Shares of Chubb (NYSE:CB) have been a solid performer over the past year, rising 36%, and currently sitting near an all-time high as strong underwriting and elevated rates have combined to support strong profitability. Since rating shares a strong buy in October, shares have largely kept pace with the market rally, returning about 20%. Given their strong rally, shares have now moved beyond my $242 price target, making it a natural time to revisit Chubb and determine if it is time to take profits. I see further, though more moderate, upside.

Seeking Alpha

In the company’s fourth quarter reported on January 30, Chubb reported core operating earnings of $8.30, more than double last year’s results. For the full year, it earned $22.54. There was a one-time tax benefit from a Bermuda tax law change of $2.76 in Q4; excluding that, its Q4 earnings were $5.54, and full year results were about $19.78. Still, its most recent report was a blockbuster as Chubb continues to deliver exceptional underwriting results.

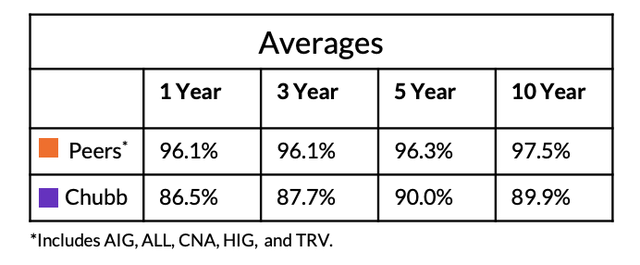

In the company’s fourth quarter, it had a combined ratio of 85.5% with a current year accident ratio of 84.3%, excluding catastrophes. For the full year, its P&C combined ratio was a record low 86.5%. Q4 tends to be a better quarter seasonally for underwriting results, as we are past hurricane season, but both Q4 and full-year results were excellent. As a reminder, a combined ratio of 100% means an insurer breaks even on its underwriting; CB is netting about $0.14 on every dollar of premiums. As you can see below, this year was a continuation of Chubb’s history of underwriting excellence. Indeed, in each of the last ten years, Chubb has turned an underwriting profit despite several years with large catastrophes.

Chubb

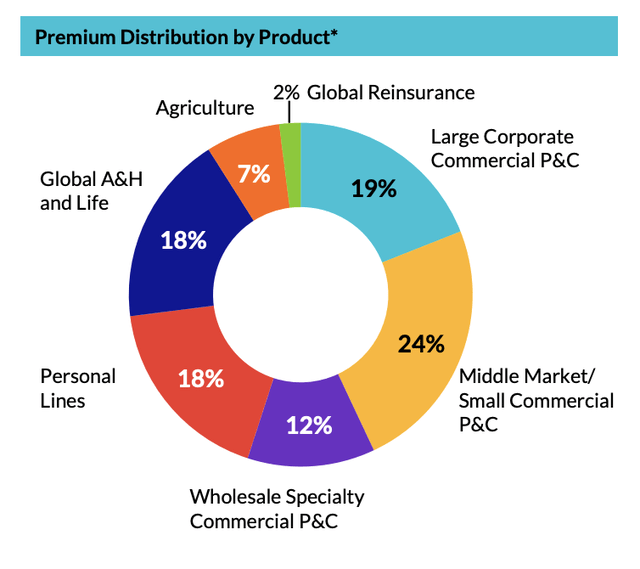

There are multiple drivers of this. First, Chubb is one of the few-remaining “premium” brands within financial services, as I discussed previously, given its reputation for paying out quickly and generously when there is a claim. That ease of service has allowed it to actually pay out relatively little vs its premiums as it charges higher premiums given the appeal of doing business with Chubb. Additionally, Chubb has a very diversified model, as one of the few truly global US insurance companies. It operates across a wide range of geographies and sectors, as you can see below, which helps to reduce its exposure to any one event or sector.

