Afya (NASDAQ:AFYA) is one of the leading private medical education providers in Brazil.

I covered the company in December 2023 with a Hold rating. I liked the company’s quality characteristics but believed the price was high.

In this review, I analyze the company’s 4Q23 and FY24 guidance and its investors’ day. My conclusion is that considering FY24 guidance, the company is attractively priced at these levels, balancing present profitability and future growth. That’s why I’m upgrading the rating to Buy.

Thesis recap

Afya is one of Brazil’s largest providers of private medical education, with 10% of the private market share (in terms of approved seats). The company also has a developing graduate arm and a portfolio of health-tech products.

I believe Afya’s core business has a lot of quality characteristics.

Education is cycle-resilient because families invest in it despite troubled times. Medical education is one of the most expensive types of education, which means the target public is mostly higher-income families with lower sensitivities to the cycle.

The brand of a good education provider can grow with time, with the extreme example of the enormous brand power of the most famous universities in the world. Although Afya is not the next Harvard, its colleges can compound brand value as they age. Pricing power is high because of this.

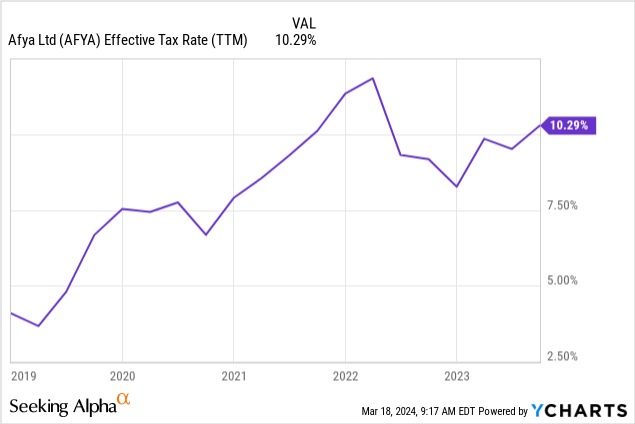

The market margins are high, with approximately 30% operating margins in the consolidated business despite investments in growth and the digital portfolio. Afya pays very low taxes because it can net the scholarships it offers under the PROUNI program.

Capacity is constrained by the Ministry of Education, especially in the less developed regions where Afya concentrates its campuses. Afya acquired smaller players for significantly accretive multiples of 5/6x EV/EBITDA.

4Q23 results and future trends

Afya reported FY23 results a few days ago. In this section, we review those results and some developments that have affected FY24.

Delays and limits to Mais Medicos: A big part of the company’s expansion plan is to offer more undergraduate seats. Last year, the Brazilian government announced the Mais Medicos 3 program, which would increase the number of medical seats all over the country. I speculated that Afya could get about 600 of those seats.

The original calendar implied result publications by July 2024. Unfortunately, the program was delayed, with presentations now expected for July 2024 and results in early FY25.

More importantly, each holding company is only allowed to participate with one campus per state. According to management, this reduces the number of Afya’s participating campuses from 36 to 23, with effects on potential seats undisclosed. If we adjust my previous forecast by campus change (not correct, given that different campuses have different sizes), it will decrease the expected seat potential to 400.

Maturity and pricing power: Still, the company’s undergrad segment presented 25% growth (12% organic) caused by maturing seats in new campuses (each seat can accommodate seven students), and pricing power (the average tuition increased 10% compared with 4.5% inflation in Brazil).

Growing graduate business: The graduate (continued education) business was the year’s star, with growth in the 30% range, fully organic. This was achieved via the expansion of campuses and programs.

In my previous article, I mentioned that a lack of residency vacancies challenges the graduate program. However, management clarified on its Investors’ Day that the graduate programs do not require residency vacancies. The participants get the same education to pass their residency exams without being at the hospital so much.

This represents a huge advantage, as the lack of residency vacancies affects many doctors in Brazil. Also, residency programs are a mix of poorly paid work and education. Afya’s programs avoid poorly paid work and focus on education only.

