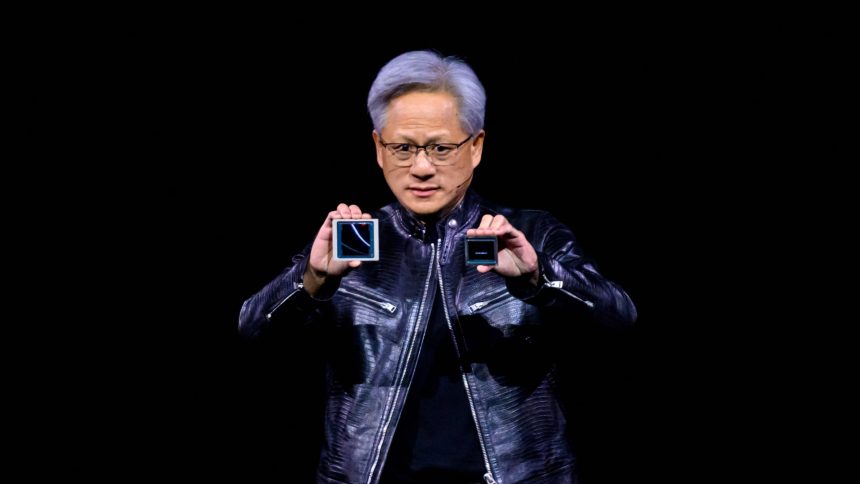

Recently, I read a terrific little book about Abraham Lincoln, called “Lincoln Reconsidered,” by Professor David Herbert Donald, and the fundamental premise behind the title was simple: If you want to go down in history as a politician who is compassionate, honest and a visionary, you have to get right with Lincoln. That’s how sainted the 16th president is in U.S. history. Having just come back from Nvidia’s GTC conference, I have to tell you that if you are in Silicon Valley – or anywhere in tech, cybersecurity, medical technology, finance, retail and automotive – you have to get right with Jensen. It’s just a fact of life. I repeat: You have to get right with Jensen Huang, the co-founder and CEO of Nvidia. This is not a difficult task. Jensen sure makes it easy for you to get right with him. The man is as gracious and as kind as anyone I have ever met, not in business, but in real life. He is thoughtful, kind and secure in his being. He is like your dad, your brother, your uncle, the ones you really love, all wrapped up into one. It’s the craziest thing: He makes you so darned happy. Like Lincoln, he brings out all of our better impulses and he gently suppresses our worse ones with humor and a joke or two. Again, who is that? Lincoln. To be sure, he is much smarter than we are, just like how Leonardo da Vinci was during his time on Earth. I had been calling him da Vinci but after watching Jensen in action I think that he’s got too much Lincoln in him to pigeonhole him to one of the greatest thinkers of all time. Jensen presumes a 10-year time frame and then wants it done in 10 minutes. The things we are seeing from Nvidia now – like the Blackwell artificial intelligence computing platform unveiled at GTC – were first thought about a decade ago, drawn up over many years. Then, seemingly, voila, and that 10 years has past and here it is. A decade. That’s the amount of time it takes to gestate the H100 graphics processing unit or the Grace Hooper Superchip or the Blackwell after that. Of course, there are so many things that have to go right to make these machines work within our lifetimes that I don’t know another soul who would have pursued the possibilities. Only Jensen seems to have been able to visualize that you could speak to a computer without needing to write software code and, after feeding it trillions of pieces of information, it could give you answers that seemed impossible to ever be arrived at. Can you imagine believing that one day there could be 208 billion transistors on something about three inches wide? That’s what Nvidia needed semiconductor design firm Synopsys to do to make this next generation of chips. And it happened. The power of the stacking of these chips is, as Jensen likes to say, insane. Right now, Nvidia has had not one, but two different breakthroughs: Accelerated computing at a ridiculously fast speed and generative artificial intelligence. The latter allows you to speak to the computer, tell it what to read – takes a second for it to plow through Moby Dick – what to watch and teach it what it needs to know. It’s the sum of everything you ever thought of and much more. Jensen needed to create a human knowledge machine with superhuman powers of recognition and thinking and, yes, simulating cognition. It wasn’t supposed to happen. But he did it. The GTC conference amounted to an homage to a man whom I think is uncomfortable being paid homage to because that’s just not who he is. But I don’t know what to say. Would it anger him if I said that he created something no one else could think about, let alone create? I hope not. I, too, want to get right with Jensen, even as he assured me people didn’t even need to do that. If you watched our “CNBC Leaders” special about Jensen that aired this week, then you don’t need to know more about his life. I left nothing in the locker room. I do, though, want to talk about who is actually getting it right with Jensen. The companies that do this are going to be very successful in business and could have a stock that goes higher. That’s because they will be able to solve problems, answer queries and compute faster in a way that will allow them to pull away from those who can’t – or won’t. Given there were a ton of separate partnership and product announcements that came out at the conference, there’s an awful lot to choose from. But let me give it the old subjective try. Cut above the rest First among all equals is Amazon , a longtime Club holding. Here’s a company that totally gets Jensen and the relationship is among the strongest of any company in the world. Amazon Web Services may be the biggest client Nvidia has, and it uses Nvidia’s computing power to drive down prices for cloud computing while increasing the speed and accuracy of AI inference. Inference is the day-to-use of AI models once they’ve been trained on large quantities of data. If you go online and listen to a 10-minute clip of AWS CEO Adam Selipsky talking to Jensen at an AWS event last year, you would think Amazon buys everything Nvidia makes. And I think they