Chubb

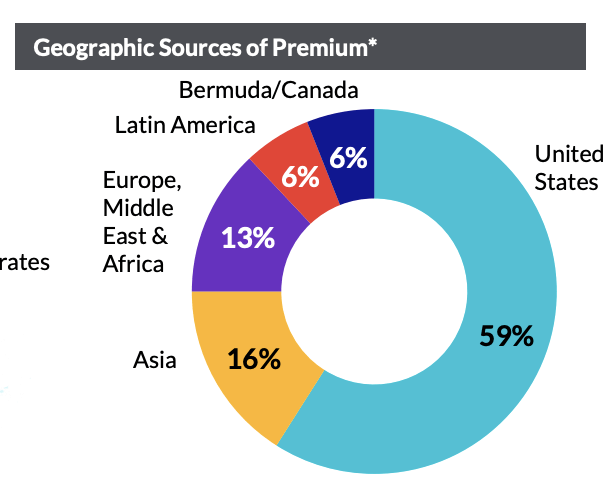

Geographically, the US is its largest market but only drives about three-fifths of the business. Moreover, its international business is growing more quickly, increasing its diversity. US-centric P&C insurers can have volatile results based on hurricane seasons. Chubb still has exposure, but it is less. Consider that 2022 was a difficult year for catastrophes in the US, given Hurricane Ian, while 2023 was exceptionally quiet. Chubb’s cat losses fell to 2.6% from 3.4% last year. It benefits from a quieter season, but the volatility these storms cause is fairly low, providing more stable earnings. Q4 saw cat losses decline to 1.2% from 1.4%.

Chubb

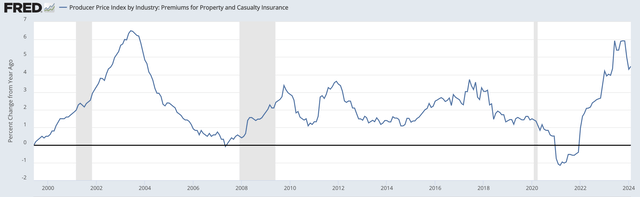

The delayed nature of insurance premiums to inflation is also helping to favorably drive results. Because insurance contracts are often about 12 months, it takes time for them to pass on higher inflation to customers. As you can see below, insurance premiums only recently peaked, unlike overall inflation, which has been steadily declining for months. With premiums rising as inflation falls, claims should be relatively less costly, which should support ongoing strength in underwriting.

St. Louis Federal Reserve

Higher rates are playing a significant role in revenue growth with net premiums of $11.6 billion in Q4, up 13.4% with commercial insurance rose by 10%. A growing book of business combined with a low combined ratio meant that P&C underwriting profits rose 35% to $1.52 billion. Its smaller life insurance unit grew 20% to $1.45 billion in policies with $263 million in profits, up 44%. Now, there was a noteworthy geographic dispersion in growth with North American P&C premiums rising 6.2% while overseas rose by 19%, aided by a 37% jump in Asia.

One reason for slower US growth is that the company saw major accounts grow by just 1.4%, due to underwriting adjustments, and growth should reaccelerate. There was a $125 million hit to premiums from large accounts on primary and excess casualty as it adjusted underwriting in the wake of higher losses. About half of its lost revenue was due to impacted client retention.

This is actually a positive in my view. When an insurance company grows too quickly, investors have to question if they are gaining share because they are underpricing risk and will eventually have underwriting losses. CB’s decision to accept lower premiums for a quarter and adjust underwriting speaks to their underwriting-first approach, which has proven valuable to investors over the years.

To this point, the blistering pace of growth in Asia of 37% is noteworthy, and the company’s combined ratio was 85.3% in 2023 from 84.6% in 2022. Now, this increase was primarily due to higher catastrophes, which are volatile year by year, and 85.3% is still extremely strong. Still, this pace of growth alongside a higher combined ratio does leave open the possibility CB is being marginally aggressive on pricing to boost scale in these regions, essentially boosting revenue at a slight loss of margin. The underwriting deterioration is not sufficient to merit caution, and a larger franchise may be worth a slightly higher combined ratio. Still, this is a trend to monitor.

Because it continues to grow its business, the company now has $80.1 billion in insurance reserves from $75.7 billion a year ago and $22 billion in unearned premiums from $19.7 billion a year ago. A growing book of reserves is a positive as this insurance “float” is essentially an interest-free loan on which Chubb earns investment income. With an underwriting profit, it is more akin to a negative yielding loan, in fact as it pays out less than it received in premiums. The company has a$136.7 billion investment portfolio. This portfolio is quite conservative with $115 billion in fixed income with an average rating of “A” and duration of 5.

Because of this, CB has been a beneficiary of rising interest rates as it invests maturities into higher yielding bonds. As a consequence, pre-tax net investment income rose 30% to $1.37 billion. That is about a $5.5 billion annualized pace whereas full year investment income was $4.9 billion from $3.7 billion in 2022. That is because each quarter it has been able to invest at higher yields than maturities.