Digital growth via B2B: In previous articles, I commented that I do not like Afya’s digital strategy. In my opinion, the company is an education business, not a software developer. Still, the segment is growing, with 17% organic in FY23.

The company also unveiled a new subsegment of B2B services, which are provided to pharmaceutical companies for client education. Pharma companies can pay Afya to advertise on its practice management platforms (iClinic has 27 thousand users). This is similar to a medical visitor program, where pharma companies send people to doctors’ offices to educate them on their products. The B2B segment generates 20% of the digital segment’s revenues but is growing at 60% clips.

The digital segment has 75%+ gross margins, but the company does not disclose operating profitability. At Investors Day, management commented that the segment is still in investment mode, with breakeven not achieved. They do not expect to do more acquisitions as the product pillars are already in place.

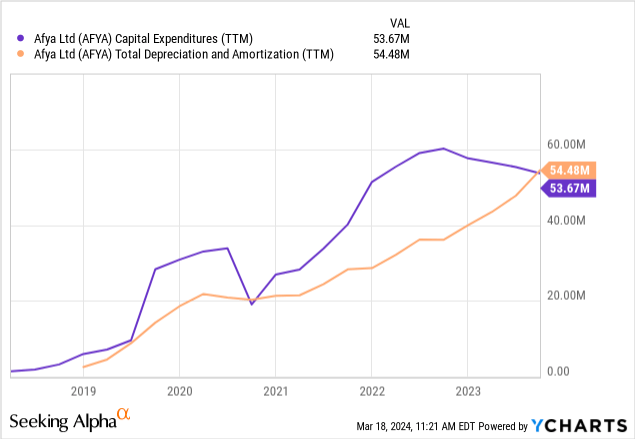

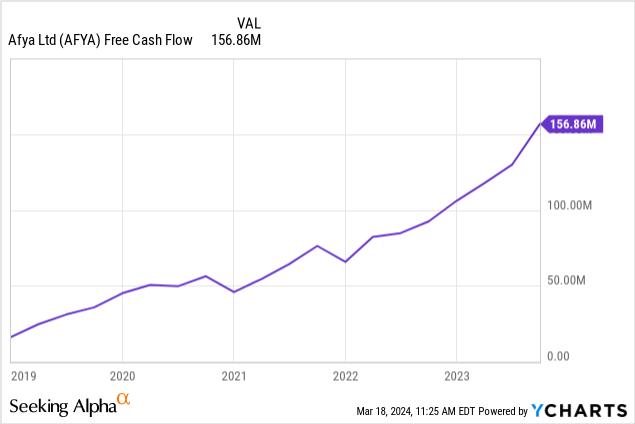

CAPEX is turning: In my previous article, I commented on how CAPEX has been high in recent years thanks to the opening of campuses and programs, at close to 10% of revenues. It should be lower in the future, considering it a mature company. Despite the revenue growth this year, CAPEX has decreased and is now below D&A. Management has guided for $50 million in CAPEX next year.

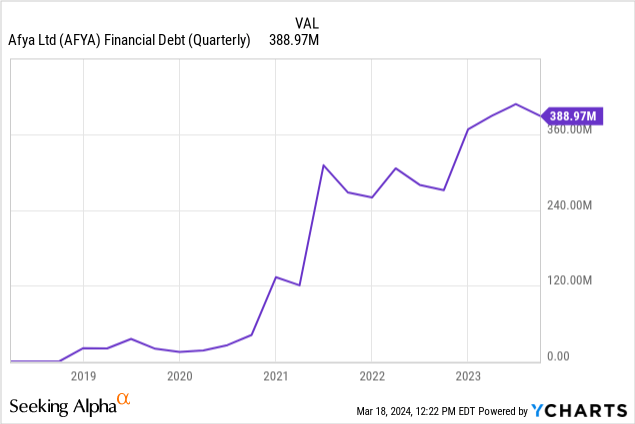

Debt and rates decreasing: The company has been repaying some debt, and it should continue this year, mainly to repay seller debt from acquisitions.

Brazilian rates are decreasing, already 200 basis points from their top, and are now close to 11%. This should reduce the weight of interest on the income statement.