would buy all of what Nvidia makes if they could, as Jensen laughingly suggested when I queried him about Amazon’s accelerated computing needs. Amazon owns a big stake in AI startup Anthropic and if you compare Anthropic’s Claude 3 model to ChatGPT from Microsoft -backed OpenAI or Google ‘s Gemini, you can tell what all that extra compute combined with all of those smart people gives you: an answer in conversational, smart prose to every query. ChatGPT, on the other hand, sounds like a robot. Gemini reads like a PowerPoint. Anthropic says Claude 3 hallucinates less than other rival large language models, meaning its responses are more accurate, and the model just gets it in a way that makes you have fun with it while you are working on it. Lots of kids I know play with Claude 3 all of the time. No one seems to have that good a time with ChatGPT anymore, and Gemini is just plain boring. Amazon’s e-commerce and video operations use Nvidia chips to suggest things to you all of the time. The more computing power, the more data that can be processed. The more data, the more knowledge a model has. The more knowledge, the better inference. I know it seems crazy, but a lot of the success Amazon’s retail and video businesses have is because its predictions about what you want are so perfect. But if you have all of the data in the world as it does — and Google and Microsoft don’t have as much —then you can see why the company has such incredible revenue and earnings power. We are all creatures of habit, and the machines have learned our habits, especially Amazon’s. If there was one stock I would buy based on what I saw this week beyond Nvidia, it would be Amazon. The company is getting it right with Jensen more than anyone else in the world. The second is server maker Dell Technologies . I think Jensen regards Dell as a crucial partner when it comes to installing Nvidia’s systems anywhere. You don’t call Jensen or his team if you want to install the new Blackwell system and all of its accoutrements into a data center. Nvidia is a company of almost 30,000 employees —divide $2 trillion by that headcount number and see what each one is worth. Many are engineers. If you want to build a system using all Nvidia has, you call Dell. Then Dell can send a team that works with Jensen’s team to install it. Founder and CEO Michael Dell, unique among all executives, got a shoutout during Jensen’s fabled keynote address at GTC and was in the front row to receive it. Talk about getting it right. I found myself cursing that I didn’t know how close they were until Dell’s blowout quarter released Feb. 29 . Despite already rising roughly 47% year to date, its stock probably has a lot more to run. But, Club members, I am torn because how much of one particular part of the stock market can you own? After Amazon and Dell, there might be a pretty big drop-off right now for who is getting it most right with Nvidia. Others in the ring Jensen values the relationship he has with Siemens , the great German industrial firm. I know this because he is so excited about what he calls the “last frontier,” which is manufacturing. AI models understanding physical things will help realize the true industrial revolution Jensen believes he is unleashing, not just the AI factory he proselytizes for. He says the construction of factories is a gigantic business, and Siemens knows how to construct a virtual representation of the factory — what Nvidia calls a digital twin —before it is built in the real world in order to cut waste and speed time to market. He is truly in awe of how good Siemens is as a builder. However, it’s not a stock that trades here other than in some rinky-dink American depositary receipts, so I’m not going to recommend it. But other than a reference to Rockwell Automation and to Cadence Design Systems , it seems like Siemen’s shares Jensen’s vision more than any other in the frontier. Cadence is a valued partner in other aspects of what Nvidia makes but this one, I felt, was worth more study. You might wonder why I spent so much time with health-care company Medtronic . That’s because I believe they have chosen to partner with Nvidia more aggressively than anyone in the medical device space — that’s my judgment, not the judgment of either company. I talked to you about Medtronic’s colonoscopy machine that is matched with Nvidia’s supercomputer. Normal machines miss too many cancerous polyps. This one doesn’t. I saw a lot of other great products from Medtronic for brain, hypertension and nerve pain, but they don’t seem as loaded with Nvidia chips. Johnson & Johnson came up so many times about its operating room of the future , but I just can’t get my arms around the company’s asbestos liability, which is why we exited the stock last year. I am now trying to deal with the potential of lawsuits against Abbott Laboratories for infant formula that’s often considered the only hope for some babies and is recommended by doctors with known risks. J & J has tens of thousands of lawsuits for talc with no doctor’s recommendation and no known risks, at least to the customer. Club