The company has an unrealized loss of $6.8 billion that sits in accumulated other comprehensive income (AOCI) from buying bonds in a lower yielding environment. This loss is unlikely to be realized given its liquidity and cash flow from new premiums. Instead, it should be able to reinvest these bonds as these mature at par into new bonds at higher yields. Now with the Fed likely to start cutting rates at some point this year, this tailwind will gradually fade. Still, I expect investment income to rise thru 2024 and likely peak in 2025 before investment yields start declining. In a falling rate environment, the 5-year duration means it will be a gradual fall in investment yields even if reinvestment yields drop sharply.

Overall, the company had a core return on tangible equity of 23.9% in Q4 and 21.6% for the year, and its tangible book value ex AOCI rose by 3.3% sequentially, adjusting for the tax benefit. That gives CB a $102.78 tangible book value ex-AOCI, up from $94.90 at the end of 2022. Given its strong results, Chubb has also announced its intention to raise its dividend by 6% to $0.91/quarter in 2024. Due to buybacks, its share count was down 2% to 411 million in 2023, and I expect a similar drop in 2024.

Back in October, I expected CB to earn about $19.25 over the next twelve months, resulting in a $242 fair value, or 12.5x earnings. However, interest rates now appear likely to stay higher for longer, and insurance pricing power has also remained resilient. Assuming 2-3 Fed rate cuts, I expect a $50-100 million sequential rise in investment income. That is a ~$1.60 per share tailwind from 2023. I also expect about an 8% growth in premiums, assuming some moderation in pricing. To be conservative, I assume a 1% rise in combined ratio from record levels, as events like catastrophes were quite low in 2023. That gives CB $21-22 in earnings power. Assuming another 2% decline in share count, that translates to $21.50-$22.50 in 2024. That is up about 11% from $19.78 in core 2023 EPS.

Now, while this is my estimate, one thing I would note is that Chubb does not offer guidance; something, management reminded analysts of this quarter. That said, there are clear strategic focuses; at a high level, we want to see the company keep doing what it’s doing–grow premiums while maintaining stringent underwriting and investing conservatively to benefit from elevated yields without taking undue credit risk. To continue to grow the business, I expect to see CB focus on its high-growth excess insurance business–for instance providing flood coverage to high-net worth homeowners beyond FEMA flood insurance level.

This has been a source of growth, and it is a good example of an “uncrowded and niche” market where CB can command pricing power (as many insurers have been wary of Florida exposure) and utilize its underwriting expertise. These are the prospective of customers who value the Chubb premium brand, allowing it to charge attractive premiums. I also expect it to continue to grow its Asian business and seek to increase its geographic diversity; Chubb maintains favorable ties in China where it was the first insurer to own the majority of a Chinese firm.

Importantly, businesses like this are not tied to trade or tariffs, and Chubb is positioned to benefit from China’s aging society, which should increase demand for life insurance products. Given the nature of the business, I view it as unlikely to be impacted by tense US-China relations on trade and technology. However, if an all-out war began over Taiwan, this could risk becoming a stranded asset inside China similar to what happened to companies with Russian subsidiaries.

Ultimately, a US-Sino war strikes me as a tail risk. This risk would hurt Chubb, but there would likely be very few companies not to see a significant impact to their business. In coming quarters, I will be closely monitoring its overseas combined ratio; given this is where it is growing most quickly, there is the most risk here of its underwriting having loosened. If we see the combined ratio move past 88%, I would be concerned it is sacrificing too much margin in the pursuit of revenue growth.

On the flip side, if we see combined ratios remain at current levels, that would provide upside to my EPS estimates as a I assume a 1% increase in the combined ratio, just given how strong 2023 was. If we do not see a rise, EPS could approach $24. The increase in excess business could also create an increase in seasonality with more losses potentially focused in Q3 (peak hurricane season), which is a trend investors should monitor. If wee see another solid catastrophe performance in 2024 similar to 2022-2023, that would further validate CB’s strategy and could support additional multiple expansion.

Given these factors and my base case, I view shares at 11.7x forward earnings as attractive. Now, given the general consensus that rates more likely to fall than rise, investors are likely to view interest-earning companies like insurers with some caution as that form of earnings could slow, though any decline for CB would be gradual as it still is carrying bonds at lower yields than present conditions. I view a 12.5x-13x time multiple as appropriate or about 10x investment income and 15x the underwriting profits, which are more durable over a cycle. That provides a fair value of about $280.

That gives shares about 9.5% upside, and about 10.5-11% including dividends. As such, the majority of the returns have been realized, but CB can still generate double-digit returns for investors. I continue to view it a premier franchise in the sector, but with just moderate upside, I am moving shares to a “buy” from “strong buy.” CB is still a good and attractive core holding, but it is no longer dramatically undervalued.

Read the full article here