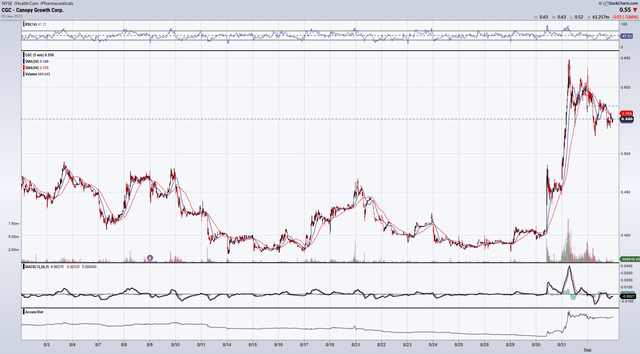

www.StockCharts.com

1-month price chart from StockCharts.com | Advanced Financial Charts & Technical Analysis Tools

The company’s stock price has been on a one-year decline, along with the rest of the cannabis industry stocks. Canopy Growth’s stock price has lost 84% over the last year, 75% over the last six months, and 34% over the last three months. The stock has been on the uptrend over the last 1 month with 16% gains and five days with 41% gains. The stock is currently trading above its 50/20 moving-day averages, but not its 200 moving-day average.

The greater rally in the market is likely over for now until more news appears about the rescheduling or the company has more news about its operations. The stock price has been trading under $1 per share since May 2023. Although the company has not confirmed any news of a reverse stock split, the stock will have to stabilize above $1 soon to avoid such an event.

Valuation and Investment Strategy

According to the company’s book to share value around $1 per share, it is undervalued at the moment. Its forward multipliers, NTM Total Enterprise Value / Revenues = 2.61x, indicate that the company’s stock price is undervalued. Future events for the company will require revaluation, especially if the company sells BioSteel.

There is low risk of liquidity, but the company’s financial performance may not immediately improve. There may be more earnings reports with decreasing revenues and increasing loss. The larger stock market will indeed remain volatile which will continue to affect the company’s stock price and the cannabis sector. The chance of a reverse stock split is high, but other cannabis companies have endured the same event. SNDL (SNDL) has still not recovered from its reverse stock split.

With the high-risk rating in mind, I rate the company as a buy because it is undervalued and it is positioned for entry into the US markets. If the stock price stabilizes over $1 per share, then long-term gains will approach 80% or more. It may be better to wait for the current rally and news to subside and look for an even lower entry point. One may find gains in the short-term by playing $0.50 call options, which have had a lot of volatility over the last thirty days.

Conclusion

The US government may decide to reschedule the cannabis plant to Schedule III based on new recommendations from the HHS. News of the possibility caused a temporary rally in all cannabis stocks and support stocks. If the government reschedules, it will not impact US cannabis markets as much as passage of the Safe Banking Act. Either way, it may be time to consider a long-term position in cannabis stocks, like Canopy Growth, to gain from events unfolding over the next year or two. I rate Canopy Growth as a buy for now and recommend that investors watch the news on cannabis legislation.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here