holding Abbott has a tiny fraction of that exposure with very different circumstances. If you are selling Abbott because its competitor Reckitt Benckiser lost a case for similar baby formula, you should short J & J until the cows come home. To the contrary, we’ve bought additional Abbott shares twice over the past week or so. Yes, Club holding GE Healthcare uses AI and Nvidia is a partner, but I would be too promotional if I said buy its stock because of that. The truth is Nvidia seemingly partners with everyone. Your task is to figure out which partnerships are better than others. Does the fact CrowdStrike announced a partnership with Nvidia for cybersecurity mean Club name Palo Alto Networks doesn’t do business with Nvidia? Absolutely not. Nvidia does business with everyone. But bragging rights do matter, and Crowdstrike seems more right with Jensen than Palo Alto. That said, Palo Alto is being called in for some very big deals in the wake of the UnitedHealth Group cyberattack, which is really bad and much worse than some people realize. Plus, the federal government has been pushing companies toward a solution for cyber deficiency that’s made for Palo Alto. In fact, I felt better about Palo Alto after this trip than I have any time since the big crack in the stock. That view stands even after I sat down with the CEO of current front runner CrowdStrike. ServiceNow gets kudos for working with Nvidia on workflow; consider it the Dell for installation of all sorts of office productivity tools and methods. Again, if you want to see what Nvidia’s accelerated computing and generative AI can do for your company’s workflow, you call ServiceNow, not Nvidia. At GTC, ServiceNow announced it is using Nvidia Inference Microservice, or NIM, to develop AI copilots and other generative AI applications faster and more cost efficiently. Nvidia unveiled NIMs at the conference. I am sure there are others you can call for that help, many of which are listed in the myriad press releases published during GTC. But, for my money, the CEO of ServiceNow, Bill McDermott, has gotten it right with Jensen pretty much more than anyone in that particular area of expertise. There’s not enough talk about it, but Tesla is a real devotee of Nvidia. Elon Musk wants and wanted to build his own supercomputer, but he’s on Nvidia’s system now. We had a terrific piece Thursday on CNBC.com by Lora Kolodny that talked about the complicated relationship between Tesla and Nvidia. Musk would like to build everything involving generative AI himself, but it’s just better for him to buy directly from Nvidia because Nvidia is so far ahead. That’s not my judgment. In one of the pages of press release testimonials about how good Nvidia is, I found this nugget from Musk : “There is currently nothing better than Nvidia hardware for AI.” Both Musk and former Snowflake CEO Frank Slootman have groused in the past that Nvidia charges too much for its products, but given the billions upon billions of investment that Nvidia had to make to create these suites of products, it seems rather reasonable to charge what the market can bear, knowing that nobody other than Advanced Micro Devices is even close — and, after this past week, AMD isn’t as close as it was. It isn’t like Nvidia is keeping anyone from making their own supercomputers. I asked Jensen if it mattered to him whether Amazon or Microsoft were making their own versions of accelerated computing chips that can do inference, and he said not at all. He welcomes them. He’ll help them. Only in the silly games that analysts and reporters play is Nvidia threatened by these clients. Jensen’s just not going to do anything but help his customers, even if they aren’t as nice as they should be. And yes, he and I spoke about the concept of nice very often. We both think it’s incredibly important, even as it took me a circuitous path to find it out while it came pretty naturally to him. In the auto industry away from Tesla, Jensen expressed excitement about his relationship with Ansys , a terrific engineering software maker headquartered outside of Pittsburgh that reminds me a lot of Autodesk . Ansys is being bought by longtime software and design partner Synopsys. When that $35 billion deal closes, which isn’t expected until next year, I think the combined company might become the one to watch, if not own, in the manufacturing and software space. Cadence was called out as a partner on multiple occasions for using Nvidia to help its pharmaceutical and biotechnology clients. Like Synopsys, Cadence has a long-standing, multi-faceted relationship with Nvidia. The stocks of both Synopsys and Cadence have been unbelievable performers. The CEOs of both companies share pride in their relationships with Nvidia and Jensen. I know people want to buy red-hot server maker Super Micro Computer , which got plenty of callouts at GTC, but Synopsys and Cadence seem to have higher intellectual property and, therefore, should be more highly valued. When it comes to the giant cloud-computing providers like the aforementioned Amazon, Nvidia feels like Switzerland