The situation seems manageable, with net interest expenses in FY23 of about BRL 350 million compared with operating income of BRL 750 million. In addition, the company holds cash and investments of $160 million against total debts of about $490 million ($390 million in debt below plus $100 million in seller financing).

Guidance and valuation

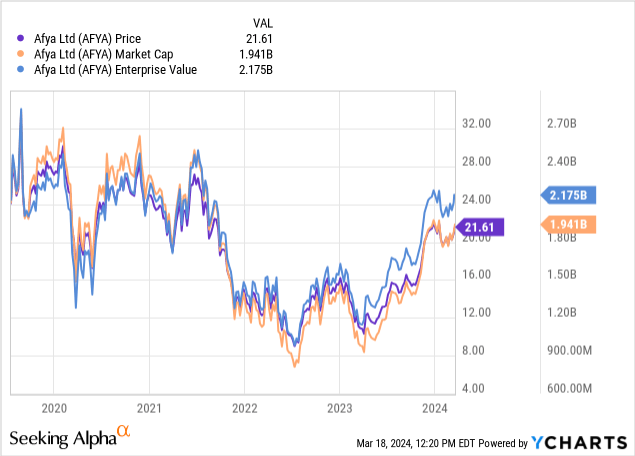

Afya trades today at a market cap of $2 billion and an EV of about $2.2 billion. I prefer to use EV instead of market cap because the company is leveraging to finance acquisitions, but it can repay this debt from FCF when it matures.

We can approach this valuation from several perspectives.

Starting with current profitability. The company’s adjusted FCF to capital is about $140 million. This comes from removing about $20 million in lease expenses from the FCF below (IFRS companies report lease interest in cash from financing instead of operations as in GAAP). This represents a 15x EV/FCFC multiple.

From a guidance perspective, the company expects to post revenues of BRL 3.2 billion, with EBITDA margins of 40%. Removing the expected CAPEX of BRL 250 million for next year will result in EBITDA minus CAPEX of about BRL 1.05 billion, or $210 million.

This already represents a very attractive valuation of 10x EV/EBIT minus CAPEX, for a company of Afya’s quality characteristics and growth perspectives.

Growth potential: Management unveiled the 2028 projection on its Investors’ Day 2023. The company expects to double the number of undergrad seats (and revenues); it plans to multiply graduate revenues by four (to $100 million) and digital revenues by 6x (to $240 million). This would lead to consolidated revenues of BRL 6.8 billion in 2028.

These aggressive targets could serve as an upward limit, which is an ideal scenario. The company has not commented on the margins in the digital segment. Still, an optimistic scenario would have them generating 10% margins while the undergrad and graduate segments generate the current 30% margins. This situation would lead to an EBIT of BRL of 1.8 billion or an EV/FY28E-EBIT of 5x.

Challenges to growth: The company has several challenges in materializing that promise.

First, the undergrad growth is 50% inorganic, as it acquires 1,000 seats (200 per year). The latest acquisitions yielded seat prices of BRL 2.3 million per seat. This represents an additional $92 million in capital expenditures per year. It also requires finding acquisition targets in an increasingly concentrated market.

Second, the digital segment projection is based on multiplying the revenue per user, using comparisons from Japan and the US. These markets are much more developed, and doctors generate much more income than in Brazil ($230 thousand in the US vs $72 thousand in Brazil, according to Afya).

Still, the company can generate organic growth via the Mais Medicos program and expanding the successful graduate programs (although even in management’s view, it will only represent a fraction of undergraduates at maturity).

Conclusion

The guidance is aggressive, but we need not trust it to justify Afya’s current valuation. The company trades at a 10x multiple of EV to expected FY24 FCF to capital. Given the company’s quality characteristics, this is already attractive without considering growth.

Any growth, particularly in undergraduates organically via Mais Medicos as inorganically via the roll-up strategy, comes as an additional return. The same is true for organic growth in graduate programs, and pricing increases above inflation.

The company’s financial situation is stable, with good interest coverage and close to half of its debts covered by cash holdings.

Read the full article here