as a neutral pal. Alphabet’s Google Cloud is front and center as a partner, and so is Microsoft’s Azure. In a press release , you saw prominent quotes from Sundar Pichai, CEO of Alphabet, and Satya Nadella, CEO of Microsoft. They both run companies that you go to for any help on generative AI and accelerated computing. I admit to not being savvy enough to differentiate which one is better to go to for the whole Nvidia suite. Let’s just say they are fabulous partners, but to buy the stock of Alphabet over Microsoft because of its relationship with Nvidia seems wrong-headed. Oracle makes a strong statement for getting it right with Jensen. Larry Ellison, its chairman, co-founder and chief technology officer, praised Blackwell in a release. Makes sense. He’s trying to build as many data centers with the latest and greatest from Nvidia that he can. Meta Platforms also had nice things to say. “We’re looking forward to using Nvidia’s Blackwell to help train our open-source Llama models and build the next generation of Meta AI and consumer products,” founder and CEO Mark Zuckerberg stated in a press release. I was hoping I could point to a robotics company that’s worth buying, but I think Blackwell will need to ship in volume before someone figures out how humanoid robots can be most effective. It will happen, though. At this point, I sidled up to the bar of a robot and he made me one of three drinks, but it was a bit of a parlor game because there was a man there to help it all happen. The technology is definitely not there yet. Apple’s Vision Pro-blem A real quandary I am having about nascent and putative relations is how much I should be talking about the possibility of Club holding Apple being a close partner with Nvidia. Everything got so convoluted last week after the Justice Department filed its godawful hack of an antitrust lawsuit , making it hard for anyone to stay focused on what I saw, which was the magic of the Vision Pro linked to Nvidia’s 3D graphics platform Omniverse . It allowed you to think that you were sitting in a car when you were sitting on a chair, opening a vehicle hood when there was no hood, and looking at an engine where there wasn’t an engine. I don’t know what to say. If you’re Apple, how can you turn down the chance to lean into this opportunity? The problem is we are dealing with a company in Apple that doesn’t like to be talked about. It’s been like that for as long as I can remember. Apple is not going to call me and say, “Jim, how cool was that?” They might not even call Jensen and say anything to him. For all I know, it might be all generalities for the moment. I pushed the possibility hard. And yes, I know, pushed is the right word because I did something a long time ago that was very right when it came to Nvidia. I believed. I saw what its technology could do. And I told you, endlessly. I just told you and told you. Am I supposed to not tell you this now because I don’t know if Apple CEO Tim Cook likes it, or likes me talking about it ? Is it possible Cook put out a product for one reason — in this case, a mixed-reality headset targeted toward consumers — and another, enterprise-focused one developed? Well, isn’t that the whole point of the developers conference? Do I think Nvidia would like to do more business with Apple? I think Nvidia would like to do more business with everyone, including alleged opponent Intel . Doing business with everyone is the way Jensen operates. It is one of the keys to how this company’s market capitalization surpassed $2 trillion this year. So, ultimately, I have no particular insight if Apple is doing anything with Nvidia other than allowing Nvidia to mention its name near the end of the keynote. Maybe that’s all there is to it. Nevertheless, when you are dealing with Nvidia, you can’t just watch something like the keynote with the car and the Vision Pro and think, “Nah, Apple will never go for that.” No more than you could say neither would Amazon or Google or Microsoft or Tesla, all of which willingly partner with Jensen. It’s possible Apple says, “Who cares? We are a consumer company. We are not going to be trapped into doing business-to-business work with some Nvidia supercomputer.” But how about if we look at it like this: What would happen if I had said nothing and one year from now the Vision Pro for businesses comes out and it is a best seller that immediately creates a revenue stream the bears say Apple will never have? I know what will happen: I will feel like I dropped the ball. It will feel like I, unlike everyone else, doesn’t want to get right with Jensen, and nothing could be further from the truth. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Recently, I read a terrific little book about Abraham Lincoln, called “Lincoln Reconsidered,” by Professor David Herbert Donald, and the fundamental premise behind the title was simple: If you want to go down in history as a politician who is compassionate, honest and a visionary, you have to get right with Lincoln. That’s how sainted the 16th president is in U.S. history.

Read the full article here

News Room